wdstock/iStock Editorial via Getty Images

Article Thesis

Many longer-term AT&T (NYSE:T) shareholders that have held T stock for years are very unhappy with the company’s recent performance and the recent dividend cut. For someone deploying new money today, AT&T seems like a solid value pick, however. On top of that, new AT&T also does look like a compelling dividend growth pick, with a still very solid initial dividend yield and considerable dividend growth potential over the coming years.

Spin-Off Record Date Arrives

The record date for the media business spin-off following the merger with Discovery (DISCA) is April 5. The closing of this transaction is expected in the coming weeks, as most of the relevant approvals have arrived already. With AT&T about to be transformed, let’s take a look at what the future could hold for the media/entertainment company and legacy AT&T (the telecom company).

Investors of AT&T will receive about 0.24 shares of the new media company for every share of pre-split AT&T that they owned. Based on a current DISCA share price of $25, that implies a $6 per-share value for AT&T owners relative to the pre-split AT&T share price. With AT&T trading at $24 per share today, the market-implied post-split share value is $18 per share. AT&T is valued at $170 billion today, which means that telecom AT&T is valued at $128 billion right now.

Media/Entertainment Has A Good Outlook

Following the merger and spin-off of the media company, the new media/entertainment business will be one of the top players in the streaming market. With an implied market capitalization of ~$60 billion, the media business does not seem expensive. Instead, WarnerMedia could be the most appealing streaming investment at current valuations. HBO Max has grown its subscribers at a rapid pace in recent quarters, and with integration between AT&T’s entertainment assets and those from Discovery, WarnerMedia’s content library only gets stronger.

HBO and Discovery will eventually offer a single application that will make it easier for subscribers/users to access its content. Integration between these two companies and the buildout of this new offering will take some time, thus I don’t expect this offering to be available this year. But for longer-term investors that shouldn’t matter too much, and WarnerMedia looks attractive both from a content perspective as well as from a valuation perspective.

For reference, Netflix (NFLX) has about 220 million subscribers and is valued at $170 billion. HBO Max, on the other hand, had about 74 million subscribers at the end of 2021. If an HBO Max subscriber was equally valuable as a Netflix subscriber on average, then HBO’s value could be in the $60 billion range alone. That calculation does not yet account for HBO Max’s stronger growth and all the other media/entertainment assets that WarnerMedia will eventually own. I would thus not be surprised to see WarnerMedia do well eventually, both from an operational perspective as well as when it comes to share price performance. That being said, it seems possible that there will be selling pressure initially. Legacy owners that received shares in the new company due to owning AT&T may not be interested in holding this growth asset. That will be especially true for income investors, as WarnerMedia won’t make any dividend payments in the near term. As those income investors sell their shares in WarnerMedia to redeploy funds into dividend-paying equities, WarnerMedia might see its shares decline for a while before eventually stabilizing. In the long run, I do believe that the outlook for WarnerMedia is positive. For current owners of AT&T, the performance of the core telecom business is more important, however.

Core AT&T: Cheap With Strong Cash Flows

At a market-implied share price of $18 for core AT&T, the dividend yield is roughly 6.2%. That’s less than the trailing yield on AT&T’s shares but still pretty high compared to what one can get from most equities. Even more important, the dividend will be very sustainable at this new level.

With a share count of a little more than 7 billion, the $1.11 per share dividend will cost AT&T around $8 billion a year. At the same time, core AT&T will generate free cash flows of around $16 billion this year (Pro-forma/not accounting for WarnerMedia). That makes for a dividend payout ratio of 50% relative to the free cash flows core AT&T will generate. When we consider that all investments in the company’s operations, including 5G buildout, are already accounted for as these are subtracted from operating cash flows in order to get to the free cash flow number, the 50% payout ratio looks highly sustainable. AT&T will thus have around $8 billion a year left over for net debt reduction or buybacks at the 2022 run rate. It gets better, however, as 2022’s free cash flow estimate is artificially depressed by items such as vendor financing payments.

