Melpomenem/iStock via Getty Images

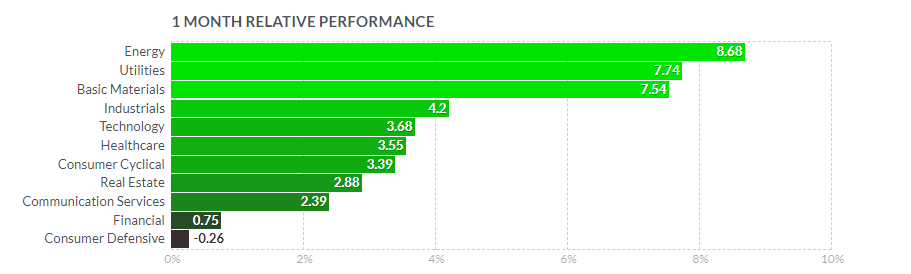

The stock market recovery that started two weeks ago continued yesterday, fueled by a 7% drop in WTI crude oil prices to $106 and a steady decline in volatility that now has the CBOE Volatility Index below 20 for the first time since January. Interest rates are climbing at both the short and long end, but investors are interpreting it as though the economy can absorb the monetary policy tightening that is already expected this year without it meaningfully slowing growth.

fnviz.com

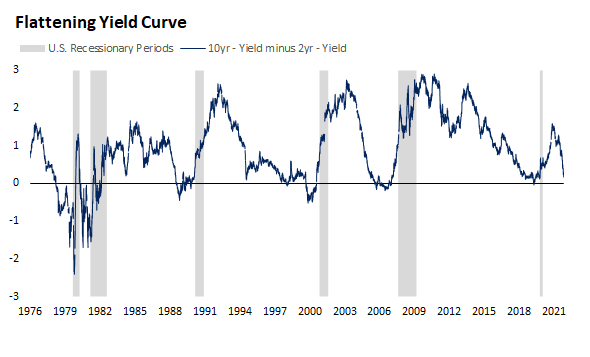

Bears have pointed to the inversion of the 5- and 30-year Treasury yields, whereby the shorter-term yield has risen above the longer term, as a signal that the economy is headed for a recession. The last time we had such an inversion was 16 years ago, and this one follows an inversion of 5- and 10-year yields earlier this month. The thinking goes that when long-term yields fall below short ones it means the bond market sees much weaker growth down the road. Therefore, if the Fed attempts to tame inflation by slowing the rate of growth further, it will result in recession. The problem is that investors are using the wrong maturities to come to that determination.

bloomberg.com

The 5- and 10-year yields have inverted more frequently than the 2- and 10-year yields and given investors several more false signals when it comes to recessions. The 2-year Treasury yield is a better reflection of where investors see the Fed’s interest rate policy in the near term. The 2.35% yield is pricing in the 25-basis-point increase at the last meeting plus an additional 200 basis points of increases through the remainder of this year. The 10-year yield approximates the neutral rate at which point the Fed is not implementing a policy that is tight or easy. That stands at approximately 2.5%. The difference between these two yields is still positive by 15 basis points. If this curve were to invert, it would be a greater concern. There was an inversion in 1998 that did not result in recession, but more often than not it has been a precursor to recession, yet with a meaningful delay.

bloomberg.com

In fact, the 12-month period following either inversion (2s/10s or 5s/10s) has typically been a good period for the economy and stock market. It is not until the second year after inversion that headwinds mount and on a much more consistent basis when both curves are inverted.

I still think we can avoid an inversion of the 2-year/10-year curve and see it steepen from here, which would be a tailwind for the broad market and a steroid shot for the financial sector in particular. Banks borrow money at short-term rates and lend at the long term, so a flat or inverted curve crushes their net interest margins. The sharp rise in short-term rates is what has prevented the financial sector from participating in the stock market rebound. Should we see some steepening of the curve, the banks should start to outperform again.

finviz.com

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment