Philip Steury/iStock via Getty Images

Thesis: Expanded Opportunities From A Powerful Partnership

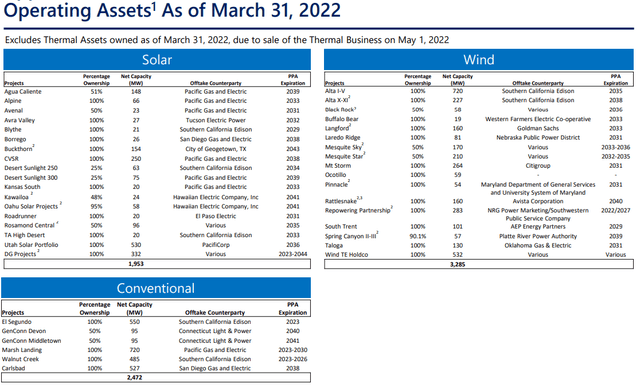

Clearway Energy, Inc. (NYSE:CWEN, NYSE:CWEN.A) is a renewable energy yieldco with a 7.7 gigawatt portfolio of renewable energy facilities. That is enough electricity to power nearly 3 million homes for a year. The power these assets produce is sold to utility companies, corporations, and government entities under long-term, fixed-rate contracts, making CWEN’s cash flows largely steady, predictable, and recession-resistant.

CWEN and CWEN.A pay the exact same dividend, but CWEN is the much larger and more liquid share class. Thus, it typically trades at a higher price than CWEN.A. Right now, CWEN offers a dividend yield of 4.4%, while CWEN.A yields 4.8%. On top of that, the company is confident in its ability to raise its dividend at the upper end of its stated 5-8% target range through at least 2026.

I would argue that this is a very attractive entry point for CWEN or CWEN.A (I own the latter share class), for two reasons:

- The company’s combination of relatively high yield and dividend growth provides attractive income growth prospects.

- A recent partial acquisition of CWEN’s parent company and sponsor now give it two powerful renewables developers on which it can rely for future portfolio growth.

In order to gain a full grasp of the beneficial effect this new deal will have on CWEN, we should have a basic understanding of the company’s history.

(Please note that this article will simply cover the most recent developments with CWEN. For the full investment thesis and expanded details about CWEN’s portfolio and business model, see this article from January 2022.)

A Brief History of Clearway Energy

The current form of Clearway Energy Inc. began in the Fall of 2018.

Before 2018, what is now Clearway Energy Inc. traded on the NYSE as NRG Energy Yield and was sponsored and partially owned by NRG Energy Inc. (NRG). But in 2018, Global Infrastructure Partners (“GIP”) acquired NRG’s stake in NRG Energy Yield as well as NRG’s renewable energy development platform.

NRG Energy Yield then changed its company name to Clearway Energy Inc., and the ticker symbols for its two share classes changed from NYLD and NYLD.A to CWEN and CWEN.A, respectively. At the same time, NRG’s former renewable energy development platform became Clearway Energy Group (“CEG”).

After this transaction, GIP owned 100% of renewable energy developer CEG, which is obviously a privately held company. And CEG owned 42% of the publicly listed Clearway Energy Inc., which is CEG’s yieldco.

The way the business model works is that CEG, the developer and sponsor, sells or “drops down” completed and stabilized projects that are generating steady cash flows to CWEN, which pays out a large portion of its free cash flows to its own shareholders as dividends. These projects typically have long power purchase agreements in place with financially strong counterparties like utilities, corporations, and governments.

Meanwhile, CEG takes the cash received from CWEN in exchange for completed renewable energy projects and puts that toward more development projects.

Unlike NextEra Energy, Inc. (NEE) and NextEra Energy Partners (NEP), which are both operated by the same management team (NEP is externally managed by NEE), CWEN is internally managed, meaning that its management team is employed by CWEN and is distinct from that of CEG.

The Deal With TotalEnergies

This brings us to the most recent deal, in which French oil & gas supermajor TotalEnergies (TTE) acquired from GIP a 50% stake in CEG, which thus gives TTE a 21% stake in CWEN (because CEG owns 42% of CWEN). The agreed consideration for this acquisition is $1.6 billion plus a 50% interest (minus one share) in a TTE subsidiary that owns a 50.6% stake in US solar panel maker SunPower Corporation (SPWR).

In essence, this deal is something of an asset swap. GIP receives half of TTE’s stake in SPWR (minus one share which keeps TTE the larger shareholder) as well as $1.6 billion in cash, while TTE receives a 50% interest in CEG, making TTE and equal partner with GIP.

This partnership between GIP and TTE is one of the most powerful ones imaginable for a renewable energy yieldco.

TTE has been investing in the green energy space for a decade or more now, having gotten a meaningful head start against its other oil supermajor peers who are now following along the same track of renewables investment.

TTE’s goal is to become a multi-energy company that continues to profit from oil and gas for many years to come but also acknowledges and taps into the growth opportunities from renewable energy. Upon completion of this transaction, TTE will have a renewables portfolio of around 25 GW in the US alone.

TTE has indicated that it intends to “support Clearway’s growth by providing CWEN in the US with access to its power trading capabilities, as well as give it priority on the farm-down of its own developed projects.”

Priority on the acquisition of TTE’s in-house developed projects is a huge win for CWEN, as it opens up the possibility of eventually adding to its portfolio some of TTE’s big and high-quality projects, such as future offshore wind assets in North Carolina for which TTE was recently awarded a contract.

What’s more, TTE recently agreed to acquire Core Solar, an Austin TX-based developer of utility-scale solar and energy storage projects. Presumably, some of these completed and stabilized projects could end up getting acquired by CWEN at some point.

Having a right of first offer for TTE’s American renewable energy development projects greatly expands the pipeline of potential drop-down acquisitions for CWEN.

As GIP stated about the deal (emphasis mine):

We are proud of the growth and accomplishments of the Clearway team since our initial investment in 2018, and we are confident that with TotalEnergies as a partner, Clearway will be able to accelerate the deployment of cost-competitive renewable power in the US.

In other words, TTE’s new 50/50 partnership with GIP in CEG should allow CWEN to increase its already respectable pace of portfolio growth. And with faster portfolio growth should come faster cash flow and dividend growth.

Temporary Insulation From Unfavorable Capital Markets

What about the risk of rising interest rates and a bear market in stocks causing CWEN’s cost of capital to spike? Potentially, a rise in weighted average cost of capital high enough could make acquisitions unprofitable, or at least not profitable enough to be worth pursuing.

The good news here is twofold:

- Most of CWEN’s debt is in the form of self-amortizing, non-recourse, asset-level loans (similar to a mortgage for real estate) that will mostly or fully amortize by the time the respective power purchase contract expires. This mostly eliminates refinancing risk. For instance, by the end of 2026, CWEN will have paid down $2.175 billion in principal on its non-recourse debt, which makes up 40% of its total non-recourse debt.

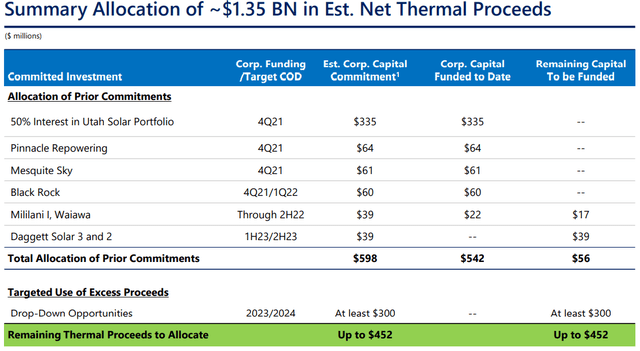

- CWEN recently sold its thermal energy assets for net proceeds of $1.35 billion, which completely eliminates the yieldco’s need to issue equity for at least a few years.

About $600 million of the net proceeds have already been committed to new acquisitions, while another $300 million is in the negotiation phase with CEG for possible deals coming online in 2023 and 2024. The remaining $450 million may very well be put to use in the coming years in opportunities that come up via the new strategic partnership with TTE.

Furthermore, CWEN intends to invest this war chest of cash into projects at stabilized cash available for distribution (“CAFD”) yields of around 8.5%. That gives the yieldco a strong investment spread even after the rise in cost of capital.

Bottom Line

Management has issued CAFD per share guidance of $1.81 for 2022. That puts CWEN’s price to CAFD at 17.7x while CWEN.A trades at a 16.3x multiple. The flipside of this equation is that CWEN’s CAFD yield sits at 5.6%, while CWEN.A’s CAFD yield reaches 6.1%.

Though neither CAFD yield is all that high, it’s still a decent yield for such a fast-growing company. Remember that management has projected dividend growth on the high end of its 5-8% range through 2026.

After another 2% dividend hike in Q2 2022, the yieldco’s annualized dividend of $1.414 gives it a comfortable payout ratio of 78%. That payout ratio may tick up further this year if management delivers more quarterly dividend raises, but it will likely stay in line with peer NEP’s payout ratio in the low 80% territory.

With a powerful new partnership between sponsors GIP and TTE, CWEN (and especially CWEN.A) looks like a fantastic way to collect a growing dividend from the rapid expansion of renewable energy in the United States.

Be the first to comment