courtneyk

Eighteen months ago, I praised Performant Financial’s (NASDAQ:PFMT) management for its decision to abandon the company’s legacy student loan recovery business and focus on the rapidly growing healthcare segment:

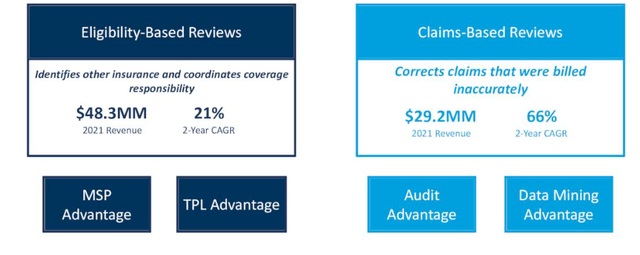

Company Presentation

Unfortunately, the performance of the new core business has also been impacted by the pandemic as hospital utilization rates have not yet returned to pre-COVID levels.

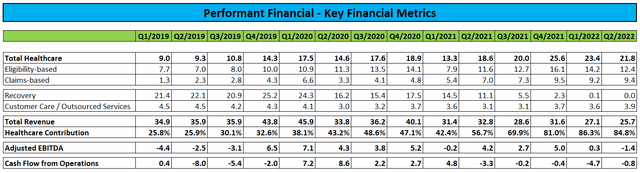

Company SEC-Filings

Last month, Performant Financial reported somewhat uninspiring second-quarter results with both revenue and Adjusted EBITDA down sequentially but year-over-year growth in the core healthcare business remained sufficient for management to affirm full-year expectations:

Given our continued achievements in the second quarter, and in combination with the KPI and opportunity growth ahead of us, we remain pleased with how we are tracking toward current year expectations and more importantly, our long-term goals,” stated Rohit Ramchandani, Senior Vice President of Finance and Strategy at Performant. “Despite a tumultuous macroeconomic climate we remain well capitalized and positioned to continue executing against our investment strategies, which will promote continued long-term growth. As we look ahead to the second half of the year, we are pleased to reiterate our Healthcare revenue and adjusted EBITDA guidance ranges for 2022 of $92-$96MM and $2-$4 million respectively.

In the Q2 presentation, management highlighted a robust sales and implementation pipeline, strong eligibility inventory developments and a sustained rebound in core utilization rates as drivers for anticipated stronger results in the second half.

Full-year cash usage is still expected to be between $4 million and $8 million as the company continues its catch-up in hiring to prepare for new contract implementations.

That said, liquidity won’t be an issue for the time being as at the end of Q2, Performant Financial had unrestricted cash and cash equivalents of approximately $16.0 million while the company’s $15 million revolving credit facility remained undrawn.

Bottom Line

Despite less-than-stellar second-quarter results, Performant Financial remains on track to achieve its previously communicated full-year projections.

While shares have suffered alongside the general market, I would advise investors to hold off from opening or adding to existing positions at this point and closely monitor the company’s progress over the second half of the year as downside revisions would almost certainly result in shares taking a major hit in the current market environment.

Be the first to comment