Joe Raedle/Getty Images News

Tesla, Inc. (NASDAQ:TSLA) is likely facing major headwinds during Q4 after Q3 revenues came up short of expectations due to a weak yuan and slightly weaker ASPs, as expected, while the OEM’s large price cuts as President Xi Jinping’s third term quickly sparked fears in the nation’s stock market. Tesla’s dependence on China as a major sales and distribution hub, a continuously weakening yuan, and the price cuts constitute major headwinds for the electric vehicle (“EV”) leader moving into Q4, likely weighing significantly on revenues.

Tesla’s Q3 Revenues Come Up Short

Although Tesla ended Q3 with record quarterly deliveries alongside a strong push to record volumes in China during September, revenues came up short of expectations.

Tesla Q3 revenues still reached a record $21.45 billion, driven by the record volumes, with auto revenues reaching nearly $20.4 billion. Revenues for the quarter were previously projected at the beginning of October to be ~$21.5 billion, due to a weak yuan (forex impact) as well as weaker ASPs – two factors that Tesla specifically highlighted as adversely impacting revenues in its earnings release two weeks after.

Tesla’s Q3 underscored the OEM’s continuously growing dependence on China as a major region for sales, revenues, and margins, and the recent shifts in the political stance as well as within Tesla’s price cuts resound negatively for Q4.

China Dependence Surges In Q3

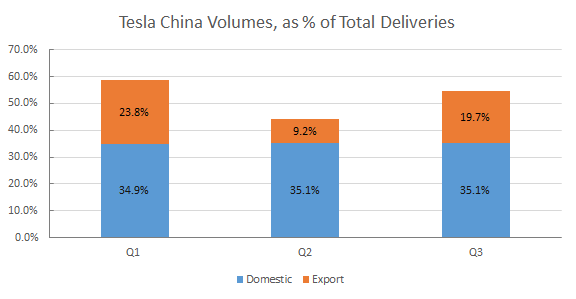

China’s record volumes for September saw Tesla’s dependence on the region surge during Q3, driven by a surge in exports relative to the second quarter as domestic sales, as a percentage of total deliveries, have remained relatively stable.

Data from Tesla/Gasgoo

As seen above, China accounted for 54.8% of Tesla’s total delivery volumes for Q3, up 14.6 percentage points from Q2, as April’s major weakness limited exports from Shanghai. Tesla’s record high exports in August took the region to command nearly 20% of Tesla’s Q3 volumes via exports, at 67,741 vehicles.

While domestic deliveries fluctuated each quarter – 108,300 units, 89,275 units, and 120,576 units, respectively – they accounted for approximately 35% of Tesla’s total volumes; in essence, weakness in China signals potential weakness for Tesla, given the concentration risk.

Although volume dependence surged, driven by a renewed uptick in exports during July and August, revenue contribution from China failed to show such growth. China’s Q3 revenues of $5.13 billion failed to match delivery growth rates – revenues grew just 35.5% sequentially from Q2 even as volumes jumped 67.3%. This was driven by a declining ASP as well as a weakening yuan, two factors to play increasingly larger headwinds in Q4. As such, China still only contributed 25.2% of Tesla’s total revenues, up just 1.6 pp from Q2’s 23.6% contribution, even on such strong volume growth.

Yuan Weakens Further On Political Tensions

With Chinese President Xi Jinping starting his third term, the yuan weakened to a 15-year low as Xi’s leadership moves “sparked worries about the continuation of market-unfavorable policies and increasing risk of policy mistakes” while stirring concerns about economic growth. Increasing geopolitical tensions also loom over Tesla, as the U.S. and China are ratcheting up bans in advanced semiconductors, and while EV manufacturing has not been mentioned, its similarity in relation to the need for advanced chips is worrisome.

China is important to Tesla, with its largest installed capacity of 750,000 vehicles per year, but the deterioration of the yuan in connection with the changing political sphere further pressures Tesla’s top and bottom lines. Tesla noted that forex rates had a negative impact on both revenues and profitability, hitting operating income for ~$250 million.

During Q3, the yuan weakened ~3.7% to an average of ¥6.86 from an average of ¥6.61 in Q2 as economic woes mounted and China’s growth outlook dimmed. The recent political landscape has sent the yuan spiraling further, with the yuan falling to ¥7.31.

