Keystone Features/Hulton Archive via Getty Images

Investment Thesis

Viatris (NASDAQ:VTRS) is set to announce its Q322 earnings on November 7th, and just as has been the case for the last five quarters, there is a good chance that top line revenues will decrease both sequentially and year-on-year, and an equally good chance that gross profits will also fall.

Viatris quarterly income statements – n.b. Viatris began trading as a separate entity in Nov 2020. (Seeking Alpha)

That is likely going to depress a share price that has lost 28% of its value over the last 12 months still further, and although rumours of a sale of the company’s European consumer health products has lifted the stock price from $8.50 to $10.00 in the past few weeks, it is difficult to see how a shrinking company grows its share price long term.

Given Viatris does ~75% of its business outside of the US, the strong dollar is likely to negatively impact Q322 earnings, which will not help the stock price in the short term either. On the more positive side, a growing dividend yield has now reached 4.8%.

In this post I will discuss why Viatris initially looked like a great investment opportunity, why optimism has foundered, and what management may be able to do to get things moving in the right direction.

Viatris’ Shrinking Pains

Viatris was formed via a merger between generic drug maker Mylan and a spinout of Pfizer’s generics drug brand Upjohn, and like many investors, I purchased the stock based on the company’s incredibly low price to sales ratio, which remains a feature of the company today. Viatris’ current market cap is $12.15bn, whilst its revenues forecast for FY22 is for $16.2-$16.7bn.

The P/S ratio is therefore 0.74x, which is an unusual phenomenon. Out of the top 500 largest listed companies by market cap, only 51, or ~10%, had a higher revenue figure than market cap in FY21.

Viatris tends not to provide earnings per share (“EPS”) guidance, but if we use free cash flow (“FCF”) per share as a surrogate, Viatris has forecast for FCF of $2.7bn in FY22, and the company has a share count of 1.213bn, which results in FCF per share of $2.20, and a forward price to free cash flow of 4.5x. Out of the top 500 listed companies by market cap, only seven had a lower price to free cash flow, in 2021, and only seven had a lower P/E ratio.

It’s logical to therefore take the view that Viatris stock makes for a strong buy, since the only way for the extremely low P/S and P/FCF ratios to correct themselves is through a rise in the share price – so long as revenue generation and profitability remain at least constant.

Which brings us to the problem with Viatris – can a company whose revenues and gross profit are shrinking every quarter ever make for a strong investment proposition? Yes, the forward P/S may look strong today, but if it is going to widen in every quarter as revenues shrink, there is no requirement for the share price to rise.

This explains why Viatris’ share price dropped dramatically, from $14.50 to $10.00, when the company announced the sale of its biologics division to Indian Pharma Biocon in a deal worth $2.3bn in cash plus a $1bn equity stake in Biocon. Admittedly, Viatris retains a ~13% stake in Biocon, but biosimilars was one of the few divisions at the company that looked like growing revenues long-term, and without it, Viatris’ growth prospects look even slimmer.

If the entire investment thesis in relation to Viatris is based on recognising ever-decreasing sales of once dominant brands such as Lyrica, Viagra, Xanax, and Lipitor, and keeping R&D costs to a minimum to ensure profitability, then the outlook for shareholders looks bleak.

News broke earlier this month that Viatris is trying to find a buyer for its consumer health assets in Europe, which management believes could fetch a price of up to $2.9bn. Again, the deal may be a good one, but no company is ever going to grow its share price by selling its entire portfolio and hoping it gets more than the market expects, especially when the underlying assets are becoming less valuable with each passing year.

In a recent Fireside Chat at the Bank of America (BAC) Global Healthcare Conference in London, Viatris CEO Michael Goettler and President Rajiv Malik, insisted growth was coming, so perhaps there is a plan in place that is more sophisticated than an asset fire sale.

Let’s take a closer look at where Viatris’ growth may be coming from.

How Does Viatris Grow?

During the fireside chat CEO Goettler made the valuable point that, thanks to the pandemic, this was the first conference its CEO, President and Chief Financial Officer had been able to attend together in person. Since Viatris began trading in November 2020, at the height of the pandemic, perhaps it would be fair to cut management some slack, and agree that under the circumstances, downsizing was the correct approach to take.

Viatris, is, after all, no small company, with, according to Goettler, 37k staff and trading in 165 countries. It is also heavily indebted – to the tune of $21bn, according to its Q222 earnings presentation. Management has done well to reduce the debt from $25bn, but the Q420 gross leverage, debt to adjusted EBITDA of 3.7x will not reduce greatly in 2022 due to a forecasted $6bn adjusted EBITDA at the midpoint, implying forward debt to adjusted EBITDA of ~3.5x.

The onerous debt burden is another reason why Viatris needs to grow rather than shrink, and with 60% of its revenues derived from legacy brand sales, it’s clear the company needs to find new sources of revenues. These sources, according to Goettler, will be found within the gastrointestinal (“GI”), ophthalmology and dermatology markets.

Management revealed (during the recent fireside chat) that its decision to make the Biocon deal was due to its perception that “vertical integration” – handling every aspect of a business as opposed to working with outside contractors and companies – was the way to win in this relatively new market.

Biocon has the necessary expertise to be vertically integrated, with as many as 20 biosimilar programs in development, 11 of which are partnered with Viatris, who retain a sizeable stake in Biocon. These include biosimilar versions of Roche’s (OTCQX:RHHBY) breast cancer drug Herceptin, Amgen’s Neutropenia therapy Neulasta, and the first ever approved “interchangeable” biosimilar, Semglee – an insulin medication.

According to President Malik:

It’s the right way to look into. If you’re looking into first step let’s take ophthalmology or dermatology as an area. The first acquisition or first tuck-in acquisition can be a sort of anchor asset, where we also bring in some capabilities, competencies and some pipeline or some market product, depending upon what’s available at that point of time.

And then simultaneously continue to scout for more Phase 2, Phase 3 candidates to enrich the pipeline and build that pipeline, because one product is not going to build a sort of franchise for that

Personally, my issue with this approach is why it was necessary to build a new division – Ophthalmology or Dermatology – presumably at considerable expense, with cash that ought to be earmarked for debt repayment – when there was a promising biosimilars division already in house? If Biocon was the company with the better infrastructure, why not acquire Biocon, instead of selling the company your crown jewel biosimilars division?

According to Viatris it is because of its pre-existing global infrastructure and regulatory experience, which means it ought to be able to progress new products through the drug approval process and market them globally with the minimum of fuss and expense.

Goettler also suggested that he preferred the GI, Ophthalmology and Dermatology markets, highlighting their size, and stressing that innovation in these fields is generally carried out by smaller biotech concerns as opposed to Big Pharma, which makes it easier to build a commercial presence. Goettler suggested that in the US:

With 60 to 80 people, you can cover most of these areas from a salesforce perspective. So the build is relatively small. You have high likelihood of development success, right? The PTRS (probability of technical and regulatory success) is higher, the end points are clear. So that’s all the characteristics that we think that really fits us.

Another element of this strategy is “anchor assets”, according to Goettler and Malik, with Goettler explaining:

An anchor asset doesn’t have to be a $1 billion blockbuster. It could be a $500 million. It could be a $400 million product that comes in that gives you the presence in the market maybe comes with the salesforce, maybe comes with some of the branded capabilities.

The problem here is that Viatris may only have ~$500m to buy up biotech concerns, given the pressure on the company not to overspend and damage its credit rating. If the credit rating were to be downgraded, Viatris ability to meet its debt obligations would be in doubt, and that would surely damage the company valuation. There are not many biotechs out there that would consider selling for less than several billion dollars if they felt they had a $500m peak selling product in their pipeline.

What To Expect From Q322 Earnings

Before we speculate about Q3’22, let’s take a look at the year-on-year comparison between Q2’22, and Q2’21.

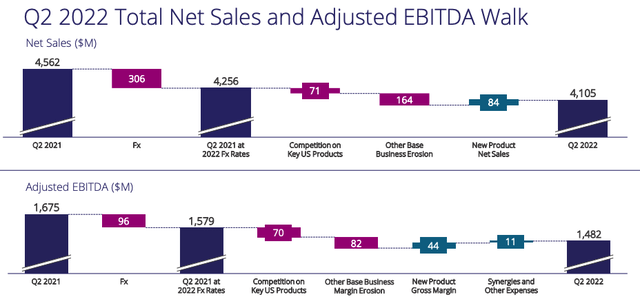

Viatris net sales and adjusted EBITDA walk Q221 to Q222. (Viatris)

As we can see above, adverse FX actually did the most damage in terms of impacting revenues in Q2’22 vs Q2’21. This is a factor outside of Viatris’ control and subject to change, but even so, it is likely to impact Q3’22 earnings just as it did Q2’22, since the dollar has gotten stronger over the past few months.

Otherwise, we can see competition in the US damaging product sales – hardly surprising when we consider that Viatris products have long since lost patent protection and there are new and better selling products on the market.

Base business erosion appears to be a worryingly catch-all term which suggests there are other underlying issues in play – the promised $1bn of post-merger cost synergies does not appear to be in evidence with just $11m realised in Q2’22.

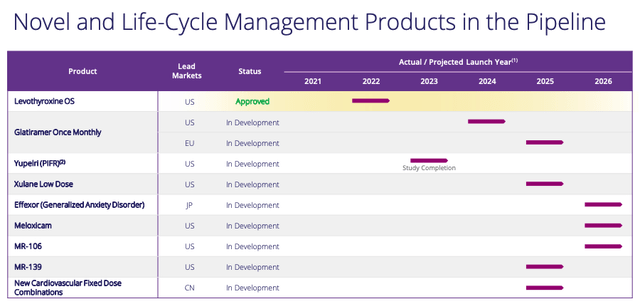

In terms of new product net sales, a glance at Viatris’ pipeline shows that shareholders will have to be patient here, with the bulk of new product launches – if approved – expected after 2024.

Viatris product pipeline (Viatris)

In summary, I don’t have great hope that Viatris’ Q3’22 earnings will reflect anything other than incrementally falling product sales. At best, the quarter-on-quarter drop will be marginal, given the FY22 forecasts, at worst, management will downgrade earnings again, which is likely to reverse the recent share price growth.

Conclusion – Keeping The Faith With Viatris Is Going To Be Tricky But Management Has A Plan At Least

There has been a trend for Big Pharma spinouts recently – Merck spun out its Women’s Health and generics / biosimilars divisions into a new entity, Organon (OGN), last year, realising an $8bn taxation windfall as a result. French Pharma Sanofi (SNY) and British Pharma GSK (GSK) have also separated out their Consumer Health divisions. Johnson & Johnson is about to follow suit with the launch of Kenvue, a spin out of the Big Pharma’s Consumer Health division.

Although the parent companies have been at pains to sell these spinoffs as strong companies in their own right, it is hard to escape the conclusion that these spinouts are more about Pharma’s dumping consumer health in favour of drug development – a more lucrative, higher margin business.

Despite looking highly attractive with their low market valuations and high sales volumes, spinouts are a convenient way to dispose of debt and there is often a worrying lack of a plan going forward, which is doubly worrying given the entire business is comprised of assets whose peak sales years are long behind them.

It is therefore a tough challenge for the new company’s management teams. They do at least have time on their hands and strong infrastructure to build upon in terms of global sales networks and experienced staff.

In Viatris’ case, an attractive dividend and low market valuation masks a multitude of problems, but I am not giving up on the company yet. Although it seems a bizarre decision to look to sell your only promising asset – the biosimilars division – and build something new from scratch, perhaps management is right to conclude that maintaining a passive interest in a relatively unproven industry through Biocon, whilst focusing on traditionally strong industries such as GI, Ophthalmology and Dermatology is the appropriate way forward.

Time will tell, but in the meantime, investors may have to get used to some ugly quarterly earnings, pressure on the debt rating, and a trickle rather than a flood of new products, as sales of Lyrica, Viagra, Xanax etc. slowly decline.

Be the first to comment