South_agency

Published on the Value Lab 11/10/22

LivaNova (NASDAQ:LIVN) is a company we cover from time to time. Let’s update our models with a substantially declined price and comment on the previous quarter’s developments, outlining the key points we’ll be following for in the next quarter as it relates to the LIVN thesis, which remains much the same around the optionality provided by neuromodulation with multiple large trials running and in particular difficult-to-treat depression, a very large market. We find that LIVN is very undervalued.

Salient Q2 Points

Let’s have a look at some of the key data from Q2 starting with revenue.

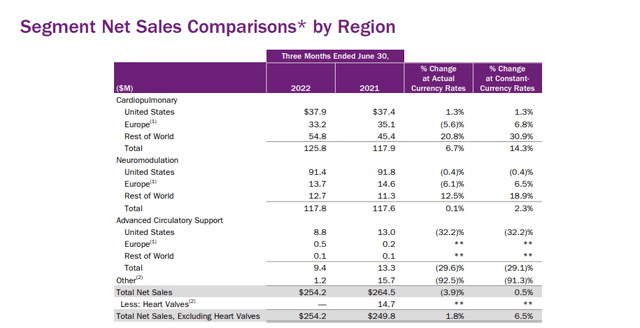

The revenue picture is pretty easy to account for:

- Cardiopulmonary is benefiting from a return to normal in diagnosis and procedure rates as the West gets over mortal concerns around COVID-19. The markets here are secular as the heart-lung machines that they sell are used in major and secularly growing treatment areas. The revenue growth is well supported, and has overcome pressure from FX, as this segment has more than 50% of revenue in markets outside the US.

- Neuromodulation was beginning to see some volume growth deceleration, where the only real product here is the epilepsy VNS product. Replacement procedures are apparently keeping revenue up, but no new spurt has come. Also FX effects with a strengthened dollar have taken their toll, but US exposure is over 85% of revenue here. The key issues to discuss in neuromodulation come later with the profit picture.

- ACS is really struggling in revenue because severe COVID-19 cases are on the down. This is a surged market that is falling back entirely and likely permanently.

Where things get more complicated is with profit.

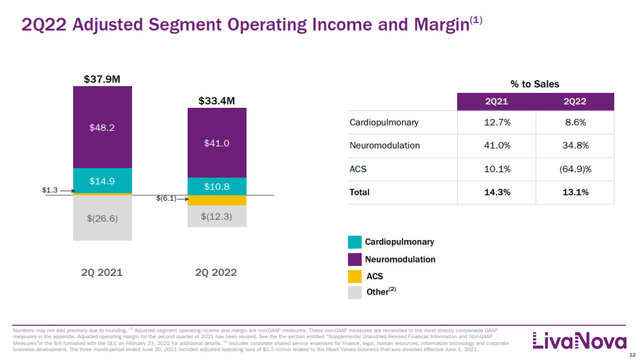

Operating Income (Q2 2022 Pres)

Profits are in general decline except for within corporate. The reason here is that some one-off legal costs are declining very meaningfully relative to last year. There may be new legal costs related to the Milan ruling but that’s currently not easily quantifiable except for the possibility of $519 million in maximum damages based on the claim. We use that in the EV for our valuation of LIVN to be conservative – it is being fully and maximally accounted for in valuation.

Going back to segment declines, they are in part due to issues with procurement, troubles with supply chain and higher freight costs. Freight is apparently the most of the pressures especially in cardiopulmonary which is a more global business, but in neuromodulation there is also the issue of higher clinical trial costs as LIVN onboards more patents on the trials to try get a signal in the data for it to move its trials into insurable and approved products.

Remarks

We calculate that EBIT can more than quadruple if all the neuromodulation trials work out and reasonable levels of penetration into the prevalent treatment areas is managed. So what stage are we at with each?

- RECOVER: They have implanted the 325th patient and have also received confirmation that the study should continue to recruit more patients up to 375 for the RCT study for the DTD implant. They will also begin a bipolar depression arm, which is a whole other treatment indication in effect. Apparently a growing chunk of the cohort in the unipolar study is passing the 6-month mark, which is when differences between the control and the test group should start appearing. Once that difference become statistically robust, the RCT that is currently being recruited for can stop and future patients who want the implant will be able to join an open label study so that they can also receive the treatment. Once every patient enrolled in that initial phase after it was closed have been observed for the full 12-month period, a final analysis and peer-reviewed article is going to be submitted to the CMS in hopes that the DTD implant becomes an insurable product. At that point we hope to have a successful commercial venture. LIVN expects the RCT to be able to close by the end of the year, which means a year thereafter is when we will see the submission to the CMS happen.

- ANTHEM: In the Q4, the trial expects to enroll its 500th patient. After that if all conditions are met, functional data can be submitted to the FDA. In a similar manner, this is being studied using interim analyses of patients, first 300, then 400 and now 500, on a periodic basis. The study has been approved by the FDA, so once the patients have been fully observed for the success of the implant in regulating hearts using VNS, there is the possibility of a final approval and commercialisation.

- OSPREY: The VNS product for sleep apnea is recruiting patients for the trial. The trial needs to be approved first, at which point it will begin into a similar stage to where ANTHEM is.

While the ANTHEM and OSPREY trials could produce very successful products that would change the company profile, let’s focus just on DTD which is the largest in terms of prevalence and by far the closest to becoming commercialised, since it has been approved since a decade ago.

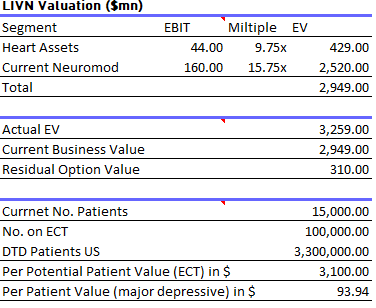

With the declines in the stock price, and even with discounting all fair multiples for the various businesses by 25%, we get the following valuation. We have annualised the EBIT figures.

Valuation (VTS)

The implied per patient value assuming the only relevant market is people on electroshock therapy for their DTD is $3.1k. That’s really not a lot considering this an implant and the price of electroshock therapy, which costs on average $15k a year. If more people would be open to the implant it comes down to $100 per patient in value.

Overall, the decline in the LIVN stock renders the opportunity from DTD very undervalued. With the other trials underway as well, the implied multiple on LIVN is far lower than 7x EV/EBIT on that future potential income, assuming somewhat generous penetration and prevalence. But the DTD situation is enough to make the company pretty undervalued, even also considering the potential liability from the Milan lawsuit.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment