Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) shares are down about 56% over the past year, and we believe it is time to move the stock to a buy. NVDA has had a rough year, to say the least, with a significant GPU crash and a harsh macroeconomic environment. We believe the stock is forming a bottom and expect to witness a significant rally as data center demand ramps up. While we believe the stock can remain very volatile in the near term, we think longer-term investors should begin to look for entry points for the stock.

We were previously sell-rated on NVDA based on our belief that the company was highly exposed to crypto-related GPU sales. We expected a significant gaming downside as Ethereum switched from Proof of Work to Proof of Stake. Consistent with our belief, the company saw significantly weakened GPU demand. We expect this to continue as macroeconomic headwinds persist and local currency devaluation pressures the consumer gaming demand. Our bullish sentiment is based on our belief that the data center segment will pick up gaming slack. We expect data center demand to significantly outperform expectations due to new product cycles and inventory hoarding by Chinese customers that are not included in the entity list. We believe NVDA provides an attractive entry point now as the gaming downside has been priced in for the most part and as we witness the data center segment becoming a new growth catalyst.

Data centers to take center stage

Data center revenues comprise more than 50% of NVDA’s total revenue. We expect this percentage to increase as data center demand ramps up. Despite the recent U.S. restrictions on DoC exports, we believe NVDA’s data center GPU sales will rally due to new product cycles and inventory hoarding.

Let’s backtrack and explain how NVDA falls into the “tech wars” between the U.S. and China. The U.S.’s recent restrictions halt the sale of data center products to China. The restrictions are expected to harm NVDA’ s revenue and other U.S. semiconductors, specifically Advanced Micro Devices (AMD). NVDA is heavily exposed to sales in China; around 26% of NVDA’s geographic revenue was derived from China in the fiscal year of 2022. Despite this, we believe NVDA data center demand to increase significantly. As the U.S. restrictions materialize, we expect to see significant inventory hoarding by other Chinese customers that are not included in the entity list. We believe the inventory build-up will continue regardless of weakening consumer spending, as the supply-demand dynamics of customers are irrelevant when it comes to hoarding.

In addition to the inventory hoarding, we believe data center demand will increase as the new product cycle rolls out. NVDA’s data center segment grew 61% Y/Y in the company’s 2Q22 earnings report. We expect further growth for the segment and believe it’ll become NVDA’s new bread and butter.

Gaming weakness not washed out

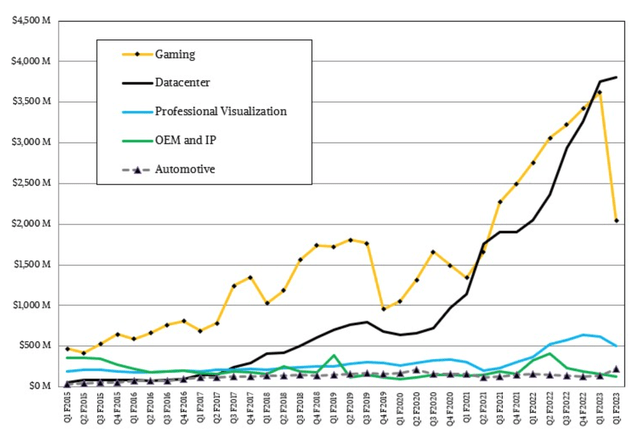

NVDA continues to see weak gaming demand, and we expect this to continue towards 1H23. NVDA’s gaming sales are expected to decline about 60% or more than $2B from the peak level two quarters ago. While we had previously been concerned about the gaming segment due to its exposure to crypto-mining-related GPU sales, we now believe the weakness has multiple facets. We believe current macroeconomic pressures and local currency devaluation will likely put additional pressure on the consumer gaming demand. NVDA’s data center segment has taken first place as the primary revenue stream for the company in 1Q22. We believe the data center segment outperformed due to gaming weakness but now believe the data center itself will experience demand tailwinds.

The following graph outlines NVDA’s revenue by segment.

Valuation

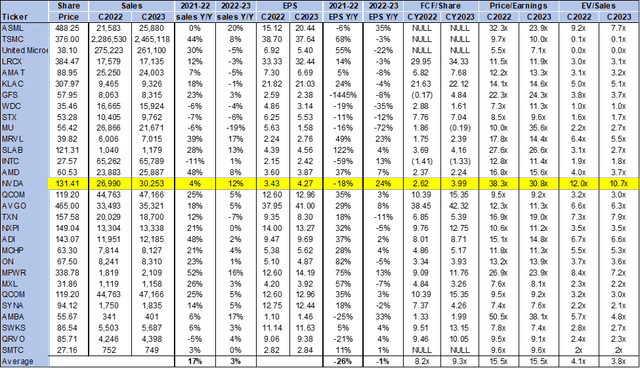

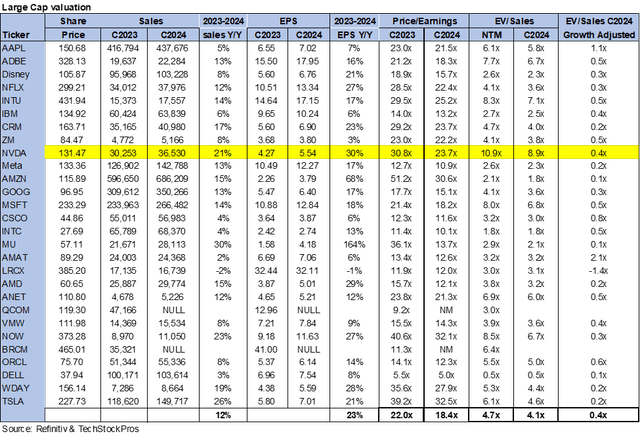

NVDA is not cheap. The stock is trading at 10.7x EV/C2023 sales compared to the peer group average of 3.8x. On a P/E basis, the stock is trading at 30.8x C2023 EPS $4.27. We believe data center demand tailwinds will offset gaming weakness and recommend long-term investors buy the stock. The following chart illustrates the semiconductor peer group valuation.

Refinitiv & Techstockpros Refinitiv & Techstockpros

Word on Wall Street

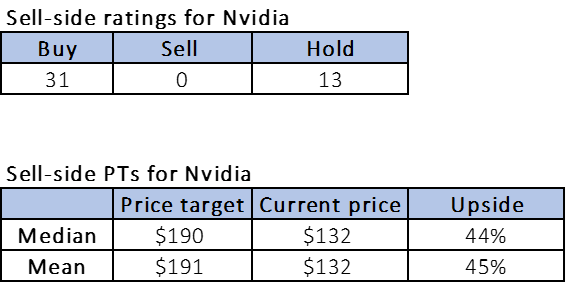

Wall Street is bullish on the stock. Of the 44 analysts covering the stock, 31 are buy-rated, and 13 are hold-rated. We share Wall Street’s bullish sentiment on NVDA. The stock is currently trading at $132. The median and mean price targets are $190 and $191, respectively, with a significant upside of 44-45%. The following chart indicates NVDA stock’s sell-side ratings and price targets:

Refinitiv & Techstockpros

What to do with the stock:

While we were previously bearish on the stock, we believe the winds have changed for NVDA. We expect to see demand for NVDA’s data centers significantly improve. While we believe gaming weakness will continue, we move the stock to a buy. We believe NVDA stock presents an attractive entry point at current levels.

Be the first to comment