Евгений Харитонов/iStock via Getty Images

Company Profile and Opportunity

Tellurian Inc. (NYSE:TELL) is an integrated LNG (Liquefied Natural Gas) producer. TELL owns, develops, and produces its own natural gas, which comes from the nearby Haynesville Shale, which has some of the cheapest natural gas in the world. TELL is building Driftwood LNG, a liquefaction facility, which converts natural gas into LNG by freezing and compressing it 600 times. Tellurian’s forthcoming LNG production will be put on a ship FOB (Free On Board) and sold elsewhere in the world where prices are much higher. The price difference today between international LNG and US domestic natural gas (Henry Hub) is near historic highs due to poor European energy policy and the Russian invasion in the Ukraine. On August 25th, 2022, the domestic Henry Hub price was $9.375/mmBTU, the European “TTF” benchmark was $94.196/mmBTU, and the Asian Japan Korean Marker “JKM” was $69.995/mmBTU. Tellurian’s Driftwood project should generate billions in cashflow when it is built and operating in 2026.

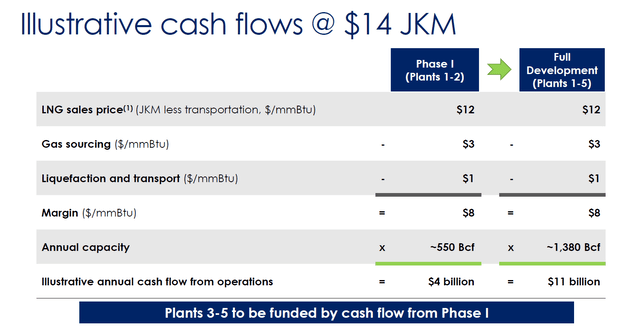

Below is an illustration, from the company’s most recent investor presentation, that shows about $4 bn in cash flow per year when Phase 1 (2 trains) is complete; and, when fully constructed with Phase 2 complete (all 5 trains), Driftwood should generate about $11bn in cash flow per year.

estimated cash flows (Tellurian Inc. Investor Deck Aug 2022)

The project timing based on Souki’s Cheniere experience is 40-44 months from April 2022, which was when Driftwood’s construction with Bechtel commenced. This implies a completion date of September to December 2025.

Charif Souki is Tellurian’s Executive Chairman. Souki is a pioneer in the LNG industry; he was co-founder and Co-CEO of Cheniere Energy, the largest LNG export company in the US. Tellurian’s team “originated and executed c. 79% of U.S. LNG capacity development and c. 36% of global LNG capacity development across four continents.” Tellurian’s model is transformative; its integrated model seeks to capture the US versus international natural gas price spread rather than operate as a toll road process provider. Tellurian has “all FERC and DOE permits secured for Driftwood LNG terminal and pipelines.”

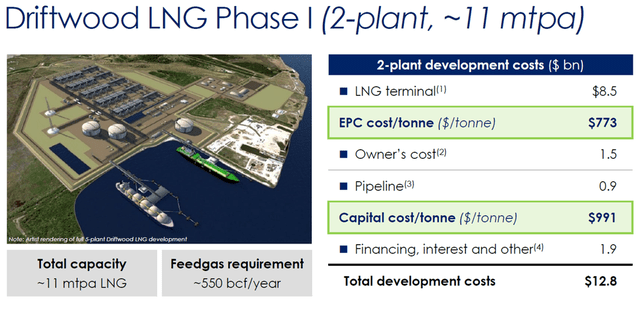

Tellurian’s high-octane model requires $12.8 bn which it expects to raise through 2/3 debt and 1/3 equity. This is a difficult task, but Souki’s background as an investment banker, successful entrepreneur, and Co-Founder of Cheniere makes him a seasoned executive and successful LNG financier. As one energy banker said, “If anyone can do it, Souki can.” Not all are convinced.

The illustration below shows the site and costs for Driftwood LNG Phase 1 facility. Once Phase 1 is completed, Tellurian looks to fund Phase 2 (trains 3, 4, and 5) out of cash flow produced by Phase 1.

Tellurian’s estimated cash flows for two and five trains. (Tellurian August 2022 deck)

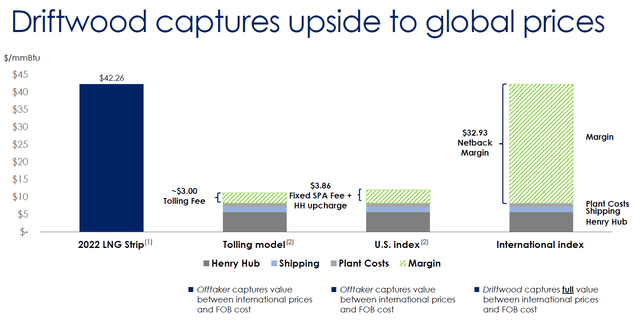

Due to Russia’s invasion of Ukraine and today’s energy crisis, which is especially severe in Europe, today’s $32.93/mmBTU Netback Margin (see chart below) is nearly four times the $8/mmBTU Tellurian has projected in the first chart which estimates $4 bn cashflow from Phase 1 and $11 bn cashflow from Phase 2. Tellurian’s funding prospects are aided in part by the Biden Administration’s commitment to deliver 50 BCF/yr to Europe by 2030 to replace Russian natural gas.

margin illustration (Tellurian Investor Deck)

Because Tellurian’s Driftwood LNG is a high risk and high return project and due to recent years’ energy market volatility, TELL stock has been quite volatile. Charif Souki puts his money where his mouth is. He personally experienced margin calls in the 2020 COVID-19 market crash. Tellurian’s management owns 20% of Tellurian’s stock, so shareholders’ interests are aligned with management.

two year chart (Two Year Tellurian Chart Yahoo Finance)

The Natural Gas and LNG Market

The world has embraced climate change and UN Sustainable Development Goals and has sought to transition from fossil fuels to renewables like wind and solar. Unfortunately, this strategy and these goals have not been deployed uniformly and with limited success. In fact, before the February 24th Russian invasion of Ukraine, Europe was already engulfed in an energy crisis. Consequently, last year, Europe changed policy and proposed both LNG and nuclear as “transition fuels” to provide the needed energy for basic utilities at a reasonable price while the transition plays out over the decades ahead.

The energy crisis is global and not just European. Europe and North America enjoy high standards of living, but much of the rest of the world needs more energy for their economies to grow and converge toward our high standards of living. 3.5 billion people globally do not enjoy continuous electricity. With UN Sustainability Goal #1 to end poverty and #2 to end hunger, there will be huge demands for energy in the future and natural gas looks to be the most compelling energy source during the energy transition of the coming decades.

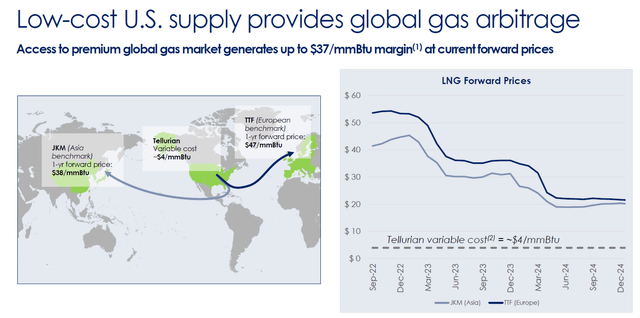

The illustration below shows how cheap US natural gas can provide the world with needed energy and emit half the carbon emissions of coal and oil. The diagram on the right shows how the forward contracts point to lower future LNG prices that are comfortably higher than our first illustration that showed a $8/mmBTU margin generating $4 bn in cash flow per year.

LNG delivery routes (Tellurian Investor Deck)

Radical Decarbonization with Fossil Fuel Natural Gas

Another powerful case for secular natural gas growth is made by the largest natural gas producer in the US, EQT Corporation. EQT argues compellingly that if we simply replace all the international coal production with natural gas, we could hit the decarbonization goals well ahead of 2050! Much of the global carbon emissions come from China and India which burn massive amounts of coal. If all international coal production was replaced with LNG, the world would hit our climate goals faster and without the devastating energy cost inflation plaguing the world.

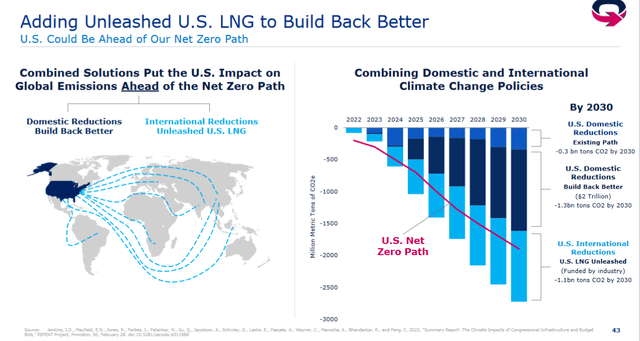

The chart below details the LNG international coal replacement strategy advocated by EQT and others. This underscores the importance of LNG to the energy transition and the size of the addressable market.

LNG routes globally (EQT Corporation)

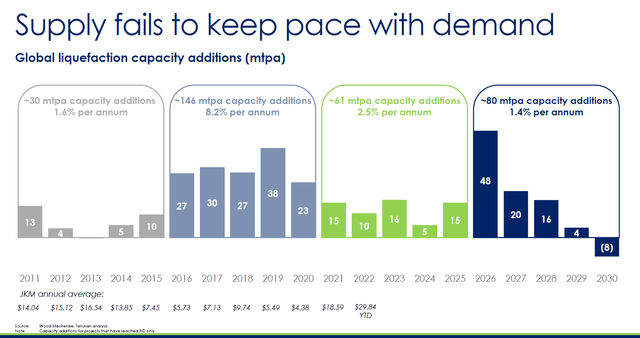

Currently, the global liquefaction capacity growth projections suggest the market is early in its growth cycle. Further, the chart below shows that projected LNG production capacity is insufficient to meet future needs. The lack of new LNG projects suggests that future prices are not at risk of over-capacity.

LNG’s historic and planned capacity growth (Tellurian Investor Presentation 8.2022)

Valuation and Souki History:

Tellurian Inc.’s market cap is $2.56 billion, today, and share price $4.50. As of 6/30/2022, Tellurian’s common equity was $653 million and cash $823 million, so little of Driftwood LNG’s value is being attributed to Tellurian’s market capitalization.

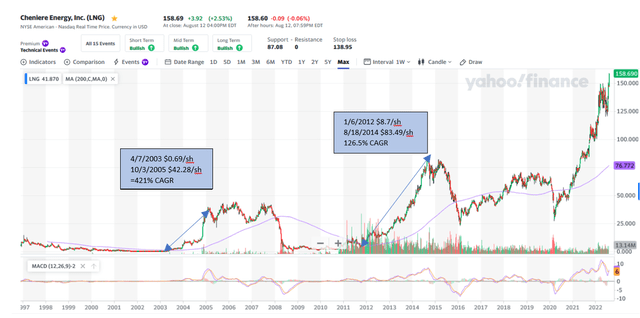

When looking at Cheniere’s (LNG) long-term stock chart, we observe that the Cheniere’s shares experienced their most rapid growth during the finance and construction periods. For example, Cheniere’s first project was a gasification facility when the company was importing LNG and gasifying it. During that period, 2003-2005, Cheniere’s stock appreciated at 421% CAGR. Secondly during 2011-2014, Cheniere’s stock appreciated at 126.5% CAGR when Cheniere was building its first liquefaction facility and the company restructured to become a LNG producer and LNG exporter.

Consequently, we believe this financing period for Tellurian investors will be as critical as was the case with Cheniere when it went through its financing and construction periods in 2003-2005 and 2011-2014. As the prospects for financing become a reality and the company becomes fully financed, Tellurian shares could appreciate at similarly abnormally high rates, if the company successfully finances Driftwood LNG.

The chart below of Cheniere Energy, Inc. highlight the periods of unusual appreciation.

Finance and Construction period performance for Cheniere (Yahoo Finance IGA research)

Charif Souki and Tellurian Inc. have seen wild swings. When Cheniere built its first facility, the plant was a degasification plant based upon high domestic US natural gas prices and low international gas prices. In the early 2000s, as fracking became widespread, the discovery of abundant associated natural gas in US shales changed the business proposition for Cheniere. This game-changing US natural gas discovery quickly reversed the economic proposition for importing LNG. From January 2008 to November 2009, Cheniere’s shares plunged from $32.07/share to $1.78/share – a 94.5% decline in under two years.

Souki then restructured and redesigned Cheniere to convert low-cost US natural gas into LNG. This was a great challenge because while Cheniere was initially successful, Souki had to persuade his investors to reinvest in the massive new liquefaction facility. Souki succeeded with this monumental challenge. Cheniere’s stock took off again rising to $83.59/share, from a low of $1.87 in 2009, before Charif Souki left the board in December 2015 due to a board fight with renowned shareholder activist Carl Icahn.

If financing goes through, the future cash flows are discounted at a much lower rate, much like a biotech company moving through clinical trials and getting FDA approval. We estimate that the discount rate for TELL currently is about 40%, but on FID or FNTP the discount rate will drop to 15%. That forward valuation should increase 2.66 times based on a discount factor contraction from 40% to 15% (40/15=2.66). That derisking would imply a price target of $12 per share (2.66 x 4.5/share = $12/share) on FID. Furthermore, a long-term downward sloping trend line in the chart below suggests a price target on FID derisking could take the stock to $16/share.

Technical price target (Yahoo Finance IGA research technical price target)

Assuming $11 billion in cash flow in 2026, based on TELL’s investor package forecast and a three-times cash flow multiple, TELL could have a market cap of $33 billion in 2026-27. Assuming Tellurian has one billion shares outstanding, due to dilution from convertible bonds and convertible stock issuance, TELL could be a $33/share stock or 13 “bagger” as Peter Lynch wrote in One Up on Wall Street.

Financing Model Change

Tellurian modified its financing model target from “FID” Final Investment Decision to a rolling equity and cash flow funding strategy. This financing strategy change frustrated shareholders and emboldened shorts. In late 2021, Souki had announced that Tellurian would announce their banking group by year end. The company has said that the financing would be 1/3 equity and 2/3 debt. Consequently, when the bank financing syndicate team, representing $8 bn in bank debt or placement capacity, was not announced, investors were disappointed. This may have happened due to the company not acquiring enough Haynesville natural gas to secure that financing commitment or interest rates rising. Early in 2022 Souki had projected that Tellurian would achieve FID in the first half of the year. When the FID was not announced, this again hurt the stock because the financing of the Driftwood project is a significant derisking of Tellurian’s “raison d’etre” construction project. Many thought that announcing the FID would move TELL stock to the double-digit price range. Then the stock would commence a steady upward march, much like Cheniere’s stock did during its second financing run.

The other key valuation element was TELL’s equity finance side. Many thought that Tellurian’s only equity source was selling common stock. This simply was not true. TELL’s equity can come in different forms, including TELL’s upstream assets/cash flow, infrastructure investment (like the original Blackstone/Sabine Pass deal), a strategic investor (LNG off taker or domestic E&P), convertible stock, or TELL stock (which is least favored and most dilutive.) These construction finance transactions can be complex. They can be done at the Driftwood level or at the Tellurian Inc. level. Blackstone’s convertible deal with Cheniere in 2012 illustrates the complexity of a convert deal and is a logical proven financing strategy TELL may use — Cheniere Agrees to Sell $2B of Equity for Sabine Pass Liquefaction Project – Blackstone

Souki is a former investment banker, and the management owns 20% of Tellurian stock, so we expect that Souki will look to use every viable option to pursue the least dilutive opportunity to raise capital. Consequently, using their own cash flow from upstream operations and or finding a strategic investor-customer would be the preferred route to financing, even if it takes longer and to the chagrin of retail investors.

Strategic Equity Investor Nat Gas E&P or International Off Taker

On February 24th, the world changed with Russia’s invasion of Ukraine. Within a week of the Russian invasion of Ukraine, Germany’s Chancellor Olaf Scholz reversed the country’s green policy, ordering the construction of LNG import facilities, terminating plans for the Nord Stream 2 pipeline with Russia, and sending weapons to Ukraine. Now Europe will need to replace 20 Bcf/d of Russian gas, the equivalent of c. 35% of the world’s LNG market. This led to a sharp spike in LNG prices and Tellurian’s stock in the six weeks following the invasion.

It seemed that Germany would quickly buy Driftwood’s offtake, but they did not. It appeared that Germany also sought to structure a deal with the Qatari’s but that also did not transpire. It seems that Europe’s plans to convert to hydrogen made some of these deals problematic. Asia does not seem so inflexible and that may be why we see TELL use the JKM marker for its cash flow illustration above, even though the European TTF price is higher.

With the strengthening of the US economy interest costs rose. With this year’s stunning energy crisis, opportunities for strategic investors grew following the Russian invasion of Ukraine. Domestic strategic investors also emerged as more compelling funding sources. Souki, in his informative two-minute YouTube videos on the Tellurian website, explained on May 17th that several natural gas producers had expressed interest in gaining access to the international markets through LNG. Two minutes with Charif Souki on companies looking to have a larger presence in U.S. LNG

Several public natural gas companies reported their interest in taking an equity role in LNG. Possible equity investors include: EQT Corporation (EQT), Chesapeake Energy Corporation (CHK), Comstock Resources Inc. (CRK), Devon Energy Corporation (DVN), Antero Midstream (AM) and Southwestern Energy Company (SWN). Souki said that the Cheniere Sabine Pass facility was first funded with the equity and then the banks followed.

