fatido/iStock via Getty Images

We maintain several REIT portfolios at iREIT on Alpha and by far our best performing portfolio is the Small-Cap REIT Portfolio. Currently the portfolio holds around 25 REITs ranging in size to our largest position, Orion Office (ONL) to our smallest position, Community Healthcare (CHCT).

See my latest article on ONL Here.

We launched the Small–Cap REIT portfolio in January 2016 and since that time it has returned over 34% annually, vs. 9.4% annually for (VNQ). Several of our top holdings (since 2016) have been:

- Power REIT (PW) +129% annually

- Arbor Realty (ABR) +69% annually

- Centerspace (CSR) +62% annually

- City Office (CIO) +56% annually

- Alpine Income Property (PINE) +54% annually

Over the years, as long as I have been writing on Seeking Alpha, I have found very good success at finding the so-called “diamonds in the rough” as my team and I are always scanning the REIT universe in the quest for the unpolished gems.

It’s more of an art than a science, as valuation tends to be more difficult given the shorter earnings and dividend history of the small caps. Most are too small for rating agencies and there are just a few analysts covering them.

Of course, that’s why we like small caps, because we’re able to put them on our radar before other investors. Being able to spot the “diamonds in the rough” has its advantages, but there are also enhanced risks, namely volatility and typically higher leverage.

The bigger REITs, like Realty Income (O) and W. P. Carey (WPC), have much stronger balance sheets as they have earned the trust of investors (and rating agencies) by utilizing low-cost unsecured debt.

In addition, they’re more diversified, so their reliance on one or two tenants (or operators) does not reap havoc if one (tenant) that gets into trouble.

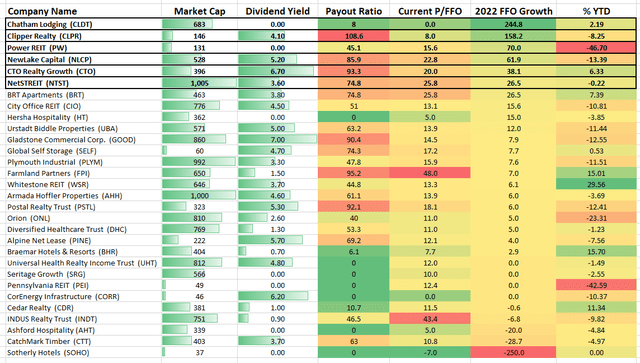

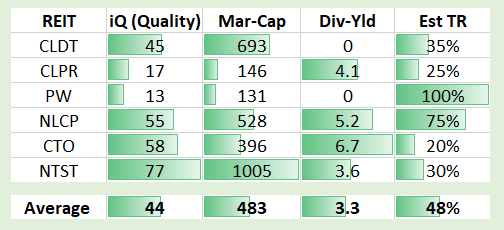

Utilizing our iREIT on Alpha tracker I decided to screen for the small-cap REITs by filtering the constituents with the highest FFO per share growth forecasted in 2022 (second column to the left below).

iREIT on Alpha

As you can see (above), these six high- flying REITs are as follows:

- Chatham Lodging (CLDT)

- Clipper Realty (CLPR)

- Power REIT (PW)

- NewLake Capital (OTCQX:NLCP)

- CTO Realty (CTO)

- Netstreit (NTST)

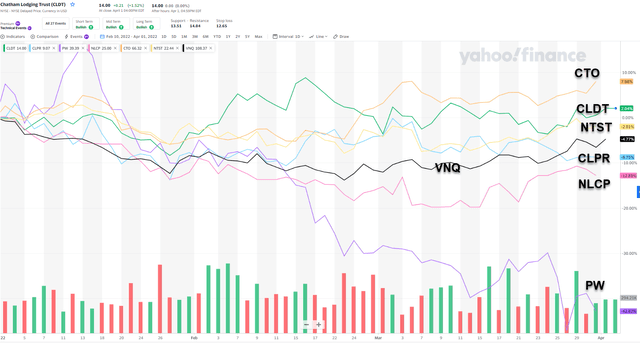

Year-to-Date (Price Only)

Yahoo Finance

Small Cap Pick #1: Chatham Lodging

Chatham has a market cap of $683 million and this lodging REIT owns a portfolio of upscale extended-stay and premium-branded select-service hotels in markets with strong long-term growth.

The company focuses on acquiring properties in markets that have strong demand generators and where it can expect demand growth will outpace new supply.

Since its inception in 2010, CLDT’s portfolio has generated the highest operating margins among all lodging REITs which is a testament to the asset quality and Island Hospitality’s operating expertise. Island Hospitality manages all of CLDT’s 40 wholly-owned hotels and all 46 hotels in the Innkeepers JV.

The portfolio consists of hotels in the upscale extended-stay segment, including brands such as Residence Inn by Marriott and Homewood Suites by Hilton, as well as the premium-branded select-service hotels such as Courtyard by Marriott, Hilton Garden Inn, Hampton Inn, and Hampton Inn and Suites.

CLDT’s balance sheet is solid: Net debt balance was reduced by $250 million in Q4-21 and liquidity totaled $199 million.

During the Q4-21 earnings call, CEO Jeffrey Fisher noted that the company is looking to dispose of older hotels in the portfolio that are on the bottom end of absolute RevPAR. This will allow the company to avoid high capex expenditures in the near term that these older properties may require.

CLDT was the second-fastest lodging REIT to become corporate cash flow positive and they have not used any equity dollars to fund corporate operations.

This is a testament to the quality of management and performance throughout 2021 and the rest of the pandemic. In Q4-21, CLDT achieved a 41.1% GOP margin at a RevPAR of $92, only 100 bps lower than the Q4-19 GOP margin.

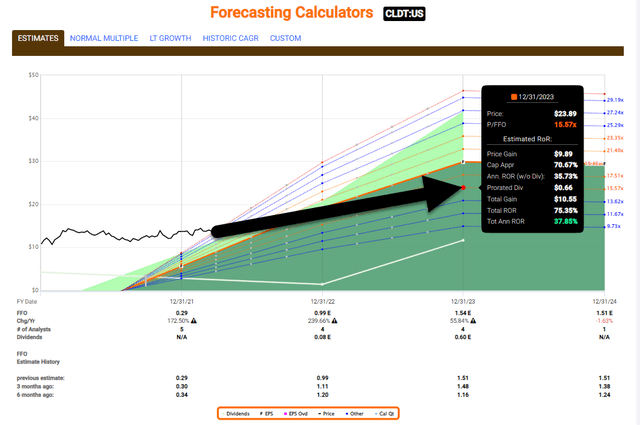

CLDT has positioned its portfolio to perform well as the return of business travel drives hotel demand higher in 2022. We recommend a BUY at a current price of $14.00 and as viewed below, we are forecasting shares to return around 35% annually.

Fast Graphs

Small Cap Pick #2: Clipper Realty

The next Strong Buy pick is small cap Clipper Realty, with a market cap of just $146 million, and the only pure-play NYC-centric REIT out there, headquartered in Brooklyn and owns buildings there as well as in Manhattan – 66 in all (3.2 million leasable square feet).

Admittedly, New York City was the epicenter for COVID-19 in the U.S., but we’re bullish with CLPR due to its focus on multifamily (81% of ABR) and on Brooklyn. Its Flatbush Gardens apartments in Brooklyn generate 37% of its revenue. This is a “low-cost option” that includes 2,496 rent-stabilized apartments in 59 buildings on 21 acres.

Clipper’s next largest property is Tribeca House, a multifamily and retail portfolio that generates around 33% of revenue. Consisting of two buildings, it holds 506 apartments and 77,000 square feet of retail space. Tribecca has strong upside because of its below-market rent.

Another Clipper asset is the Downtown Brooklyn offices at 141 and 250 Livingston Street (14% of ABR) that features approximately 549,000 square feet of office space and 27,000 of residential.141 Livingston is 100% leased to New York City at $40 PSF.

That will increase to $50 next year and 250 Livingston office is 100% leased to the city, with a recent lease renewal with impactful net operating income (NOI) growth trajectory.

CLPR also owns the residential Clover House that was brought online mid-2019 with about 102,000 square feet and indoor parking garage. It features 158 well-appointed apartments of various sizes, a rooftop terrace, fitness center, and landscaped courtyard. It reached stabilization after a three-month lease-up period, and now is 98.7% leased at an average $71 PSF.

And CLPR owns 10 West 65th Street, another residential building, involves around 76,000 square feet, plus 53,000 more of air rights. It includes six stories with 82 apartments and is located near Central Park and Lincoln Center in Manhattan’s Upper West Side submarket.

CLPR remains a small cap, but the debt profile is well positioned for long-term growth. The portfolio is financed on asset-by-asset basis and the debt is non-recourse and is not cross-collateralized with no debt maturities on any operating properties until 2027.

Also, the founders own 67% of the company, with significant public company experience and deep relationships that drive first look at many NYC multifamily opportunities.

Keep in mind, CLPR did cover its dividend in 2020 barely (100% based on AFFO). However, looking beyond 2021, analysts are forecasting growth of 19% in 2022 (based on AFFO per share), driven by several value-add projects.

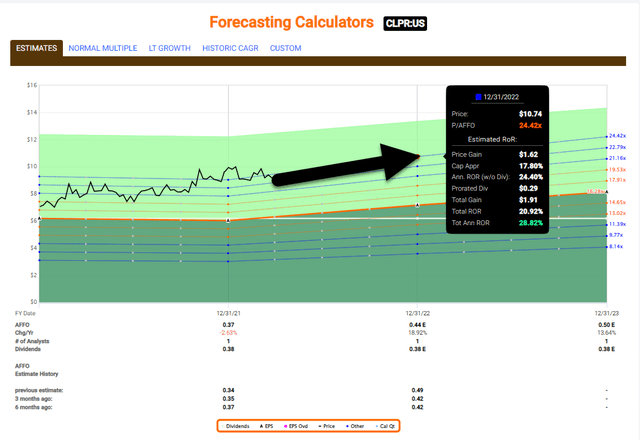

CLPR is now trading at $9.12 per share with a P/AFFO multiple of 23.5x and a dividend yield of 4.2%. We remain bullish with this small cap, with a 12-month total return forecast of 25%.

Fast Graphs

Small Cap Pick #3: Power REIT

In early January 2021 I wrote an article for iREIT on Alpha members explaining that “PW has pivoted to cannabis real estate, but more specifically the company invests in cannabis greenhouses, a unique specialty category” and “after conducting due diligence and speaking with management at PW we decided to purchase 375 shares (at $26.71) for the Small Cap REIT portfolio.”

This trade led to a pick that generated 160% in 2021 and we sold shares in late 2021 and then we bought again in 2022, as shares pulled back dramatically.

PW is currently diversified into three industries: Controlled Environment Agriculture (greenhouses), Solar Farmland (600 acres of land leased to over 107 Megawatts) and Transportation (112 miles of railroad located in Marcellus Shale territory) and the small cap ($160 mm market cap) is focused on expanding its real estate portfolio of Controlled Environment Agriculture greenhouse properties for food and cannabis cultivation on an accretive basis.

PW has a significant acquisition pipeline (in excess of $100 million at various stages of negotiations) and the existing portfolio of CEA assets have potential expansion opportunities. PW’s recent acquisition yields >19% as the REIT has sculpted rent schedule for cannabis properties.

$65 million of recent transactions are projected to return approximately $65 million over the next three years which can be used to invest in additional assets and expand the portfolio and could add approximately $12 million to FFO (assuming 100% re-investment and a 18% FFO yield on investment).

The CEO, David H. Lesser, has 35-plus years of experience in real estate and has spearheaded efforts in expanding PW’s CEA portfolio. Importantly, PW insiders own > 20% of the common shares. On April 1st the company announced earnings and the CEO said,

“From an earnings perspective, we increased our Core FFO per common share by 44% year over year. We remain confident in our long-term strategy that greenhouses provide the most economically and environmentally sustainable path for cultivation and focused on managing our existing portfolio in lockstep with accretive acquisitions.”

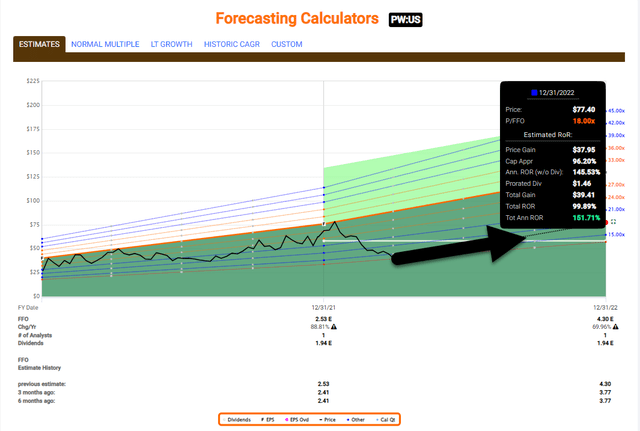

Of all of the small caps listed in this article, PW has fallen the hardest (-42% YTD), which means shares are awfully tempting right now. The P/FFO is now 13.4x (was 30x in mid-January 2022) and there’s no dividend yet (due to a net operating loss). We believe this one could repeat our success in 2021 and we’re dollar cost averaging into the position.

Fast Graphs

Small Cap Pick #4: NewLake Capital Partners

NewLake Capital Partners is a cannabis REIT that owns 29 properties in 11 states. The company is traded over the counter but is hoping it can get listed on either the NYSE or NASDAQ. As viewed below, NLCP shares have dropped 13% year-to-date:

In Q4-21 NLCP’s rental income increased by approximately $4.3 million to approximately $8.4 million compared to approximately $4.1 million for Q4-20. Rental income for the 12 months (ended 2021) increased by approximately $15.9 million to approximately $27.6 million, compared to $11.7 million for the full-year 2020.

NLCP’s AFFO in Q4-21 was approximately $7 million and for the full-year it was $21 million. On March 15th the company declared a $0.33/share quarterly dividend, a 6.5% increase from the prior dividend of $0.31.

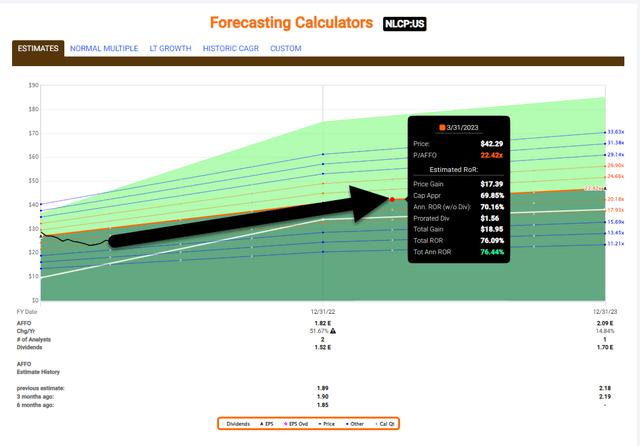

Recently I spoke with NLCP’s CEO, Gordon Dugan, and he pointed out to me that NLCO is part of the “equity riddle.” In fact, we find shares ridiculously cheap, now trading at $24.90 with a P/AFFO of 18.4x and dividend yield of 5.3%. To put that into context, Innovative Industrial (IIPR) is trading at 27.9x (and a dividend yield of 3.5%).

We recently interviewed NLCP’s Chairman, Gordon Dugan, and he explained,

“The business has been very strong. We’ve collected 100% of rents. We’re the only cannabis-related REIT that can say it’s never had a deferral or a missed payment of any sort. And that goes back a couple of years now. So we’re the second-largest player in the industry. We’re quite a bit of ways behind the largest player, which of course is IIPR. But we’ve had a very, very strong end of ’21 and beginning of ’22. And so from a fundamental standpoint, business is great.”

NLCP’s market cap is around $500 million and we believe the company can easily trade at 22x (P/AFFO). This means the total return forecast for this little gen is 75% (over 12 months).

Fast Graphs

Small Cap Pick #5: CTO Realty (CTO)

CTO is a shopping center REIT (mostly) that owns a portfolio of 22 properties (2.7 mm square feet) in markets projected to have outsized job and population growth; states with favorable business climates (i.e. TX, FL, NC, TN, CO, NV, and AZ).

Although too small for investment grade ratings, CTO has solid financials, with more than $170 mm of existing liquidity and no near-term debt maturities.

Also 100% of CTO’s outstanding debt is unsecured and the REIT has 36% net debt-to-total enterprise value and 6.1x net debt-to-EBITDA. CTO raised its dividend ahead of the earnings release, boosting its quarterly dividend by 8.0%, to $1.08, representing a 7.1% dividend yield currently.

In a recent Ground Up interview the CEO, John Albright, told me,

“So we are angling towards the multi-tenanted retail centers in the higher growth markets, business-friendly states, states that did better and locations that did better in the pandemic because they opened up earlier and so forth.

And so if you think about it, we’re going from Virginia down to the Carolinas, down to Georgia, down to Florida, over to Texas, Arizona, New Mexico. We’re in Utah, and we’re in Nevada, and we’re looking for assets in Colorado.

So those are our markets, and we feel like those are positioned very well for strong population growth, strong job growth, and properties there have been doing very well. And the leasing has been going very well as well. So that’s kind of where our position is. So we do have some office buildings that we will be monetizing, we think a fair amount of it this year.”

Another benefit is that CTO is the external manager of Alpine Income Property (PINE), another small cap that focuses on net lease properties. Because of this relationship, as a shareholder in CTO, you also benefit from PINE ownership of around $41 million.

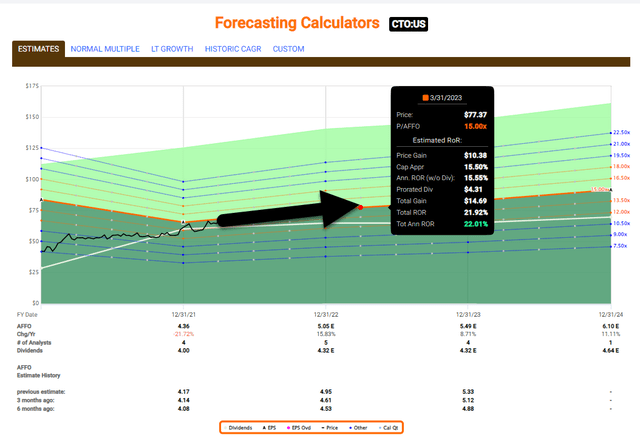

CTO is one of the cheapest shopping center REITs in our coverage spectrum, shares are trading at $66.99 with a P/AFFO of 14.8x and a dividend yield of 6.5%. We forecast shares to return around 20% over the next 12 months.

Fast Graphs

Small Cap Pick #6: Netstreit

Netstreit is a net lease REIT that IPOd in 2020, and currently has a portfolio of around 300 properties in which over 85% of the portfolio consists of investment grade tenants, or tenants with an investment grade profile (the highest % in the net lease sector). As seen below, NTST shares are basically flat year-to-date (-.70).

In just around two years, NTST has grown its portfolio by an average of $101 million per quarter and now has a market cap of around $1 billion. To fund that steady growth NTST has maintained strict financial discipline, at year end the balance sheet had total debt of $239 million outstanding of which $175 million was from its fully hedge term loan with a remaining balance from the revolving line of credit.

NTST has no debt maturities until the maturity of the revolver in December 2023, which is subject to a one-year extension option. The net debt to annualized adjusted EBITDA ratio was 4.2x at year end (below the targeted leverage range of 4.5x to 5.5x).

For Q4-21 NTST reported net income of $0.05, core FFO of $0.25 and AFFO of $0.27 per diluted share, and for the full year 2021, the company reported net income of $0.08, core FFO of $0.87, and AFFO of $0.94 per diluted share. In NTST’s January business update it established a 2022 AFFO per share guidance in the range of $1.13 to $1.17 per share.

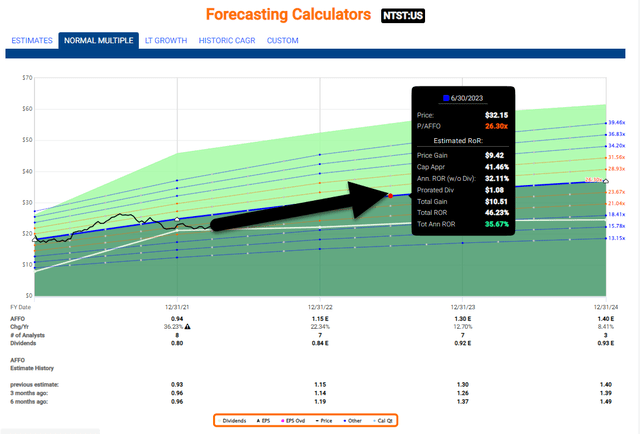

NTST grew AFFO by around 36% in 2021 and analysts are forecasting more impressive growth of 21% in 2022 (highest in the peer group and one of the highest in the REIT sector).

Shares are now trading at $22.73 per share with a dividend yield of 3.5%. NTST’s equity yield is now around 4.4% and the payout ratio is around 80%, which means the company should boost its dividend substantially this year.

Given its small size, NTST should be able to move the needle, especially is the company continues to acquire around $100 mm every quarter. As you can see below, we updated our forecast for 2022 which reflects a total return target of 30%.

Fast Graphs

In Closing…

I’m sure that you’ve heard the saying that “the higher the risk, the higher the return” and that certainly can apply to small cap investments that are riskier in nature. However, that can also apply to the reciprocal – “the higher the risk, the greater potential for loss.”

As I said at the outset, small-cap stocks are extremely volatile, and they are generally not of the same quality as the larger REITs in our coverage spectrum.

By careful screening, we have been able to generate impressive returns, but keep in mind that your risk tolerance level should be considered before dipping your toe into the small-cap pond.

As seen below, the average quality rating for these six REITs is 44 (out of 100) so you are definitely not buying SWANs (score at least 90 out of 100). Nonetheless, these small cap REITs are fascinating and for the right investor, they may be the REIT gems that will make you rich.

iREIT on Alpha

As always, thank you for reading and remember to always maintain adequate diversification. It only takes one torpedo to sink a ship!

Be the first to comment