jetcityimage

On August 25th, before the market closes, the management team at discount retailer Dollar General (NYSE:DG) is due to report financial results covering the second quarter of the company’s 2022 fiscal year. As we near that time, there are some important metrics that investors should keep an eye out for. The company has a great financial track record, but the 2021 fiscal year proved to be a bit weak. That weakness has extended, to some extent, into the early stages of the 2022 fiscal year. Even so, the company still has succeeded in topping analysts’ expectations. But in a volatile market that is dealing with inflation, high interest rates, and other concerns, there’s no telling what the future will hold. All things considered, the retailer is a quality player in its space and its long-term outlook is most certainly positive. But this doesn’t make it a prime prospect for investors to buy into. Given where shares are priced on both an absolute basis and relative to similar players, it probably is a fairly valued prospect at this time. Because of this, I have decided to rate the business a ‘hold’, reflecting my belief that it will likely generate upside that more or less matches the broader market for the foreseeable future.

Dollar General – A great business

The retail space is incredibly hard because of how competitive it is and because of, typically, low margins. But the companies that can find a nice niche for themselves have the potential to do incredibly well. One great example of this can be seen by looking at Dollar General. But before we get into the fundamentals, we should discuss exactly what the company is and what it does. According to management, the enterprise operates is one of the largest discount retailers in the US. As of this writing, it has 18,356 stores spread across 47 states. Its greatest concentration seems to be in the southern, southwestern, Midwestern, and eastern portions of the country. The types of merchandise it offers include, but are not limited to, consumable items, seasonal items, home products, and apparel. During its 2021 fiscal year, 76.7% of its revenue came from consumable items. 12.2% came from the seasonal category, while home products accounted for 6.8% of sales. Apparel, meanwhile, made-up 4.3% of revenue.

The firm specializes in providing both national branded and private branded products at prices that are usually $10 or less in stores that are fairly small compared to other major retailers. When I say small, I mean that the company’s stores currently average roughly 7,400 square feet in size and an estimated 75% of its locations are in towns of 20,000 people or fewer. This is not to say that things will not change with the business. That’s because, starting in 2021, its primary new store format is a bit larger, averaging roughly 8,500 square feet of selling space. These locations will likely be suitable for new markets for the company, and they will have the benefit of the firm spreading out many of its fixed costs across greater revenue, hopefully resulting in higher margins in the future.

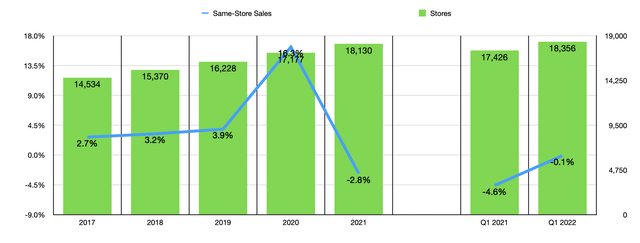

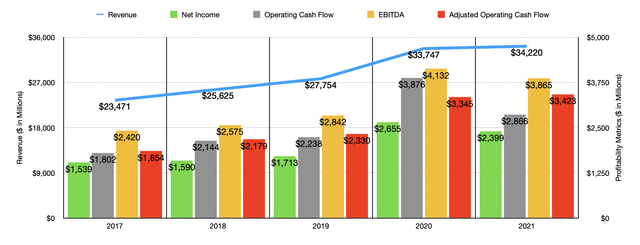

Over the past several years, the management team at Dollar General has done a great job growing the company. Revenue has expanded from $23.47 billion in 2017 to $34.22 billion last year. Sales continue to increase, including through the pandemic. In fact, according to management, sales growth accelerated during that time because of stimulus spending and the fact that consumers were focused on hoarding and getting the most bang for their buck. This growth in revenue for the company came as the number of stores the business operates increased from 14,534 to 18,130. Same-store sales increased in each of the four years ending in 2020, with the 2020 fiscal year posting a 16.3% rise compared to the 2019 fiscal year. But as the worst of the pandemic drew to a close, same-store sales did decrease in 2021 to the tune of 2.8%.

With this rise in revenue, we have generally seen an increase in profitability. Between 2017 and 2020, net income rose from $1.54 billion to $2.66 billion. But then, in 2021, net profits took a step back, totaling $2.40 billion for the year. Clearly, the decline in same-store sales negatively impacted the company’s margins. Other profitability metrics followed a similar trajectory. Operating cash flow rose from $1.80 billion in 2017 to $3.88 billion in 2020. This profitability metric did decline to $2.87 billion last year. If, however, we were to adjust for changes in working capital, then we would have seen a consistent increase year after year, with the metric rising from $3.35 billion in 2020 to $3.42 billion last year. The trajectory for EBITDA, meanwhile, more closely reflected the operating cash flow and net income of the business. The metric ultimately rose from $2.42 billion in 2017 to $4.13 billion in 2020. Then, in 2021, it pulled back slightly to $3.86 billion.

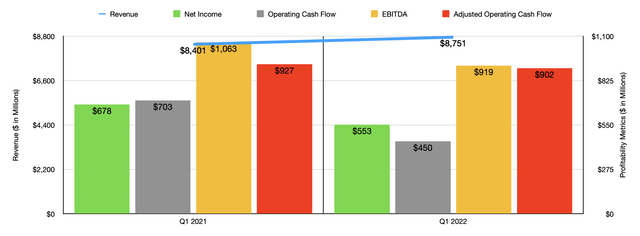

Growth for the company has continued into the current fiscal year. Revenue in the first quarter of the year totaled $8.75 billion. That compares favorably to the $8.40 billion generated just one year earlier. The company benefited from its store count rising from 17,426 in the first quarter of last year to 18,356 this year. Somewhat offsetting this, however, was a reduction in same-store sales of 0.1%. This, combined with other factors like supply chain issues, proved instrumental in pushing profitability for the enterprise down. That income in the first quarter was $552.7 million. That’s 18.4% lower than the $677.7 million generated one year earlier. Operating cash flow fell from $703 million to $449.5 million, while the adjusted figure for this dropped from $927.3 million to $902.4 million. And finally, EBITDA for the company also dropped, declining from $1.06 billion to $918.7 million.

When it comes to the second quarter of the company’s 2022 fiscal year, investors should pay attention to both revenue and profitability. It remains to be seen whether the weakness in same-store sales will continue. Regardless of what does happen, however, analysts have pretty high hopes for the firm. They currently expect revenue of $9.39 billion. That’s significantly higher than the $8.65 billion the company generated the same time last year. No doubt, the driving force behind any sales increase will be a rise in the number of locations compared to the 17,683 stores the company had in operation at the end of the second quarter last year. Meanwhile, earnings per share are forecasted to be $2.93. That would be higher than the $2.69 generated in the second quarter of 2021. Some of this might be attributable to a decrease in share count that analysts are anticipating. After all, from the first quarter of 2021 to the first quarter of this year, management did reduce the number of shares outstanding by 4.4%. But that alone will not be enough to account for this growth. The company must show strength and profitability from an absolute approach. It should also be said that the company does have a good track record of topping analysts’ expectations. For the first quarter of the year, the firm beat expectations when it came to revenue by $38.4 million, while earnings per share topped expectations by $0.11.

For the 2022 fiscal year as a whole, the picture is looking pretty bright. Revenue is forecasted to rise by between 10% and 10.5% year over year. But of course, about 2% of this sales increase is expected to come because of an extra week this year compared to last year. Other drivers would be 1,110 new store openings for the year, 1,750 store remodels, and 120 store relocations, all thanks to a planned capital expenditure budget of between $1.4 billion and $1.5 billion. It’s also expected that same-store sales should rise by between 3% and 3.5% for the year. From a per-share perspective, the picture is made a bit more complicated by the fact that management intends to allocate around $2.75 billion to share buybacks. Ignoring the share buybacks and stripping out the extra week in operation for the year, we should get net income this year of roughly $2.52 billion. Using this estimate, we can further estimate that adjusted operating cash flow should be around $3.59 billion this year while EBITDA should come out to around $4.05 billion.

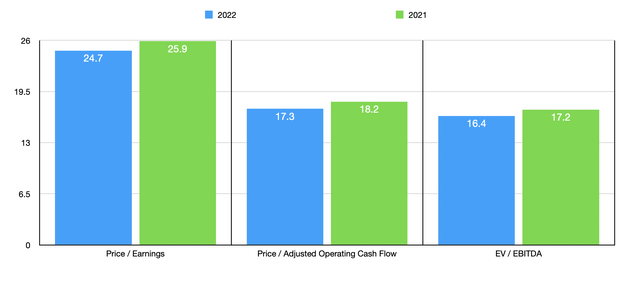

Using these figures, it becomes pretty simple to value the enterprise. On a forward basis, the firm is trading at a price-to-earnings multiple of 24.7. This is down from the 25.9 reading that we get using last year’s results. The price to adjusted operating cash flow multiple should drop from 18.2 using last year’s figures to 17.3 using forward estimates. And the EV to EBITDA multiple for the company should drop from 17.2 to 16.4. As part of my analysis, I did compare the company to the two firms that I think are most comparable to it. On a forward price-to-earnings basis, these companies had multiples of 20.7 and 27.9, respectively. Using the price to operating cash flow approach, the range was between 13.6 and 19.4, while using the EV to EBITDA approach, we get a range of between 14 and 18.7. In all three scenarios, one of the two companies was cheaper than Dollar General, while the other was more expensive.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Dollar General | 24.7 | 17.3 | 16.4 |

| Dollar Tree (DLTR) | 20.7 | 13.6 | 14.0 |

| Five Below (FIVE) | 27.9 | 19.4 | 18.7 |

Takeaway

All things considered, Dollar General strikes me as a really fascinating company that has great upside potential in the long run. Having said that, I think that shares today are more or less fairly valued, including relative to the competition. For investors who don’t mind paying a bit of a premium for a quality operator that will almost certainly do well in most any environment, Dollar General is the kind of prospect to consider. But for those wanting to buy a firm on the cheap, there are better avenues to explore at this time.

Be the first to comment