FatCamera/E+ via Getty Images

Teladoc (NYSE:TDOC) will likely forever be remembered as the poster child of the tech crash. The stock was bid up to astronomical levels as investors projected the surge in demand during the pandemic to lead to sustained gains after it. That forecast proved incorrect as the company has seen rapidly decelerating growth rates and withdrawn its multi-year growth guidance. While the stock is unlikely to return to all time highs, at least not any time soon, the vicious valuation reset has made the stock compelling even based on the adjusted growth outlook.

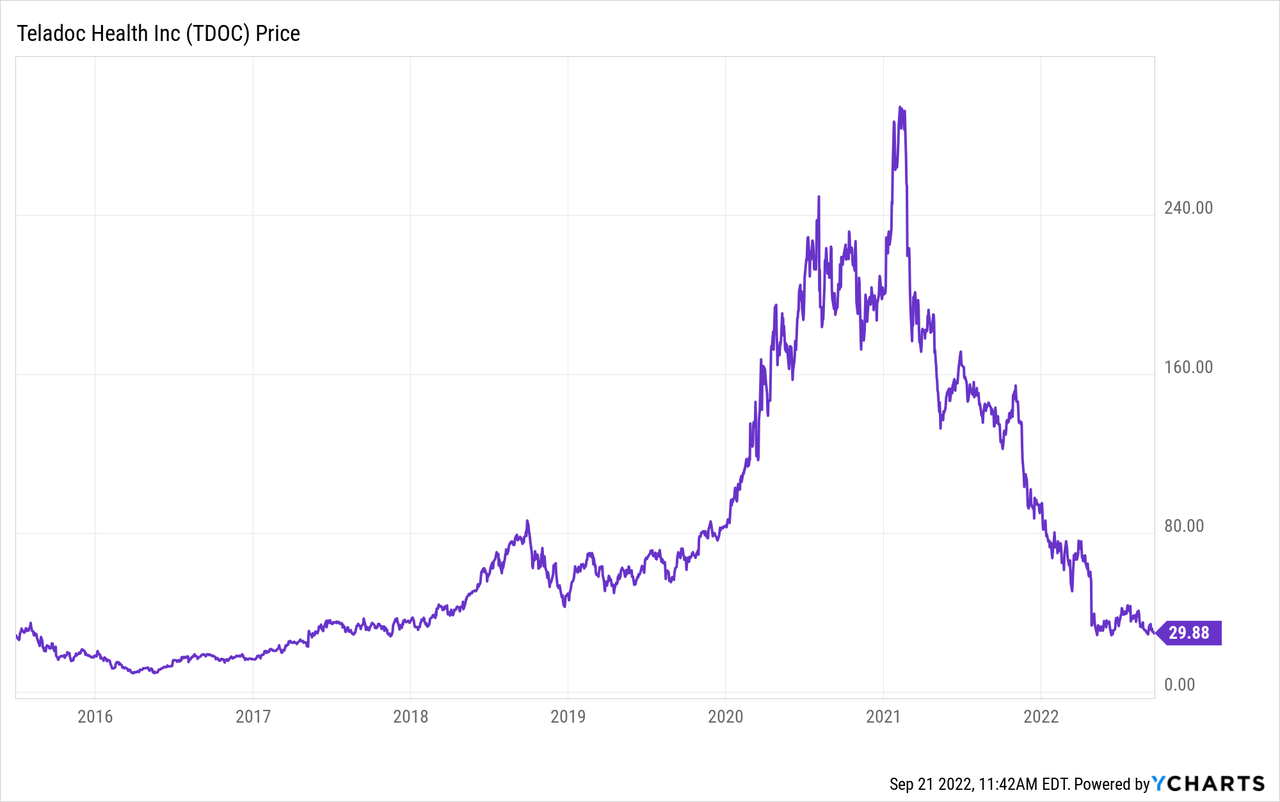

TDOC Stock Price

TDOC peaked close to $300 per share in early 2021. The stock has since fallen a whopping 90% to its current price. The stock has fallen so low that it is trading 60% lower than pre-pandemic prices and lower than where it did in 2015.

The stock seemed to have gained a large following due to being a high conviction pick from ARK Innovation ETF (ARKK) portfolio manager Cathie Wood but has crumbled as investor confidence in Wood faded. The stock shouldn’t have traded as high as it did, but today I argue that it shouldn’t be trading as low as it does now.

TDOC Stock Key Metrics

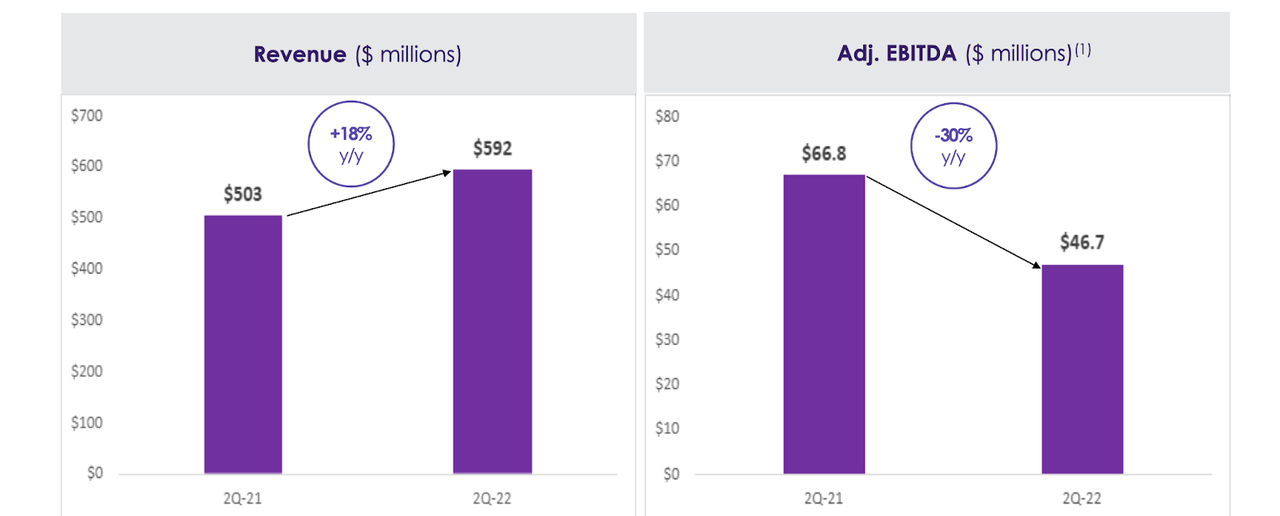

The latest quarter saw revenue grow by 18% but adjusted EBITDA decline by 30%. The revenue growth was boosted by 40% year over year growth in BetterHelp. The disconnect between revenue and EBITDA growth was due to an outsized 60% growth in advertising and marketing.

2022 Q2 Presentation

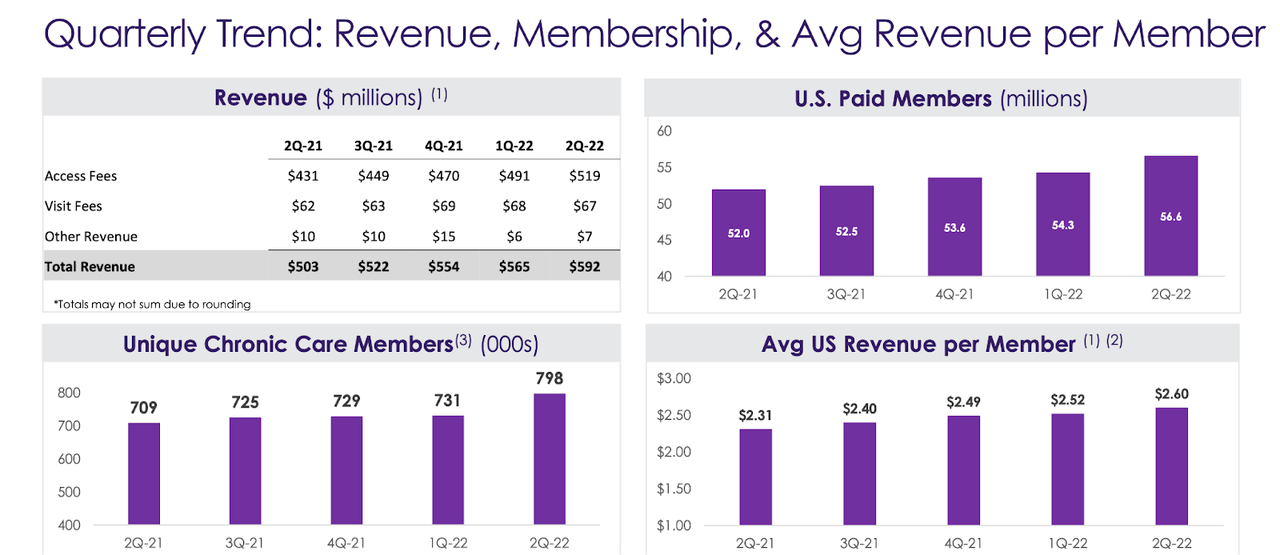

TDOC continued to grow its paid member base as well as its average revenue per member.

2022 Q2 Presentation

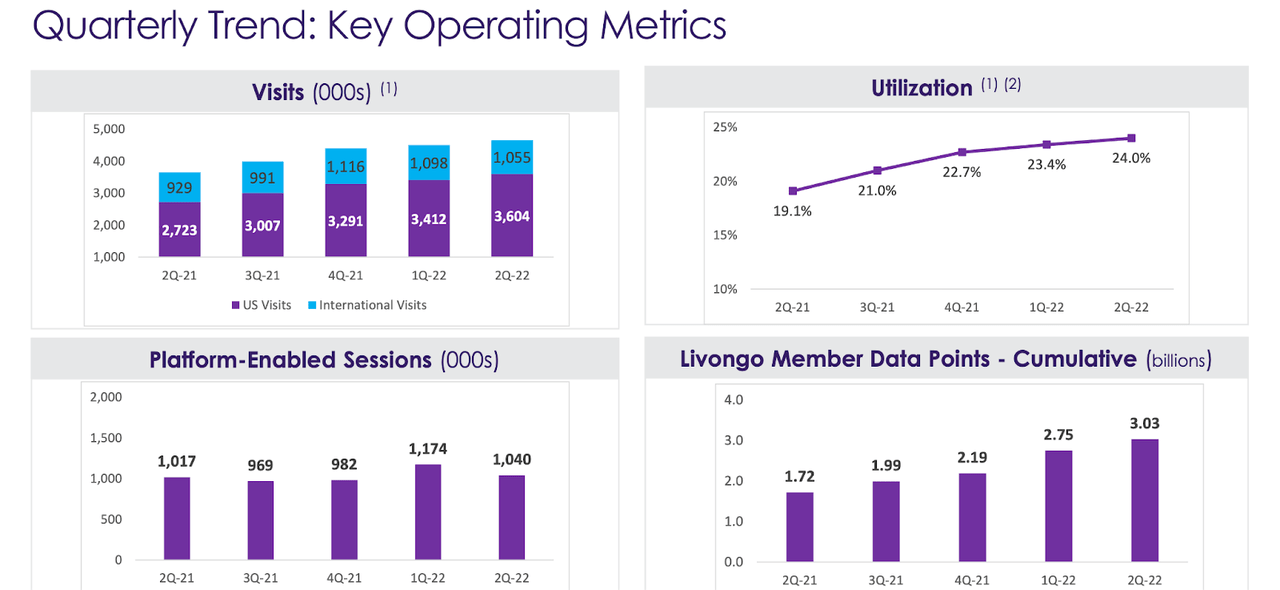

Even after the pandemic, TDOC continues to grow its utilization rate (defined as visits divided by total members). That said, the 24% utilization rate remains quite low when one factors in that there may be multiple visits from the same patients.

2022 Q2 Presentation

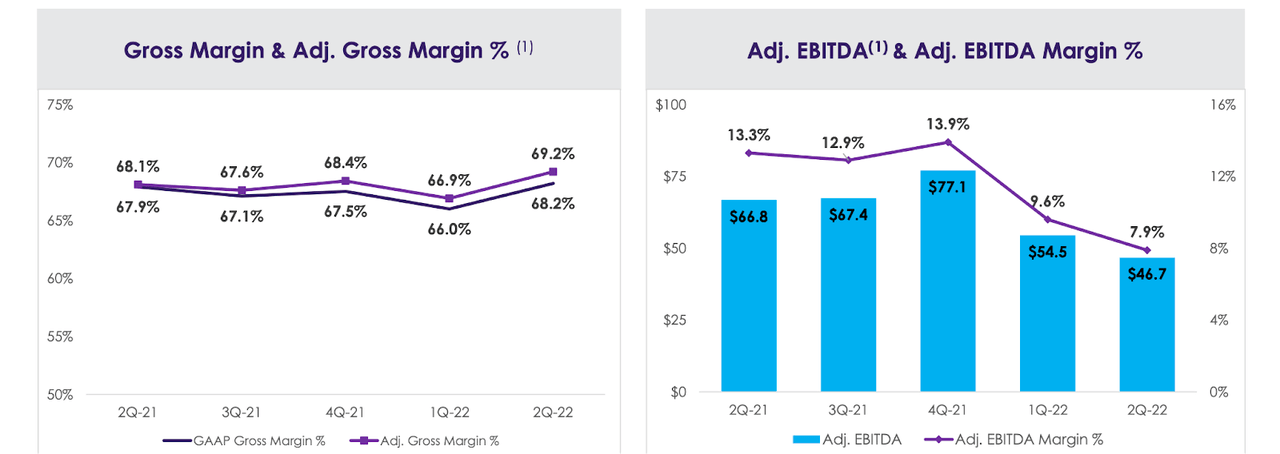

TDOC generated a 68.2% gross margin and 7.9% adjusted EBITDA margin.

2022 Q2 Presentation

Cost of revenues includes the fees paid to the physicians in the network. You can think of the business model as follows – TDOC earns $2 for every $1 paid to match physicians with patients. Adjusted EBITDA did add back $51 million of equity-based compensation in the quarter, so GAAP net income remained negative.

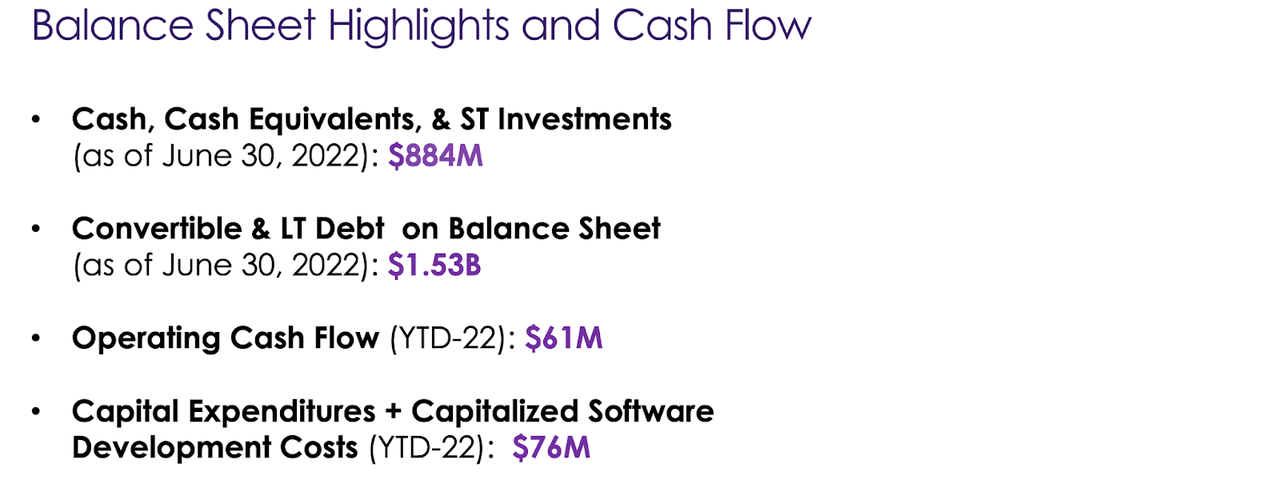

TDOC ended the quarter with $884 million of cash versus $1.53 billion of debt. The net debt position is not too concerning due to TDOC generating positive cash from operations.

