Vertigo3d

The Quarter:

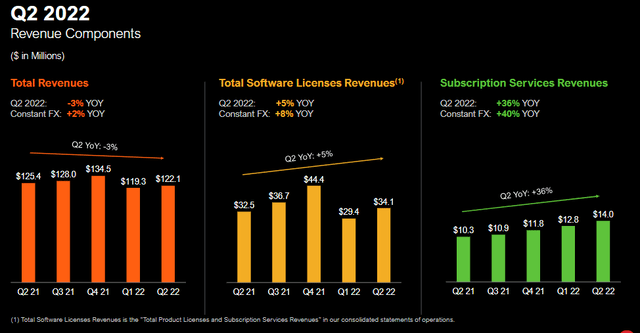

MicroStrategy (NASDAQ:MSTR) reported another ho-hum operational quarter. Its core operating software business saw revenues decline 3% YOY (year over year) and grow 2% in constant currency. The company continues to highlight its subscription services revenue, which grew a much more exciting 40% YOY in constant currency. The problem is that this business is only $14 million of revenue, a tiny 11.5% of total sales. You can see the positives the company pushed to the forefront in the presentation slide below.

Q2 MicroStrategy Partial Sales Breakdown (Q2 Company Presentation)

Despite highlighting the positives embedded within revenue, costs are an uglier picture. Operating costs including cost of revenues, sales and marketing, R&D and G&A grew from $104 million to $107 million. There is no real currency adjustment to those. So even in the best-case scenario and adjusting revenue to constant currency, the company’s core operations declined in profit. This fact leads me to my core view on this company: as a standalone software business, this company is stagnant and mediocre at best and worth only a few hundred million in the most bullish scenario.

The Bitcoin Story and Saylor Resignation:

As anyone who has followed this company knows, newly former CEO and still Chairman and largest shareholder Michael Saylor has invested heavily in Bitcoin (BTC-USD) since the summer of 2020. The company owned 129,699 bitcoins at an average cost of $30,664 as of June 30, a total investment of $3.977 billion funding through the company’s original $500 million cash balance, its cash flow, $1 billion of new class A shares, and the addition of $2.4 billion of secured and unsecured debt. The decline in Bitcoin during the quarter led to a $918 million digital impairment during the quarter, which shouldn’t surprise anyone.

The surprise to the market was CEO Michael Saylor’s resignation as CEO. He will now be executive chairman. Neither the company nor Saylor tied his resignation to the Bitcoin loss. The comment from Saylor was, “I believe that splitting the roles of Chairman and CEO will enable us to better pursue our two corporate strategies of acquiring and holding bitcoin and growing our enterprise analytics software business. As Executive Chairman, I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives, while Phong [Le] will be empowered as CEO to manage overall corporate operations.”

The market is viewing the Saylor resignation as a major positive. As of this writing (afternoon of August 2), the stock is up 14% even though Bitcoin is only up 1%. I am less sanguine. Saylor’s resignation poses a few questions. The biggest in my mind is what actually changes at the company? I find it hard to believe Phong Le stepping up from President to CEO will change the trajectory of the moribund software business. Michael Saylor remains as Executive Chairman which means an active, operating role, and also still owns over 1.9 million supervoting Class B shares, or 67.7% of the voting power. Moreover, the Board of Directors, who signed off on the Bitcoin expedition, is not changing at all. That all adds up to just Saylor stepping down as CEO as mostly cosmetic in nature.

Valuation:

It always comes back to valuation. Two years ago, right before the Bitcoin investment, MSTR had the following valuation (As of June 30, 2020).

| Market Cap (9.7mm shares at $118) | $1.150 billion |

| Debt | $0 |

| Cash and Short-Term Investments | $532 million |

| Enterprise Value | $618 million |

| EV/TTM EBITDA ($119 million) | 5.19x |

| EV/Sales ($475 million) | 1.3x |

So the market used to view the core software business at around $600 million. Let’s be super generous for argument’s sake and say 2020 was still Covid affected and the real valuation of the software business pre-Bitcoin was $1 billion. The valuation has still changed dramatically. Currently, it stands at:

| Market Cap (11.3mm shares at $318) | $3.356 billion |

| Debt | $2.375 billion |

| Cash | $75 million |

| Bitcoin (129,699 coins at $23,333) | $3.026 billion |

| Enterprise Value | $2.630 billion |

| EV/TTM EBITDA (~$75 million) | 35x |

| EV/Sales ($503 million) | 5.22x |

So, any way you slice it, the market has dramatically increased the valuation of this company simply because it has bought Bitcoin and lost about $1 billion doing so. I fail to see why the market is paying this premium given anyone can buy Bitcoin fairly easily and the amount of debt this company now holds makes the stock a hyper-leveraged bet on Bitcoin. If Bitcoin dips below $17,733, the company’s holdings of Bitcoin will be less than its debt.

Conclusion:

3.7 million shares of this company are sold short, over 39% of the float not owned by Saylor. Some of that short is tied to the company’s convertible bonds. The secured bonds of which $500 million are outstanding trade at $87 and yield about 9%. Putting that into context, the secured bonds, which have a direct claim on some of the company’s Bitcoin and on the rest of the company’s operations, are trading at a 9% yield despite being less than the company’s pre-Bitcoin valuation. That tells me those holders still see plenty of risk to this enterprise. I think today’s rally (and much of the previous weeks’ rally) is mostly a short squeeze. I don’t think this company benefits much if at all from Saylor stepping down as CEO. The stock is still a Hail Mary bet on Bitcoin, a very leveraged one that investors do not need the risk of the embedded leverage in this stock to make. One can own Bitcoin and short this stock if one has the stomach.

Be the first to comment