Dilok Klaisataporn

American Financial Group, Inc. (NYSE:AFG) is a company that may fly under the radar of many investors. It is a mid-sized insurance company that operates across an array of niche markets. However, sometimes the most overlooked companies can offer the best opportunity. AFG is a strong underwriter that has aggressively returned capital to shareholders and has an investment portfolio poised to benefit from the current environment. At just 11.5x earnings, it is trading at an attractive value too.

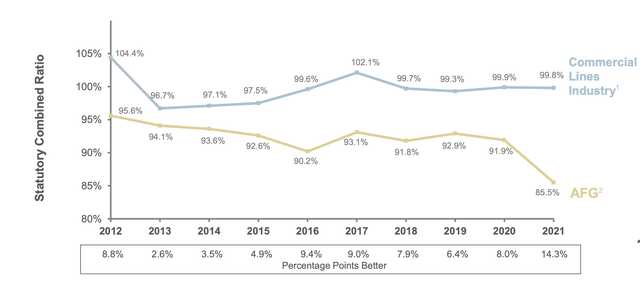

In the company’s second quarter, it reported core EPS (excluding some movements in its securities portfolio) of $2.85, up 19% from last year. It generated a core return on equity of 20.7%–these strong returns explain why it trades more than 2x its $51.68 adjusted book value. Specialty P&C underwriting profitability rose from $153 million to a Q2 record of $197 million. The combined ratio improved 2.1% to 85.8% even with 1.6% of catastrophe losses. As a reminder, a combined ratio of 100% means an insurer breaks even on its underwriting. AFG is making $14.2 on every $100 in premiums. Net and gross premiums written were up 11% and 10% respectively, providing the growth for future increases in underwriting profits.

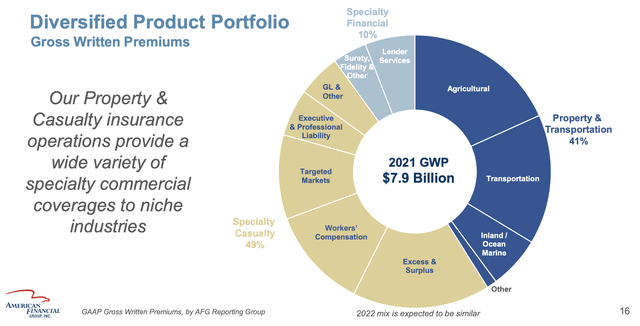

About half of its business is specialty casualty, 10% specialty financial, and 40% property and transportation. It does limited business on the coasts, meaning it should have less of an impact from Hurricane Ian than companies like Progressive (PGR) reported. AFG operates in smaller markets, such as providing insurance to executives and boards of directors, where it has more pricing power and differentiated underwriting can provide results, rather than more commodity lines like personal auto.

Indeed, AFG has been able to grow its premiums while also boosting prices. In 2021, it pushed up rates 9%, and it is on track for another 4-6% increases this year (Specialty is running higher and workers’ compensation lower). These higher premium rates should support solid underwriting profits. As you can see below, AFG has outperformed the industry on its combined ratio every year of the last 10. By building leading franchises in niche markets, AFG will never be the biggest insurer, but it will be among the highest return-generating ones, which is what we want as shareholders.

Alongside these strong Q2 results, the company raised guidance with core EPS of $10.75-$11.75, up $0.25 as overall premiums should rise 9-13% from 8-12% previously. Management continues to expect a combined ratio holding at 85-87%, a really strong outcome. This was the second straight beat and raise as the company had guided to $9.75-10.75 in EPS to start the year. When the company reports third quarter earnings on November 2, I am looking for the bottom-end of guidance to be raised as higher interest rates boost profits. Plus, in October, the company raised its dividend by 12.5% to $0.63, its 17th straight year with an increase.

Aside from being a very strong underwriter, its investment portfolio is also well positioned. 69% of its $14.3 billion portfolio is in fixed income, as is typical of insurers. of which 91% is investment grade. This high credit quality should mean there is limited default risk even in a recession. This portfolio has a duration of just 2.7 years. That short maturity profile means it has significant maturities, which it can reinvest at higher interest rates. This is a major tailwind as its fixed income portfolio has a 3.1% yield, but AFG is reinvesting bonds at over 5%, thanks to the Federal Reserve’s rate increases. As the portfolio yield rises to about 4.1%, as it can over the next 12 months at current interest rates, that will provide an incremental $1 per share in EPS.

Aside from its fixed maturities holdings, it has a $2 billion alternatives portfolio, with $1.2 billion in multifamily, an allocation which is benefitting from strong rent increases.

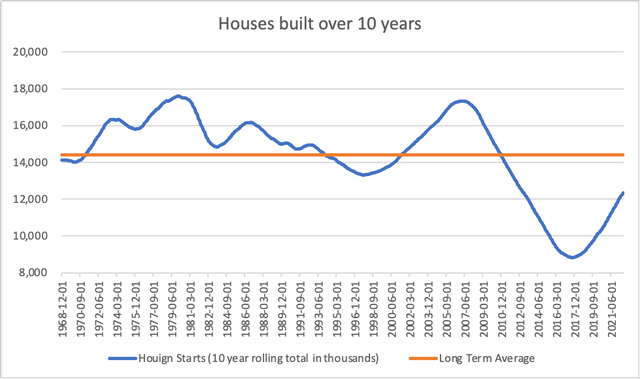

Rental inflation has been running hot this year, rising about 7%. I expect rental inflation to remain relatively strong in coming years as the U.S. housing market is so underbuilt. This lack of supply will keep prices and rents relatively high in my view, pointing to increased income for AFG as a landlord.

my own calculation

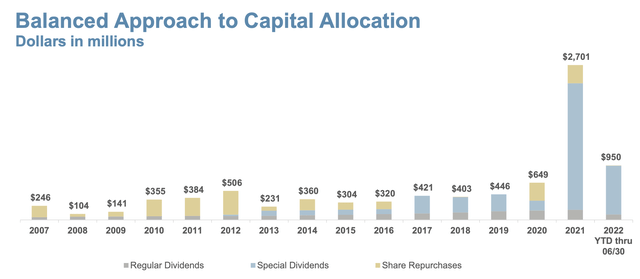

With its combination of strong earnings power from underwriting and solid investment portfolio, AFG has been able to return an incredible amount of cash to shareholders. Last year it paid $26 in special dividends, and this year it has paid $10 in special dividends. These special dividends were aided by the sale of its annuity business last year for $3.6 billion, which freed up significant capital and generated a $656 million gain. AFG has $1.1 billion of excess capital (about $13 per share) and authority to repurchase up to 7.7 million shares. Over the past five years, over 80% of capital return has been via dividends, a shift from earlier practice when the stock traded at a discount to book value.

While I would not expect special dividends like 2021 to repeat, the parent company has $750 million in cash or about $9 per share. Combined with the $1.1 billion in excess capital, and there is an avenue for the company to continue to grow its insurance business and return capital to shareholders. With the stock above book value, management seems to prefer the special dividend route to buybacks. On their last earnings call, management stated an intention to return $400-$500 million via special dividends or buybacks over the balance of the year. As such, I am looking for a special dividend to be announced alongside Q3 earnings, likely of $2-4 per share with a small amount of stock bought back alongside it.

11.5x earnings for a best-in-breed underwriter that benefits from higher rates and is returning excess capital to shareholders is a very compelling entry point. PGR trades at 2x that multiple as another best-in-breed underwriter. Given premium growth and higher interest rates, AFG is poised to earn at least $12 in 2023, even if the combined ratio rises somewhat.

Given its strong underwriting, I believe AFG should trade at least 15x earnings or toward $180. Until it does, I recommend adding shares and enjoying continued income growth as it steadily increases its base dividend and uses buybacks and special dividends to enhance shareholder returns.

Be the first to comment