JJFarquitectos/iStock Editorial via Getty Images

Dear readers/followers,

Telecommunications and communications remain one of my core segments to invest in. While many of these positions are currently lower than I would like them to be, my worries for my investments are zero. Why?

Because investments of hundreds of thousands of dollar into the backbone infrastructure of our modern world are not in the least worrying to me. This goes regardless of the quality company from a geographical point of view. We can talk about AT&T (T), Verizon (VZ), Telia (OTCPK:TLSNF), Tele2 (OTCPK:TLTZF), Deutsche Telekom (OTCQX:DTEGY), or Orange (ORAN) – I’m positive on them at the right multiple.

This goes even more for the current company I’m reviewing – Telefonica (NYSE:TEF).

Let’s see what we have going for us in this investment.

Telefonica – An update

It would be wrong to characterize Telefonica as the highest-quality telco I “BUY”. That is not the case. There are certain challenges that I’ve been through in several of my numerous articles. My stance at the time was simple – Risk/Reward is favorable here.

This continues to be my overall stance on the company – but let’s dig down a bit. Investors who underestimate fundamentals in a rising interest/risk-off market are bound for potential disappointment when safety comes “home to roost”.

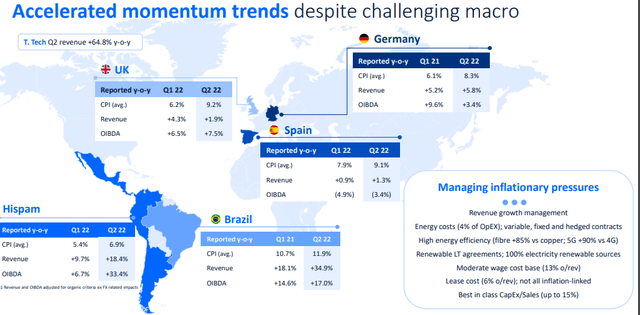

When looking at Telefonica, you must remember that what you’re checking out is a Spain, Germany, UK, and Brazil-focused business, because 80% of the company’s top line comes from these geographies. In many of these markets, the company is either a leader or close to it, and the relatively recent asset monetization of all of the non-Brazil SA/LATAM-geographies is a risk-reducing sort of move from Telefonica. The merger between O2 and Virgin bringing together the UK was another advantage.

But the market has yet to recognize these things, instead seeking to punish near-term uncertainty. While I can emphasize with uncertainty, I believe the market is unjustly punishing the company here for things that it does not really have control over.

The recent results from the company are actually quite stellar – and we have a new set of results coming quite soon as well.

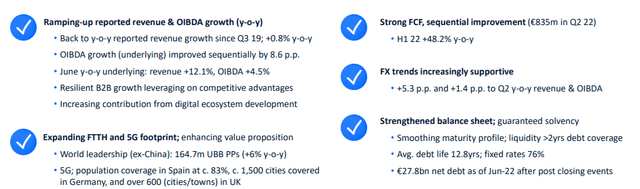

For 2Q22/1H22, the company delivered solid accelerated top-line growth and OIBDA growth. Telefonica, in fact, over-delivered on its results despite the ongoing macro and is managing what challenges it can.

This trickled down from a 5.2% top-line revenue growth to a 3.4% OIBDA growth, with sequential improvements despite the macro. Again, underperforming is not what the company is doing here – the opposite, as a matter of fact.

CapEx/Sales % is what worried many investors – but Telefonica managed these as well, with only a slight increase YOY and sequentially, while still managing to generate nearly €1.4B of company free cash flow.

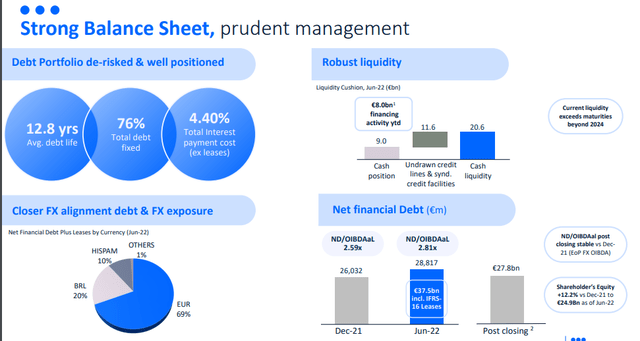

The company’s balance sheet is stronger, it has a superb debt life of nearly 13 years, with 76% at fixed rates, giving the company some resilience to ongoing interest rate increases. Plenty to like here, as such.

Less CapEx, the company’s OBIDA was even better, as we all know, the company needs to spend plenty of cash on spectrum. The fact is, the company saw improvements in nearly all of its geographies. All except Spain, as it happens.

And while I never stick under the table with risks, such as what’s being mentioned here, I want to reiterate just how safe this company is in terms of guidance, dividends, and safety. The current guidance for the company calls to high-end single-digit growth in 2022, which is exactly where the company is in 1H22. The OIBDA growth is also completely on track, and CapEx/Sales is covered (less spectrum) at around 15% guidance, but with only 13% so far – so the company is actually doing better.

The dividend is completely rock-solid. At a €0.3/share confirmed, the company’s yield is now very close to 8.6%, making this an extremely inflation-safe payor and “protector” of your portfolio if you choose to go this way – while investing in one of the strongest telcos in Europe.

Telcos are somewhat out of favor here, that is true. However, I see no reason for why this should remain for the long term. Once everything is said and done, Telefonica retains its S&P Global credit rating and has almost €23 billion of liquidity. Cash is not a problem for Telefonica – they could earn €0 and still pay off every single maturity until 2024 with the liquidity they currently have on hand – and even more.

Investors who say that there is “danger” to Telefonica from a fundamental perspective do not understand how Telcos work or understand Telefonica’s asset base, which even at conservative EV/EBITDA multiples comes in at nearly €70 billion. There remains a lot of misconception about Telefonica and what the company is and isn’t.

Again, risks do exist. But these are considered in the following way. In order to properly calculate Telefonica, you need to understand the nature of its capital structure and segmentation. Telefonica Germany is not indebted under the TEF holding company, and neither is Telefonica Brazil. Its current structure includes several, separately listed assets, and these need to be accounted for in a slightly different way. This sort of company structure always makes things a little more complicated, and this needs consideration as well. That is why you’ll find several tickers to invest in – and why I invest in the native TEF ticker that’s listed on the BME.

We’re at a massive valuation slump. Some might argue this slump is justified – I’m obviously not one of them.

Let me show you some of the valuation specifics before moving on here.

Telefonica Valuation

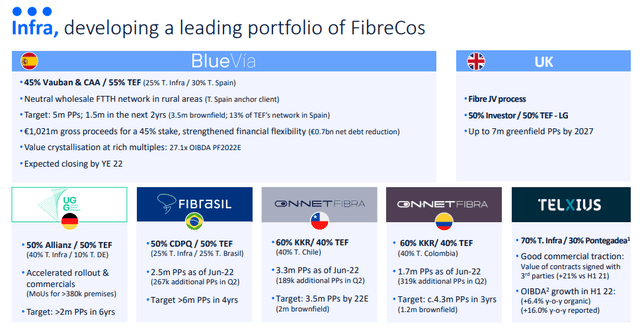

One of my previous stances definitely remains here. You either believe the company’s 5-point plan of focusing on core markets and working on Telefonica Tech and Infra in the long term, as well as the leaving of Latin America in order to create a more predictable and stable operation.

Or you believe that the inherent risks of such major moves are too great to be interested in, and some of the aforementioned risk factors skew the calculation way too far in one direction.

Either of these stances is obviously “fine”, but here is my take. You can’t mistake TEF for a business that’ll just sort of go up 10-20% from one day to the next. It’ll grow back slowly – all the while paying you a solid dividend. The undervaluation we see here is beyond clear to me.

The TEF ticker on the NYSE is currently trading at a blended P/E of 9.6x, which is significantly below the 12x it’s usually at. The reasons for this are successive years of EPS drops in the face of asset monetizations as the company adjusted its portfolio. That is why I did not invest before the real crash in 2020, and why my TEF position, especially including FX, is still up low double digits at this time despite the drops.

You’re buying TEF at below 0.4x P/B. The market can discount a Telco incumbent for a long time based on transitory headwinds.

There is plenty of global evidence of this, with businesses like Orange and others, including Swedish ones such as Telia. However, eventually, things will normalize, even if the company does as major a restructuring as we’ve seen here. And, I can tell you that I’ve made good money by investing even in the short term in telcos like this one.

In fact, a successful strategy that’s netted me tens of thousands of dollars is the very simple approach to Telia – to “BUY” below 30 SEK, and “SELL” above 39 SEK, essentially treating it like a 6-7% yielding government bond. Take a look at the company’s price history over the past 10 years and tell me that does not work.

The current target averages for TEF follow the price ranges of a €3 low and a €6.5 high. 26 analysts follow the business, of which 12 have a “BUY” or equivalent, with a target of €4.75 on average, implying an upside of 36% for the native, euro-denominated TEF ticker.

At this time, the market is applying nutty multiples like a revenue multiple of around 1.75x, a sales multiple of less than 0.5x, and EBITDA of less than 10x. The market is treating this telco cash cow like a company that’s going “down” – which I believe not to be the case.

I believe that eventually, that discount will end, and when it does, I firmly believe I will be on the right side of the equation to see returns of over 15% per year, with a 3-year total RoR of close to 55% for this company – and that, to me, is good enough to invest a decent amount of cash in.

I’m still not shifting my previous share price target for Telefonica – I remain at a “BUY”.

We’re just before 3Q Earnings here – and my thesis of “BUY” here is specifically formulated for buying before this next report. Continued strength in fundamentals will likely, as I expect it, cause the company to guide EPS and income to a level that covers not only the €0.3/share dividend but goes beyond this. This would be a catalyst for stabilization and reversal as GAAP hasn’t been above this (excepting extraordinary items) for a few years at this point, and the share price is under pressure in part due to this. Another catalyst is further guidance toward an inflation-adjusted EBITDA/OIBDA margin of above 30%, which the company is also expected to achieve for the FY22 (Source: S&P Global) and which I also expect here.

Risks I see are primarily related to the company posting a negative or flat quarter, which could further pressure the share price. However, given full-year guidance, I view this as unlikely, and given the valuation, any further decline would only raise this yield further. And given that I consider it safe, any further decline would not materially impact my long-term thesis for the company. All of these prospects are not even going into the potentials of the FiberCo portfolio, where the company is developing a very attractive potential with JV partners like Allianz (OTCPK:ALIZY), Investor, and others.

Therefore, my guidance for 3Q22 is that results, either way, are positive and make for this company to be an attractive prospect.

I’m not too exuberant here – and I’m slightly adjusting my target to account for inflation, down to €4.9/share. But that still leaves me with a fairly significant upside to this company. At this price, I still see the upside as good enough to consider investing in Telefonica – especially in today’s market, and especially given where we’re going into an environment where we want income. Telefonica is not expected to cut its dividend, and its results are expected to remain stable, despite everything.

This forms the basis of my continued Telefonica Thesis.

Thesis

My thesis for Telefonica is as follows:

- The currently-cheapest telco major in all of Europe, and one that warrants individual attention and consideration, even with everything that’s happening here.

- There are reasons for the valuation, but I view those reasons as unfairly discounting the fundamental advantages of the company. We can heavily discount the cash flows, assets, and multiples, and still, come out with higher targets than the market is giving us for Telefonica.

- I view this one as a “BUY” with a €4.9/share price target.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment