Justin Sullivan

After the bell on Wednesday, we received second quarter results from electric vehicle maker Tesla (NASDAQ:TSLA), which can be seen in this shareholder letter. We knew that overall results would be down sequentially from Q1 levels thanks to the Shanghai factory being shut down for a number of weeks. Investors were curious to see how this would impact profitability, especially when combined with two new factories ramping, and what this meant for the second half of 2022.

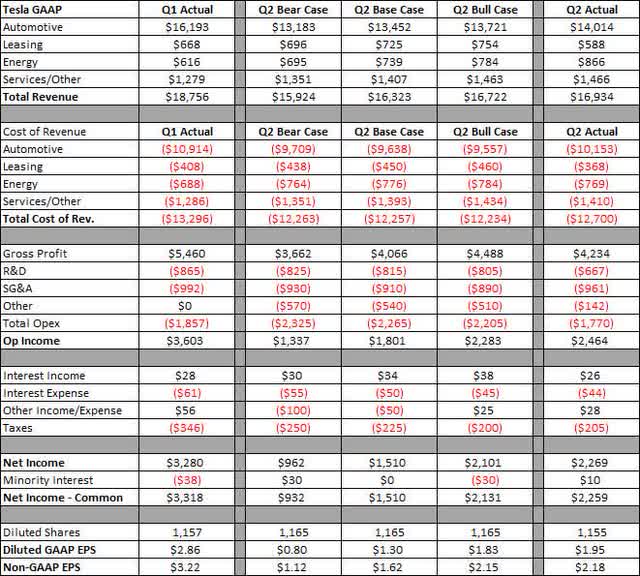

As I detailed in my earnings preview article, I wasn’t going to be overly concerned with the headline numbers unless they were really out there one way or another. For the quarter, Tesla came in a little under $17 billion in revenue, right around what the street was expecting. I was a little light all around, except for leasing revenue that dropped sequentially. My guess is that I overestimated the stronger dollar impact here, plus it seems Tesla ramped solar and services a bit more than most expectations. Credit sales also came in higher than I was looking for, but still dropped significantly sequentially thanks to Q1’s one-time benefit. In the graphic below, you can see the overall numbers against my three earnings cases. Dollar values are in millions except per share amounts.

Tesla Q2 Results (Author Estimates, Company Report)

While I was low on revenues, I also was low on the cost of goods sold. I thought Tesla would surprise a bit with margins as it recently has, but that was not the case here. GAAP automotive gross margins fell by 5 percentage points sequentially to 27.9%, falling 90 basis points shy of my estimate, while non-GAAP fell by 3.8 percentage points to 26.2%. Tesla’s gross profit dollar figure came in above my base case but was still below my bull case. The company made nice improvements in energy and services margins as those segments saw revenues jump sequentially.

On the operating side, Tesla’s expenses came in lower than my projections. Research and development costs dropped about $200 million sequentially, which seems a little odd given all the products the company is supposedly working on at the moment. The major difference here was that restructuring and other costs were $400 million less than I figured. The reason here is that Tesla converted most of its Bitcoin to fiat currency during Q2, so there wasn’t a massive impairment charge that many were looking for. The Bitcoin sale was a surprise given Elon Musk’s past comments about holding the cryptocurrency.

Tesla’s non-GAAP EPS came in above all three of my cases, mainly driven by the Bitcoin sale and other income items, which can vary wildly from quarter to quarter. Again, I’m not going to make too much of the $2.18 figure beating the $1.80 average street estimate for Q2, given the Bitcoin sale and a variety of other one-time items for the quarter. I’m guessing analysts will call this a “better than feared” quarter, but it wasn’t exactly a blockbuster that bulls can really rally around.

On the cash flow front, Tesla reported free cash flow of $621 million, a bit less than the just under $1 billion the street was looking for. Tesla’s cash balance rose to more than $18 billion, helped a bit by the Bitcoin sale. The one item that worried me a bit is that despite the huge drop in production, accrued liabilities and accounts payable rose again. This meant that Tesla’s days payable outstanding rose to 80 from 72 in Q1 and 71 at the end of June 2021, so the 80 figure represents the highest value since Tesla started disclosing this metric.

Cash flow numbers are certainly helped when you continue to stretch out payments to your suppliers. Critics also might say that the Bitcoin sale was due to Tesla being in a little bit of a cash crunch. Even though cash rose to a quarter-ending record, the company reported less interest income in Q2 than it did in Q1, and that’s despite interest rates rising. For a company with over $18 billion in cash, a quarterly interest income figure of just $26 million seems rather low.

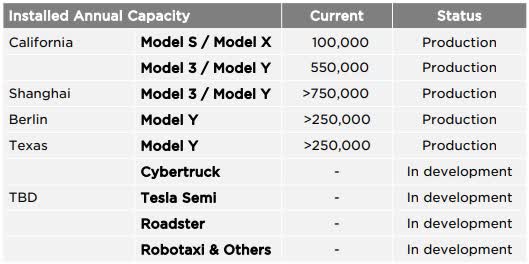

Perhaps the biggest update we got in the shareholder letter was with regard to production capacity. For the first time in a while, Tesla management updated the Shanghai number, which now exceeds 750,000 vehicles a year as the graphic below shows. The company is close to 2 million units per year of installed capacity, and current expectations call for deliveries of about 1.4 million units this year. Tesla continued its forecast for long-term growth of 50% per year but didn’t give an explicit figure for this year in the letter.

Q2 Installed Annual Capacity (Q2 Earnings Report)

As for Tesla shares, they initially popped on the headline numbers, rising more than $35 at one point to a high of $778. However, they dropped a bit back as the numbers were being digested, turning into the red around 4:38 PM. In the end, the company delivered decent headline results, but the market seemed unimpressed by the margin drop, lower-than-expected free cash flow, and the Bitcoin sale. I’ll be back in the coming days with a follow-up after the conference call is held and we get the 10-Q filing with more thoughts on the stock then as we see how it moves in the near term.

Be the first to comment