grinvalds

A Quick Take On PROS Holdings

PROS Holdings, Inc. (NYSE:PRO) reported its Q2 2022 financial results on July 28, 2022, beating expected revenue and EPS estimates.

The company provides enterprises with a variety of selling software tools and services.

Until PRO can make a meaningful move toward operating breakeven while igniting faster revenue growth, I’m on Hold for the stock.

PROS Holdings Overview

Houston, Texas-based PROS Holdings was founded in 1985 to provide configure-price-quote and related software originally as on-premises software and more recently on a subscription basis.

The firm is headed by Chief Executive Officer Andres Reiner, who has been with the firm since 2007 and was previously Software developer at Platinum Technology and Product Architect at ADAC Laboratories.

The company’s primary offerings include:

-

Smart Configure Price Quote

-

Smart Price Optimization

-

Airline Revenue Optimization and Management

-

Airline Real-Time Dynamic Pricing

-

Group Sales Optimizer

-

Digital Retail

-

Related Services

The firm acquires customers through its in-house sales and marketing teams as well as through partners, resellers and systems integrators.

PROS Holdings’ Market & Competition

According to a 2022 market research report by Global Industry Analysts, the market for configure-price-quote software was an estimated $1.6 billion in 2020 and is forecast to reach $3.9 billion by 2026.

This represents a forecast CAGR of 16.3% from 2021 to 2026.

The main drivers for this expected growth are a rise in demand as a result of the COVID-19 pandemic, as customers seek more efficient ways to power their sales efforts.

Also, the on-premise segment is expected to continue to dominate even as growth shifts to cloud-based CPQ environments

Major competitive or other industry participants include:

-

Apttus

-

Aspire Technologies

-

Callidus Software

-

Cincom Systems

-

ConnectWise

-

FPX

-

Infor

-

International Business Machines

-

Model N

-

Oracle Corp

-

SAP Ag

-

Vendavo

PROS Holdings’ Recent Financial Performance

-

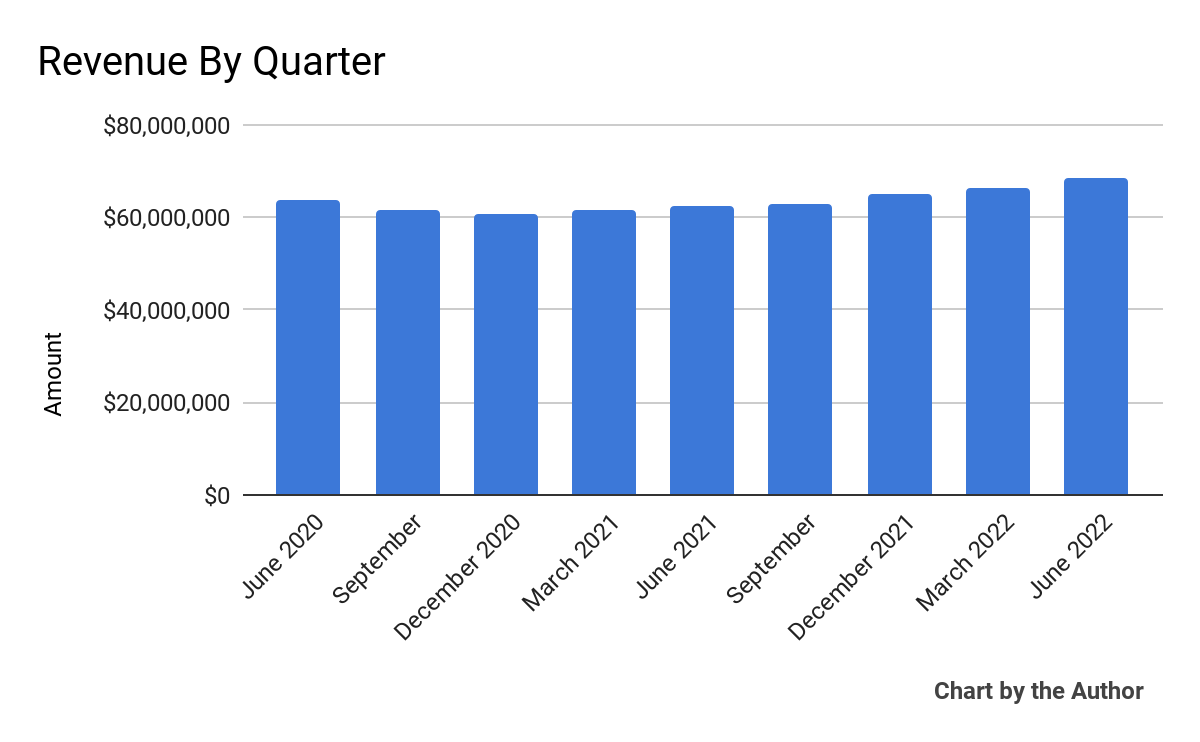

Total revenue by quarter has grown according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

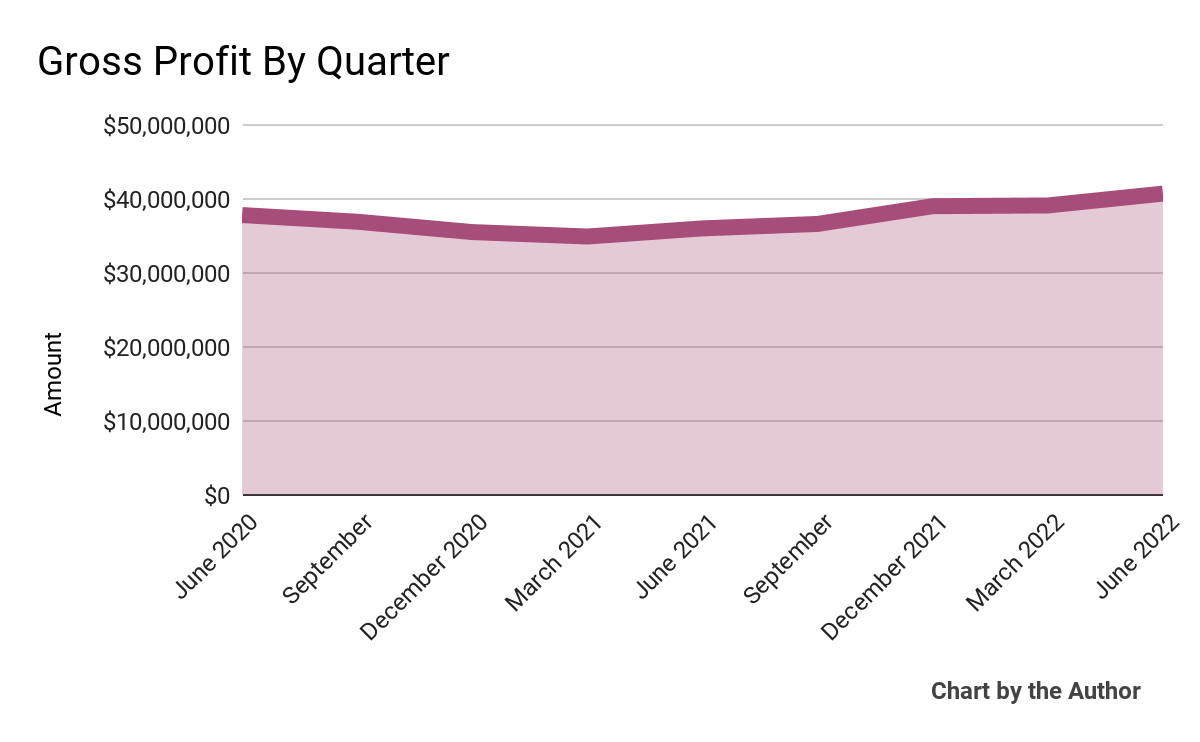

Gross profit by quarter has also risen only moderately in the past several quarters:

9 Quarter Gross Profit (Seeking Alpha)

-

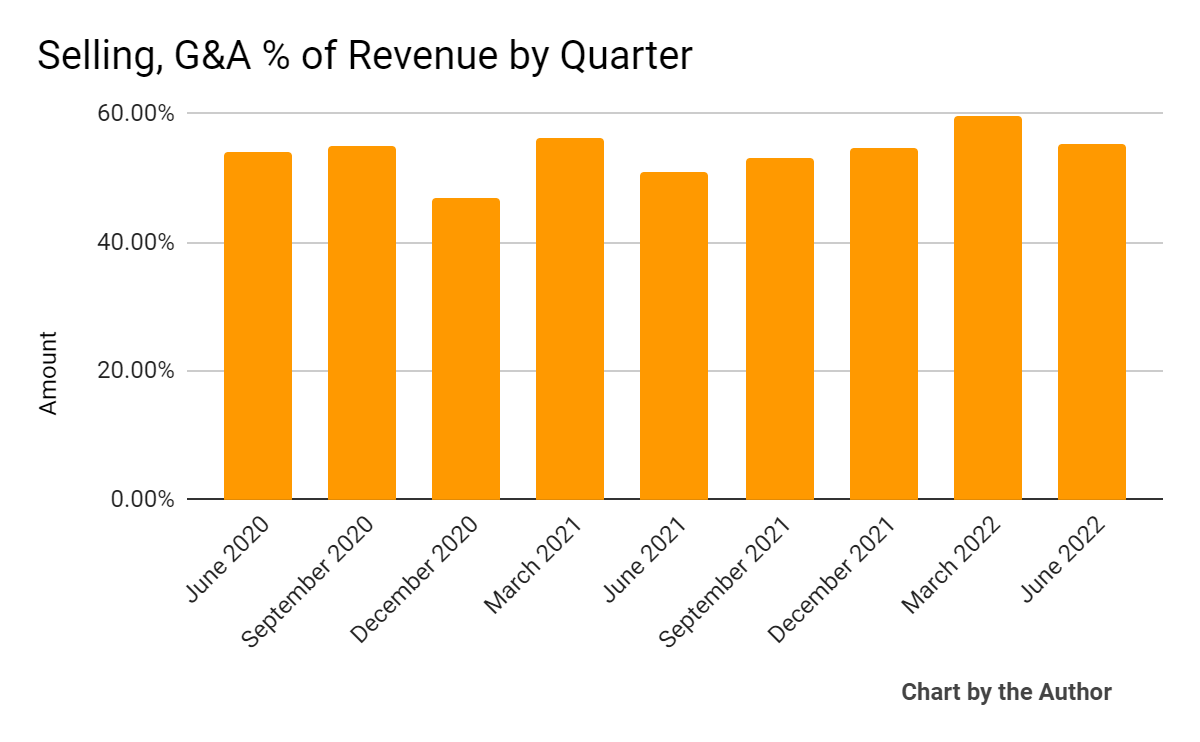

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher recently:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

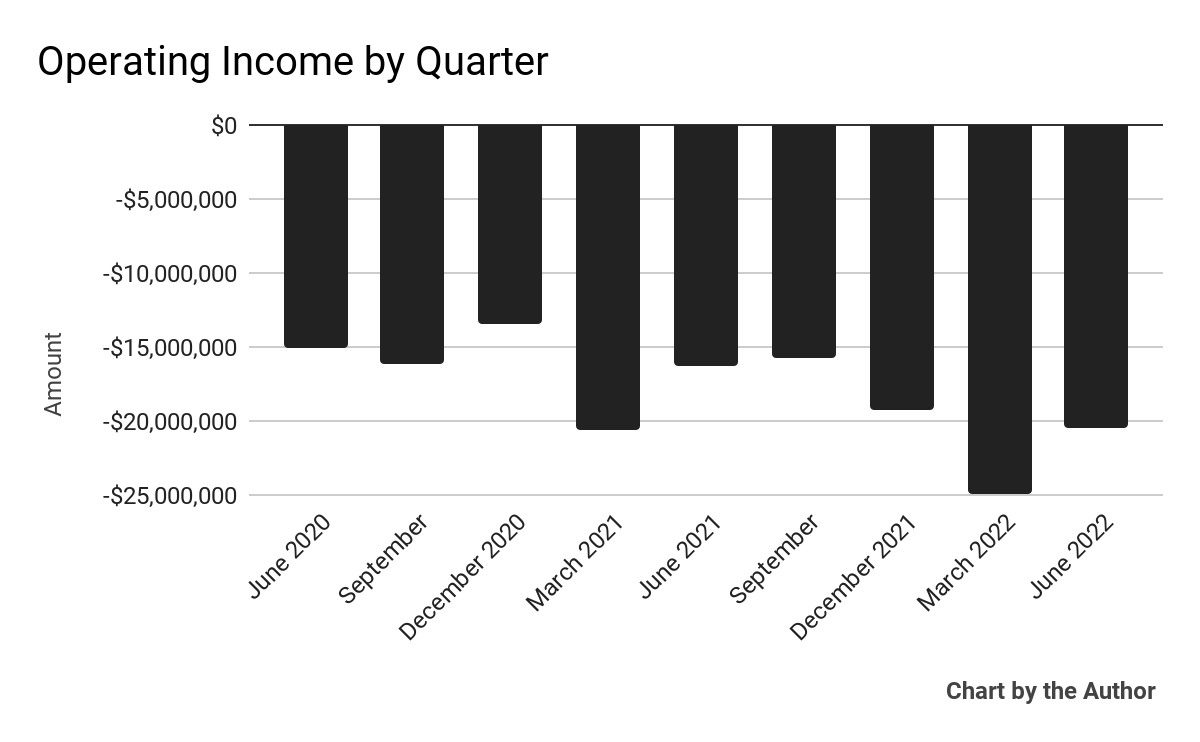

Operating losses by quarter have worsened of late:

9 Quarter Operating Income (Seeking Alpha)

-

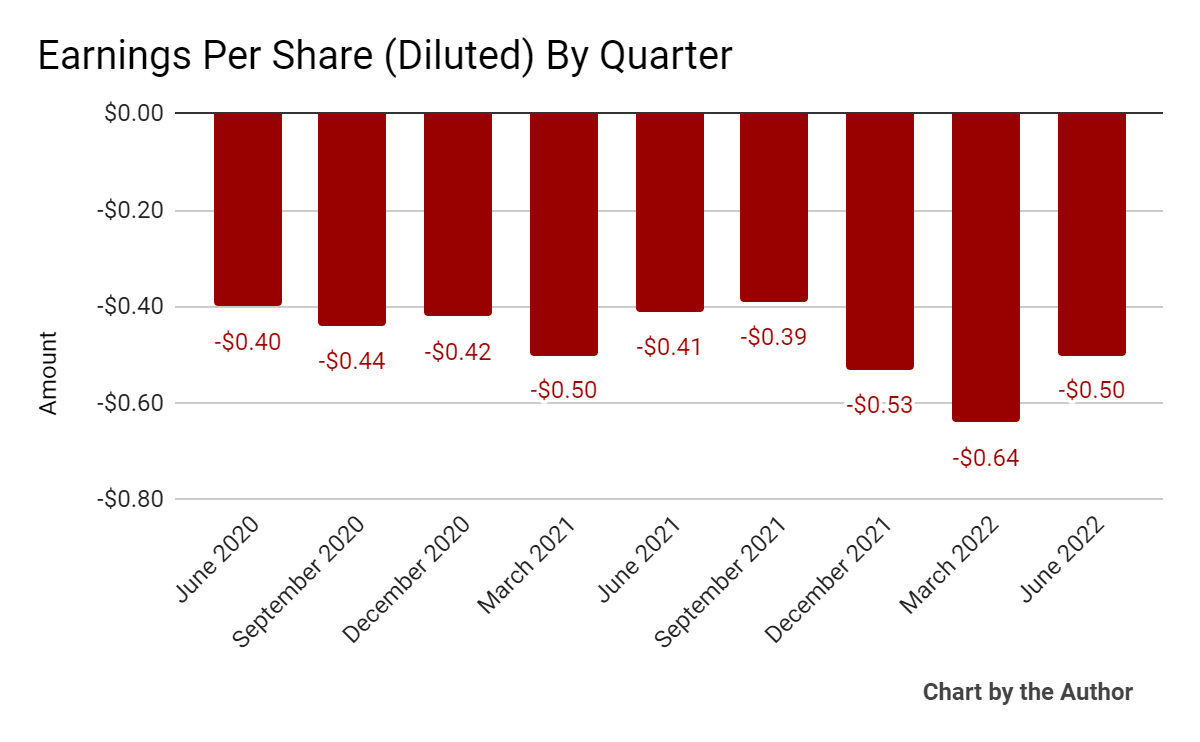

Earnings per share (Diluted) have also remained negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

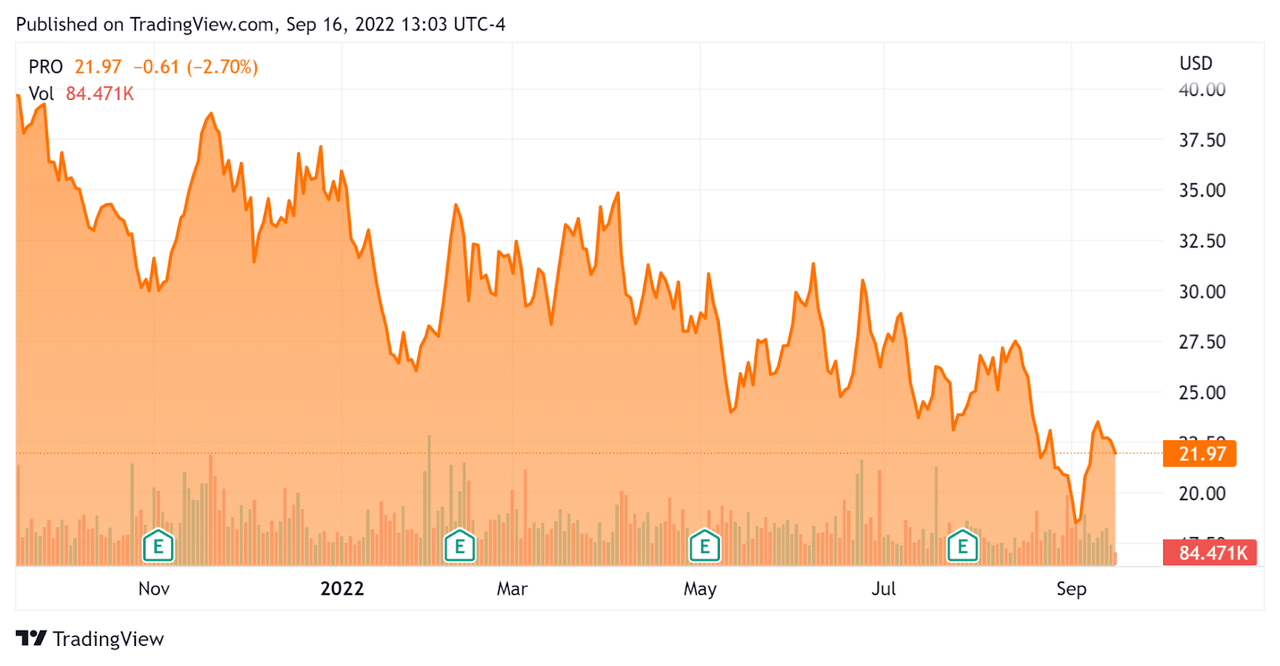

In the past 12 months, PRO’s stock price has dropped 44.4% vs. the U.S. S&P 500 index’ drop of around 14.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For PROS Holdings

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.33 |

|

Revenue Growth Rate |

6.6% |

|

Net Income Margin |

-35.1% |

|

GAAP EBITDA % |

-25.2% |

|

Market Capitalization |

$1,020,000,000 |

|

Enterprise Value |

$1,140,000,000 |

|

Operating Cash Flow |

-$22,090,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.06 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PRO’s most recent GAAP Rule of 40 calculation was negative (18.6%) as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

6.6% |

|

GAAP EBITDA % |

-25.2% |

|

Total |

-18.6% |

(Source – Seeking Alpha)

Commentary On PROS Holdings

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the “more than double” in deal count growth through the first half of 2022, “booking more deals so far this year than we did in all of 2021.”

This was likely due to a greater emphasis by companies in various verticals on improving their supply chain efficiencies as the pandemic threw supply chains into disarray.

Also, the company is seeing growth from certain large air carriers in adopting and expanding use of its offerings.

As to its financial results, total revenue rose by 10% year-over-year, while its subscription revenue component increased by 14%.

The company’s gross dollar retention rate was 93%. I’m not sure about the distinction between “gross” versus the more helpful “net” dollar retention rate. In any event, the result is uninspiring.

PROS’ Rule of 40 results have been poor, producing a negative (18.6%) result for the trailing twelve month period.

For the balance sheet, the firm finished the quarter with cash and equivalents of $215.2 million and debt of $289 million.

Over the trailing twelve months, the company has used free cash of $23.6 million while spending $40.3 million in stock-based compensation.

Looking ahead, management expects full year 2022 revenue to be around $271.5 million, with more than 80% of it in U.S. dollars.

Regarding valuation, the market is valuing PRO at an EV/Sales multiple of around 4.3x.

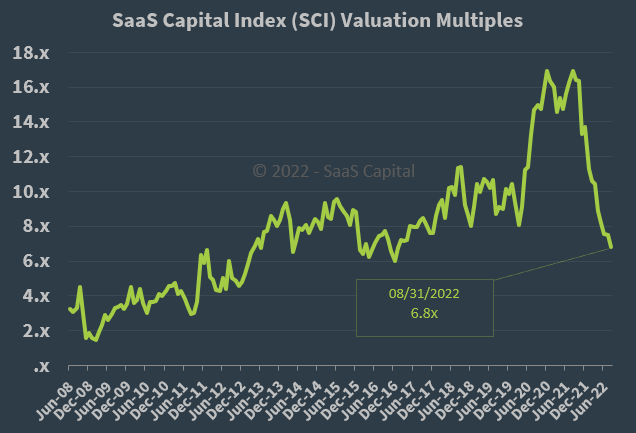

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, although the company is not a pure SaaS firm, PRO is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

PRO is seeking to make a turn toward a cloud-centric approach and appears to be making good progress in that regard.

However, its legacy business may continue to slow its growth rates while the subscription revenue model also represents a slower revenue recognition ramp while expenses remain high.

PRO is starting to generate slightly higher topline revenue growth, but operating losses remain high which is a significant negative in a rising cost of capital environment that punishes money-losing companies.

Until PRO can make a meaningful move toward operating breakeven while igniting faster revenue growth, I’m on Hold for the stock.

Be the first to comment