Ultima_Gaina

SL Green Realty Corp. (NYSE:SLG) is a New York-based REIT that focuses almost exclusively on office properties and is the largest office landlord in the New York metropolitan area. The company owns/controls these properties both directly as well as through debt, preferred equity, and JV investments. The company does have exposure to residential and retail properties, but the core of the business could be described as Manhattan office space. Areas of concentration in Manhattan include Midtown, Midtown South, and Downtown, with notable properties on Park Avenue, Madison Avenue, and Third Avenue, among others. As of June 30, 2022, the company owned interests in 64 buildings totaling 34.4 million square feet, including ownership interests in 26.3 million square feet in Manhattan and 7.2 million square feet as collateral for debt and preferred equity investments.

Valuation

This is an interesting contrarian trade for several reasons. The current valuation is the lowest it has been since the pandemic lows and the 2008 financial crisis before that. With a current market cap of about $2.7 billion, the stock is trading at about a 40% discount to book value.

SL Green Price/Book (Seeking Alpha)

The company pays a monthly dividend that equates to an annual current yield of about 9.50%. With a dividend payout ratio over 80%, the dividend is well-covered and in-line with the REIT sector. While little growth in the dividend can be expected for the foreseeable future, it appears safe at its current level given the cash flow of the business. At the current stock price, the company is trading at a multiple of FFO (funds from operations) of under 6x, far below the sector average of over 13x.

The company offers the opportunity to make a concentrated bet on New York office properties, some of which that are worth nearly as much as the entire book value of the company. For example, the property at 11 Madison Avenue, in which SL Green owns a 100% fee interest, has a gross asset value of about $2.3 billion and occupancy of 96.4%.

Despite the attractive price relative to book value compared to its own history and to its peers, recent performance has been abysmal. Year-to-date the stock is down by more than twice as much of the S&P 500 and more than 16% below the real estate sector and REITs on a total return basis.

Total Return versus S&P 500, Real Estate Sector, and REITs (Seeking Alpha)

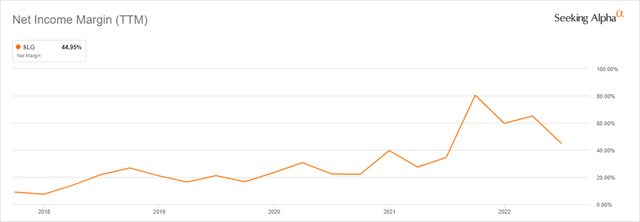

Despite the hit to office occupancy as a result of the pandemic, SL Green has been able to not only maintain margins, but improve them over the last five years, giving some of that improvement back over the last year. That said, this has been done with a smaller portfolio and lower gross rental income.

Net Income Margin (Seeking Alpha)

The value of the company’s total real estate assets declined from the beginning of the pandemic and appear to have bottomed at year-end 2020, before beginning its slow recovery at least through June 2022.

Through shedding non-core or underperforming assets, the company has been able to reduce its long-term debt significantly over the last 2+ years from around $6.1 billion to below $3.8 billion. A recent example is the sale of 414,317 square feet at 885 Third Avenue, the well know “Lipstick Building”, to Memorial Sloan Kettering Cancer Center for total consideration of $300.4 million. This space, which will be used by the institution for academic and research offices, was previously vacant. The deal, expected to close in the fourth quarter of this year, allows SL Green to retain ownership of the remaining 218,796 square feet, which is 91.7% leased.

As of June 30, 2022, the occupancy rate for the company’s operating properties in Manhattan was 91.2%.

Creating Opportunities from Adversity

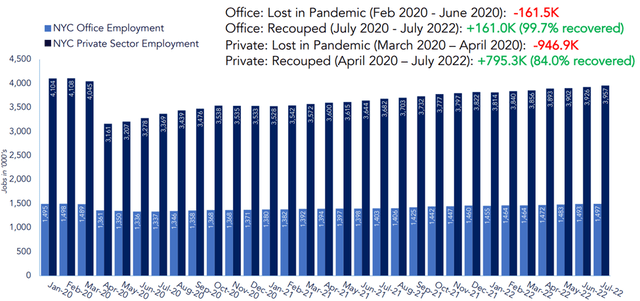

Both New York City and office space were disproportionately impacted as a result of the pandemic. Some called New York “dead”, and never believed in a recovery. Similar comments have been made about office space demand as remote work and flexibility have decreased office space demand in the wake of the pandemic. There is still a long road for a full recovery nationwide, and specifically in New York. However, that trend is in place, and while it may be a long runway, it is happening, and will continue to do so.

While there have been negative headlines in terms of job cuts at some major banks, the prospect of an economic slowdown, if it is mild, could help boost demand and occupancy for office space. In the event of a mild recession, it is reasonable to expect that many of the current job openings will evaporate. This would be the first step most companies would take to tighten their belt: slow hiring, hiring freeze, then layoffs. Because this situation would likely change the attitude of workers (i.e., the confidence that one can leave their job today and find another, often better, one tomorrow will fade as economic conditions deteriorate), more of them will have a personal incentive to return to the office at least on a part-time basis if currently 100% remote, or five days a week if currently not doing so. This is potentially bad for individuals currently avoiding their commutes, but potentially good for office space demand. I understand that this is a bit counterintuitive, but in any case, the return to the office trend will continue, even if that process takes years.

New York City Employment Recovery

NYC Employment Recovery (SL Green Realty)

Catalysts

Factors that could accelerate the improvement in company fundamentals and ultimately drive the stock price higher include increasing occupancy rates across the board, but particularly within the non-core residential and retail properties. As previous leases turnover, the company may be able to increase lease rates. The combination of higher occupancy and higher rental income over the next several years will be a tailwind for the stock price. The current majority of the portfolio of 50-100% ownership stakes will transition to smaller stakes of 20-30%, but with more leverage to the upside. The company will also seek to increase fees and promotes through its joint ventures, increasing the overall return on equity.

New construction projects within their core market are ongoing, with three projects expected to be completed in the third quarter of 2023. These projects will incorporate the company’s new strategy of holding minority interests rather than majority stakes. The company is actively working to prelease these properties prior to completion.

The debt and preferred equity portfolio have been reduced significantly over the last five years from about $2.3 billion to under $700 million. This strategic action has reduced the company’s floating rate exposure materially, a positive considering rates have risen rapidly this year.

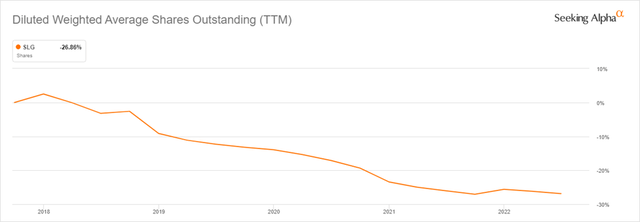

Finally, the company has been buying back its own stock, seeing it as a great value even in today’s volatile market. The shares outstanding have been reduced from 97.5 million at year-end 2017 to 64.3 million today. The company expects to purchase an additional $250 million of its own stock by year-end 2022.

Shares Outstanding (Seeking Alpha)

Headwinds and Potential Risks

The case I have made for SL Green is certainly contrarian as it is an underperforming stock in an already challenging environment. I have highlighted areas of value that could make it an interesting trade, or for those with patience, a possible long-term hold. That said, it is certainly not without risk. After all, this is essentially a leveraged bet on Manhattan office space, a market that was hit particularly hard by the pandemic.

There are no guarantees that management will continue to successfully navigate these uncertain times. The company could become over leveraged, the economy could weaken far more than expected, or the effort to bring people back into the office could stall. While it hasn’t been an issue historically for the company, debt and preferred equity investments could default or need restructuring if those counterparties stumble financially, leading to a revenue shortfall for SL Green (although the size of this exposure has been reduced significantly in the last five years.)

It is difficult to purchase a stock that is down over 40% on the year, and really hasn’t performed well in many years. The thinking here is that the intrinsic value of the company is underappreciated, and the stock price reflects that. Another risk is choosing what will prove to be a good entry point. I think the value of the company far exceeds that of the stock so buying a small position now might make sense. Of course, with a declining broader market, there may be more attractive entry points in the coming weeks or months, depending on how long there is general market weakness. This is a risk when entering any new position, but given this is a contrarian trade, I perceive that risk to be greater.

Final Thoughts

SL Green’s stock has declined significantly this year, far underperforming the broader U.S. market, real estate sector, and even its REIT peers. The case I have made for the company and its stock above is optimistic but based on the current condition and valuation of the business. Like with any position, the near term is difficult to predict, but a reversion of the stock price to intrinsic value would make this an attractive stock to pick up during the current downturn while receiving a large dividend yield. Thank you for reading. I look forward to your feedback in the comment section below.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment