SDI Productions

Thesis

We highlighted in our previous article that the market anticipated that Teladoc Health, Inc.’s (NYSE:TDOC) operating metrics could have bottomed out, even as we head closer (or already in one) to a recession.

We argued and assessed that significant damage to Teladoc’s unsustainable COVID-driven growth had already been inflicted and moderated. As such, it should help the company return to more “normalized” growth, as it lapped tough comps, benefiting from the uplift in its multi-disciplinary telehealth approach.

So, we weren’t surprised that Teladoc reported better adjusted EBITDA profitability metrics than previously guided. When the bar was set so low by management and the Street, it helped Teladoc meet its projections relatively easily. Hence, we believe management could have sandbagged expectations to demonstrate that it could still execute well and meet/surpass guidance.

We think TDOC has cleared its first decisive test in Q3. Moreover, we gleaned that TDOC has already been consolidating since May 2022, suggesting that the market did not expect to de-rate TDOC further unless results disappointed massively.

Therefore, management is on point again, even though investors need to clear their heads if they still expect a rapid recovery toward its 2020 highs. Please remember that those days are long over. If you bought at those highs and are still in the game, it would be a long wait, if anything.

Investors looking to add at the current levels should be prepared for a potential pullback, given last week’s sharp spike. Hence, we urge investors to consider layering in, taking advantage of potential dollar-cost averaging opportunities.

Maintain Speculative Buy with a medium-term price target (PT) of $40, implying a potential upside of 36%.

Teladoc: Return To Profitability Growth

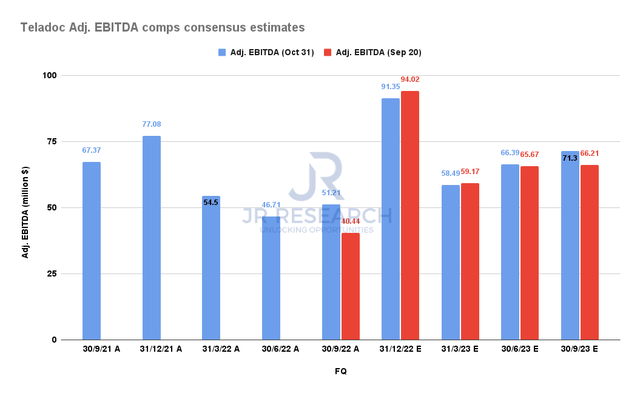

Teladoc Adjusted EBITDA comps consensus estimates (S&P Cap IQ)

Teladoc reported $51.2M in adjusted EBITDA for FQ3, well above the previous consensus estimates of $40.4M. Notably, it also came above the high end of its guidance range, spurred by robust growth and better margins from BetterHelp.

Teladoc’s Q4 adjusted EBITDA estimates have been reined in slightly, given the company’s Q4 outlook. Despite that, the market still reacted positively to its Q3 report. We believe that the market has justifiably re-rated management’s execution ability, indicating that Teladoc has better credibility in delivering its guidance moving ahead.

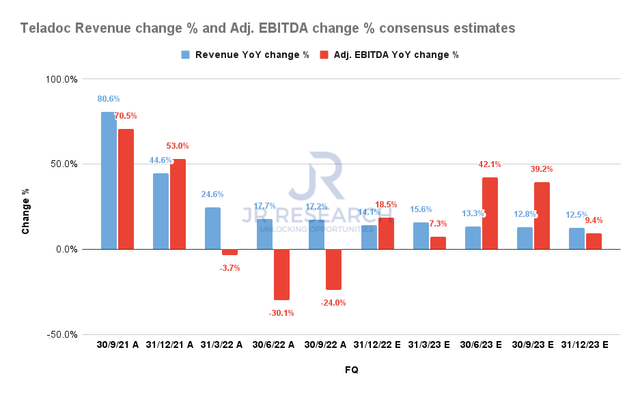

Teladoc Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

However, we must highlight that management has expressly not guided for FY23. Notwithstanding, management’s commentary in its earnings call suggested it remains optimistic about the recovery cadence of its Primary 360 business.

Furthermore, it appears to be gaining share in the fragmented market as customers pivot toward holistic platforms like Teladoc’s in worsening macro conditions. Hence, Teladoc is flexing its muscle as a leading player in the space, as CEO Jason Gorevic articulated:

We’re definitely seeing an impact from a tightening economic environment and a higher cost of capital impacting some of the smaller companies. In fact, I was with a very large client yesterday, and the challenge of them, quite frankly, questioning whether some of those smaller companies are going to be able to survive is definitely top of mind for them. So I’m not sure that I would say that we’ve seen a massive shakeout yet, but I’m hearing quite a bit among both clients as well as other healthcare companies that is very much attuned to that. (Teladoc FQ3’22 earnings call)

Hence, Teladoc’s market leadership has benefited from its recovery momentum. Nevertheless, we encourage investors to continue monitoring its ability to take more share from smaller competitors moving ahead.

Is TDOC Stock A Buy, Sell, Or Hold?

TDOC remains priced at a premium against its Healthcare Technology peers. Notably, its NTM EBITDA multiple of 19.1x is still well above its peers’ median of 7.4x (according to S&P Cap IQ data). Hence, the market has accorded TDOC’s market leadership with a premium valuation that it needs to justify.

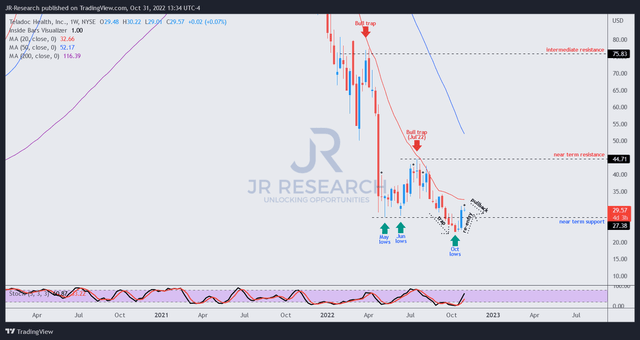

TDOC price chart (weekly) (TradingView)

We had anticipated its May/June 2022 lows to hold. But the market had other ideas as it forced a rapid selloff in September to form its October lows over four weeks.

However, that move turned out to be an astute bear trap as it forced weak holders to capitulate while ensnaring bearish investors into setting up short exposure at the worst possible moments.

Last week’s reversal has helped TDOC retake its critical near-term support decisively. Given the extent of the momentum spike, we expect some digestion before consolidating. While we expect a pullback toward its May/June lows, we don’t expect a decisive break of these levels.

Hence, it is looking increasingly likely that TDOC has already bottomed in May.

Maintain Speculative Buy rating with a medium-term PT of $40.

Be the first to comment