BING-JHEN HONG

There is no shortage of bad news in the semiconductor sector (SOX) (SOXX). Micron Technology, Inc. (MU) has just gone from bad to worse, where EPS will be literally non-existent in the current quarter and management is cutting Capex by over 30% (analysis here). NVIDIA Corporation (NVDA) is dealing with a GPU glut and its newly released RTX 40 series will probably not do very well (here). Advanced Micro Devices, Inc.’s (AMD) revenue outlook for 3Q22 will be $1 billion short of expectations as PC-related revenue falls by 40% YoY (here). Last but not least, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) (“TSMC”) just said it would also reduce its 2022 Capex from $40-$44 billion to $36 billion given softer end-market demand, despite just reporting a stellar quarter.

Let’s go through the TSMC’s 3Q22 results and future outlook.

Taiwan Semiconductor 3Q22 Overview

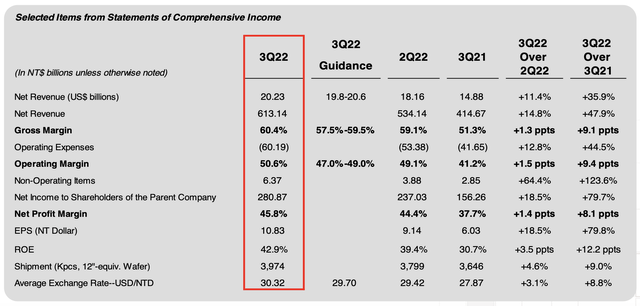

As expected, TSMC reported another strong quarter where revenue grew 36% YoY to $20.23 billion (in line with guidance). Gross margin of 60.4% came in above management’s expectation of 58.5% at the midpoint, thanks to a strong dollar, which contributed a 80bp upside vs. guidance. Operating margin of 50.6% and net margin of 45.8% were both above expectations. Finally, EPS of $1.79 also beat estimates by $0.11.

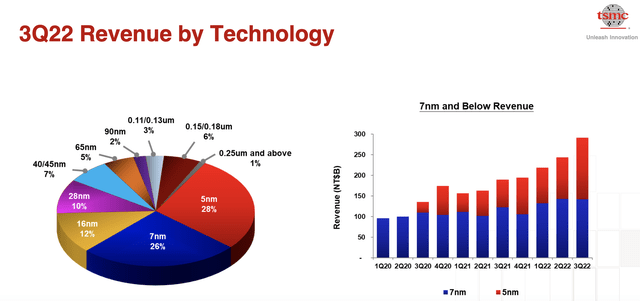

The biggest revenue contributors were again TSMC’s leading-edge technologies, namely N7 and N5, which both accounted for 54% of total revenue. The problem, however, is that N7/N6 are currently experiencing some demand headwinds due to a softer end-market, especially in smartphones and PCs.

As a result, management is taking a cautious approach by cutting 2022 Capex from $40-$44 billion to $36 billion, with N7/N6 being the main areas for adjustments. 50% of the reduced Capex is due to tool delivery issues, with the other 50% being capacity optimization given uncertain market conditions. 70-80% of Capex will be allocated to advanced technology, 10% to advanced packaging, and the remaining 10-20% to specialty tech.

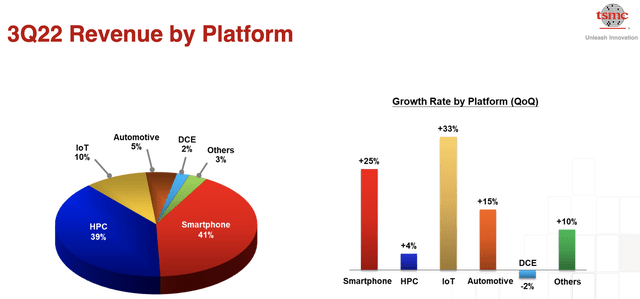

In terms of revenue by platform, both Smartphone and HPC are again the biggest revenue contributors, making up 80% of total Q3 sales. Smartphone grew 25% YoY and HPC grew 4% YoY. While both the data center and auto segment remain quite resilient, management noted orders could still see downward adjustments as customers right-size inventories. Smartphone is the most exposed segment alongside PC, which will understandably experience some pressure due to weaker demand in a post-Covid environment.

Outlook

For 4Q22, TSMC is guiding revenue of $19.9-$20.7 billion (+29% YoY), flattish on a QoQ basis due to inventory corrections in the semiconductor industry. Nevertheless, this still comes down to a full year 2022 revenue of $76.3 billion, a still impressive 34% growth YoY. Margin-wise, Q4 gross margin is expected to be 60.5% at the midpoint driven by positive FX impact offset by lower capacity utilization. Operating margin is expected to be 50% at the midpoint. Doing some quick math, we have Q4 est. EPS of $1.77 for a full year EPS of ~$6.50, up 58% from 2021.

Management highlighted that the N7 family is subject to more cyclicality due to weaker PC and smartphone demand and product delays from customers, therefore, capacity utilization is expected to fall going forward. Industry inventory reached a peak in Q3 and will start being reduced in Q4, causing some pain throughout the supply chain. However, management thinks inventory adjustments will end in 1H23.

Longer-term, TSMC reiterates its revenue target CAGR of 15-20% over the next several years and gross margin of 53%+. While the semiconductor industry is expected to contract by 2.5% in 2023, TSMC believes in still growing its business next year, likely due to share gain because of its technology leadership.

Speaking of technology, N3 is on track and will enter volume production later in the current quarter, driven by smartphone and HPC applications. While N3E will start a year later (2H23), it is 2-3 months ahead of schedule. Management believes the N3 family will be a bigger revenue contributor than N5 in its first year of production in 2020. Customer engagement is also 2x compared to that of N5. Finally, N2 is progressing well, with mass production expected in 2025. Again, customer interest is strong vs. N3 and N5.

Geopolitics

The U.S. has recently imposed export restrictions on sales of advanced AI and supercomputer chips to China. This also involves any U.S. companies selling advanced tools and equipment (e.g., KLAC, AMAT, LRCX) to Chinese companies looking to develop leading semiconductor chips. Nvidia has indicated that it would lose $400 million in quarterly revenue under the new rule (5% of 2023E revenue) and guided no further impact after the recently expanded restrictions announced by the Department of Commerce. AMD has said it expects no material impact as well. However, this is a sentiment downer on TSCM, as both Nvidia and AMD are major customers.

In 2021, Nvidia and AMD made up a total of roughly 7.2% of TSMC’s revenue. Sales in China are about 1/4 of both companies’ businesses. It’s unclear how much these two make up TSMC’s revenue today, but assuming a collective 20%-25% share, this comes down to a 5%-6.25% impact on TSMC’s top-line in an extreme scenario that all of Nvidia’s and AMD’s sales to China are banned by the U.S. government.

While TSMC did not quantify the impact, management did say the U.S. export restrictions are “manageable” and confirmed that while the most advanced AI/supercomputer chips are subject to restrictions, companion (lower-end) chips that go into the same AI/supercomputer hardware can still be shipped to China. When asked whether the export ban will lead to higher overhead costs, management said no. In addition, TSMC has obtained a 1-year license from the U.S. government to purchase US chipmaking equipment for its China expansion (for 28nm/16nm in Nanjing), alongside Samsung and SK Hynix.

Final thoughts

There’s nothing to like about the current industry down cycle, but there’s a lot to like about how TSMC is managing through the current downturn. It is carefully managing their business as a technology leader, with over 90% of market share on the leading edge. Sure, business will slow in the next few quarters and margins will experience some headwinds in 2023 due to lower utilization and higher depreciation from N3 (2%-3% impact on GM), but eventually, inventory adjustments will end and the geopolitical headwinds will settle.

What matters at the end of the day is the technology, and TSMC continues to play an important role in the world’s transformation towards a digitalized future driven by 5G, AI, IoT, Data Center, automotive and many upgrades in consumer electronics. As much as share prices have suffered a dramatic 55%+ drawdown from all-time-highs, I continue to rate TSMC a “strong buy” and believe investors willing to stick through the current downturn will be handsomely rewarded in the long run.

Be the first to comment