MJ_Prototype

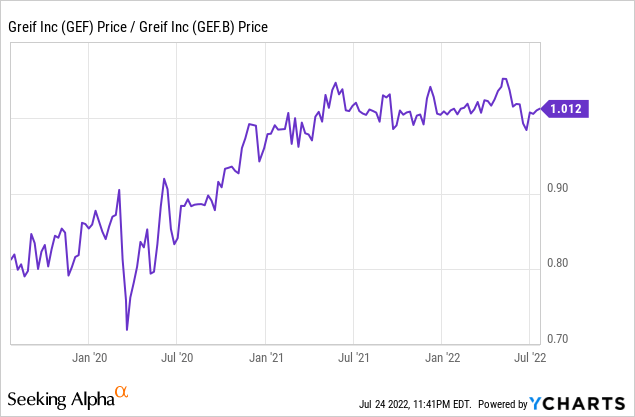

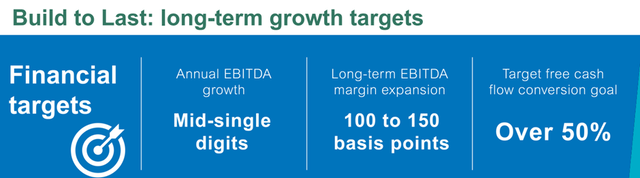

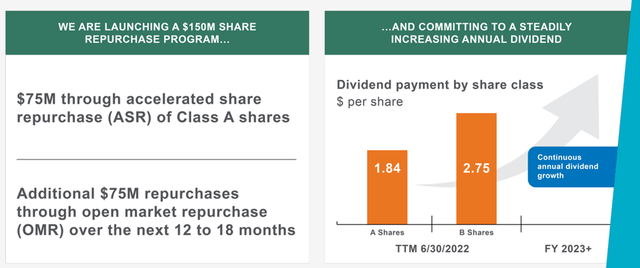

Industrial packaging leader Greif (NYSE:GEF) has outlined its new “Build to Last” strategic plan aimed at unlocking more P&L gains over the mid to long-term. Of note, GEF now sees an annual mid-single-digit EBITDA growth target, helped by a 50-100bps margin improvement target and an additional 50-100bps of upside from M&A. As a result, FCF conversion is set to sustain at an impressive >50%, supporting favorable capital deployment opportunities such as the latest ~$150m buyback program. GEF’s capital structure offers an additional opportunity via the B share (NYSE:GEF.B)/A share spread as well – the A share premium has reached new highs this year, likely helped by liquidations and the recently announced buyback, despite the B shares offering voting power and a higher dividend payout. Thus, I would favor gaining long-term exposure via the B shares or, alternatively, via a pair trade with the A shares as the funding leg, given the significant positive carry.

Strong Mid-Term P&L Targets Highlight the Underlying Resilience

The new “Build to Last” strategy unveiled by GEF at this year’s investor day should give investors a lot of confidence in the outlook. In sum, the new operating system will leverage profit improvement initiatives and accretive reinvestments across the company’s segments to drive through-cycle EBITDA growth. Given GEF’s near-term performance, I am inclined to underwrite this outlook – thus far, its efficient contract mechanisms and value-based pricing actions have protected margins against the ongoing inflationary pressures (unlike many of its peers). GEF’s paper & packaging segment, for instance, has successfully taken pricing in recycled paperboard (uncoated and coated) while maintaining a robust backlog over the last year or so.

GEF’s key mid-term financial targets are as follows – mid-single-digit EBITDA growth (including 50-100 bps from M&A), 50-100bps of margin improvement, and >50% FCF conversion. Assuming a cyclical rebound in 2023, I suspect these numbers could even prove conservative, particularly given the range of secular tailwinds at play. With population growth on the rise, sustainability increasingly emerging as a key theme, and an increased emphasis on food safety, GEF’s long-term growth runway could surprise many, in my view. Beyond the macro, GEF’s industry-leading customer service and quality have also begun to pay off, allowing it to gain share in key geographies, while the M&A pipeline (currently at >$300m in combined EBITDA) presents incremental upside as well.

Strong Balance Sheet Supports Well-Balanced Capital Deployment Strategy

GEF’s capital allocation priorities reflect its improved balance sheet – to sum up, adjusted net debt is now at ~$2bn, while the leverage ratio is well within the 2.0-2.5x target range at ~2.1x (down one turn YoY). Hence, the latest ~$150m share buyback program is well-funded. Of the total authorization, ~$75m will be allocated to the accelerated repurchase of class A shares while the remaining ~$75m will go toward open market repurchases over the next twelve to eighteen months. The capital return is set to be boosted by a steadily increasing dividend as well.

Still, there remains ample room for other capital allocation priorities, including organic growth opportunities to enhance margins and optimize the supply chain. M&A is also on the table, with management remaining active in screening potential deals and building out the pipeline further. There aren’t any major acquisitions planned, but bolt-on acquisitions aimed at extending the core business lines and products (e.g., core industrial drum operations) could still extend the growth runway from here. GEF is also sticking to its core competencies of industrial packaging, so any execution risk is likely limited as well (vs. expanding into adjacent markets). Plus, GEF has built a reputation as a disciplined acquirer, so any future deals will likely be accretive and come at a reasonable valuation relative to the 12-15% ROIC target (both organic and M&A investment).

Already Pricing in a Recession Scenario

Given the current volatility, GEF also opted to be conservative by embedding two potential recession scenarios in its numbers. At first glance, it looks like management has built in quite a buffer, and even in a major slowdown, GEF’s balance sheet and FCF should hold up well. In the meantime, the FCF generation will be helped by a cyclical rebound this year as incremental earnings flow through the P&L and lower interest expense, as well as working capital, become less of a drag on financials. Admittedly, GEF has a more cyclically oriented portfolio, so if the global economy slows, the company almost certainly will see some impact. Yet, the inexpensive valuation more than accounts for a worst-case scenario. Using the latest close and the midpoint of GEF’s recession scenario, for instance, implies a ~8x EBITDA multiple and a compelling ~9% FCF yield.

|

USD’m |

|

|

Enterprise Value @ 22nd July 2022 |

5,260 |

|

Midpoint Recession EBITDA |

650 |

|

Implied Multiple |

8.1x |

|

Equity Value @ 22nd July 2022 |

3,310 |

|

Midpoint Recession FCF |

290 |

|

Implied FCF Yield |

8.8% |

Source: Market Data, Author, Greif Projections

Compelling Long-Term Growth Story at a Discount

With pricing power holding up through the inflationary headwinds and industrial demand fundamentals supporting volume growth across its industrial packaging and paper & packaging businesses, GEF looks well-positioned to ride out the worst of the macro downturn. In addition, the pristine balance sheet adds buffer – the company’s leverage remains well within the targeted 2.0-2.5x range, while the strong through-cycle FCF generation will likely drive meaningful capital returns going forward. With the A-share premium at new highs, I would favor going long via the B shares, which not only offer higher dividends but also voting power. Alternatively, investors may consider a pair trade with the A-share as the funding leg, given it allows for significantly positive carry for the long/short position.

Be the first to comment