udra

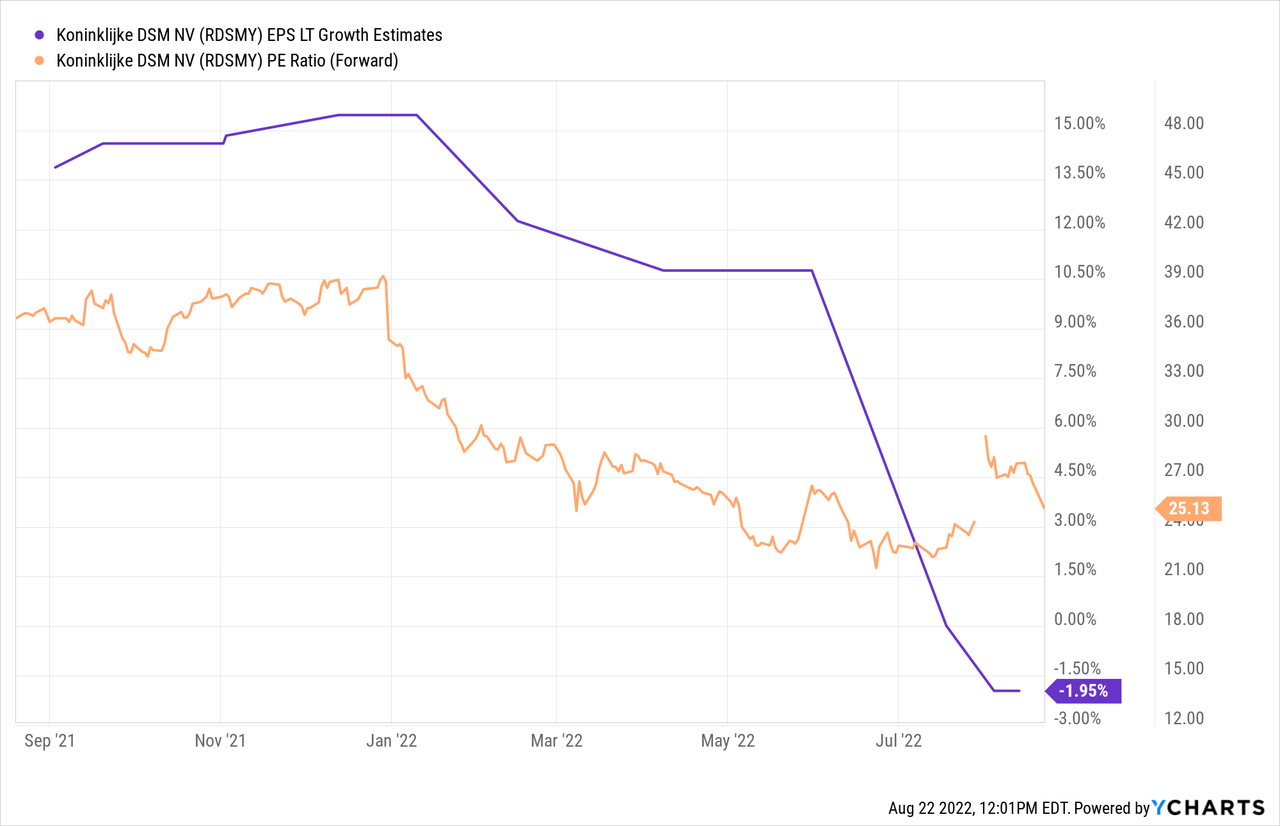

Koninklijke DSM (OTCQX:RDSMY), a leading Dutch company primarily involved in health, nutrition, and materials, once again highlighted the resilience of its pricing model amidst the current inflationary environment with a solid 2Q22 results announcement and unchanged full-year guidance. While volume growth has been a headwind and cash flow was below par, these were largely down to transitory factors such as the China lockdowns, and thus, I feel confident in underwriting sustained growth and cash generation led by the Nutrition businesses. That said, DSM stock is already trading at a premium ~25x P/E – likely pricing in much of the pending Firmenich merger benefits as well. So, while DSM management has the track record and capability to unlock the announced synergies target (~EUR350m on EBITDA), I remain on the sidelines for now.

Animal Nutrition Leads Growth Outperformance, but Margin Challenges Remain

Headline 2Q22 organic growth reached +9% on an ongoing basis (i.e. excluding Materials), led by Animal Nutrition & Health’s +11% organic growth for the quarter. Much of the segment’s outperformance was driven by strong pricing of +11% and flat YoY volumes, as strong animal protein demand offset one-off headwinds such as the China lockdowns and some destocking activity. Poultry demand, in particular, was the highlight – consumers are increasingly looking to switch to more inexpensive meats in the current inflationary environment.

