the_guitar_mann

From the 18th of July until the 22nd of July, the Farnborough Airshow is taking place. The airshow is used as a stage for aerospace companies to announce new orders, products and services and discuss the state of the industry. Traditionally, this has been one of the three big stages where Boeing (NYSE:BA), Airbus (OTCPK:EADSF) (OTCPK:EADSY) and Embraer (ERJ) disclose orders.

In this report, I provide a wrap up of the airshow, uniquely providing dollar value amounts for the order announcements and I briefly discuss the highlights for each manufacturer. Before I do so, it is important to understand how we have structured and categorized.

Explaining the The Aerospace Forum Airshow Order Tracker

In our overviews, we differentiate between firm agreements and tentative agreements clustered in Letters of Intent and Memoranda of Understanding (LoI/MoU). The firm agreements are subsequently split into orders, firmed commitments and options exercised. Firmed commitments are LoI/MoUs that were previously announced and are now firmed while options exercised are option portions of previous announcements being exercised. Firm agreements can also include options, which do not add to the backlog and customer reveals. Conversions under firm agreements, which are orders for one type of aircraft being switched to the other, are accounted for on unit basis even though the unit basis tends to be neutral and a dollar value differential is accounted for to account for the value difference between the converted aircraft. For customer reveals, we do provide value estimates on the reveal itself, but as these are not adding to the order book and only identify a customer in our final overview, we tend to omit customer reveals.

The LoI/MoUs consist of orders which will only add to the backlog when firmed and the same holds for the tentative options that customers agree on. Tentative options are more of a remote opportunity for jet makers and they are often there for customers to have options as part of a purchase agreement when the tentative agreement is formalized.

Our overviews might differ from those you can find elsewhere, because of the way we account for certain items especially conversions. Overall, in the end, the options whether it is under firm agreement or tentative are least interesting. The firm orders (orders, commitments firmed and options exercised) are interesting as they provide fresh order inflow to the backlog while conversions are interesting due to their non-neutral dollar value nature while the tentative orders are important to eyeball because they give you some insights on the sales pipeline for the manufacturers. Combined, the units and dollar value tell investors something about the jet maker’s ability to win business and potential business, which also feathers into the production plans and as a result is of importance for shareholders as higher production means higher deliveries which is when the revenues and profits is recognized and over a course of a period prior to delivery the cash flow starts.

Boeing Gains MAX Momentum

For Boeing, this airshow was really about creating momentum for the Boeing 737 MAX and more particularly for the Boeing 737 MAX 10. In a previous report, I discussed in detail why Boeing is eager to gain orders for the MAX 10 at this stage. I will not rehash the entire report, but plain and simple Boeing is trying to get a solid MAX 10 customer footprint especially in the US to force Congress to provide a waiver on Aircraft Certification Reform and Accountability Act passed by Congress in 2020 for the MAX 10. Absent of the waiver, the MAX 10 development timeline would likely slide further, costs would increase further and market appeal would fall.

Boeing 737 MAX 10 Delta Air Lines (Delta Air Lines)

So, Boeing had been looking for a customer for the MAX 10 in the US and for a while it was already clear that customer should be Delta Air Lines (DAL) for various reasons that also include the competitive space, but Delta Air Lines also is very outspoken about aircraft when it is in their interests to do so. With Delta Air Lines as a customer for the MAX 10, Boeing would also gain a big supporter that would defend and explain its case to Congress. So, unsurprisingly Boeing and Delta Air Lines announced an order for 100 Boeing 737 MAX 10 jets with options for 30 more. Additionally, the companies agreed on an order for Boeing Global Services to reconfigure the cabins of 29 Boeing 737-900ERs and extremely important for Delta was that it will become a service provider for the CFM LEAP 1B turbofans used on the Boeing 737 MAX.

The other big new customer for the Boeing 737 MAX 10 was Qatar Airways. At the start of the airshow, CEO of Qatar Airways Akbar Al Baker said that a tentative agreement for the aircraft had lapsed, but at the final day of the show, the airline placed a firm order for 25 Boeing 737 MAX 10. It added to the momentum to which 777 Partners also contributed with a firm order for 30 Boeing 737 MAX 200 jets and options for 36 MAX 8 and MAX 200 models.

Boeing 777-8F Cargolux (Boeing)

At some point during the airshow, I noted that dedicated freighter sales and passenger wide body sales had largely remained absent. Boeing did get orders for the Boeing 767-300BCF and Boeing 737-800BCF underlining the importance of its converted freighter products. When it comes to passenger wide bodies, it was a relatively slow show with tentative orders for 4 Boeing 787-8s from Azerbaijan Airlines and 5 orders from AerCap (AER) for the Boeing 787-9, but those orders point at some improvement in the situation and attractiveness for the Boeing 787 family. Furthermore, Cargolux expressed its preference for the Boeing 777-8F to replace its fleet of Boeing 747-400 freighters but numbers were not disclosed. Before the airshow it seemed like there was a possibility that Boeing would launch a Boeing 777-300ER conversion program, which I analyzed and from product and market perspective I conclude such a conversion program would make sense. A program launch was, however, not announced and maybe as Boeing makes a case for the MAX 10 to be granted a waiver a launch of a new product would not be ideal and would be better suited for the Paris Airshow or Dubai Airshow next year.

Below an overview of the Boeing announcements with a value of $16.3 billion can be found:

Firm orders and options:

- Delta Air Lines ordered 100 Boeing 737 MAX 100 aircraft with options for 30 more.

- All Nippon Airways converted orders for 2 Boeing 777-9s to orders for the Boeing 777-8F and has options for 10 Boeing 737 MAX 8 aircraft.

- Aircompany Armenia ordered 3 Boeing 737-800BCFs.

- 777 Partners ordered 30 Boeing 737 MAX 200 aircraft and holds options for another 36 MAX 8 or MAX 200 aircraft.

- AerCap ordered 5 Boeing 787-9s.

- BBAM Limited Partnership ordered 9 Boeing 737-800BCFs.

- Qatar Airways placed an order for 25 Boeing 737 MAX 10 aircraft.

- Saltchuk Aviation ordered 3 Boeing 767-300BCFs and has option for an additional aircraft of the same type.

Tentative orders and options:

- Azerbaijan Airlines committed to ordering 4 Boeing 787-8 aircraft.

Customer reveals:

- All Nippon Airways was identified as the customer for 20 Boeing 737 MAX 8 aircraft.

- Aviation Capital Group was identified as the customer for 12 Boeing 737 MAX 8 aircraft.

Airbus: A Slow Show

Airbus A321neo LATAM (Airbus)

Airbus had a rather slow show and that might be a bit surprising given that Airbus usually is the company that uses airshows to create a huge PR spectacle. Perhaps, with leadership changes that mindset has changed. Nevertheless, I believe that Airbus had an underwhelming airshow. The company saw airlines exercising options, Delta Air Lines exercised options for 12 Airbus A220-300s while easyJet (OTCQX:EJTTF) (OTCQX:ESYJY) exercised options for 56 Airbus A320neo. easyJet already signaled intention to firm the options prior to the airshow, but still required shareholder approval. Furthermore, the European jet maker received orders for 17 Airbus A321neo, expressed interest in the Airbus A321XLR and sold 4 helicopters. The underwhelming order inflow for Airbus might be related to a set of orders from operators in India that could have been finalized during the airshow were in fact not finalized.

Below an overview of the Boeing announcements with a value of $4.5 billion can be found:

Firm orders and options:

- Delta Air Lines exercised options for 12 Airbus A220-300s.

- easyJet ordered 56 Airbus A320neo aircraft and converted orders for 18 Airbus A320neos to orders for 18 Airbus A321neos.

- LATAM Airlines Group ordered 17 Airbus A321neo aircraft.

- London Air Ambulance Charity ordered 2 H135 helicopters.

- The Ministry of Interior of Rhineland-Palatinate ordered 2 H145 helicopters.

Embraer and Eve: Diversified Orders

Brazilian Embraer did not have an extremely fast airshow either, but after the reintegration of its commercial airplanes segment recently, it was also not expected that the airline would stun the world with major order inflow. Nevertheless, there were meaningful orders and the jet maker released its forecast for the coming 20 years anticipating demand for 10,950 aircraft with up to 150 seats. Turboprops will account for 20% of the orders and 80% will be covered by jets. The Brazilian jet maker also announced that to date it has accumulated Letters of Intent for 250+ next generation turboprop aircraft if the aircraft program is officially launched.

Furthermore, the spin off of Embraer X, Eve Air Mobility Systems, announced a tentative agreement for eVTOL systems with intended deployment in the defense market.

Below an overview of the Embraer and Eve Air Mobility Systems announcements with a value of $1.8 billion can be found:

Firm orders and options:

- Porter Airlines ordered 20 Embraer E195-E2s aircraft.

- Alaska Airlines orders 8 Embraer E175s with options for 21 more.

Tentative agreement and options:

- BAE Systems placed a tentative order for 150 eVTOLs intended for the defense market.

ATR Aircraft: Tiny Turboprop Maker Collects Orders

ATR Aircraft had quite a decent airshow announcing orders and commitments for its product line underlining its dominance in the turboprop market. Going forward that market is going to be interesting as Embraer aims to bring a turboprop to the market as well and ATR estimates market demand for turboprops to be 2,450 units in the coming 20 years.

Below an overview of the ATR Aircraft announcements with a value of $1.2 billion can be found:

Firm orders and options:

- Oriental Air Bridge placed an order for 1 ATR 42-600.

- Lessor Abelo placed a firm up an order for 10 ATR 42-600S aircraft.

- Afrijet ordered 1 ATR 72-600

Tentative agreement and options:

- Feel Air Holdings signed for 36 ATR 42-600/ATR 72-600s.

- Lessor Abelo signed for 10 ATR 42-700s.

Conclusion

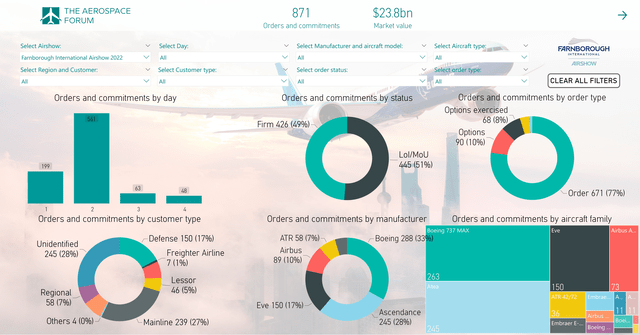

Overview TAF Airshow Order Tracker Farnborough International Airshow 2022 (The Aerospace Forum)

In total, there were announcements covering 871 aircraft. The figure above is a still from our interactive monitor (TAF Airshow Order Tracker) which convenient lets you slice the numbers. However, the interactive nature is lost when we turn those into images, so we also use a set of tables to visualize the results. Overall, we see that the announcements were mainly concentrated in the first two days of the airshow. Day two seemingly was the best day, but not really for the traditional jet makers as Day 2 announcements covered nearly 400 eVTOL tentative agreements. Furthermore, we see that the agreement types were split 50:50 between firm and tentative agreements and almost 77% were either tentative orders or firm order. The Boeing 737 MAX had most momentum during the show followed by the eVTOLs followed by the Airbus A320neo family.

So, in total, there were announcements for 871 aircraft and, contrary to many other platforms, we also included eVTOLs, that is a market reality. Not all eVTOL orders will turn into deliveries but we should consider them nonetheless. Boeing had a share of 33% in the announcements, followed by Ascendance (eVTOL) with 28% and Eve Air Mobility with 17%. Airbus accounted for 10% and Embraer and ATR made up for the remaining 12%. So, measured by units, Boeing was the clear winner.

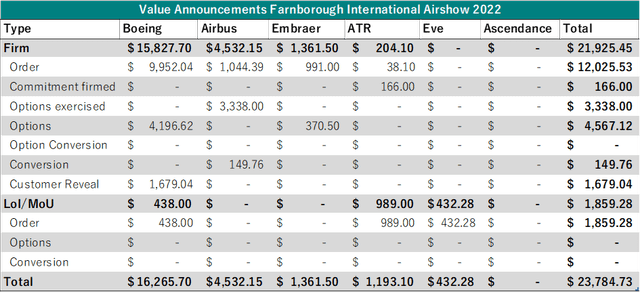

Value announcements Farnborough International Airshow 2022 (The Aerospace Forum)

Also when measuring by value Boeing was the winner accounting for 68% of the value, followed by Airbus with nearly 19%, while Embraer and ATR accounted for about 10% of the value. The remainder goes to Eve Air Mobility, where it should be noted that we have not been able to assign any value to Ascendance as the sales price of their eVTOL is not known.

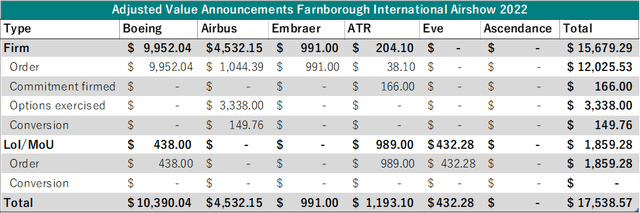

Now, also exclude parts of the value and these are the customer reveals since they do not add anything to the order book but only identify a customer and we remove options both for the firm agreements as well as tentative agreements. That way we are left with actual orders and value provide from conversions and tentative agreements which can be seen as the sales pipeline that the original equipment manufacturers disclosed.

Adjusted value announcements Farnborough International Airshow 2022 (The Aerospace Forum)

When doing so, the totals drop from $23.8 billion to $17.5 billion and Boeing’s share goes to 60%, Airbus’s share goes to 25% and the remaining 15% goes to Embraer, ATR and Eve Air Mobility. What remains is that Boeing can be seen as the winner of the airshow with $10.39 billion in orders and commitments while Airbus “only” announced $4.5 billion worth of business.

Boeing started the airshow with 186 net orders while Airbus had 259 net orders. So, Boeing would need 73 orders more than Airbus to take the lead in the annual order battle. Were they able to do so? Yes. Boeing booked 175 orders while Airbus booked 89 orders creating a 86 unit delta for Boeing, which is 13 units more than what Boeing needed to take the lead. Will Airbus care? Unlikely, because in July the company booked a major order from Chinese customers for 292 aircraft. If these will be included in the July numbers, it is unlikely that Boeing will be ahead in the annual order battle. So, Boeing has won the order battle of the airshow but it is unlikely to be enough to get ahead of Airbus in annual order battle. For Boeing it holds that they have booked the wins they wanted in support of the Boeing 737 MAX 10 and they will be more than happy with that.

Be the first to comment