David Becker/Getty Images News

Electrameccanica Vehicles (NASDAQ:SOLO) is a company I like because I believe its product actually fills an important niche, but I’m the first to acknowledge that I’m in the minority in that opinion, and hence the company may never gain the traction it needs to become successful.

With that caveat firmly in place, let me introduce the company and more importantly, the problem that I think it helps solve.

How Cars Are Actually Used

Personal Use

To set the table, let’s look at some statistics.

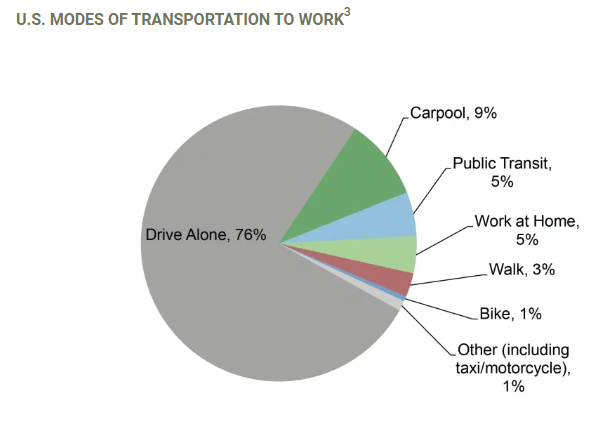

In 2019, 76.3% of US workers commuted to work alone.

University of Michigan

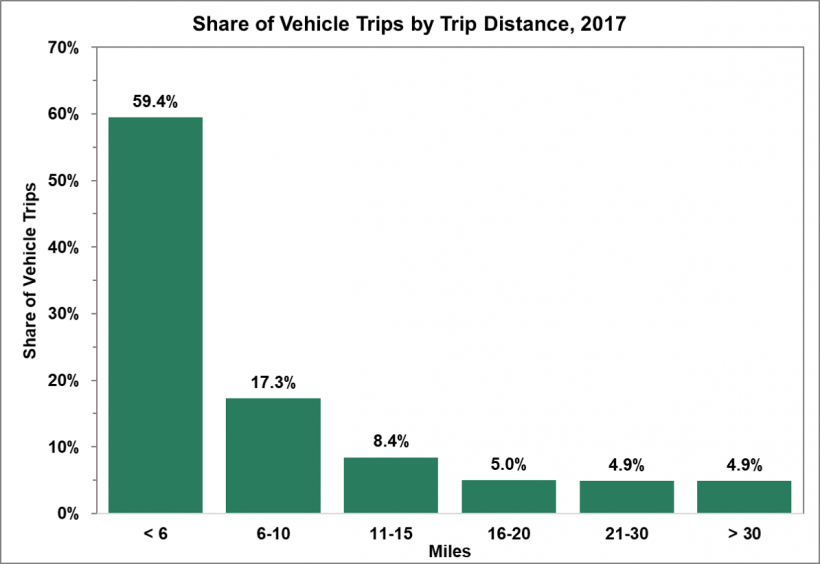

In 2017, 90% of trips were 20 miles long or less.

energy.gov

Both of these suggest that a low range, single person electric vehicle can be eminently practical for a large segment of the population. Just as importantly, the urban delivery segment is growing by leaps and bounds.

Food Delivery

Food delivery is a rapidly rising industry, and it involves single drivers almost exclusively. Beambox has a very nice set of statistics on the industry, here are a few select ones, but check the link for many more.

- The Food delivery market worldwide is expected to exceed $150B in 2022.

- By 2025, 21% of the total restaurant market is expected to be by delivery.

- 63% of consumers in the age range of 18 to 29 are more likely to use food delivery apps.

- Delivery ranges are increasing, with one month (March 2021) seeing a 43% increase in total miles driven by individual drivers relative to the previous month.

- In 2021, restaurants that didn’t offer delivery were expected to lose 70% of their customers.

- About 63% of customers prefer the convenience of delivery to dining out with their families.

These two sets of facts suggest to me that second vehicles in a household and vehicles bought by businesses for the express purpose of providing food and other delivery services can, and maybe should, be single passenger cars.

This is the market that SOLO is targeting.

Introduction to Electrameccanica

I don’t normally recite a company’s own description of itself, but in this case SOLO is more succinct than I could have been, so here is an initial, one paragraph, description of the company (with my emphasis):

SOLO is a Canadian designer and manufacturer of environmentally efficient electric vehicles (EVs). The company’s flagship vehicle is the innovative, purpose-built, single-seat EV called the SOLO. This three-wheeled vehicle will revolutionize the urban driving experience, including commuting, delivery and shared mobility. […] Depending on driving conditions, temperature and climate controls, the SOLO has a range of up to 100 miles and a top speed of up to 80 mph. The SOLO also features front and rear crumple zones, side impact protection, roll bar, torque-limiting control as well as power steering, power brakes, air conditioning and a Bluetooth entertainment system. It blends a modern look with safety features at an accessible price point of $18,500 (MSRP) for the consumer model and $24,500 (MSRP) for the delivery-oriented SOLO Cargo model, which features an expanded cargo box to accommodate a wide variety of fleet and commercial applications.

The regular and Cargo versions of the SOLO are shown below:

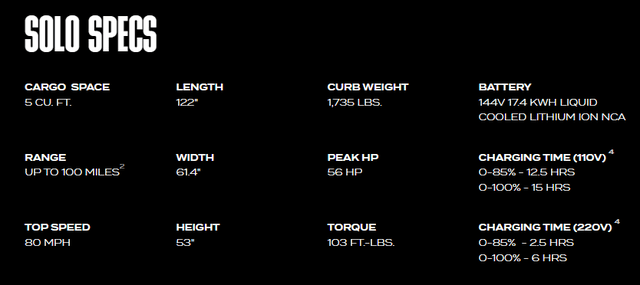

Here are the specs for the regular SOLO; the Cargo version has 8 cubic feet of cargo space and (third party) options for heating and cooling the storage area for delivery apps, but the other specs are the same as for the regular SOLO.

Mission

I think the company does a very good job of defining its market and mission, and as such can stay very focused on what it’s trying to accomplish. For example, here are some trenchant observations from the most recent investors letter (with my emphasis):

ElectraMeccanica is not competing with car manufacturers. Rather, we are competing with the idea that a car is always necessary, and that a scooter or a motorcycle is the only alternative to a car.

[…]

But a new source of power does not make a 4000- pound vehicle easier to park, or drive on crowded streets. It does not make that massive machine less expensive to buy, cheaper to insure, more efficient in its use of energy, or more environmentally responsible to build in the first place. Fuel, in other words, isn’t the only problem. The car itself is overdue for disruption – and the market that the car serves deserves more original thinking.

Performance & Valuation

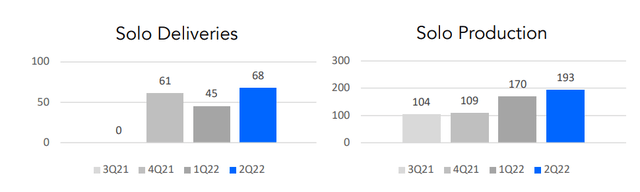

SOLO is just beginning its commercialization phase, and so far, sales have been relatively meagre. In the most recent quarter it built 193 vehicles and delivered 68. Lifetime, deliveries, and production are as shown in the graph below. Note that the undelivered vehicles are being used as sales models as the company is expanding its physical sales locations, currently focused on the West Coast of North America.

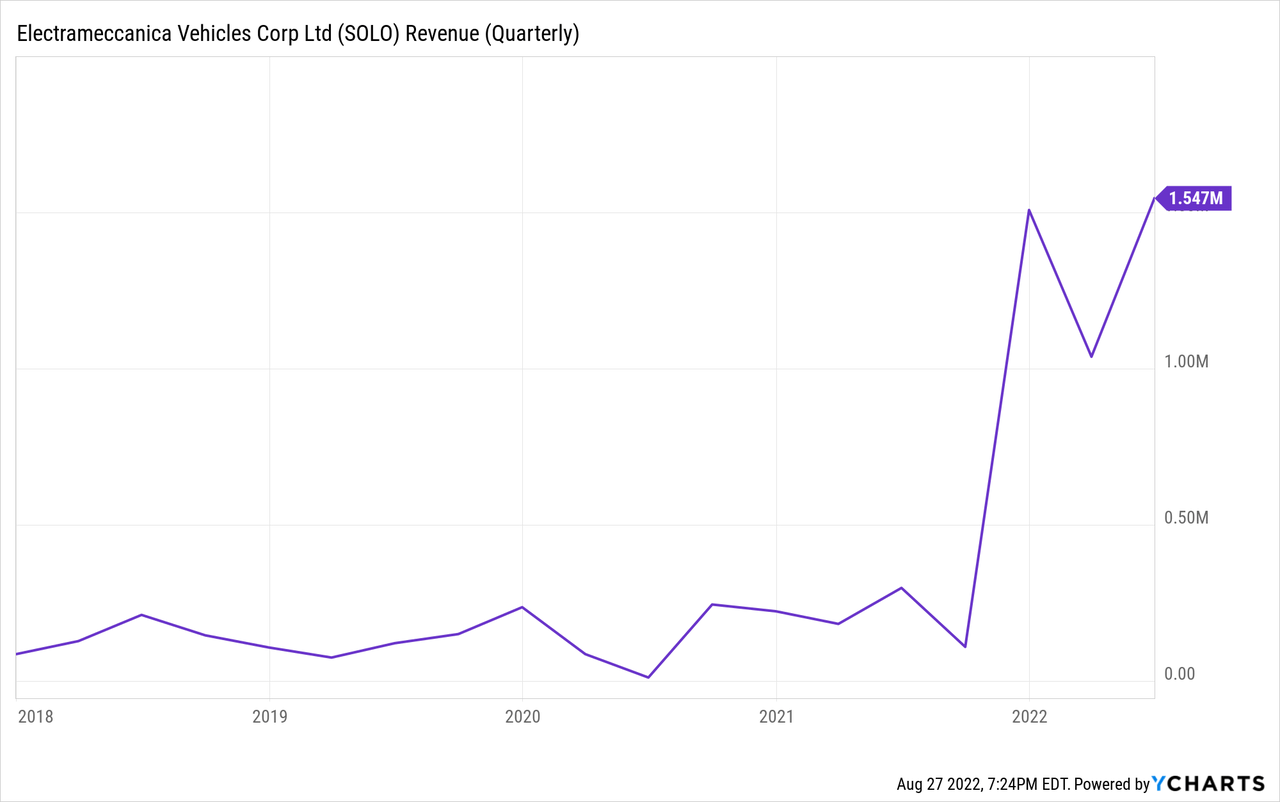

Quarterly revenues to date look like this:

Vehicle production should ramp up in 2023 when the company’s Mesa Arizona factory, with an annual production capability of 20,000 vehicles, is slated to be open and operating.

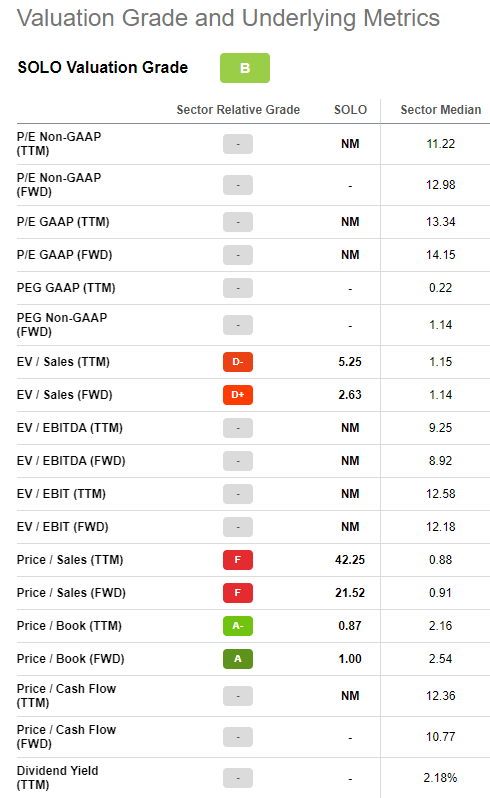

Valuation Metrics, as summarized by Seeking Alpha, are as follows. Given that the company should be rapidly ramping up sales, the EV/Sales metric is actually pretty reasonable in my opinion.

Seeking Alpha

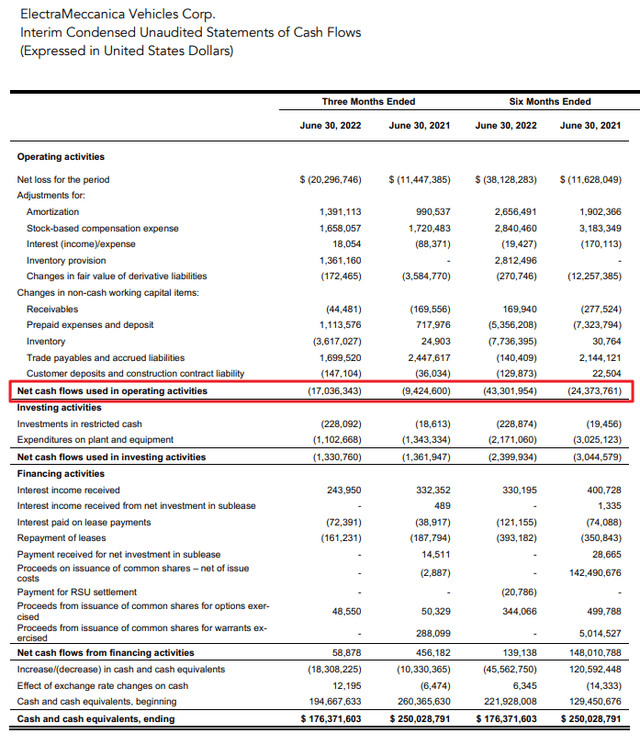

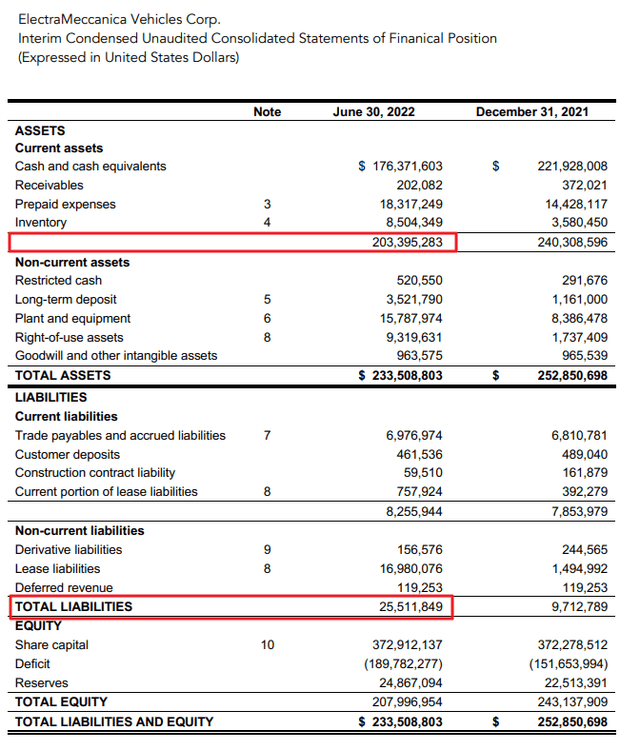

More importantly, cash burn and cash on hand are given in the company’s latest investors letter. The company is burning about $85M annually and has about $175M in net current assets on its books. That means a financing in 2023 is more than likely.

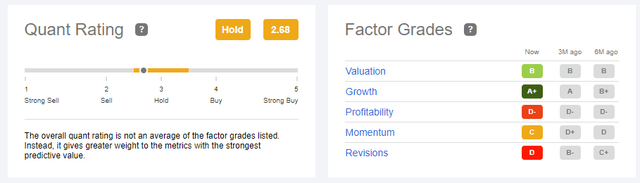

Seeking Alpha Quant Rating & Factor Grades

Seeking Alpha currently rates SOLO a hold, with valuation and growth attractive, but profitability a concern.

If considering an investment in the company, it may make sense to wait for the quant rating to move into “Buy” territory before doing so.

Conclusion

I think that SOLO is targeting a very interesting market and as the EV market shifts from relatively high net worth buyers to ones wishing to use EV’s as practical urban vehicles (delivery and second household vehicles), SOLO could greatly benefit. But since sales so far are de minimis and the company will have to do more financings to have any hope of scaling up production and sales, I’m rating it a “Hold”. That said, I personally own a small speculative position, just to keep the company on my radar.

Be the first to comment