NicoElNino

Markets are still struggling to price in a variety of risk factors, including: How long and how far will interest rates rise? When will inflation peak? How will the war in Ukraine evolve? Is a global recession fate, and if so how deep will it be? No one has a crystal ball and the future’s always uncertain, but trending behavior in markets can offer some useful perspective, particularly when debates about the future are unusually stark.

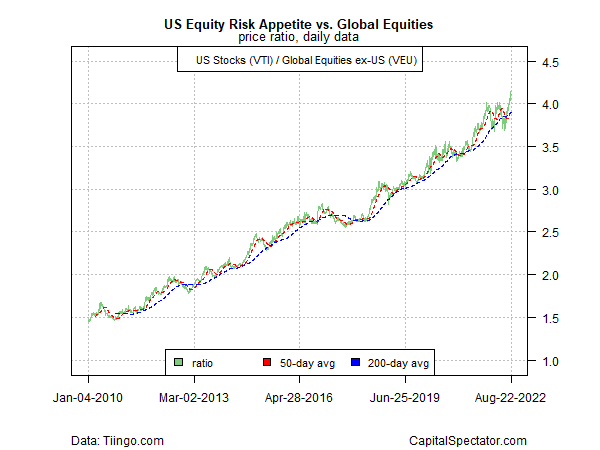

Let’s start with the question of whether US equities will continue to outperform foreign stocks? Yes, or so one can argue based on the crowd’s collective bias, which is unchanged via relative performances for various pairs of proxy ETFs. For example, the ratio of US shares (VTI) to global stocks ex-US (VEU) shows no sign of breaking its long-running upside trend, which implies that sentiment continues to forecast relative outperformance for American equities.

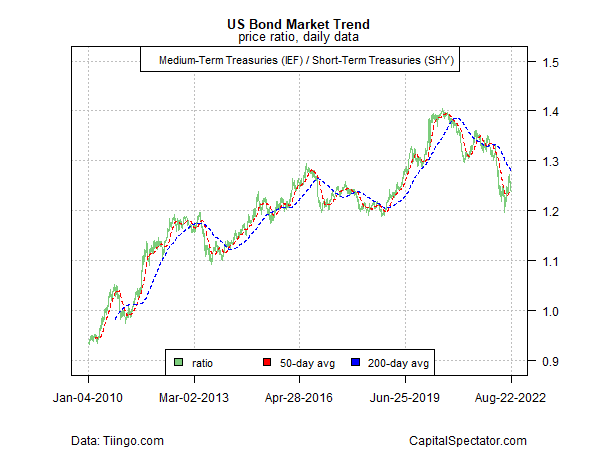

Turning to the US Treasuries market, the recent rebound in government bond prices may be a turning point favoring risk-on after a rough first half in 2022. But skeptics counter that the jury’s still out as the Federal Reserve continues to signal that rate hikes will roll on. The bounce in the ratio for medium-to short-term Treasuries captures the latest shift in sentiment toward risk-on, but it’s premature to say that the trend is staging an enduring comeback.

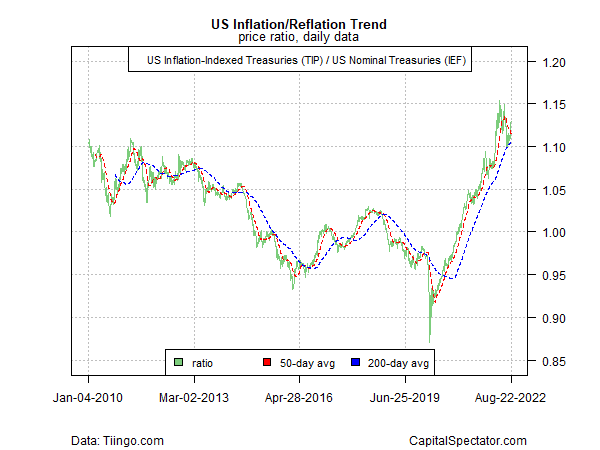

On a related note, the relative strength in the inflation trade has taken a hit lately, but it’s too early to write the obituary. The question of whether relative strength for inflation-indexed Treasuries (TIP) vs. nominal Treasuries (IEF) can continue to outperform may face a critical test in the months ahead.

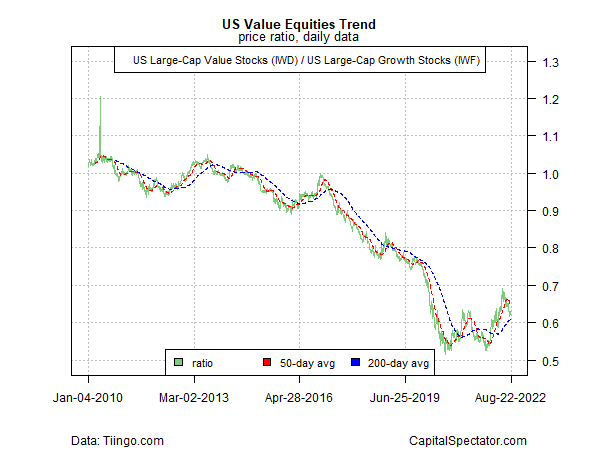

Meanwhile, the recent recovery in value stocks (IWD) is running into turbulence relative to growth shares (IWF).

