FRT may be a King, but what’s a King to it’s more senior securities? Nils Jacobi/iStock via Getty Images

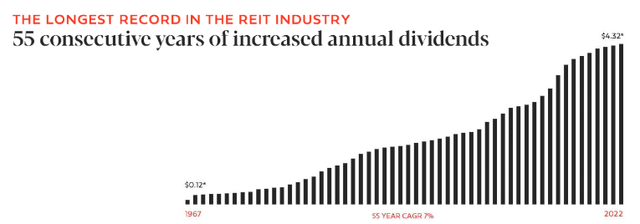

Federal Realty Investment Trust (NYSE:FRT) is a fully integrated retail REIT which has been around for decades, since 1962. During that time the company has consistently increased the dividend 55 years straight making them part of an elite group of just 37 companies that have done this known as Dividend Kings. These are companies that have weathered the storm time and again, decade after decade, and done so while maintaining a growing dividend.

It’s also apparently the longest record of annual dividend increases in the REIT industry.

FRT Investor Presentation: Dividend History

So that’s nice. Yet we all know that past success isn’t a guarantee of future success so we should look a little more closely at their portfolio.

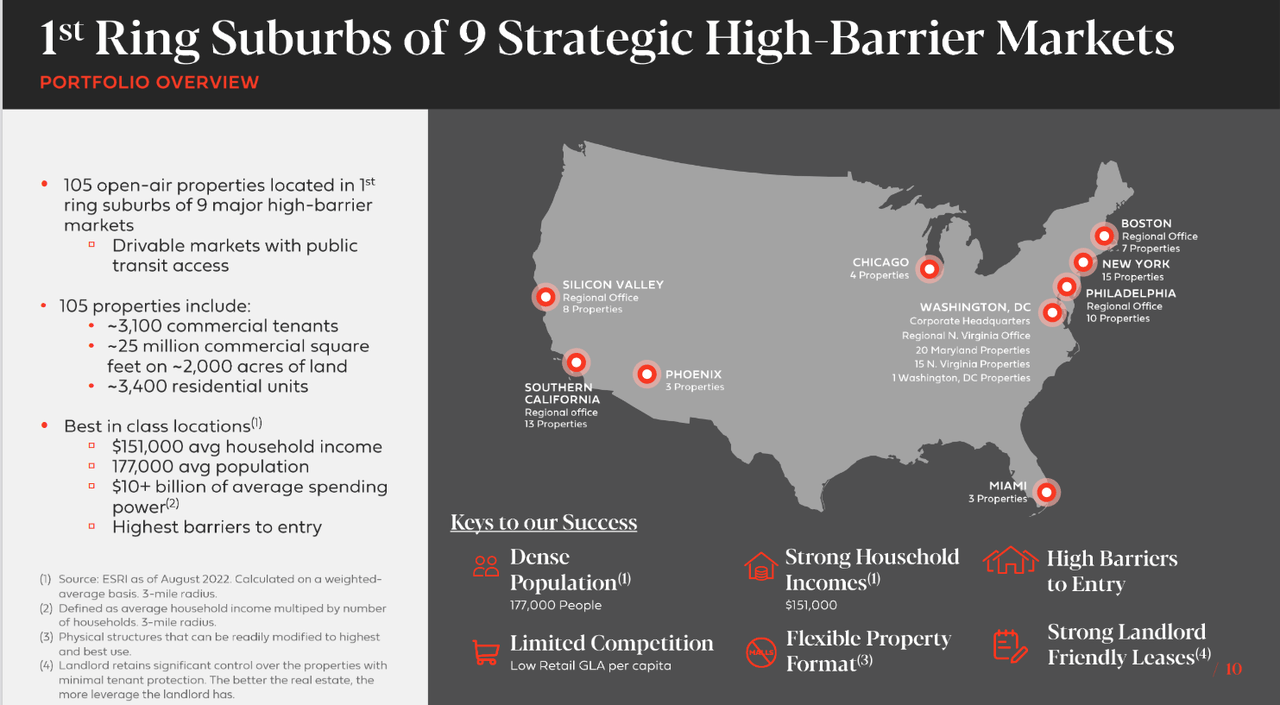

At a high level, the company manages 105 properties with ~3100 commercial tenants, 25 million square feet, and ~3400 residential units. These properties are in what management identifies as “strategically selected first ring suburbs of nine major metro markets with high-barriers.” Here’s what that translates to on a map.

FRT Investor Presentation: Portfolio Geography

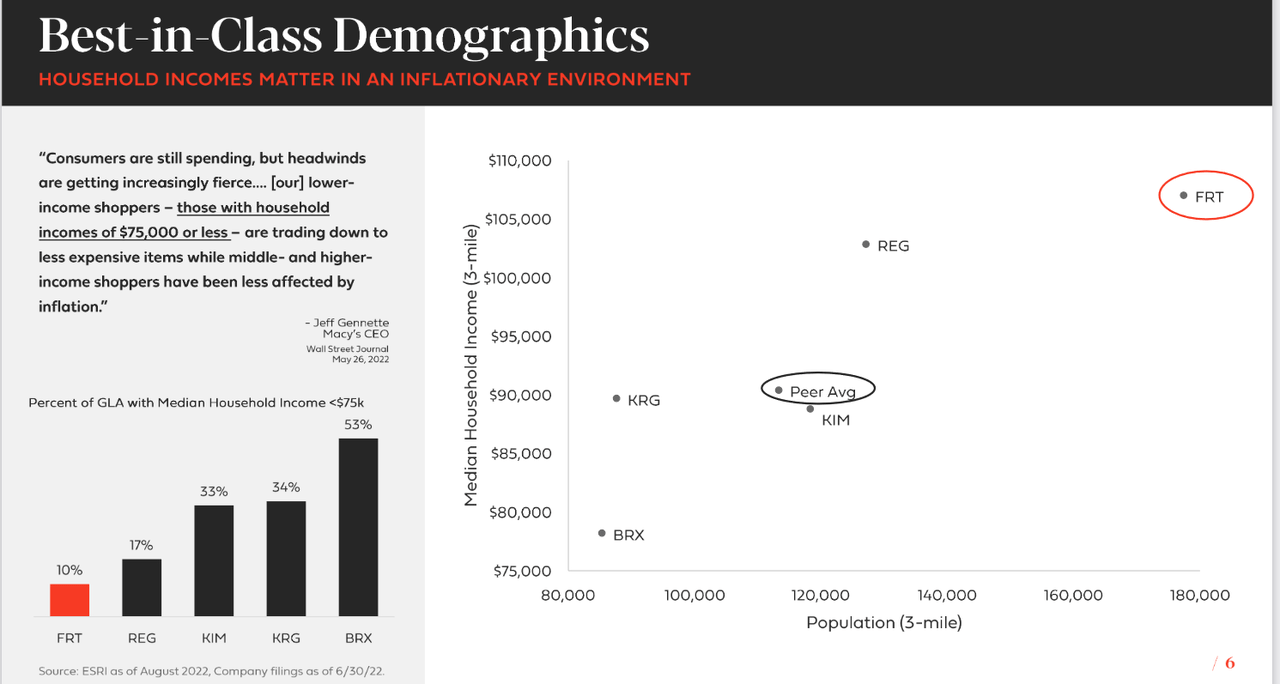

These strategically selected areas have created a standout feature for FRT: their demographics. With the ongoing inflationary environment a challenge that retail may see is households with lower median income cutting back on spending. We can see that with FRT that the median household income within 3-miles of FRT properties is above $105,000 and well above peers. Not only that but the density of population for FRT is higher as well.

FRT Investor Presentation: Demographics

Given these demographic features the company may be better insulated to decreased consumer spending. Certainly they seem better poised to weather this scenario than any of the peers referenced.

We can observe that the company saw record high quarterly FFO in Q2 of $1.65 and increased FFO guidance overall suggesting 9.5% – 12.2% FFO per share growth over 2021. From a balance sheet perspective, they maintain a credit rating of BBB+ from S&P and a Baa1 rating from Moody’s. Leverage is high at 5.8x net debt to EBITDA. Based on their Q2 filing the debt-to-equity ratio is 1.64x which seems manageable given growing FFO.

Another way to gauge the leverage is by looking at the value of their real estate versus their debt. Senior notes and debentures came in at $3.407b in Q2 with depreciated real estate carried $7.058b. If we look at this from the perspective of the loans being secured by the real estate then the loans are at a loan-to-value of just 48% – that’s very conservative and suggests the value of the real estate should help to support the debt.

Ninety-three percent of the debt is at fixed rates which will also help given the rising rate environment.

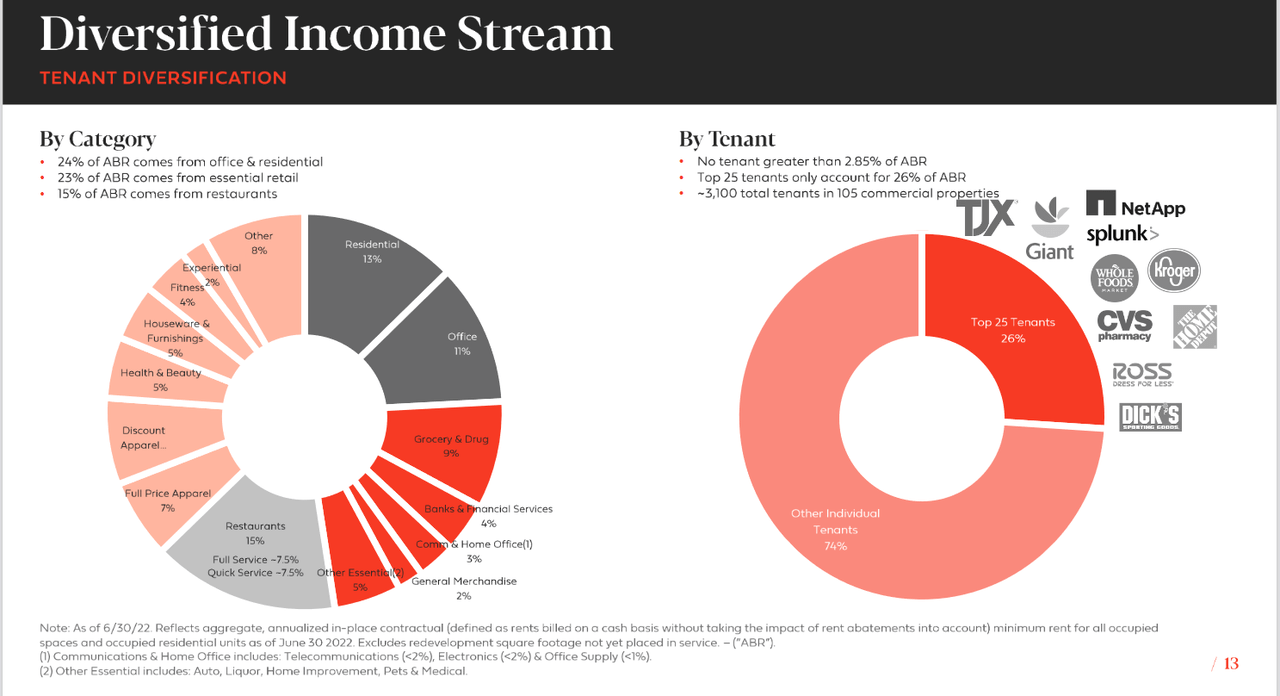

Lastly, we can see their portfolio is well diversified both by category of business and by tenant. This will also help the company navigate any lingering recession.

FRT Investor Presentation: Income Stream

FRT Valuation and the Preferred Option

Here’s where I run into a hurdle with the company. The Trust is currently priced at 2.85x P/B which is technically below their five-year average of 3.84x. Regardless, that’s a bit rich for my taste even as FFO is growing. Guidance for 2022 FFO is $6.10 – $6.25 which means even taking the high end the stock is trading at a P/FFO of 15.48x. I like to buy companies that are trading at a discount to their valuation; FRT does not appear to be.

Yet there is another way to invest in this company which appears to represent a mispricing: the Series C cumulative preferred shares (NYSE:FRT.PC). These are a small $150 million set of shares which are covered by shareholder equity of $2.876 billion over nineteen times. Income for the first six months of this year has totaled $109.642m with net income over the last five years equaling $1.279 billion.

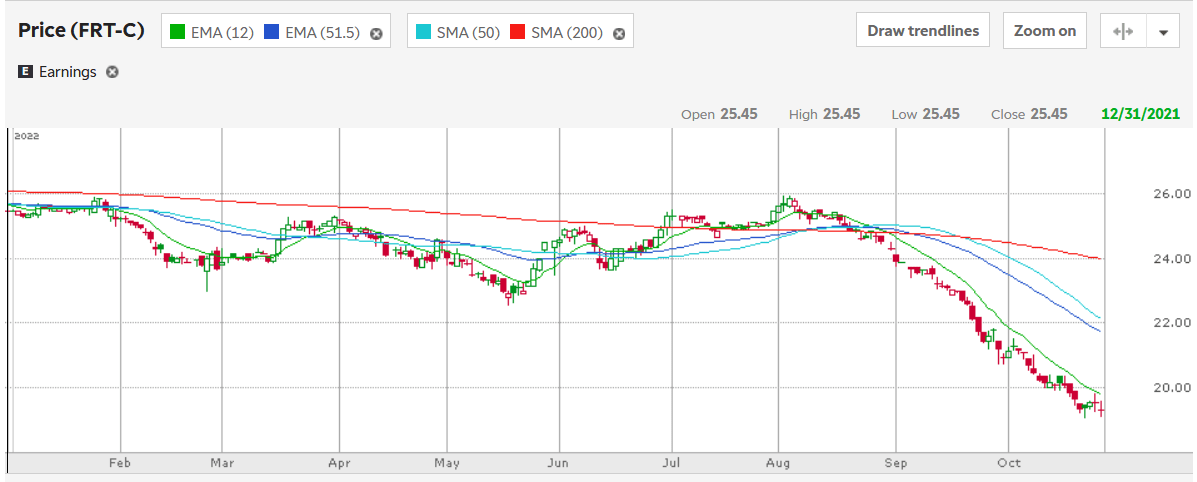

Despite the clear support for full valuation of the preferred at par value ($25.00) the preferreds are currently trading just off their 52-week low at $19.33. Just as recently as August these shares traded above par value and they typically have throughout the past year.

TD Ameritrade: FRT-C YTD Chart

The downward trend is likely somewhat related to the yield. Even at the current depressed prices, the $1.25 annual dividend represents a 6.46% yield. With interest rates rising the value of that yield is not as much as it once was. Yet given the nature of the company it seems to be a guaranteed 6.46% yield.

Consider that if the company fails to pay a dividend on their preferreds that means they are also unable to pay a dividend on their common shares. That feature ruins an established 55-year history and their basis as a Dividend King stock which they clearly value. I think with this reality in place that it’s highly likely that buying today will lock in a 6.46% yield. And even if catastrophe strikes and the company doesn’t pay dividends on the preferreds it is a cumulative structure, meaning a dividend would still accrue which preferred shareholders would be entitled to.

When we consider that the company has an open ATM equity program we can see also how the company is issuing common stock to the benefit of preferred shareholders. In the six months ended June 30th, 2022 they generated $259.4 million from this program. That alone covers the full value of the preferreds by 173%.