We now believe that EQT Corporation, the country’s largest natural gas producer, would be a logical strategic investor in Driftwood. Furthermore, EQT just renewed a $2.5 bn five-year line of credit and with the signing of the Inflation Reduction Act, the Mountain Valley Pipeline should make connecting the Utica and Marcellus shales in the Northeast with Driftwood more viable.

Additionally, on August 5th, Southwestern Energy Company (SWN), the largest Haynesville natural gas producer in the US, said in their conference call “We are evaluating on a risk adjusted basis, potential opportunities to benefit from global pricing by leveraging our approximate reliable long-term supply capability to help enable liquefaction projects to achieve FID”, Bill Way, CEO. That reads like a clear indication that SWN would likely fund TELL.

The New Milestone FNTP versus FID

One of the stories that the shorts were touting was that the SPA contracts of Vitol and Shell would expire on July 31, 2022, if a Full Notice To Proceed “FNTP” was not agreed to by Bechtel for Driftwood. (See page 21 under condition precedent.) That threat came and went. Amendments to the SPAs were announced and neither Vitol nor Shell cancelled their SPAs. (See page 22.) Vitol and Shell own the LNG transport ships and charge a fee for their service, unless the project looked unlikely to succeed, why would they cancel these agreements if LNG is in great demand?

What became clear is that FNTP is more meaningful than the FID, in that if Bechtel commits to building the facility, then the prospect the facility being built is assured and the final elements of the financing are of secondary concern to Bechtel. Though FNTP financing amount required by Bechtel has not been made public, it is less than the full FID of $12.8 bn.

We see a sequential funding proceeding like this. Tellurian raises $3.4 billion from strategics EQT and SWN with each contributing $1.7 billion each, then with TELL’s own $800 million ($675 million cash and $200 million in cash flow 2022), then the $4.2 billion in equity would be covered. Then Tellurian might raise $4 billion in debt through its bank syndicate and or convertible stock. Souki had disclosed that they had signed over 50 NDAs signed with potential funders. Then Tellurian could have about $8.2 billion which might be enough for Bechtel’s FNTP milestone. Under NDA, Tellurian might be able to disclose funding sources like the EXIM bank or other financing options which would satisfy Bechtel.

Consequently, we believe that FNTP is the key milestone for Tellurian to derisk its stock. With a higher stock price and a lower risk profile, with or without EXIM bank, Tellurian could achieve its FID as late as 2023, but shareholders could be rewarded for their patience since this rolling financing structure would be TELL’s least dilutive financing process.

Recent Positive News Supports Tellurian’s Imminent Financing

On June 1, 2022, Tellurian signed a $500mm convertible bond deal. In addition, on July 13, 2022, Tellurian entered into an agreement to acquire additional Haynesville Shale land and production from EnSight strengthening its ability to self-fund. On August 3rd, Tellurian reported a 47% sequential increase in natural gas production. On August 18th, the author initially published a similar TELL article on Seeking Alpha, TELL closed 13% higher and benefited from their Haynesville EnSight deal closing news. In order to get the Inflation Reduction Act passed, Joe Manchin negotiated for approval of the Mountain Valley Pipeline. The August 16th passage of the Inflation Reduction Act should facilitate EQT being a strategic investor along with SWN, though other entities or combinations could make the strategic equity investment in Driftwood to help it secure its targeted the $4.2 billion in funding.

On July 13, 2022, Souki made a thoughtful critique of the pay for service or toll road model versus Tellurian’s integrated model pointing out that Cheniere had to ask for an emissions waiver and that the Freeport explosion shows that there is little room for error in the traditional fee for service model which Tellurian is seeking to displace. Two minutes with Charif Souki on the Tellurian model. The fact that Icahn Enterprises L.P. (IEP) recently sold its Cheniere stock back to Cheniere is quite interesting, especially when Icahn stepped into Cheniere stock just as its development plans were materializing.

Tellurian is employing state of the art Zero Emissions technology and working with Bechtel, the EPC Cheniere used. We believe that many of the finance relationships that Souki forged while at Cheniere gives him a deep bench of funding prospects with whom Souki has credibility. We also like Tellurian’s institutional shareholders, some of who we consider among the smartest on Wall Street: Blackrock Inc., Paulson & Company, Inc., Shaw, D.E. & Co. Inc., and Citadel Advisors, LLC. Tellurian appears to be in good position to secure funding for FNTP and become a powerful growth story like Cheniere and an energy transition star. The macroeconomic environment with spiking natural gas prices could not be better for Tellurian to finance Driftwood LNG.

Be the first to comment