Ranger Oil’s management team has done a really nice job of shifting into growth mode to take advantage of the surge in energy prices.

vovashevchuk

A common theme in the investing world centers around the idea of being able to create cash flows, or returns, from investments that everyone else sees but either does not, or cannot, deliver on. In simplest terms, we view this as someone at the mall walking the parking lot and picking money off of the ground. In a professional setting, there are a lot of words and phrases used to describe events such as this, including alpha generator, value-add, value creator, etc. What you want to call it is not important, but you most certainly want to stay alert and find management teams who engage in creating shareholder value through every means possible, even when that centers around tasks that others find too menial or not worth their time.

We most certainly believe that this is what is going on at Ranger Oil Corporation (NASDAQ:ROCC) with their management team. Ranger is focused on the Eagle Ford formation in East Texas, and is fortunate to have their acreage in a window heavy in oil and NGLs.

Bolt-On Acquisitions

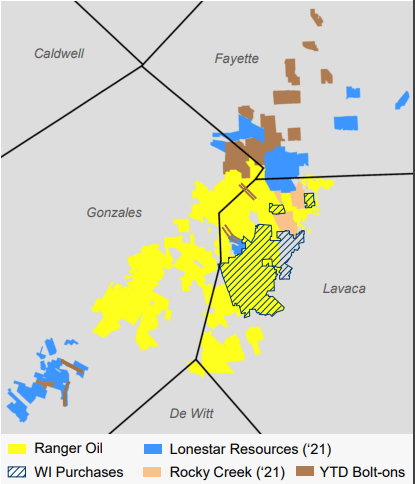

On its latest conference call to discuss its quarterly results, Ranger Oil President and CEO Darrin Henke explained how the company was deploying its FCF and pointed out that they had added 20,000 net acres via 8 bolt-on acquisitions during the second quarter and early third quarter. The acreage had an initial cost of $139 million, which was nearly fully funded with cash flow generated by the company, or less than $7,000 per acre in one of the most economically attractive and regulatory friendly plays in the country.

Ranger Oil has been active in transactions that can increase their contiguous acreage position in the Eagle Ford. (Ranger Oil Corp., Investor Presentation Q2 2022)

These transactions have helped the company build up a nearly 20-year inventory (at current prices) of drilling locations (which total about 1,000) while also helping to improve the prospects for the company moving forward by enabling them to continue to streamline operations by drilling longer laterals and having a larger contiguous land position.

The Q&A that followed management’s prepared remarks shed further light on the M&A activity/market in the Eagle Ford, as management explained that you can find extremely attractive deals in the sub-$100 million area but face extreme competition once you get into the $100-$500 million range. Larger transactions above $500 million are also attractive, and management believes that Ranger will be able to source some of those deals moving forward as well.

Other Good News

Like others in the E&P space, Ranger Oil has become quite disciplined in its approach to capital allocation. While others are pretty far along in their processes for returning capital to shareholders, Ranger appears to be in the early stages and we think that could potentially be a nice “kicker” moving forward. The company’s board also approved a new $140 million share repurchase program through June 30, 2023. Ranger has repurchased $46 million shares since May 2022 – representing over 3% of shares outstanding.

The company moved up plans earlier this year to initiate a dividend and announced a dividend that was richer than expected. Currently the company pays a $0.075/share quarterly dividend, which over time should increase significantly.

Potential M&A Target

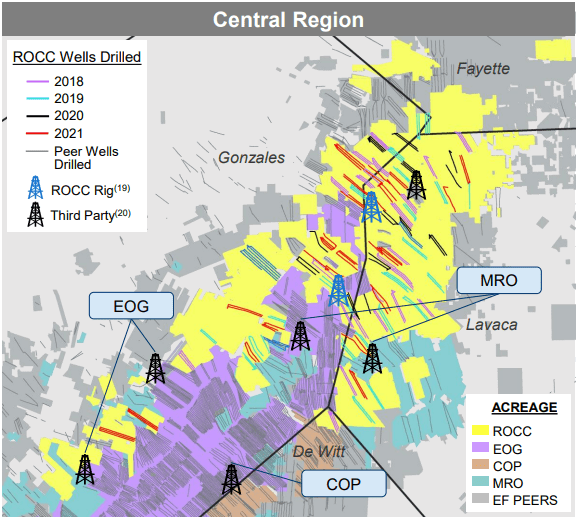

As Ranger continues to add acreage (via bolt-on transactions) at very attractive valuations, the company makes itself an even more attractive takeover target for larger players such as EOG Resources (EOG) and Marathon Oil Corporation (MRO) who have acreage nearby and could easily swallow the single-play Ranger via M&A. Majors such as Exxon Mobil (XOM) are also actively drilling near Ranger acreage, but a $1.5 billion market cap company does not begin to move the needle for a $390 billion+ market cap oil major.

While we like the story in front of us with Ranger continuing to buy attractive acreage that they can create more economic benefit from than others while adding high-single digit or double digit (in the mid-teens) growth in production moving forward, we recognize that this acreage might be best served in the hands of another industry player willing to pay up for it. With the large portion of production being skewed to oil and NGLs, Ranger is quite attractive to larger players looking to replace production in the coming years.

Ranger has a number of potential suitors with acreage nearby. (Ranger Oil Investor Presentation)

Our Take

We have always liked small E&P names as they have a little bit more freedom to find attractive deals and can justify the effort to source those deals, as it takes a smaller cash flow to move the needle for them. In the past we have had success with smaller resource plays doing roll-ups and consolidating basins or plays. Ranger reminds us of some of those successful investments but has the additional kicker of it not being the biggest fish in the pond. There are natural acquirers who could easily digest a Ranger acquisition and with the low cost of acreage that Ranger is accumulating, it could make any takeover offer that much more tempting for shareholders once they see what that acreage is worth in a package to someone else.

We like Ranger Oil at these levels and think that investors will not only benefit from their operations but also from management’s deleveraging, which will eventually lead to the company being able to address the $400 million in outstanding bonds that yield 9%+. Currently the bonds trade at a slight discount to par but being able to start retiring some of this debt could increase cash flow by dramatically cutting the $35 million+ in interest they are currently paying.

Debt reduction, share repurchases, dividend increases, production growth and a potential exit via a takeover offer are all very good reasons to own this stock, especially when each item is a value add. We think that Ranger shares are a ‘Buy’ but prefer to buy in the $30-$35/share range. The options market is not really attractive here, and the company only has traditional “monthlies”, so unless an investor wants to write a September 16, 2022, Put with a $35 strike price to collect a premium of $1.70-ish per share, or $170 per contract, then we think buying on pullbacks is best for long-term investors.

Be the first to comment