Mongkol Onnuan

Thesis

Trading at a EV/EBIT (FWD reference) of about x3.5, and offering a dividend yield of greater than 10%, Vale S.A (NYSE:NYSE:VALE) could perhaps be one of the most cheaply valued companies on the market. It is true that iron ore and copper prices have slumped recently, but Vale will likely nevertheless manage to record attractive profitability, and aggressively return capital to shareholders.

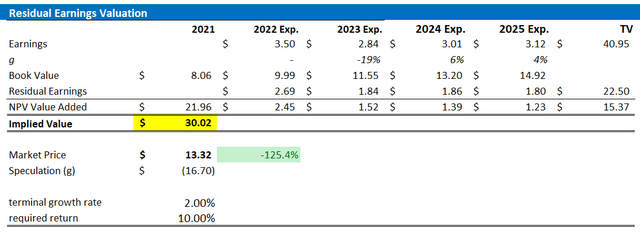

Personally, I believe that VALE stock should be valued at about $30.02/share. I anchor my argument on a residual earnings valuation with EPS assumptions based on an analyst consensus estimates until 2025.

For reference, VALE stock has outperformed year to date, being down only about 3.5% versus a loss of 25.3% for the S&P 500 (SPX).

About Vale

Vale S.A. is a major global mining company based in Rio de Janeiro. It explores, mines and sells iron ore, copper and other raw materials in Brazil and internationally. The company operates two major segments: Ferrous Minerals and Base Metals. The Ferrous Minerals segment accounts for slightly more than 90% of total revenues and is focused on extracting iron ore and pellets, manganese, ferroalloys, and other ferrous products. The Base Metals is less than 10% of revenues and mines nickel, cobalt, copper, as well as precious metals such as silver and gold.

In 2021, Vale generated $52.6 billion of revenues and thus matches the size of major international players such Rio Tinto (RIO), $63.4 billion of revenues; BHP Group Limited (BHP), $60.5 billion of revenues and Anglo American plc (OTCQX:AAUKF), $41.5 billion of revenues.

Deep Value Thesis

There is one simple, but major argument why investing in Vale is highly attractive: the valuation simply does not correctly account for the company’s strong financials and cash-flow profile.

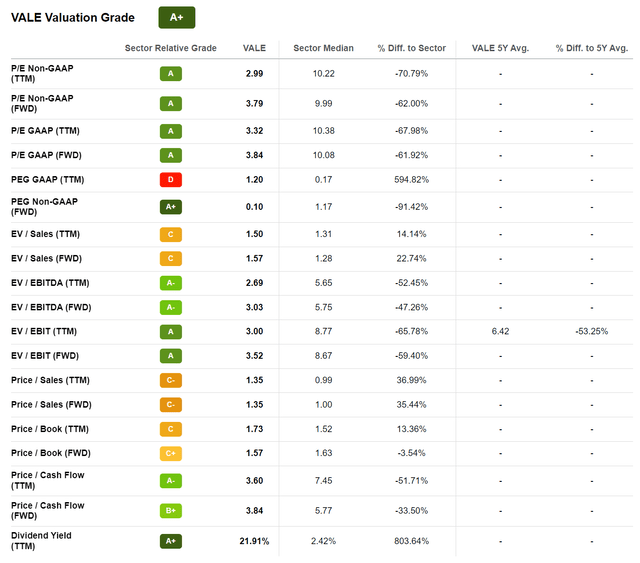

Vale stock is currently trading at a P/E (FWD reference) of about x3.8, which is approximately 67% cheaper than the respective median for the mining sector of x10.4. On an unlevered basis, Vale’s EV/EBIT multiple is trading at a 47% discount to the sector, priced at x3.5.

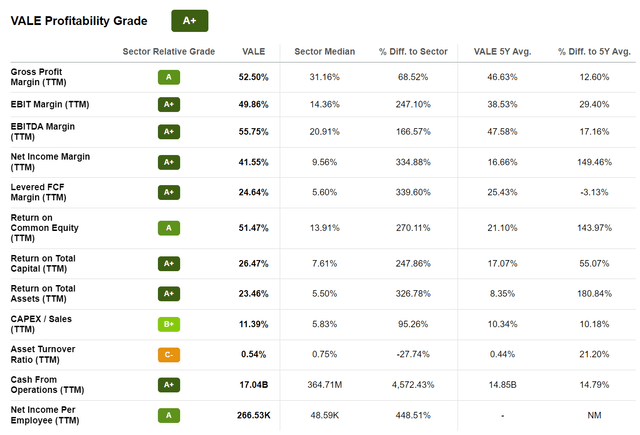

In my opinion, such deep discount multiples are simply not justified, as investors should consider that Vale’s profitability metrics are consistently above industry. For reference, Vale’s EBIT margin (TTM reference) is 49.8%, a 247% premium to the sector. Vale’s net profitability margin is 41.5%, which implies a premium of 335% respectively.

Investors are right to fear a contraction for the mining sector, given that an economic slowdown is unquestionably observable, and the mining industry is very levered to the global economy. But still, the mispricing of Vale stock allows for a deep margin of safety. Investors should consider that Vale’s cyclically adjusted annual operating profit for the past decade can be calculated somewhere around $13 billion — and Vale’s market capitalization is currently valued at only x5 this number, $63.4 billion.

Accordingly, Vale’s structural profitability (cyclical adjusted operating profit) would need to contract by half, before the 10% dividend yield becomes endangered.

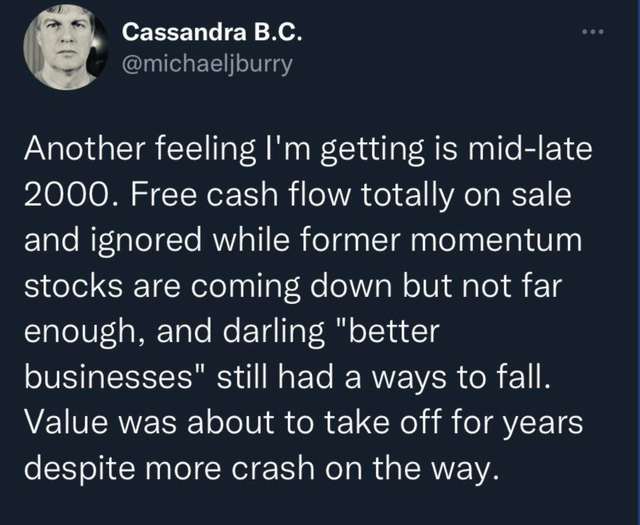

Notably, famed investor Michael Burry — who is often considered as a pessimist and perma-bear — has recently highlighted that the market is underestimating the value of value stocks. He hinted that despite the ongoing market selloff, businesses with strong cash flows – companies such as Vale – should do relatively well in the coming years.

For reference, in the years following the “internet bubble” deflation, Vale stock appreciated by almost 2.000% in less than six years.

Target Price Estimation

In my opinion, value stocks are best priced through a residual earnings model. The residual earnings model anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise

- To estimate the capital charge, I anchor on VALE’s cost of equity at 10%.

- For the terminal growth rate after 2025, I apply 2%, which is arguably reasonable and in line with estimated nominal global GDP growth.

Given these assumptions, I calculate a base-case target price for VALE stock of $30.02/share (about 125% upside).

Analyst Consensus EPS; Author’s Calculation

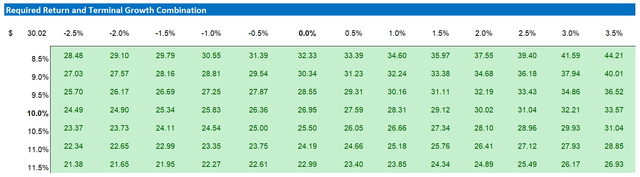

Interestingly, within a reasonable possibility set of different terminal growth grate and the cost of equity assumptions, Vale appears materially undervalued. Here is a sensitivity analysis table.

Analyst Consensus EPS; Author’s Calculation

Downside Risks

Trading at a x3.5 EV/EBIT multiple, I think the market has discounted too much bearishness regarding Vale’s business prospects. But investors should nevertheless note that, as a mining company, Vale’s business profitability is strongly levered to the health of the global economy. Accordingly, if weak economic activity would persist for a long period of time, Vale might fail to accumulate enough value to pay the dividend. And a dividend cut would materially depress investor confidence. Moreover, based in Brazil, Vale is exposed to somewhat heightened political risks — as recent violent political clashes surrounding the 2022 Brazil election have highlighted. Finally, investors should also consider that Vale’s global operations expose the company’s profitability to foreign exchange fluctuations, which might distort economic fundamentals.

Conclusion

Although I acknowledge the macroeconomic weakness that might pressure the profitability of mining companies for the foreseeable future, I argue that VALE stock is deeply undervalued. Investors should consider that Vale stock is currently trading at a P/E (FWD reference) of about x3.8, which is approximately 67% cheaper than the respective sector median of x10.4. Moreover, Vale’s cyclically adjusted operating profit would need to contract by some 50%, before the 10% dividend yield becomes endangered.

Be the first to comment