ozdigital/iStock via Getty Images

Introduction

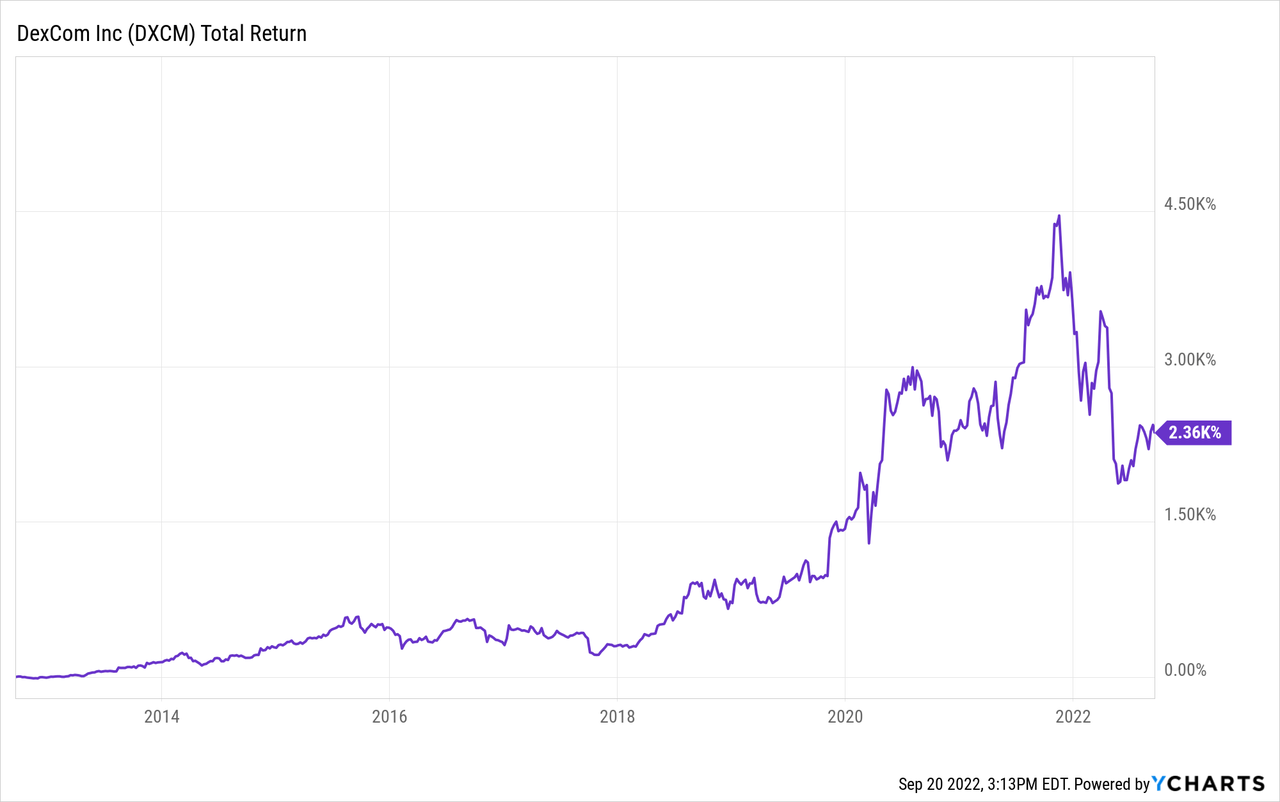

DexCom (NASDAQ:DXCM) has risen sharply in recent years until the beginning of this year. The stock has entered a bear market. This is probably mainly due to the Fed’s strict policy to contain inflation. Interest rates are rising sharply, correcting the prices of expensive growth stocks. DexCom is also a growth stock whose share price has declined.

DexCom is growing strongly, developing and introducing top products to the market, but the stock is still highly valued. Due to current Fed policy, I have put DexCom on hold. Fundamentally, the company is strong, but the share price is highly dependent on the policy of the FED in my opinion. I only buy growth stocks like DexCom when the FED has a dovish policy, when interest rates stabilize or fall. I think the stock is a hold.

Company Overview

DexCom specializes in the development of continuous glucose monitoring (CGM) systems. These systems are often used by diabetic patients. It offers four products:

- DexCom G6, an integrated CGM system

- DexCom Real-time API, for the integration of real-time CGM data into digital health applications and devices

- DexCom ONE, to replace fingerstick blood glucose testing

- DexCom Share, a remote monitoring system.

DexCom has a collaboration partner with Verily, part of Alphabet (GOOGL)(GOOG). There are currently several CGM systems on the market, such as Abbott Freestyle Libre (ABT). Both are FDA-approved CGM systems. According to reviews, the DexCom G6 is more accurate, easier to use and has several advantages than the Freestyle Libre.

The insulin pump delivers the required amount of insulin throughout the day. The Omnipod, made by Insulet (PODD), is an insulin pump and continues to be the market leader in tubeless insulin delivery devices. The Omnipod must work with a CGM such as the DexCom G6.

Quarterly Results Were Strong

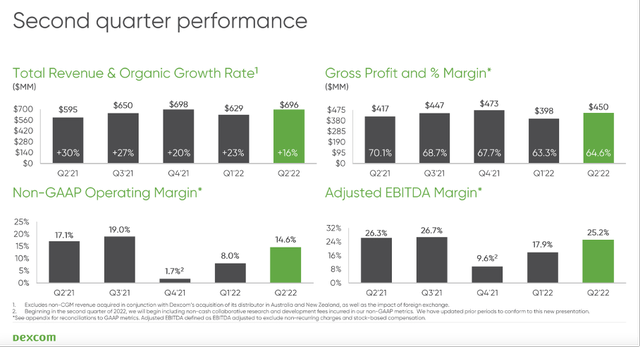

Second quarter revenue grew 16% year over year. Gross profit increased 8% to $450 million, but gross margin declined from 70% to 65%. Gross margin declined as new DexCom G7 production increased. In the long run, DexCom will benefit from this. The new DexCom G7 is an upgrade of the DexCom G6 and is easier to use, has a longer battery life and is cheaper to manufacture.

Second quarter performance (2Q22 Investor presentation)

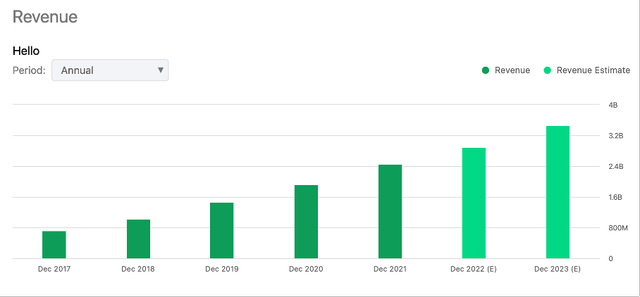

DexCom’s revenue grew strongly. From 2017 to 2021, sales grew by an average of 36% per year. 15 analysts expect sales to grow 18% year-on-year in 2022 and 20% in 2023, so a slowdown in growth is expected.

DXCM’s Revenue (SA Ticker Page)

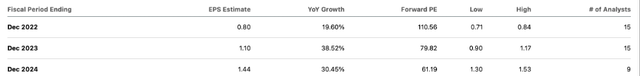

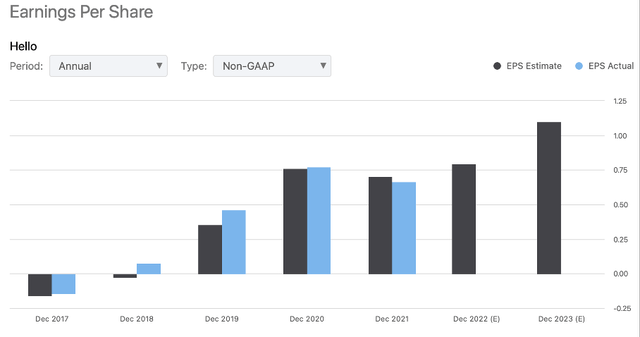

Earnings per share also grew strongly but stagnated in 2021. Analysts predict that earnings per share will grow strongly in the coming years.

DexCom has brought top products to the market for diabetes patients, they now have insight in their glucose levels in real time and inject dosed insulin. The strong increase in revenue shows that there is a lot of demand for the products. I also expect more and more diabetic patients will use DexCom’s CGM products.

Valuation Metrics Tells Us The Stock Is Expensive

Growth stocks such as Dexcom are often highly valued in the market. Some with a price to sales of up to 50. Others are valued less dearly. DexCom’s price to sales is 12.8, but price to sales says nothing about valuation because companies’ profit margins are different. DexCom generates solid gross margins of a whopping 66%.

DXCM’s EPS Estimates (SA Ticker Page)

Earnings per share estimates are positive, with many analysts forecasting 30+% growth in earnings per share in the coming years. However, the forward PE is expensive, the forward PE for December 2024 is 61, an earnings yield of only 1.6%. However, the PE ratio provides an insight into the current valuation. It remains to be seen whether EPS will indeed grow that fast.

An example is Meta Platforms (META); in 2017 Meta, then known as Facebook, was trading at a PE ratio of about 40, and currently, in 2022, the PE ratio is 12. The share return is nil. Investing in companies with a high PE ratio carries risks when growth stagnates, and this risk is also highly noticeable for DexCom. The company makes top-of-the-line products, but the stock valuation is expensive. And with the current policy of the Fed, investors are moving from risky stocks to safe dividend stocks. This shift is reflected in DexCom’s stock price. The stock is a buy if the Fed comes with a dovish policy, but for now I’ll keep the stock on hold.

Conclusion

DexCom develops and markets continuous glucose monitoring (CGM) systems for diabetes patients. DexCom offers added value because diabetes patients do not have to prick their fingers to check their insulin levels but can view their glucose values in real time. DexCom has marketed top products for diabetes patients. The company is growing strongly, with second-quarter revenue growing 16% year-on-year. Gross margin declined slightly, but this is due to the production expansion of their state-of-the-art DexCom G7. The new G7 is the successor to the DexCom G6 and offers simpler functionalities and a longer battery life. It is also cheaper to manufacture. Analysts expect revenue growth of 20% for 2023, but revenue growth is expected to stagnate. DexCom’s shares belong to the growth stock category. Earnings per share are expected to grow strongly, but the forward PE ratio remains high. Several analysts expect earnings per share of $1.44 for 2024, which equates to a future PE ratio of 61. The stock is valued at this price level well into the future, so I think it is expensively valued. With the Fed pursuing a hawkish policy and interest rates expected to rise further, investors tend to buy safe dividend stocks and avoid growth stocks. I therefore do not expect an increase in the share price. However, the company makes top products, and I would like to see the stock in my portfolio. I will wait until the stock price is attractive, and I think the stock is a hold at this time.

Be the first to comment