On the other hand, the Health, Nutrition & Care segment was the key disappointment, with organic growth falling short of consensus expectations at +7% overall on +5% pricing growth and +2% volumes. As both Health, Nutrition & Care, and Food & Beverage segments were impacted by supply chain constraints this quarter, the weakness is likely transitory, and the resulting order backlogs likely entail a sales shift into the coming quarters. Per management, these constraints eased towards the end of the quarter as well, so expect strong exit rate momentum in the coming months. Headline margins also fell short at 19.3% (down 240bps YoY), although this was partly down to the dilutive impact of price increases and FX. Normalized for these factors, the margin would have been closer to a resilient ~21%. In the meantime, cash conversion was also down to ~29% (vs. 55% in the prior year), so it was no surprise that the leverage ratio (net debt/EBITDA) increased to ~0.9x (net debt now at ~EUR1.4bn).

Reiterated Outlook Signals Underlying Resilience

On a positive note, DSM management opted to make no changes to the full-year outlook of high-single-digit EBITDA growth – this comes despite the FX tailwind alone likely implying a mid-single-digit % run rate. There was no mention of the FCF guidance from previous outlook statements either (recall management had previously outlined a high-single-digit adjusted net operating FCF increase). I view this as a clear positive, defying any concerns that rising food prices could pressure overall demand and drive lower volumes across the key Human and Animal end markets.

Plus, DSM reaffirmed signs of substitution toward lower-priced meat proteins (away from premium proteins) and limited down-trading in the food and beverage (F&B) despite food price increases. With dietary supplements also called out as an outperformer, despite tough YoY comparables, Health, Nutrition & Care looks set to see a strong rebound into the coming quarter, supplementing the strength in Animal Nutrition & Health, where pet food continues to grow strongly.

Potential DSM-Firmenich Merger Upside

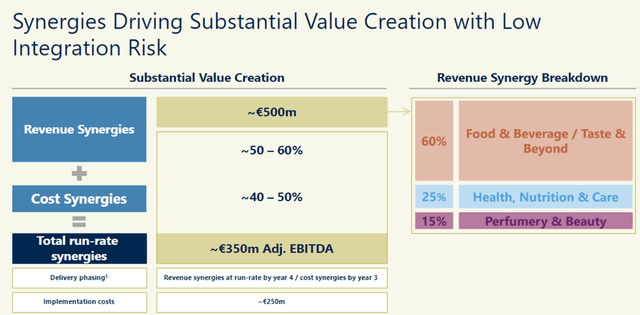

Leading up to earnings, DSM and Firmenich had announced an exciting new merger, creating a higher quality pro-forma entity with a Perfumery & Beauty business as well as a significantly increased F&B exposure. In effect, DSM is reducing the proportion of more commoditized nutrition products such as vitamins and carotenoids (with petrochemical-based inputs) to <40% of the portfolio while also reducing margin volatility. Geographically, the move will also result in a rebalancing away from Europe (down to <50% from >60% prior) toward the higher growth Americas and Asian regions. Given the growth trends in the latter geographies appear structural, with a growing middle class supporting rising demand for higher-quality nutrition and personal care products, I view the move as a clear strategic positive. Coupled with the reduced exposure to higher-cost European energy, the planned merger should support a higher valuation multiple over time.

The financials are compelling as well – DSM is aiming to unlock ~EUR500m in revenue synergies over the next four years, as well as ~EUR350m at the EBITDA line. Per DSM, 50-60% is targeted as a drop-through from revenue synergies, with the remaining 40-50% from cost synergies – at the midpoint, this implies a sizeable >EUR190m of revenue synergies and ~EUR160m of cost synergies at the EBITDA level. Yet, at a low-single-digit % of Firmenich sales, this synergy target could prove conservative, in my view. Also notable is the balance sheet implication – DSM-Firmenich will retain ample balance sheet capacity post-deal, allowing it to lever up for deployment into more inorganic growth opportunities down the line. Potential bolt-on acquisitions are the most likely option at this point, although I would not rule out transformative M&A once the integration is complete.

Quality at a Price

DSM’s resilient 2Q22 results and continued expectations for high single-digit % adj EBITDA growth highlight the underlying quality of the business model. Much like many of its peers, however, DSM is seeing some weakness in free cash generation due to high working capital charges and transitory headwinds such as the China lockdowns. In the near term, the “stickiness” of cost inflation also remains a risk, and pass-through could become more challenging should macro-economic conditions take a turn for the worse. Thus, I would remain conservative on the EBITDA run rate throughout the year, as headwinds remain and DSM’s Animal and Human Nutrition businesses are coming off a high base. While the Firmenich deal is compelling, and DSM has the institutional capabilities to execute on the targeted ~EUR350m EBITDA synergies, the lofty stock valuation is too big of a hurdle, particularly with macro-economic uncertainties and merger risks on the horizon.

Be the first to comment