October’s average exchange rate of ¥7.17 weakened a further 4.6% when compared to Q3’s ¥6.86 average rate; the yuan’s decline is showing little signs of stopping at the moment. With Q4 nearly one-third of the way through, the yuan would have to strengthen rather rapidly and dramatically back to ¥6.5 in order to mitigate any negative forex impacts. As that is unlikely, given the macro and (geo)political risks, the yuan is projected to weigh heavily on Tesla’s results again. A preliminary estimate pegs the yuan to weaken ~5.5% to ¥7.24 on average throughout Q4, a larger decline leading to a larger impact in a high-volume quarter.

Price Cuts Also To Dent ASPs

In addition to the weakening yuan, Tesla’s recent 9% price cuts in China are also expected to weigh heavily on revenues by dragging region ASPs lower, potentially below $40,000.

Although ASPs in China looked to have increased marginally in Q3 compared to Q2, from $42,420 to $42,550, ASPs are still down from the beginning of the year in the region. On Monday, Tesla “cut starter prices for its Model 3 and Model Y cars by as much as 9% in China, reversing a trend of increases” across the EV industry due to rising materials and components prices.

The Model 3 “was reduced to 265,900 yuan ($36,727) from 279,900 yuan,” while the Model Y “was cut to 288,900 yuan,” or $39,903, “from 316,900 yuan, the product prices listed on its Chinese website showed.” The prices shown are at a rate of ¥7.24. At ¥6.86, the levels of the yuan seen in Q3, the reduced price of the Model 3 would be $38,760 and the Model Y, $42,113. This shows just how significant an impact the weak yuan can have on vehicle prices when translated in USD for reporting purposes.

Disregarding the weakness in the yuan, the price cuts will have a negative effect on ASPs. As previously mentioned, Tesla’s average ASP in China during Q3 was about $42,550; with the price cuts and the yuan’s weakness, ASPs for Q4 for China are likely to fall to or below $39,000, given the starting price of the 3 sitting below $37,000 at the moment. Such a trend does not reflect positively for revenue growth.

Assessing Q4 Revenue Impacts

Although the setup for Q4 initially appeared more positive on the surface following Q3 results – 20,000 vehicles in transit, Shanghai output near highs as output in Berlin and Austin ramp – the price cuts in China, heightened political uncertainty, and a persistently weakening yuan further cloud the picture for Q4.

Tesla had noted an “increasingly challenging to secure vehicle transportation capacity and at a reasonable cost during these peak logistics weeks” during Q3, which may not ease quickly during Q4. Tesla had a backlog of about 20,000 vehicles in transit that will hit the books in Q4, offering a bit of a boost to quarterly deliveries.

Internal forecasts confirmed by Reuters at the end of September set an “ambitious target to produce almost 495,000 Model Y and Model 3s” during Q4 despite “lingering supply chain risks, a slowing economy and rising competition and falling Tesla order backlogs.” However, during Tesla’s Q3 earnings call, the manufacturer “said some logistics challenges would persist, with fourth-quarter deliveries growing by less than 50% while production rose 50%.” Less than 50% growth would suggest deliveries come in around 440,000 units, over 10% below initial internal estimates; that tally would also bring full year deliveries to approximately 1.35 million vehicles, just shy of a 50% annual growth target calling for 1.4 million vehicles.

While the ramp at Austin and Berlin for Model Y production is expected to contribute to Q4 deliveries, China again is likely to hold a pole position as a major contributor to the quarter’s growth. Building off August and September’s strength places an initial Q4 volume estimate at around 230,000 units for China.

At an estimated 230,000 units from China, the region would still account for about 52.3% of Tesla’s total estimated volume of 440,000. Assuming about 65% of that volume is sold domestically (nearly in line with Q3’s domestic/export split), along with an ASP of about $38,800 due to the yuan and price cuts, revenues for the segment are initially projected to be ~$5.8 billion – showing just ~13% q/q growth in revenues on ~24% growth in domestic deliveries. With China’s ASPs likely more than 40% lower than the global ex-China ASP average of $69,700 this year, the price cuts and yuan are likely to have a greater impact on revenues.

Given the heightened tensions and increased political and geopolitical risks, translating into direct risks to Tesla via a weakening yuan and a significant concentration, a cautious view on shares is maintained following Q3 earnings. Q4 is likely to see some persisting logistics challenges and price cuts for Tesla, and the weak yuan cutting into revenues and negatively impacting the bottom line.

Be the first to comment