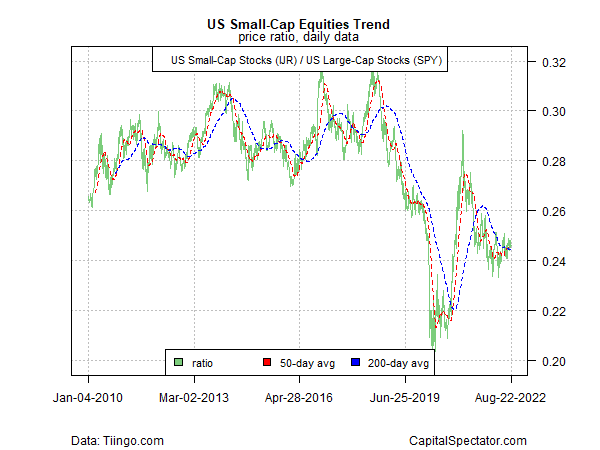

Headwinds are even stronger for US small-cap stocks (IJR) vs. the broad equities market (SPY).

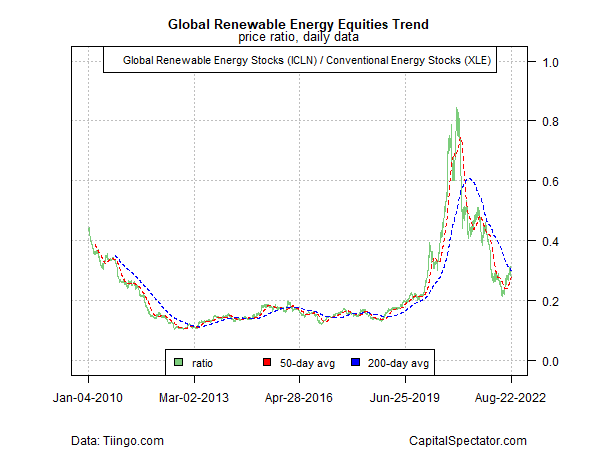

Meanwhile, a recovery may be brewing for renewable energy share (ICLN) relative to conventional energy (XLE).

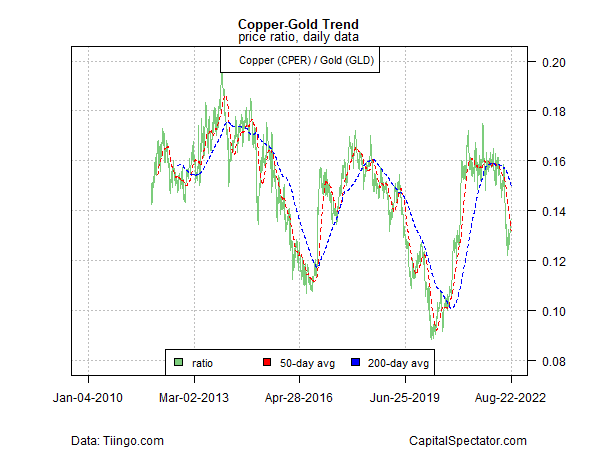

Tracking the relationship between copper (CPER) relative to gold (GLD) is considered a markets-based proxy for business-cycle trends and on that basis the trend still skews bearish for the macro outlook.

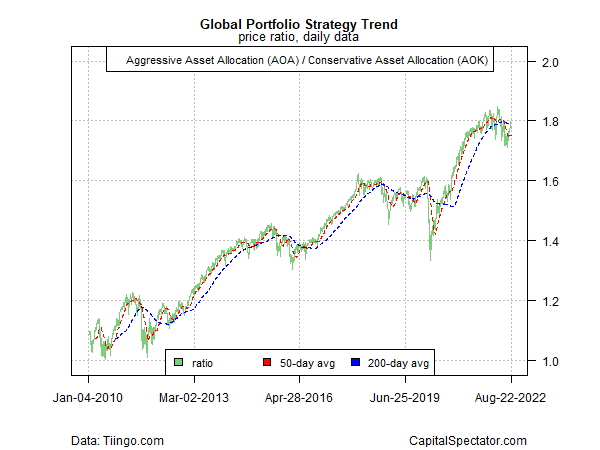

Finally, the crowd is edging toward a relatively defensive posture for asset allocation, although there’s still room for debate. The relative performance of aggressive allocation vs. conservative has faltered lately, but so far the shift is modest and so it’s too soon to say that the crowd has thrown in the towel for favoring risk-on at the strategic portfolio level.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment