AsiaVision/E+ via Getty Images

When investors make bets, the concept of trading vs. longevity generally arises. With seemingly attempts at fossil fuel destruction by some, it is extremely important to understand the role of natural gas and in particular the role that Antero Midstream (NYSE:AM) plays in energy. This discussion could explore rabbit holes or viable investment information. Hopefully, we chose viable investment views.

The Playing Field

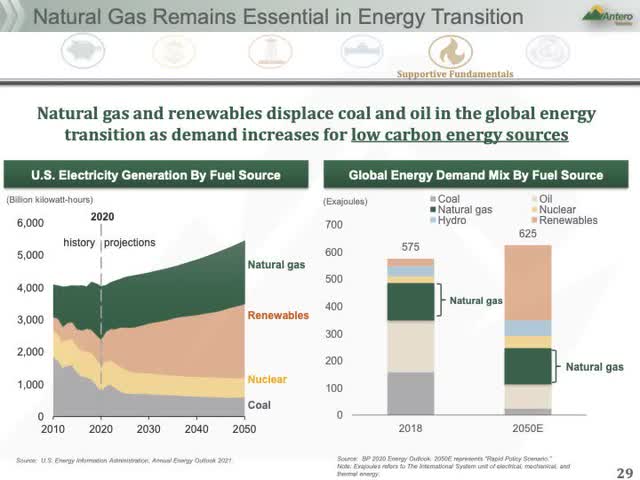

We begin by discussing the playing field. Every player loves feeling his coach’s arm around him when chips are down. In this case, the reassurance needed concerns future markets. According to an article from International Energy Forum, “The versatility of natural gas is one key to its expected prominent role in the energy transition, serving as an energy source for all sectors . . . . When it comes to greenhouse gas emissions, natural gas has a significant advantage over coal, emitting about half the CO2.” Although we take real exception to the belief that energy is in transition, natural gas (‘NG’) still provides a cheap lower carbon alternative. (The EIA projects, by definitions in the English language, supplemental for renewable not transitional with regards to renewables.)

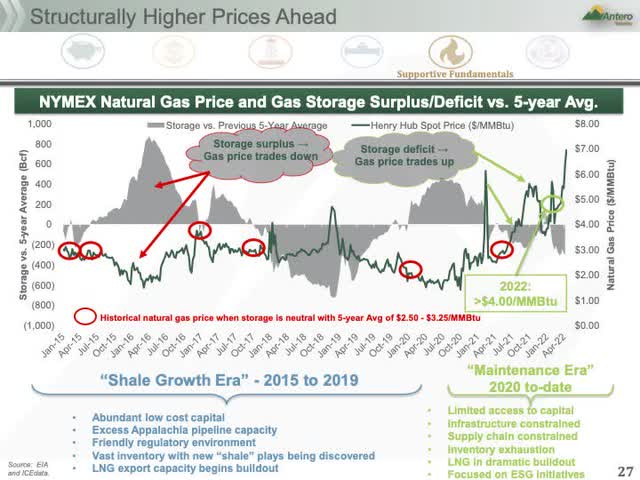

The price of NG has obviously been inversely sensitive to the material balance (adding or subtracting from storage). The following slide found in the Antero Resources (AR) section of the Midstream’s last presentation illustrates this collation. With NG storage swinging negative (gray area), its price increases and vice versa.

What appears to be changing within recent markets is the sensitivity of price with excesses or shortages.

A graph of NG pricing from Investing.com again strengthens this observation. In early June, the price dropped from $9.00 to just under $7 in a matter of days. Investors might think that some major precipice event occurred. Strangely, it didn’t.

Natural Gas

On the 7th of June, an explosion occurred in the pipe racks of the Freeport, Texas L.N.G. plant forcing a shutdown. Its size?: “The U.S. natural gas market will now be temporarily oversupplied as 2 bcf/d or a little over 2% of demand for U.S. natural gas has been abruptly eliminated,” said Rob Thummel, managing director at Tortoise Capital.” Yes, a meager 2% of usage shutdown. Continuing, “Natural gas prices plunged on Tuesday, after Freeport LNG said its facility that had a fire last week likely won’t be back up and running soon.” The actual plunge on this news was just short of 20%. A partial startup for Freeport is scheduled for September, with full startup in December.

Although Freeport’s event dumped US NG prices, European prices did the opposite, which in the past have been about six times greater than the US. Prices strengthen with L.N.G. shipments slowing from the US and Russia closing the Nord Stream I pipeline with a claimed reason of maintenance. From recent history, Europe’s abandoning much of its fossil fuel energy generation believing in renewable energy was the future, but their NG demand is unquenchable. To further add salt to the wound, winds in the North Sea have stopped blowing at normal rates at times, and also other issues exist, such as the war in Ukraine, resulted in tight supplies becoming even higher. In desperate hopes to solve these issues, Europe returned to NG and/or nuclear for supplying its needs. Thus, demand isn’t expected to wane anytime soon.

A slide from Antero’s most recent presentation shows the US Department of Energy 2050 projections for natural gas.

Natural gas needs aren’t disappearing, likely not in my lifetime. Again, the role of renewable energy is best described in plain English, additive.

The Company (Lineup)

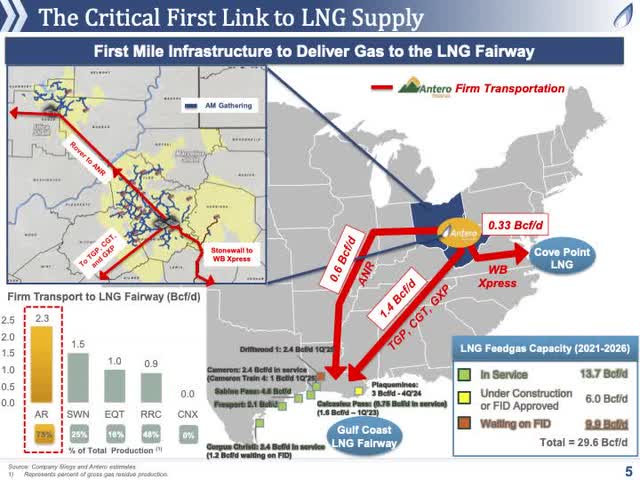

With the playing field defined, left field, center, and right fences in place and the bases secured, let’s turn to the players, the company. Antero Midstream primarily transports natural gas and delivers fresh water for and to Antero Resources. The next slide shows its resources and locations primarily in the Ohio-West Virginia regions.

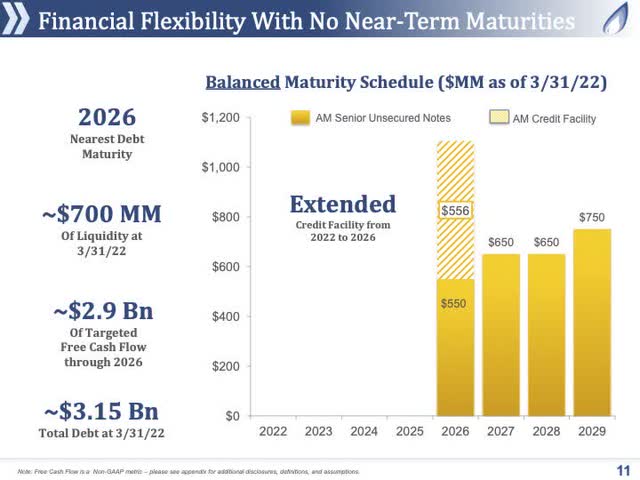

We review the balance sheet shown next.

The company’s borrowing is secure through 2025 with nothing due. The leverage equals 3.6 with a company target of less than 3.

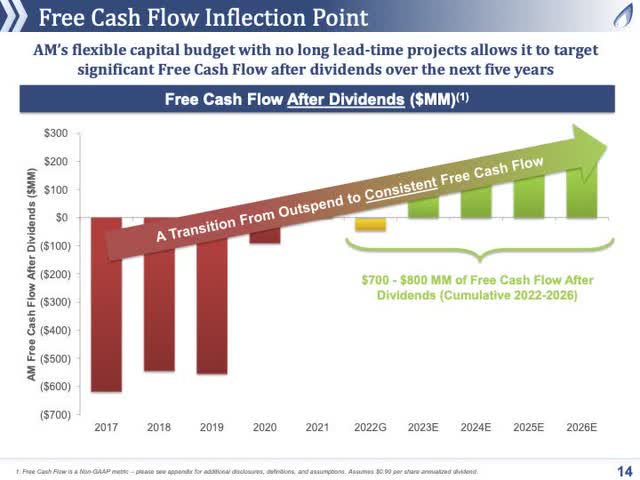

The next slide informs investors of its projected cash flow for the next five years.

Management expects to generate an excess cash flow of $750 million in the period from 2022-2026. The excess is planned for debt reduction through 2025, thus lowering leverage to less than 3. The dividend is expected to be trapped at the current value, a key investing point.

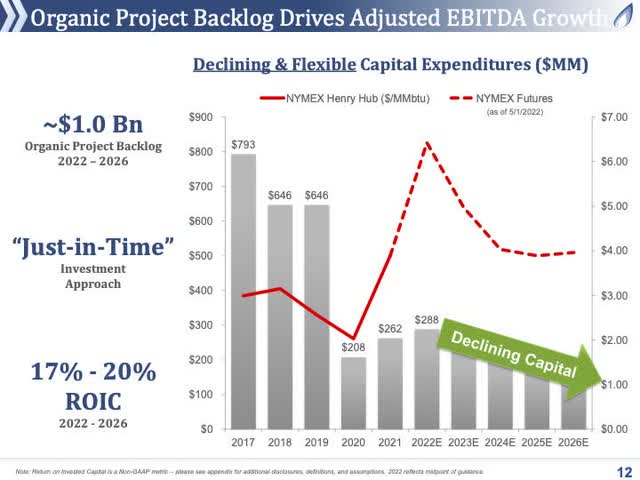

Midstream began a capital drilling program last year, lasting through 2025-2026, for Resources. The inflection point for this expenditure hits this summer. Details are shown in the next slide.

With the next quarterly report, investors will experience the full behind the plate 1st row view about the company’s ability to execute its plans. But, the plans to lower debt, continue paying a $0.90 per year dividend in a long-time viable market, is in place.

The Chart

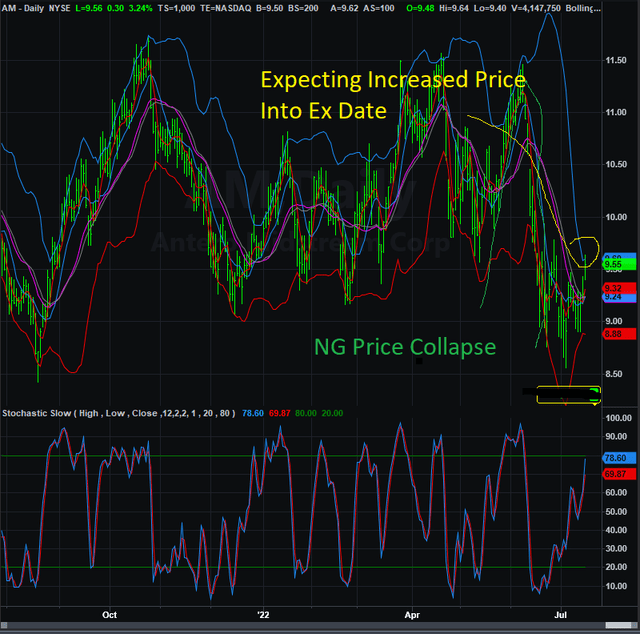

With all investments, price charts help investors understand a little bit about timing, but mostly concerning volatility risk. A TradeStation Securities generated chart follows.

The price of the stock is volatile and will likely continue to be so in this environment and in our view more so than investors might expect with a steady $0.90 distribution.

The Investment Comes With Volatility

With Antero Midstream walking to the plate with a NG bat, its long-term finances are on stable grounds. But, its price, which follows NG prices at some degree, creates an illusion for investors of business weakness. Natural gas is likely to be volatile even on small changes in usage or production. Midstream’s business performance isn’t affected by small changes though its stock price might be. We continue to hold positions in Midstream. We sell naked puts at the lows and sell covered short calls on or near ex-dividend dates, for this quarter, July 26th. Prices tend to cycle peak around ex-dates and the pay-out-date. We are expecting a natural gas price increase with the approach of startup at Freeport in September and December. AM’s price will likely follow at some level.

We continue to expect a trapped dividend for a few years while management pays down its debt in particular the $600 million due in 2025. This also caps the trading range.

Risks

Risks from economic shutdowns still exist. China’s recent shutdown is a prime example. But the long-term bullish story for natural gas is intact. It is likely to continue. The coach has his arm around the team; the bases are set and the fences in place. It seems time to begin or add to positions on these buying opportunities. But, for investors, remember, remember, remember, highly sensitive volatility will abound. Be watchful and aware.

Be the first to comment