2022 Q2 Presentation

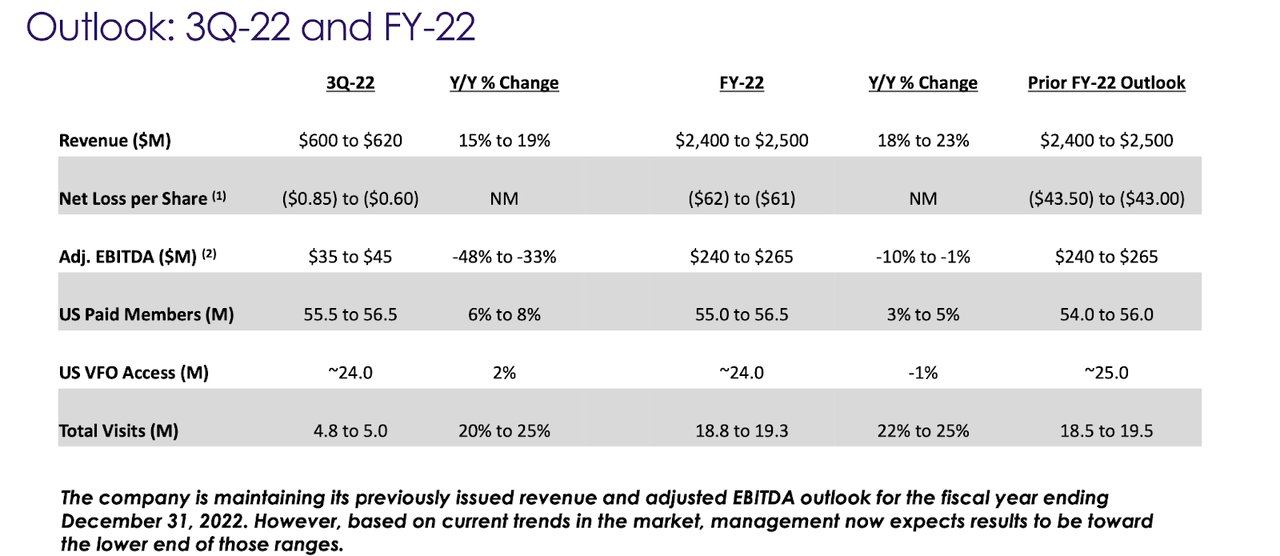

Looking ahead, TDOC once again reduced guidance and now expects revenue growth to fall between 18% to 23%. The fact that adjusted EBITDA is also expected to decline is troubling, as it may imply that the company is only able to maintain growth by increasing advertising spend.

2022 Q2 Presentation

Is TDOC Stock A Buy, Sell, or Hold?

By now, investors have come to terms with the disappointing growth outlook. On the conference call, management reiterated that they are not giving a multiyear outlook anymore.

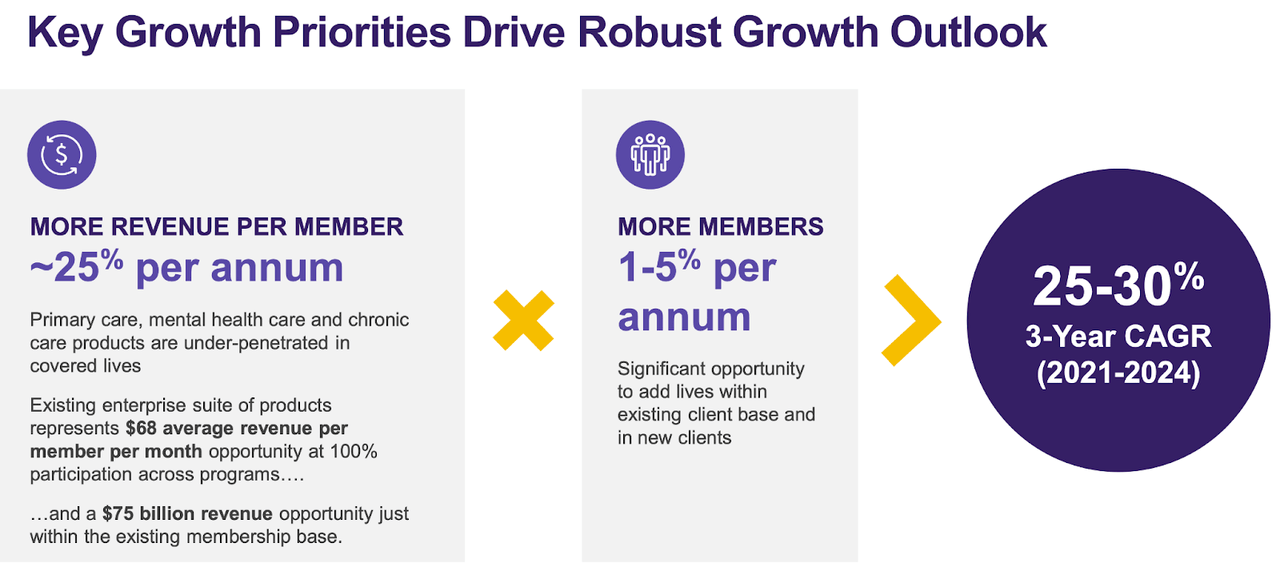

Recall that TDOC had previously guided for at least 25% compounded revenue growth through 2024 based on 1-5% member growth and 25% average revenue per member growth.

