spooh

Kaman Corporation (NYSE:KAMN) is a diversified company that operates in aerospace and defense, medical and industrial markets. In 2021, to develop brand value and strategically improve operations, the company came up with a new reporting segment which is comprised of engineered products, precision products and structures as the main reporting segments.

Product catalog (company website)

Engineered product segment – with the major operations to serve the aerospace and defense industry, it provides proprietary aircraft bearings and components such as miniature ball bearings and spring energized seals.

Precision products segment – mainly provides precision safe and arming solutions for missile and bomb systems for the US military and allied military.

Structures segments – provides complex metallic and composite aerostructures primarily for commercial and military aviation.

Over the period, U S. military, foreign and allied military, Sikorsky Corporation, the Boeing company (BA), along with various other aircraft manufacturers, are the major customers of the company. Having such a substantially strong customer base might put significant pressure on pricing, but the company has maintained its profit margins at an adequate level. But the substantial fluctuations in the operating result might be a result of significant pricing pressure.

Although the company has significant strength in its business model, various risk factors can affect the operating results. In my view, a valuation of 12 times earnings or above for a company whose revenue has been declining might not provide a considerable margin of safety. Also, the recently increased operating expenses might hurt the company’s profitability. Therefore, I assign a sell Rating for the stock.

Historical performance

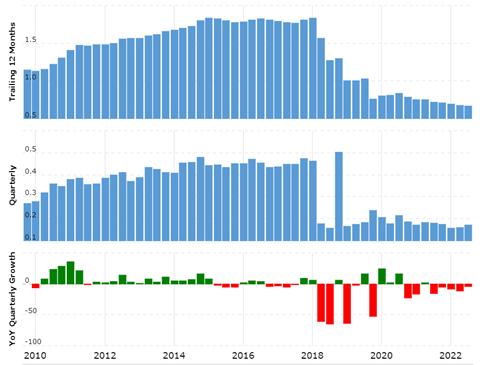

Revenue (macrotrends.net)

From 2009 to 2016, revenue kept increasing consistently. But in 2017, revenue dropped significantly from $1.8 billion to about $724 million. And since then, it has been oscillating at this level. Also, with the drop in revenue, profitability dropped considerably, but in the last year, it has increased to about $43 million in 2021.

Over the period, management has been focusing on reducing debt, as a result, long-term debt dropped from $434 million in 2015 to $189 million by 2021, but due to the acquisition of Parker-Hannifin Aircraft Wheel & Brake Division net debt has reached $609 million.

Over the period, cash flow from operations has been significantly attractive. Still, the CFO has remained subdued in the last three years due to supply chain issues and increased working capital load. Also, the cash generated has been invested in acquisitions, strengthening the business model.

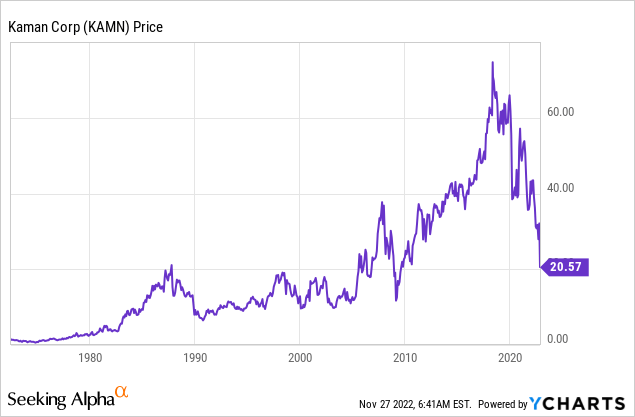

Stock price (YCharts)

Furthermore, from the drop of 2008, the stock price consistently increased more than five times and reached its all-time high of about $72 per share by 2018, but since then due to volatile profit margins and a drop in the cash flows the stock price has been dropping significantly, as a result, the stock has lost over 72% of its value to date, and has been trading for just $20.57 per share.

Strength in the business model

The company faces significant pressure from original equipment manufacturers (OEM) to reduce prices; despite such pressure, the company has maintained its profit margins due to efficient operations and cost control strategies, which shows that low-cost operations have been helping the company to attain profitable operations.

In FY 2020, management positions have changed substantially, as a result, Ian Walsh became the new CEO, and with the substantial change in management positions along with business strategy, operating efficiency might improve in the upcoming quarters.

Along with that in early 2022, the business entered into various manufacturing agreements which can help the company to strengthen its business model.

Risk factors

As the company has been depending on government contracts for a substantial part of its revenue, any changes and termination of the contracts might hurt the company. Also, gaining pricing power over government entities becomes very difficult as a result of margins on these sales are considerably lower than expected. Any further pricing pressure might hamper the profit margins significantly. Also, these government entities might ask for a longer payment duration which can put significant pressure on working capital.

Due to its dependence on the aerospace and defense industry, the company’s operations tend to fluctuate with the cyclicality of the industry and government spending.

Furthermore, the recent acquisition has led to a significant rise in goodwill. Therefore, it seems that the acquisition is substantially expensive. Also, it might take considerably longer time as the company has been spending significant money on developing the business operating margins, which might remain subdued for upcoming quarters, in such conditions, the stock price might see a considerable correction.

Also, recently increased debt can bring huge interest expenses, which can further reduce net profits.

Recent development

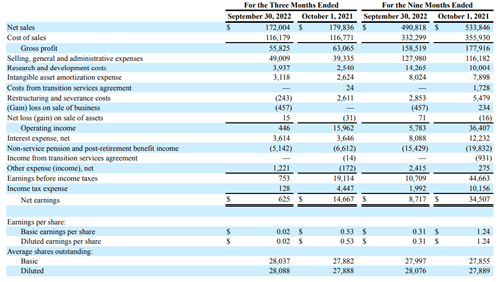

Quarterly result (Quarterly report)

In the recent quarter, net sales have dropped slightly to $172 million but due to higher selling expenses and lower gross margins, net profit dropped significantly. Also, in the last nine months, revenue and profitability have been affected significantly. Also, as a result of the Parker-Hannifin Corporation acquisition, the net debt has increased to about $609 million to date.

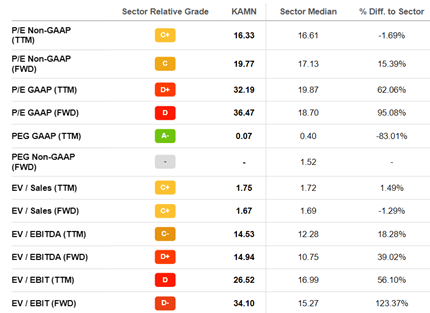

Valuation metrics (seeking alpha)

Currently, the company has been trading for $576 million whereas it has produced over 8.7 million in net profits during the last nine months, Although the company has produced over $43 million in 2021, the company’s cyclical operations and substantially increased cost might put significant pressure on net margins. Therefore, I believe the company might face trouble maintaining its margins due to the high expenses to develop the acquired business and recently increased interest costs, and in such a case the stock price might suffer significantly. I assign a sell rating to the stock.

Be the first to comment