Phynart Studio/E+ via Getty Images

1. Introduction

Modern people suffer from chronic muscle pain due to the habit of sitting for a long time at home or work. They use a variety of methods including drug treatments and manual therapy to relieve pain and stay healthy.

The Joint Corp. (NASDAQ:JYNT) provides the solution for chiropractic care. Licensed practitioners conduct adjustments and offer an excellent alternative to pain relief measures for patients who are concerned about the side effects of drug treatment.

Furthermore, the company is creating great value for consumers, business partners, and the company itself by improving inefficiencies and inconveniences that exist for a long time in the chiropractic industry through its unique and innovative business models.

2. Investment thesis

First of all, The company is in a large and growing industry, and its current market share is still small, leaving room for further growth in the future.

Second, it possesses several characteristics of a quality business, including the first mover advantages, an ability to sustain high returns on invested capital, and conservative balance sheets.

Lastly, the current share price has significant upside potential in consideration of the company’s growth potential and quality.

2-1) Growth

The chiropractic industry is big and growing. Chiropractic care helps individuals with various pains, particularly back pain. According to a company filing which refers to the bureau of labor statistics and IBIS world chiropractors market research, people in the U.S. spends about $90 billion on back pain and about $18 billion on chiropractic services.

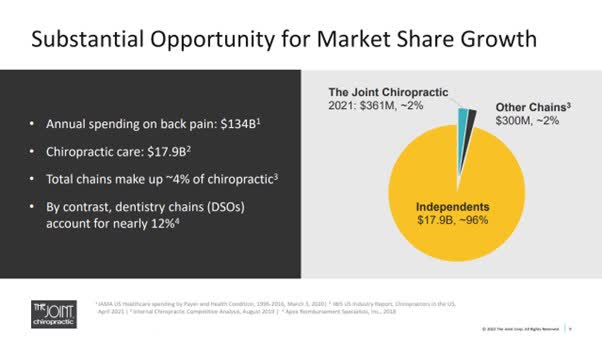

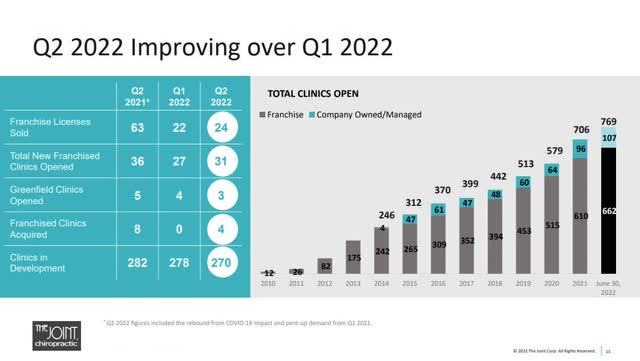

The company’s market share (The Joint Q2 22 Investor Presentation)

Nevertheless, the company’s share is only a fraction of the overall market. In other words, the company has ample room for further growth in this market in the future. As shown in the picture above, the market is highly fragmented. 96% of the market is composed of sole practitioners, and only 4% represent multi-unit operators like JYNT. Comparing multi-unit operators, the company has a market share of half, indicating it has competitive advantages.

2-2) Competitive advantages

The company is innovative in the way it practices its business in a highly inefficient industry. It differentiates itself from its competitors by using a private pay, non-insurance, cash-based model.

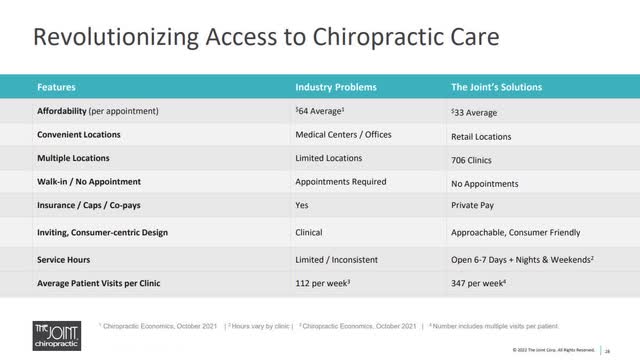

Innovative value proposition (The Joint Q2 22 Investor Presentation)

The company delivers convenient, appointment-free chiropractic care in retail locations to its customers or patients. Also it provides great values to its employees and business partners like chiropractic practitioners, including higher salaries and no hassles with administration, which eventually gives more time to improve their core skills.

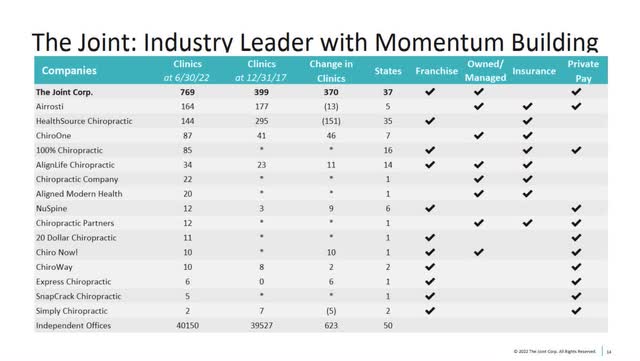

Peer group of the company (The Joint Q2 22 Investor Presentation)

The company increases its value based on its competitive advantages as well. First of all, it maximizes the first mover advantages. As seen above, the company has the largest share among multi-unit operators and is widening the gap. Although Airrosti, HealthSource Chiropractic, and ChiroOne Wellness Centers are comparable in scale, they are declining in contrast to the company’s increasing number of clinics since 2017. Also, they mostly depend on insurance-based models. Competitors that adopt the same cash-only model as JYNT are 11 companies but cannot match the company in scale. Eight of them just operate fewer than 12 clinics.

Second, the company directly operates the clinic or recruits franchisees. Franchising gives it a great competitive advantage. It reduces capital expenditures because franchisees finance a part of the investment. It also generates high returns for the company by receiving fees such as royalties based on sales.

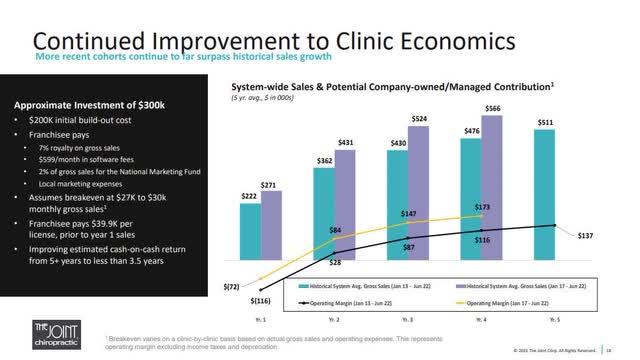

Clinic economics (The Joint Q2 22 Investor Presentation)

It is good for franchisees to participate in the franchise of the Joint. Its clinics show great unit economics because the initial investment is small. All they need is a decent-sized retail space and a minimum of two people to run a clinic including WC (Wealth Coordinator) and DC (Chiropractic Doctor). There is no inventory risk like in other retailers. Therefore, The period to reach breakeven point is quite short and it takes about eight months.

Business segments ( The Joint Q2 22 Investor Presentation)

The company’s current portfolio consists of 85% franchised and 15% company-owned clinics. It needs to rapidly increase clinics to gain wide brand awareness across the country. However, the proportion of franchising will increase later when it enters a certain maturity stage. I expect it to take three years, or when it operates more than 1,000 clinics. Then, profitable business segments will more contribute to the company’s overall profitability, which will greatly increase the company’s value.

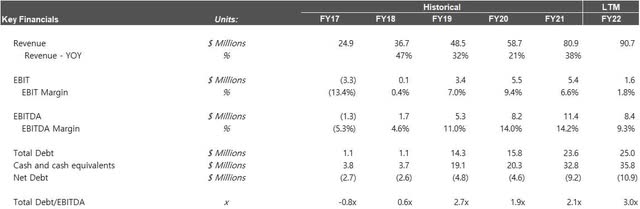

Credit Metrics (Created by the author using company reports)

Lastly, the company maintains a conservative and strong balance sheets. It can withstand the current economic uncertainty and unfavorable macroeconomic factors including rising interest rates, high energy prices, intensifying geopolitical risks. The company has a cash balance greater than the total debt amount, protecting itself from refinancing risks and using cash for lucrative reinvestment opportunities. Also its services are by nature tech-proof unlike other retail companies.

3. Valuation

The company’s core value driver is the franchise clinic segment. Franchise clinics generate strong and stable free cash flows because they have better profitability and higher capital turnover than company-owned clinics.

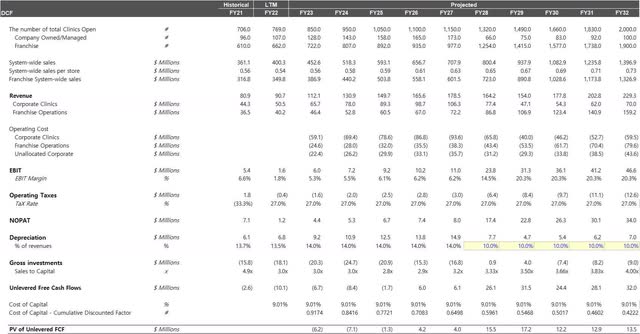

My valuation assumptions are as follows: the target number of clinics open for the next 10 years is 2,000. I assume the proportion of franchise clinics to increase from 85% to 95%. The Joint’s system-wide sales per store is expected to grow 3% per annum, and franchise fee margin royalties are set at 12%. Tax rates are 27.0% and the cost of capital is about 9.0%. Using these assumptions, I estimate the company’s future free cash flows as shown below.

DCF (Created by the author using company reports)

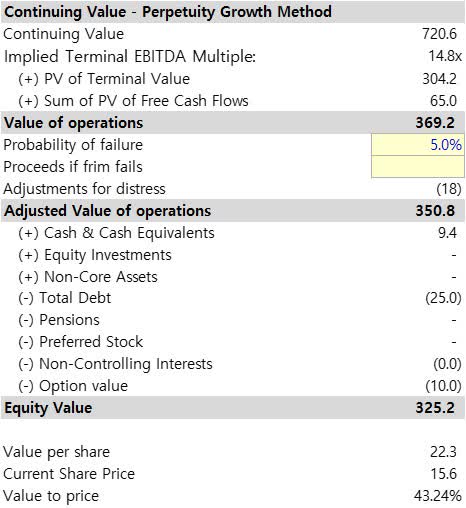

My valuation model implies the company’s terminal EV/EBITDA multiple at about 15 times. The calculated value per share is about $25 after considering a 5.0% probability of failure. It indicates the current price is undervalued and has about 40% upside potential.

Value per share (Created by the author)

I examined the distribution of intrinsic value per share by conducting a sensitivity analysis of main value drivers which include target clinics open, store sales growth rates, and the proportion of franchise clinics. I found that falling short of the target number of stores had a significant impact on the value. If the number of stores falls below 1,350 over the next 10 years, the current stock price has no upside potential.

Conversely, sales growth per store does not seem to have a greater impact than other factors.

Finally, if the franchise store ratio remains the same or below, the stock price is likely to fall more. It is because the company has to grow by doing a low-margin capital-heavy company-owned clinics, not by profitable franchise clinics.

Sensitivity analysis of the main value drivers (Created by the author)

4. Risks

The high inflation environment had an unfavorable effect on the company’s profitability. Labor cost is one of the main costs required to run a clinic. Recently the company raised the salaries of its clinic employees. As a result, the period to reach Breakeven point increased from six months to eight months.

However, the company has the pricing power to offset the cost increase. Historically, the company raised the price several times. Its average service price was $22 in 2015, but now $33. The price increases will be positive for the company’s profitability as the company opens up more clinics.

In addition, there is room for further price increase because it provides a unique value compared to traditional chiropractic care services. Just as Netflix (NFLX) maintained its pricing power by providing a differentiated value from linear TV, The Joint’s service is highly differentiated from a traditional one. However, what sets it apart from Netflix is that there are not yet strong competitors in the market. Netflix still offers great value compared to traditional TVs, but it also has to compete with strong competitors such as Amazon (AMZN) and Disney (DIS).

But the company doesn’t seem to have such a strong competitor. So I am confident that the ability to maintain its pricing power is going to remain intact for the foreseeable future and the profitability of the company will gradually improve despite the harsh inflation environment.

5. Conclusion

The Joint Corp. is a value compounder. The company operates in a big and growing chiropractic market. It has business qualities that can sustain a high return on invested capital. I am confident that the combination of growth opportunities and competitive advantages will deliver above-market return.

However, the stock price is undervalued due to external factors and provides a good entry point to take a long position in the company. A high-inflation environment might delay realizing its upside potential, but The Joint Corp. has a pricing power that can overcome the negative effects.

Be the first to comment