2021 Q4 Presentation

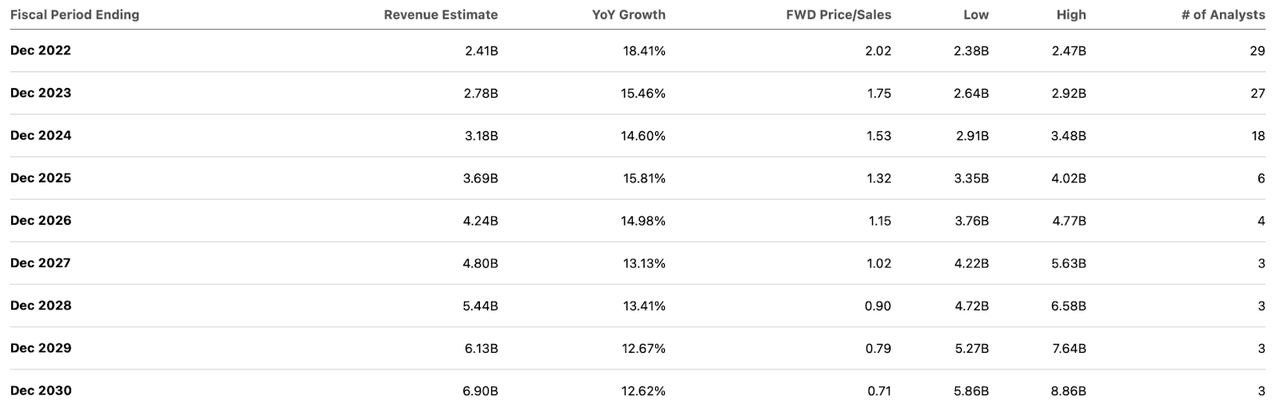

That guidance was likely a key driver in previous multiples and fading confidence in that guidance – not to mention the official removal of the guidance – has removed any semblance of support from the stock. Yet as of recent prices, the stock is now trading at 2x sales. Consensus estimates call for double-digit topline growth over the next decade.

Seeking Alpha

It doesn’t make sense for the stock to go back to all time highs based on the new growth outlook, as 20x sales versus 15% topline growth would be an egregious multiple even based on pre-crash valuations. But the current stock price is pricing in too much pessimism. I can see the company eventually sustaining 30% net margins over the long term. But let’s instead assume 15% net margins. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), I estimate a fair value of around 3.5x sales, implying a stock price of $60 per share of roughly 100% upside over the next 12 months.

What are the key risks? I have already mentioned the possibility that growth is being driven solely by increasing marketing and advertising expenses. A crucial element of the bullish thesis is the secular trend toward virtual healthcare. On paper, that thesis seems to make sense – many doctor visits might not require in-person contact and mainly revolve around answering patient questions. But it is possible that the general population does not care so much about their wellbeing in the first place. If that is true, then virtual healthcare may not benefit from the same secular growth drivers as that of e-commerce. Another risk is that of leverage. If cash flow generation turns negative, then TDOC may suddenly become a solvency risk as a combination of higher interest rates and cash burn would place a high toll on the balance sheet. There is also the risk of competition. While TDOC has the largest network, it is possible that regional healthcare systems could set up their own competitive products – it is unclear if having a national presence really gives TDOC an advantage over smaller operators. After all, if regional healthcare systems are able to adequately serve their local communities, then wouldn’t their virtual healthcare offerings theoretically be enough to serve those same communities as well?

TDOC stock remains a high risk pick, though as discussed with subscribers of Best of Breed Growth Stocks, I am of the view that a diversified basket of beaten-down growth stocks can provide strong long term returns from here. I rate TDOC a buy on account of the attractive risk-reward proposition.

Be the first to comment