z1b/iStock via Getty Images

Earlier this year, we posted a Market Update to explain our accumulation strategy during these times of high market volatility.

In short, we plan to make small weekly additions to our portfolio in order to buy the dips in many phases. This is the best strategy in our opinion because it is impossible to time a bottom, but we know that prices are very attractive today. Instead of trying to predict what’s unpredictable, we maintain a focus on the bigger picture and don’t lose sight of long-term results.

We then also noted that we would fund all these purchases with cash from four different sources:

- Property Loans: I have a portfolio of property-backed loans. As the loans mature, I take the proceeds and reinvest them in equities.

- Dividends: I take all dividend payments in cash and reinvest the proceeds.

- Portfolio recycling: Occasionally, I may sell a position to reinvest in others that are more heavily discounted.

- Monthly Savings: Finally, I also use my savings to buy the dips.

Today, we continue to execute this accumulation strategy. We highlight two recent purchases of our Retirement Portfolio that we funded with a combination of new cash from savings, maturing loans, and dividends.

AvalonBay

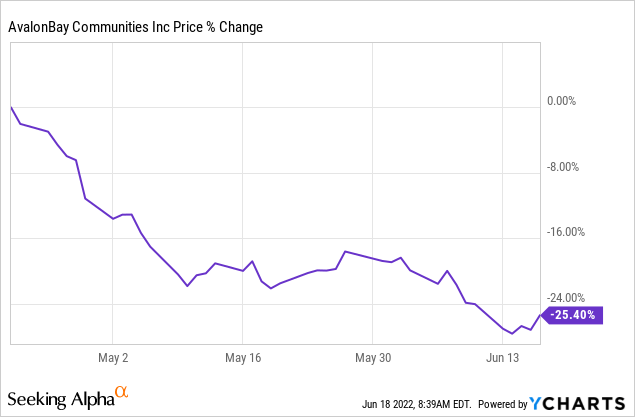

AvalonBay Communities, Inc. (AVB), the blue-chip apartment REIT, recently saw its share price drop from $260 to just over $190:

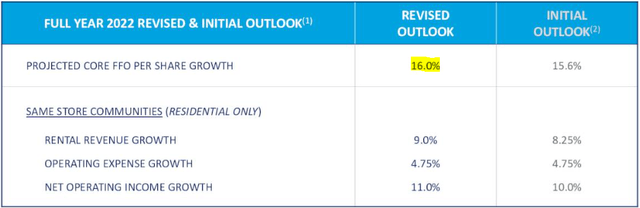

This sharp drop happened in just two months, and it occurred despite reporting results that exceeded expectations. Its same property NOI rose 10.3% while its FFO per share rose by 15.9% year-over-year. It also slightly increases its guidance for the full year, and it now expects its FFO per share to grow by 16% in 2022.

AvalonBay experiences rapid growth (AvalonBay Communities)

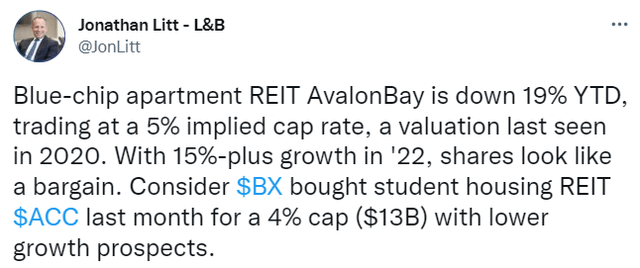

This disconnect between fundamental and share price performance prompted Jonathan Litt, Founder of Land & Buildings (one of the largest REIT activist hedge funds in the world), to post the following tweet:

Jonathan Litt buys AvalonBay (Twitter)

AvalonBay’s portfolio should trade at closer to a ~3.5% cap rate, but you can currently invest in it at an implied ~5.5% cap rate.

As a reminder, Blackstone (BX) recently acquired American Campus Communities (ACC) at a 4% cap rate, and those assets should objectively trade at a higher cap rate than those of AvalonBay.

Further proof of that is AvalonBay’s recent dispositions. In the last quarter, it sold three of its less desirable non-core assets at a 3.9% average cap rate. The CEO describes these as “older, slower growth assets” and even those got a 3.9% cap rate. Even if you valued AvalonBay’s entire portfolio at this cap rate, it would be quite steeply undervalued.

What makes AvalonBay even more compelling is the fact that it is able to recycle this capital into new development projects. It has billions of development projects underway or in its pipeline, and it is able to achieve 6.5-7% yields upon completion. This creates enormous value for its shareholders.

We expect AvalonBay to rapidly return to $250+ per share, unlocking 30%+ upside from the current share price. While you wait, you earn a 3.3% yield and the company’s fair value continues to rise.

We are upgrading the shares to a Strong Buy.

Alexandria Real Estate

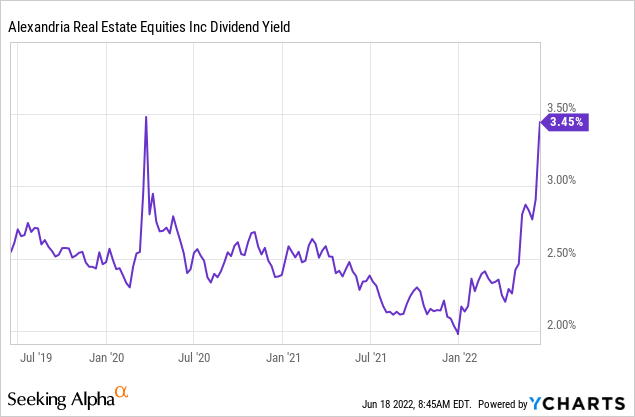

Alexandria Real Estate Equities, Inc. (ARE) has been one of the worst-hit by the recent sell-off. This is probably because life-science buildings are a “growth sector,” and ARE also holds biotech equity investments on its balance sheet.

Life science building investment (Alexandria Real Estate)

But regardless of what the 40% drop may lead you to think, the company is actually performing really well.

It just hiked its full-year guidance and reaffirmed that it expects 30%+ rent hiked in 2022. This shows you that there is strong demand for life-science buildings in the post-covid-19 world, and ARE is the leader in this space.

Most of its properties are currently leased at rents that are much lower than they would command in today’s marketplace. As leases gradually expire, ARE has a predictable path of rapid growth ahead of it.

The last time ARE traded at such a low valuation was back in 2020:

We believe that the company has 50% upside potential, and beyond this, it has the potential to deliver ~12% annual returns from its yield and growth prospects. That’s very attractive coming from a safe, recession-resistant blue-chip stock in an uncertain world.

Closing Note

AVB and ARE are two of our favorite blue-chip REITs in today’s market and we hold large positions in our Retirement Portfolio at High Yield Landlord.

Our Retirement Portfolio currently enjoys a 5% average dividend yield, we expect 5% annual dividend growth, and it has never suffered a dividend cut, not even during the pandemic. Beyond that, it enjoys great inflation and recession protection since it is mostly invested in essential real assets like apartment communities and life science buildings.

Be the first to comment