islander11

Summary

I recommend going long Couchbase (NASDAQ:BASE) for a potential 62% upside over a three-year period. BASE is a cloud-based database service that provides businesses with a flexible, scalable alternative for their application data needs. It is well-suited for enterprise architects and application developers, and offers significant cost savings and improved resource utilization.

Company overview

Couchbase is a cloud-based database service that provides businesses with a flexible, high-performing, and scalable alternative for their application data needs.

Underpenetrated market

From my perspective, operational databases represent one of the largest unrealized potentials in the enterprise software industry as it stands right now. Accessing and manipulating data in real time is essential for any application, from the simplest alarm clock to watching a movie on Netflix (NFLX). As the pace of the digital transformation quickens, businesses must quickly adapt by implementing a modern database built to support the enterprise software that powers today’s customer experiences.

Now more than ever, businesses need to provide customers with unique and compelling online experiences in order to attract them, as almost every element of our lives moves online. Everything is shifting, from the way we make purchases to the way we do things. We have become accustomed to real-time, always-on, data-driven, and responsive digital experiences that are also highly personalized and accessible from any device, anywhere.

To bring this fresh approach to interaction to life, applications act as a link between the real and virtual worlds. Experiences engage customers, and applications enable them. Applications are more than just a convenient medium for performing mundane tasks like making a reservation or a purchase. Nowadays, we expect our highly interactive applications to provide us with an improved way to do everything, from planning the ideal trip to ordering tailor-made clothes.

In today’s world, applications need to scale to millions of users at once, make use of both structured and unstructured data, and process huge volumes of data in real time. What used to be a simple purchase is now a complex customer journey with potentially thousands of digital touchpoints. Users’ expectations continue to rise, along with the volume, variety, and velocity of customer data, making exponential growth in data processing necessary.

I believe that businesses, in order to deal with the consequences of our evolving technological lives, need to develop new, highly dynamic applications and update their underlying infrastructure. Moreover, in my opinion, traditional database systems were not intended to deliver the speed, scalability, and adaptability essential to today’s software. In order for businesses to undergo a digital transformation, they will need to implement new database technologies to support the architecture of newly developed applications and the redesign of existing ones.

Couchbase solution utilizes modern tech

Couchbase is an enterprise-grade database management system. Their database was built to handle the rigorous requirements of enterprise-grade software. In addition, the database can be controlled by the client or by BASE, and it functions in a wide range of environments, including the cloud, multiple or hybrid clouds, and on-premise.

The primary goal of the BASE solution is to equip businesses with a cutting-edge database that can run at the superior efficiency and massive scale necessary to provide the kind of next-generation customer experiences that consumers have come to expect. If businesses want to keep their mission-critical applications competitive in the face of rising customer expectations, they can use the BASE platform to migrate to a more modern database system.

In my opinion, BASE is ideally suited to serve the needs of both enterprise architects and application developers, both of whom play critical roles in kicking off the process of migrating away from traditional relational databases. When it comes to modern databases, I believe BASE offers significant TCO benefits, lowers technology costs, and ensures more efficient resource utilization for enterprise architects by enabling the effectiveness at scale and high accessibility required for enterprise applications.

To improve throughput, customer experience, and safety, I believe that businesses are re-designing their applications to run in the cloud. Here is where the compelling value proposition of BASE’s platform comes into play, as it is made to facilitate the creation of critical applications at scale.

Flywheel effect to get stronger as BASE grows

I believe that BASE’s differentiated technology is the engine that drives its go-to-market strategy: a Sell-to and Buy-from motion. BASE emphasizes a mature “sell to” motion directed at enterprise architects and is augmented by a “buy from” movement directed at application developers. In my opinion, BASE approach to the market has opened doors for both top-down and bottom-up sales approaches. This provides BASE with a robust flywheel that will propel more efficient marketing efforts, shorter sales cycles, and increased sales volume by increasing the platform’s visibility and adoption among enterprise software and application developers.

In addition, BAE’s land and expand strategy contributes to this virtuous cycle. In addition to simplifying the onboarding process for new Couchbase users, the BASE platform can eventually replace the company’s current database for applications. This helps BASE become an integral part of customers’ IT infrastructures by increasing Couchbase’s adoption as a system of record and source of truth for businesses. The prospectus includes commentary from management stating that many customers’ first use of the BASE platform is as a caching mechanism for their initial applications.

I anticipate that as these customers gain experience with Couchbase, they will opt to use it as a system of record for their most important applications, thereby increasing the company’s average ARR per customer and profitability.

Becoming a turn-key solution could be another growth lever

BASE has the potential to become a one-stop shop for businesses. Couchbase Cloud is an IaaS service built on top of its server, giving enterprises more say over their data, privacy, and operational expenditures while reducing their reliance on any one particular cloud provider. Turnkey deployment of the BASE platform seems like a promising option, freeing up IT departments to focus on strategic business goals and development rather than database administration

A BASE study found that, when comparing Couchbase Cloud to the Atlas cloud service from MongoDB (MDB) and the DynamoDB database service from Amazon (AMZN), the former was the more cost-effective option. Also, Couchbase Cloud’s free trials of the BASE platform for application developers are an additional perk; in my opinion, these trials effectively show off BASE’s compelling and unique features.

Valuation

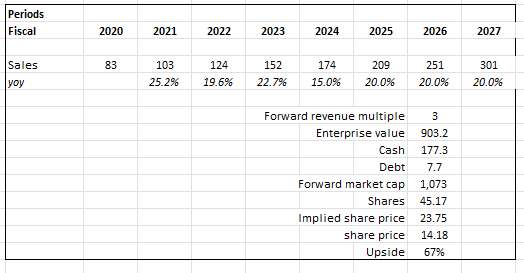

According to my model, BASE is undervalued. At this price, investors can expect a 67% return over three years.

My model assumption is based on management’s FY23 revenue guidance and my belief that the company’s growth will resume after FY24. Given the weak macroeconomic environment, I forecasted that FY24 would be a year of slower growth, which is in line with the consensus. Beyond that, I expect BASE to continue its growth by reinvesting in the business, so short-term margins will be negative.

BASE is currently trading at three times forward revenue. I think BASE is worth $23.75 in FY26 if it trades at 3 times forward revenue then.

Own calculations

Risk

No signs of FCF until at least after 2026

This is not necessarily a bad thing because BASE is still growing at a healthy rate in the high teens to 20%, but it may cause investors to be concerned if another round of factor rotation occurs in the equity market from growth to cashflow-positive stocks. We’ve already seen this happen once (consider all of the high-growth software stocks trading at more than 20 times revenue), and there’s no reason to believe it won’t happen again.

Competitors are really large players

BASE operates in a highly competitive database software market. Many well-known companies, such as Oracle (ORCL), IBM (IBM), and Microsoft (MSFT), have strong customer and channel relationships that allow them to sell their products to customers more effectively. This is especially true given that these players are already in use by customers. Bundling and offering discounts would make it easier for them to upsell their products.

Conclusion

Over the next three years, I believe that going long BASE could generate a return of 62%. BASE is a database service hosted in the cloud that can be scaled to meet the growing data needs of any business. Enterprise architects and application developers can benefit from its reduced costs and maximized efficiency.

Be the first to comment