Passakorn Prothien

Neobanks have been all the rage since the 2008 global financial crisis brought the global economy to its knees and traditional banks had to retreat from lending to certain parts of the market on the back of stringent new regulations and capital requirements. This catalyzed the growth of non-bank lenders and online-only checking account providers like Dave (NASDAQ:DAVE). The West Hollywood, California-based company, whose name was meant to allude to the biblical story where David faced and beat the giant Goliath, was founded in 2016 and has since grown to 7 million members as of its last reported earnings quarter.

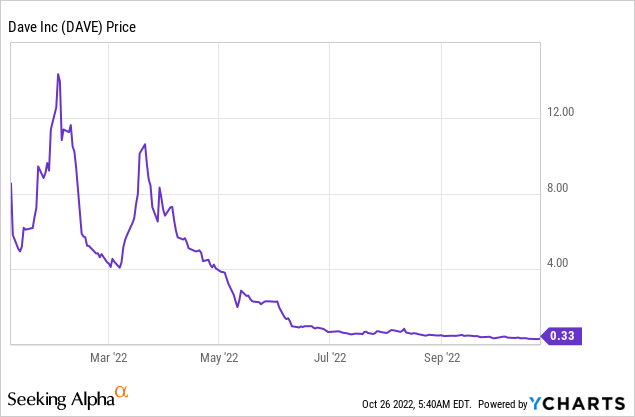

The company aims to compete with traditional banks through its bonfire of established inherently anti-consumer practices with no overdraft fees, no minimum balance fees and no ATM fees. For a $1 per month membership subscription, users can access its no-fee checking accounts and up to $500 in overdraft also without fees or interest. However, this has not been enough to prevent the company from being exposed to the full market rage with its common shares down 96% year-to-date. This has made Dave trade at less than the $1 price required to continue being listed on the NASDAQ. A potential delisting is a possibility after a 180-calendar day cure period from receipt of its receipt of deficiency notice at the end of July.

Whilst a reverse stock split would be an accessible remedy, it would represent a fall from grace for a company that counts billionaire and Dallas Maverick owner Mark Cuban amongst its early investors. The company was also featured on the 2020 CNBC Disruptor 50 list. A list that now reads like the obituary of dreams with most of its recent public companies down materially from their recent highs. Even by deSPAC standards, Dave’s collapse has been dramatic. Common shares are way below its $10 SPAC reference price for a market cap of $125 million. This is against a pro forma fully-diluted equity value of $4 billion when it announced it would go public in a deal with Victory Park Capital, a Chicago-based global investment firm and with a $210 million PIPE led by Tiger Global Management. It also heavily contrasts with the $1 billion it held at its last pre-public private funding round.

There is seemingly no floor which keeps shares as a hard avoid for all investors, this is especially with the broader macroeconomic backdrop expected to deteriorate further. There is likely more pain to come with still no certainty from management as to plans to regain Nasdaq compliance. This will have to be covered during their next earnings call as a delisting would compound the company’s issues and remove them from the vast majority of their investor base.

There Is No Floor And The Risks Are Plentiful

To be clear here, an investment in Dave at these levels would represent bottom fishing with the underlying issue seemingly being a total loss of investor faith in management. This has been compounded by concerns around slowing growth and potential charge-offs from the company’s focus on sub-prime customers. This holds the potential to spark further disaster going into a recession.

The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $47 million, a 22.4% increase from its year-ago quarter but a miss of $2.24 million on consensus estimates. Gross margin at 47.8% was a 220 basis point sequential decline. The company notched net losses of $27.1 million during the quarter against cash and equivalents that declined from $301.8 million to $256.8 million. Dave added 560,000 net new members to increase its membership total to 7 million. However, the company stated during its earnings call that transacting members stood at 1.54 million with 4.5 transactions per monthly transacting member. This infers that just around 22% of total members conduct a transaction every month. Put another way, almost 8 in 10 members have signed up for Dave but do not use it in over a month. That’s a significant level of inactivity and management might be best placed to redefine what constitutes a member.

Growth Is Slowing And Dave Is Exposed To Market Rage

Dave’s collapse has been nothing short of breathtaking with its initial ambition to disrupt the old traditional banking order with a digitally native low-fee approach to financial services having been seemingly rejected by the stock market. The company’s name was meant to paint a vivid picture of the small guy in triumph against a much larger and stronger opponent, but Dave has found itself crushed with revenue growth slowing, its stock price in freefall, and its membership engagement a fraction of total.

Further, whilst its 28-day delinquency rate of 3.71%, was a 75 basis point improvement compared to its year-ago quarter, this stands to increase as the macroeconomic situation in the US stands to further deteriorate. The company should be avoided in the interim as market volatility is expected to return on the back of future interest rate rises and what is likely to be a period of negative economic growth.

Be the first to comment