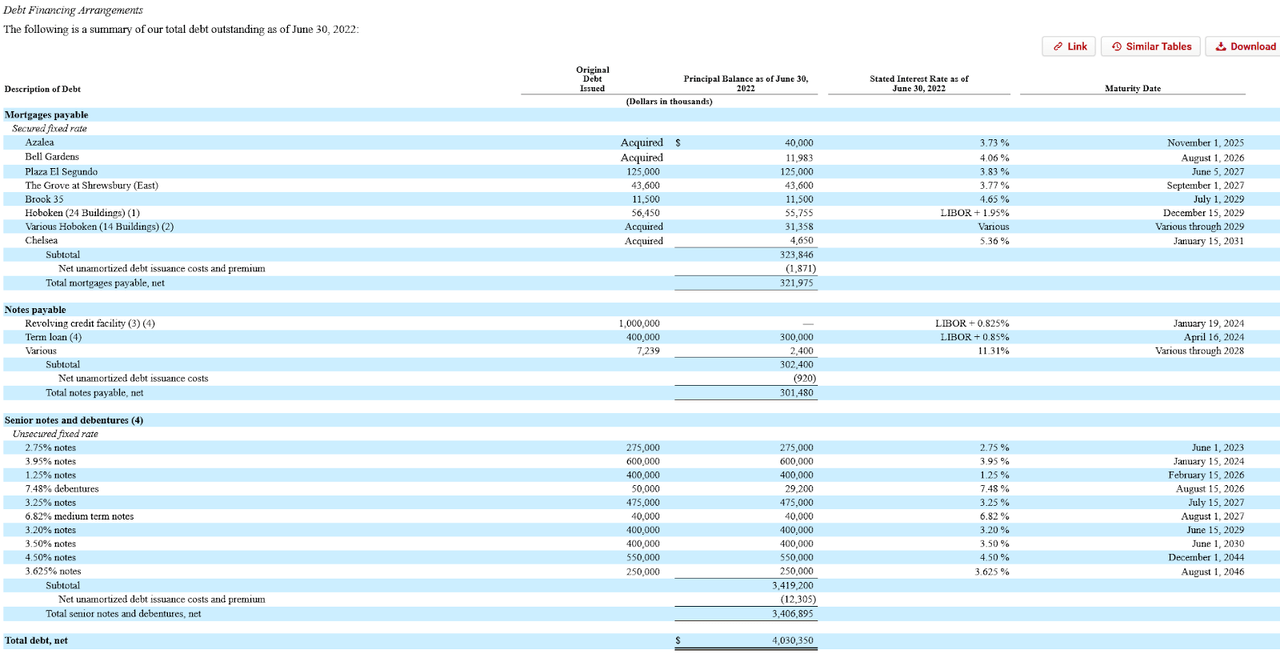

The preferreds very recently became callable as of 9/29/2022 so in theory the company could redeem them whenever. Historically speaking, the company has two other series of preferred shares that were redeemed – though these were both over a decade ago. If we look at their debt financing agreements we might find some clues as to the likelihood of it being called.

Q2’22 Filing: Debt Financing Agreements Table

The financing cost of the preferreds is a fixed 5.00%. There are only four debt agreements which are more costly than this in that chart above. What this means is that if the company were in a position to pay down debts purely based on the cost of financing, it would be fifth in line to pay down.

The Bottom Line

Investors may be drawn to the Dividend King status and current 4.46% yield for FRT. With the stock trading at what I consider to be high valuations I’d say that although the yield is covered, the potential for capital appreciation seems minimal to me. Even if they execute and achieve their 2022 FFO guidance the stock would be trading at a P/FFO of 15.48x.

Management is currently diluting common shareholders through an ATM equity program which is fueling growth, but again will likely put sustained pressure on the common stock over the next year.

My reflection here is that switching from FRT to their preferred share may be a better opportunity over the next year. FRT.PC sports a higher 6.46% yield, pays quarterly just the same as the common, and is currently well supported by the balance sheet, growth of company, and equity issuance. And it’s trading at ~23% discount to par value meaning there’s capital appreciation potential.

If the preferred is redeemed sometime in the next two years we could estimate the returns on that. Two years of a 6.46% yield (12.92%) plus the capital appreciation to par value from current prices of $19.33 (29.33%) would imply a two-year total return of 42.25%. And regardless, that 6.46% yield is locked in with the company’s reputation as a Dividend King. They cannot fail to pay this and keep their 55-year tradition – so I think it’s highly likely that this preferred will continue to pay dividends as normal and ultimately be redeemed at par.

The pertinent question is when. But given the current common stock dynamics I think the preferred is poised to outperform over the next year or two. So a switch may be worth it.

Be the first to comment