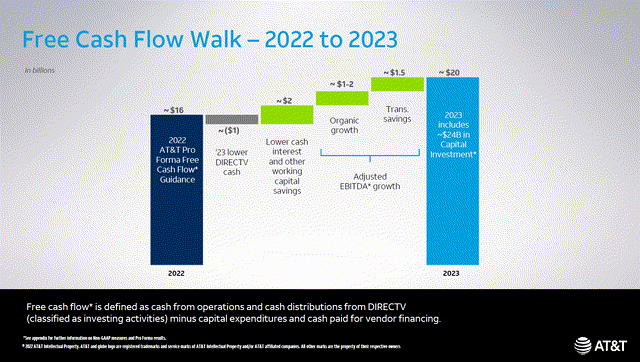

AT&T 2023 FCF (AT&T presentation)

AT&T’s management is forecasting that core AT&T will do $20 billion of free cash flow in 2023. Lower interest expenses due to debt paydown, organic growth, and cost reduction efforts will be the key drivers for higher free cash generation. At the $1.11 annual rate, the dividend payout ratio for next year is thus just 40%. Around $12 billion would be left over for buybacks and/or debt reduction.

AT&T is also forecasting that 2023 will be the year of peak capital intensity due to 5G investments. This means that, beyond 2023, capital expenditures should start to decline again — if management is right. In that case, between some operating cash flow growth due to business expansion, and declining capital expenditures, free cash flows should climb further. Annual free cash flows of more than $20 billion thus seem likely for 2024 and beyond as long as management’s projections are correct.

AT&T’s debt levels have been one of the most important issues investors have brought up in the recent past. Most of AT&T’s debt is fixed-rate debt, thus rising interest rates aren’t a real threat for the company for now. Still, reducing debt is clearly in the interest of shareholders, as lower leverage will ease fears and could thereby lead to multiple expansion that would lift AT&T’s shares upwards. AT&T’s current net debt totals $161 billion according to YCharts. When we adjust this number for the debt that will be shifted to WarnerMedia following the spin-off (around $43 billion), we get to around $118 billion of Pro forma net debt for core AT&T.

According to AT&T’s recent investor day presentation, core AT&T will do about $41.5 billion in EBITDA this year, and around $44 billion in EBITDA in 2023. This gets us to a leverage ratio (net debt to EBITDA) of around 2.8 for this year, without any further debt reduction. If AT&T uses all of its surplus free cash flow for the current year to pay down debt, it will end the year with net debt of around $110 billion, for a leverage ratio of 2.65. If AT&T further uses the $12 billion of surplus free cash flow in 2023 to reduce debt levels further, it will end 2023 with net debt of $98 billion — relative to the forecasted EBITDA for next year, that makes for a leverage ratio of just 2.22. For a capital-intense business that is resilient to recessions, that’s not high at all.

In other words, at the end of 2023, AT&T could be in great financial shape if the company uses its vast cash flows to strengthen the balance sheet, despite paying out billions of free cash in the meantime. At that point, further debt reduction would likely not be a focal point for management any longer, and I assume that more cash would be shifted towards dividends (via dividend increases) and buybacks.

AT&T’s legacy business also looks quite cheap today. Based on a spin-adjusted share price of $18, the legacy business is trading for just ~7.4x net earnings, using management’s forecast for EPS of $2.42 to $2.46 for 2022. Based on next year’s guidance with a midpoint of $2.55, core AT&T is valued at just 7.1x net profits, which makes for a 14%+ earnings yield.

The Pro forma enterprise value for core AT&T is $246 billion today, consisting of $128 billion of Pro forma equity and $118 billion of Pro forma net debt, both accounting for the WarnerMedia spin-off. With Pro forma EBITDA for 2022 being forecasted at $41.5 billion, core AT&T is trading at 5.9x EBITDA today. Generally, EV/EBITDA ratios of less than 10 are seen as inexpensive — AT&T very clearly falls into that category today.

Verizon (VZ), which is a relatively close comparison to core AT&T, is valued at an EV/EBITDA ratio of 7.4x (2022 estimate) today, according to YCharts. If core AT&T eventually re-rates to a Verizon-like valuation, its shares would easily have double-digit upside potential, even before accounting for organic EBITDA growth and further debt reduction that should shift value towards equity holders over time.

In short, core AT&T is not a high-growth business but looks attractively priced nevertheless. Investors will get a very competitive yield, and the company will have massive surplus cash for debt reduction and/or buybacks. Trading at a discount compared to peers, core AT&T has significant upside potential over the coming years.

Takeaway

For someone that bought AT&T at $40 a share a couple of years ago, T has been a pretty bad investment. Income investors also naturally aren’t happy with the dividend cut. But at current prices, AT&T seems like a very solid investment. The media business has a solid outlook and is relatively inexpensive, and core AT&T should offer share price appreciation on top of an above-average dividend yield over the coming years.

Be the first to comment