Byjeng

Waste services giant Republic Services (NYSE:RSG) may not seem like the most exciting prospect on the market. After all, who gets excited about trash? But over the past several months, the firm has proven to be a paragon of stability, with continued growth on its top and bottom lines and a reasonable share price preventing it from falling even as the broader market declines. While I still do believe that there are more appealing prospects in this space today, I do also recognize now that my prior ‘hold’ rating on the company was probably overly pessimistic. Because of this, I have decided to increase my rating on the company from a ‘hold’ to a ‘buy’, reflecting my new belief that it should outperform the broader market for the foreseeable future.

Trash pays

About a year ago, on November 4th of 2021, I published an article discussing the investment worthiness of Republic Services. In that article, I lauded the company’s track record for growth, admitting that some of that growth came about as a result of acquisition activities. I found myself impressed with the strong cash flows the company generated and felt as though the trend would continue. But at that time, I also thought that shares of the company were pricey, leading me to conclude that it was more or less fairly valued. This led to my initial ‘hold’ rating on the stock, indicating my belief that it should generate returns that more or less would match the broader market moving forward. But since then, things have not gone exactly as planned. While the S&P 500 is down by 16.3%, shares of Republic Services are actually up by 1.4%.

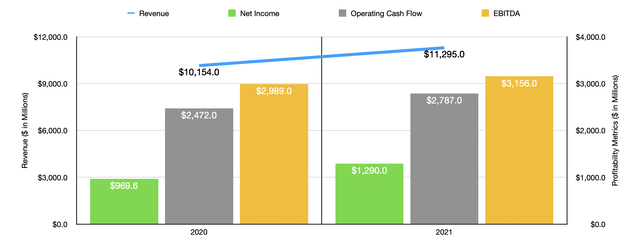

When I last wrote about the enterprise, we only had data covering through the third quarter of the 2021 fiscal year. Today, we now have data covering through the third quarter of 2022. But before we get to that, we should talk about how the company ended 2021. For that year as a whole, revenue came in at $11.30 billion. That’s 11.2% higher than the $10.15 billion the company generated only one year earlier. This increase in sales was driven by strength across the board. For instance, residential revenue grew by 6.2% while small container revenue increased by 10%. Growth under the large container portion of the business was even more impressive, coming in at 10.7% year over year. Net landfill revenue increased by 10.5%. And other revenue categories also increased nicely. Collectively, management attributed these increases to a couple of different factors. For instance, average yield increased revenue by 2.9% thanks to positive pricing changes across all of the company’s lines of business. Volume, meanwhile, increased revenue by 3.8% thanks to increased solid and special waste event-driven volumes. Meanwhile, acquisitions, net of divestitures, added 2.8% to the company’s top line.

With this rise in revenue, we also saw improved profits. Net income for the business rose from $969.6 million in 2020 to $1.29 billion last year. Of course, we should also pay attention to other profitability metrics. As an example, operating cash flow for the firm shot up from $2.47 billion to $2.79 billion. That translates to a year-over-year increase of 12.7%. we also saw EBITDA improve nicely, climbing from $2.99 billion to $3.16 billion. That is a gain of 5.6% year-over-year.

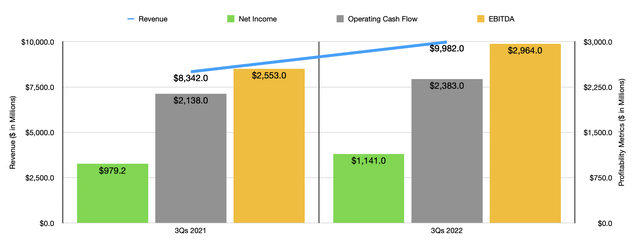

Heading into the 2022 fiscal year, Republic Services had a lot going for it. That’s because, in February of that year, the company acquired US Ecology in a deal valued at $2.2 billion. This helped to push revenue for the company for the first three quarters of its 2022 fiscal year up to $9.98 billion compared to the $8.34 billion reported the same time last year. At the end of the day, acquisitions, net of divestitures, contributed 9% to the company’s 19.7% increase in sales. Increased volume contributed 2.7%, while average yield contributed 5%. Fuel recovery fees, meanwhile, helped the company to the tune of 2.7%. With this increase in revenue, profits for the company continue to climb. Net income rose from $979.2 million in the first nine months of the 2021 fiscal year to $1.14 billion the same time this year. Operating cash flow increased from $2.14 billion to $2.38 billion. Meanwhile, we also saw an increase when it came to EBITDA, with the metric rising from $2.55 billion to $2.96 billion.

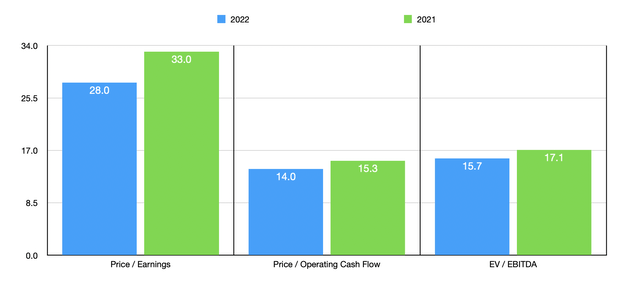

For the 2022 fiscal year as a whole, management claimed that earnings per share should be between $4.77 and $4.80. Given the current number of shares outstanding, hitting the midpoint should translate to net income of nearly $1.52 billion. Management also provided guidance for operating cash flow, with a range of between $3.03 billion and $3.07 billion. The midpoint here comes out to $3.05 billion. And a good approximation for EBITDA, based on that, would be $3.45 billion. Given these numbers, I calculated that the company is trading at a forward price-to-earnings multiple of 28. The forward price to operating cash flow multiple should be 14, and the EV to EBITDA multiple should be 15.7. To put this in perspective, these multiples, using data from the 2021 fiscal year, would be 33, 15.3, and 17.1, respectively. Although there are many other players in the waste space, perhaps the single best company to compare Republic Services to would be rival Waste Management (WM). At present, that firm is trading at a price-to-earnings multiple of 29.4. The price to operating cash flow multiple is 14.7. And the EV to EBITDA multiple should come in at 14.9. As you can tell, Republic Services is cheaper than Waste Management using two of the three methods we used to value the firms.

Takeaway

When I last wrote about Republic Services, I made the case that shares were looking rather pricey. I stand by my original argument that the stock is certainly not a value play. Having said that, I do acknowledge that I was looking at the picture wrong. My own mindset at that time was focused on its upside potential relative to what the broader market would likely see. I did not consider or appreciate how stable the company could be during difficult times. This makes me view the risk-to-reward profile of the company in a different light. While I do believe that upside potential for shares over the long haul is weaker than what the broader market should experience, I do think that shares are stable enough to warrant a ‘buy’ rating with the idea that the company should outperform during difficult times and underperform during great times.

Be the first to comment