guss95

Last week, Enagás (OTCPK:ENGGF) (OTCPK:ENGGY) released its strategic plan for 2022-2030. After our latest publication, we reaffirm our positive view of the Spanish gas operator, and we also confirm how Enagás will play a crucial role in the European energy crisis.

With the ongoing Ukraine war and the following sanctions imposed by the EU country members, Russia is no longer a reliable oil & gas supplier. Even if there isn’t a plan B, it is now clear to all European leaders that all the solutions proposed to free Europe from fossil fuels imported from Moscow will require many years to be online. In the short/medium term, Europe will be under the pressure from high energy prices, as Russia’s main pipeline called Nord Stream 1 will most likely remain closed due to scheduled maintenance. This gas pipeline contributes to 15% of European gas needs – and it was supposed to be reopened on the 21st of July, but the scenario that currently seems the most realistic is that the pipeline will remain closed even after the aforementioned date, causing an inevitable energy crisis.

How Enagás Will Contribute?

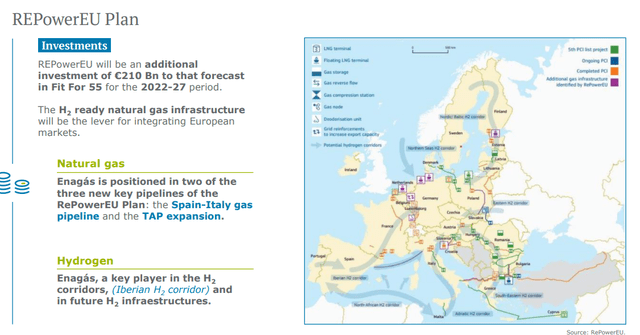

- Enagás owns the infrastructures for the storage and transformation of liquefied natural gas which could replace part of the Russian supplies. The company has in its portfolio 6 regasification plants (the one in Barcelona is the largest in Europe) that are able to absorb quantities of LNG that are slightly less than those managed in the rest of the European region. In numbers, Enagás could manage 40% of the total capacity in continental Europe. In the short/medium term, US’s LNG will pass from Spain in order to ease dependence on Moscow. We expect to increase export from the US by 15 billion cubic meters this year, with even more substantial shipments in the future. The problem will then be redistributing the gas to the rest of Europe because Spain and France currently share two small gas pipelines. Looking at the strategic plan, there is an investment for a new intra-European connection that will link Spain and Italy thanks to a submarine gas pipeline envisaged by REPowerEU.

- Enagás intends to play a crucial role in the future European hydrogen economy, aiming to produce up to 20% of the continental H2 output expected by 2030. Total investments are almost €2.7 billion. The CEO stressed that all new gas infrastructures must already be born ‘hydrogen-ready’. And he also foresees that Enagás will be able to supply 21 billion cubic meters of hydrogen or about 2 million tons per year by 2030.

- Aside from the gas pipeline, between now and 2030, €690 million will be allocated to renewable hydrogen infrastructures (€235 million already by 2026), through projects such as HyDeal and Catalina but also initiatives related to the development of new storage facilities dedicated to H2.

- Another €205 million will be invested over the next 8 years by the subsidiary Enagás Renovable in 30 different green hydrogen production projects.

REPowerEU Plan (Enagás strategic plan for 2022-2030)

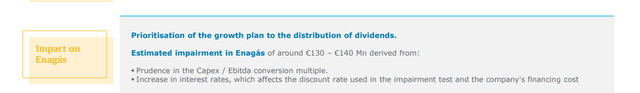

According to the company’s strategic plan, Enagás expects to close its 2022 account with a profit of between €380 and €390 million. This result takes into account positive and negative one-offs. On the positive impact, there is the Clean H2 Infra Fund 30% sale, whereas on the negative side, there is the Tallgrass Energy write-off for a total consideration of €130/140 million.

Tallgrass Energy write-off (Enagás strategic plan for 2022-2030)

Valuation and Conclusion

Adjusting with the latest company’s guidance, our internal team is now forecasting an average growth in ordinary profits of 1% from 2022 to 2026 and of 4% in the period between 2026 and 2030. Taking into consideration the CAPEX requirements, Enagas estimates €1.3 billion in investments up to 2026 and another €1.4 billion up to 2030 for a total of €2.7 billion over eight years. However, these calculations do not take into account the European RePower plan to guarantee energy security, which provides, among other things, heavy investments in interconnections (that we estimated at another €2 billion). Based on our DCF and considering the new investments, we still positively view Enagás, and we reaffirm our buy rating with a lower target price from €27 per share to €25 per share.

Be the first to comment