benedek/E+ via Getty Images

By Fei Mei Chan

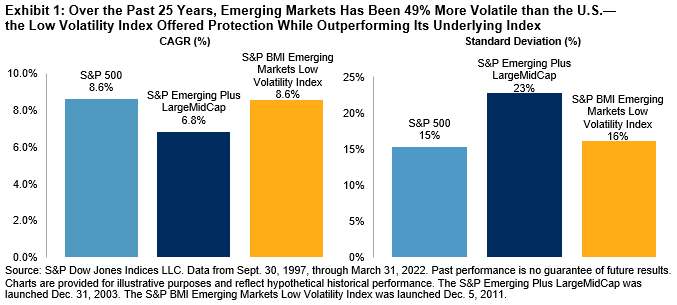

Low volatility strategies were designed for times like the ones we’ve experienced so far in 2022. Year-to-date through March 31, 2022, equities have struggled. In the U.S., the S&P 500® was down 4.6% YTD. The S&P Developed Ex-U.S. BMI and the S&P Emerging Plus LargeMidCap fared even worse, plummeting 5.6% and 6.7% YTD, respectively. But emerging markets have underperformed broader global benchmarks and the U.S. since long before the first quarter of 2022. In the past 25 years, the S&P Emerging Plus LargeMidCap gained 6.8%, while the S&P 500 was up 8.6%.

Hindsight, of course, is 20/20, and we don’t know how emerging markets will perform relative to their developed counterparts going forward. Often, people look to international markets to diversify their home-country investments—and with good reason. The correlation between the S&P 500 and S&P Emerging Plus LargeMidCap over the past 25 years was 0.74. Diversification may be the “only free lunch in finance,” but the performance of emerging markets does tend to be more volatile—49% more volatile than the S&P 500, to be precise.

What tend to be more reliable, however, are strategies that are explicitly designed to extract a certain pattern of returns relative to the broader market. In the past 25 years, the S&P BMI Emerging Markets Low Volatility Index returned 8.6%, compared with 6.8% for its underlying index.

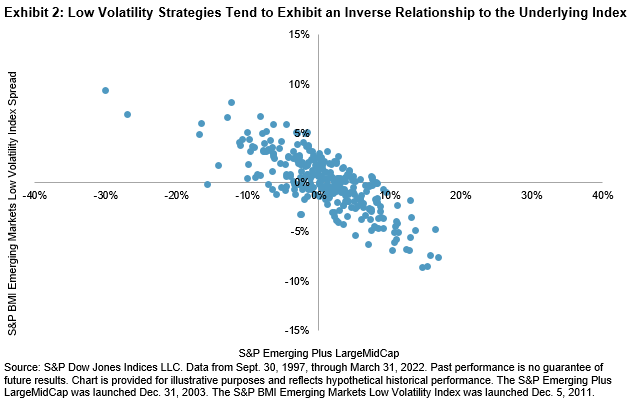

By losing less when markets fall, low volatility strategies have typically outperformed over the long run. This phenomenon is observable universally across markets. The resulting performance pattern is captured in Exhibit 2, which shows the relative performance of the S&P BMI Emerging Markets Low Volatility Index (vertical axis) against the monthly performance of the S&P Emerging Plus LargeMidCap (horizontal axis).

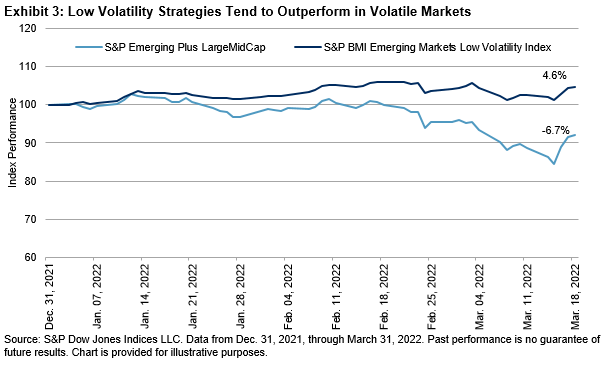

In times of high stress, low volatility strategies tend to have more bandwidth to offer a buffer against volatility. This has proven to be true in the case of the S&P 500 and S&P 500 Low Volatility Index so far in 2022, declining 4.6% and 1.7%, respectively. It has been even more impactful in the case of emerging markets, where conditions are innately more volatile. In the first quarter of 2022, the S&P BMI Emerging Markets Low Volatility Index outperformed its underlying index by 11.3%.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment