AnthonyRosenberg

Thesis

V.F. Corporation (NYSE:VFC) has continued to fall after our previous update suggesting the market has continued to force holders to give up their shares. Coupled with the company’s revised FQ2’23 and FY23 guidance, the market sent VFC down further.

Our analysis of its FY27 model indicates that management is confident of revenue reacceleration and operating leverage gains that are even ahead of the prior consensus estimates. However, the market’s reaction suggests that investors remain focused on the near-term demand headwinds in retail, even though global supply chain pressure has eased tremendously.

Given VFC’s global portfolio, with about 40% revenue exposure ex-US (as of FQ1’23), we believe the recent hammering could also be attributed to the surge in the dollar index.

Furthermore, the threat of a global recession has increased, with global economies hampered by the Fed’s accelerated rate hikes, leading to unintended capital outflows. As a result, their ability to leverage further monetary easing has also been crimped, given the record inflation and U.S. interest rates differentials.

We believe the market has been justifiably pricing in the prospects of a global recession hitting the operating performance of companies like V.F. Corp. Notwithstanding, we maintain our thesis that significant damage had been inflicted on VFC’s valuations. Coupled with the recent battering, VFC’s valuations look even more attractive.

Therefore, investors need to ask whether they are convinced that management can deliver its FY27 strategic model. We assessed that the current valuations suggest that the market remains focused on near-term performance.

Accordingly, long-term investors confident of the company’s execution through FY27 could leverage the collapse in VFC stock to add more exposure and ride the next potential wave up.

We reiterate our Buy rating on VFC.

V.F. Corp.’s Revised Guidance Doesn’t Look As Bad As It Seems

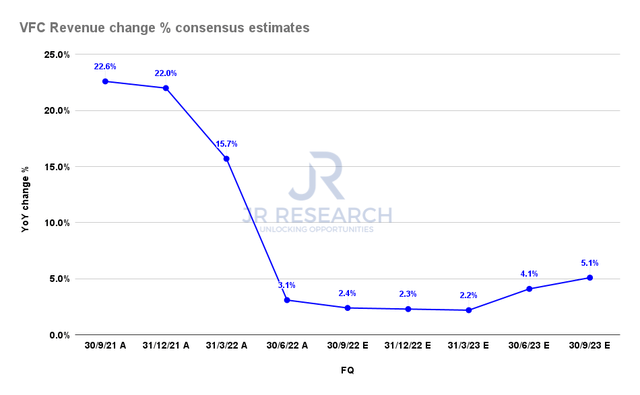

VFC Revenue change % consensus estimates (S&P Cap IQ)

V.F. Corporation revised its FY23 revenue growth guidance from at least 7% to 5.5% (midpoint), as the company expects a much weaker-than-expected performance for FQ2. As a result, it also revised its revenue guidance to be up “low single-digit” for FQ2.

Notably, the prior consensus estimates had likely factored in V.F. Corp’s near-term headwinds, as it projected revenue growth of 2.4% in FQ2. Therefore, the market’s reaction seems focused on its profitability.

V.F. Corp downgraded its EPS guidance markedly for FY23 from $3.1 (midpoint) to $2.65 (midpoint), with FQ2’s performance significantly impacted.

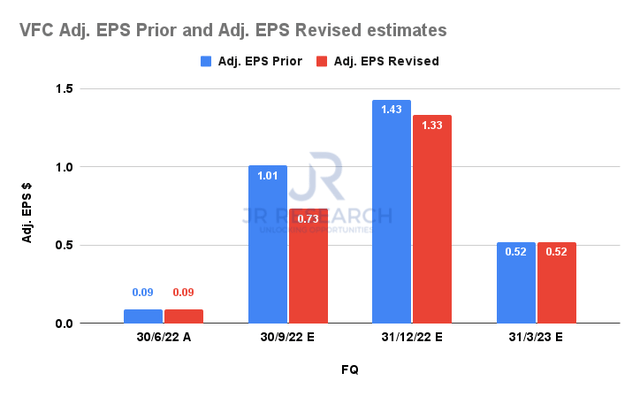

VFC Adjusted EPS comps estimates (S&P Cap IQ)

The consensus estimates had previously modeled V.F. Corp’s FY23 EPS at the lower end of its guidance range. Therefore, we postulate that the Street had already factored in a high level of prudence in its estimates.

However, the company’s revised outlook for FQ2 threw out even the lowest end of its previous guidance range.

As seen above, V.F. Corp’s revised guidance suggests an adjusted EPS of $0.73 (midpoint) in FQ2, down from the previous Street’s consensus of $1.01. Notwithstanding, our analysis indicates the brunt of the revision is likely focused on FQ2, as seen above.

Therefore, we estimate that the revised guidance has a much lesser impact on V.F. Corp’s critical CQ4 (or FQ3) performance and little to no effect on its FQ4 performance ending March 2023.

Accordingly, we believe the company sees transitory weakness centered on the current quarter but does not expect it to be structural. Hence, investors are urged not to panic.

Significant Growth Reacceleration From FY24

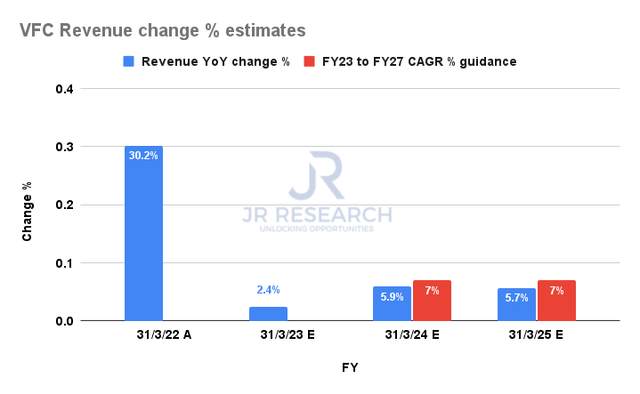

VFC Revenue change % estimates (S&P Cap IQ, VFC management)

Furthermore, the company’s FY27 model indicates that it’s confident of delivering a 7% revenue CAGR (midpoint) through FY27, which is discernibly above the prior modeling by the Street.

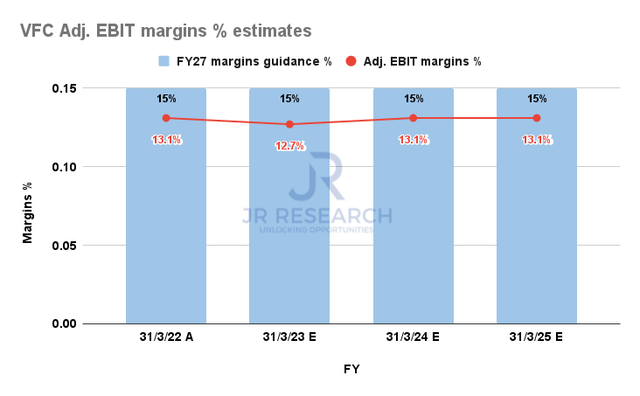

VFC Adjusted EBIT margins % estimates (S&P Cap IQ, VFC management)

Furthermore, management expects to post an adjusted operating margin of 15% by FY27. Accordingly, it suggests that V.F. Corp sees a significant reacceleration in its operating leverage moving forward, lifting its profitability.

Management highlighted in its FY27 model that it sees the opportunity to create more operating efficiencies as it delivers its DTC strategy, supported by a larger share of its ex-US footprint.

Notwithstanding, the reaction from the market suggests that it’s focused on its near-term execution before it accords credibility to management on the projections from its FY27 model.

VFC’s Valuations Have Been Battered

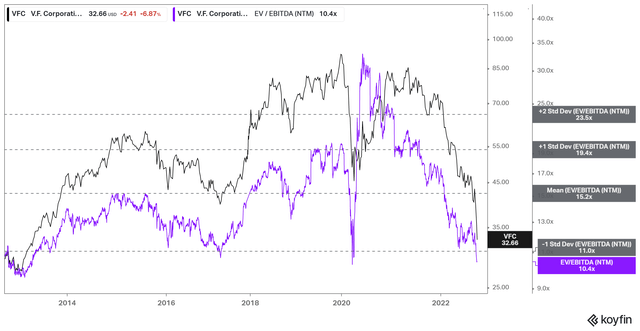

VFC NTM EBITDA multiples valuation trend (Koyfin)

As seen above, VFC’s NTM EBITDA multiples have collapsed to the two standard deviation zone below its 10Y mean. We believe it suggests significant pessimism had already been priced into its near-term execution.

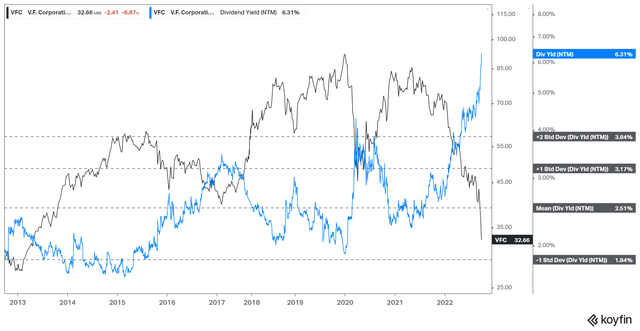

VFC NTM Dividend yields % valuation trend (Koyfin)

Furthermore, its NTM dividend yields have surged well above highly pessimistic levels over the past ten years. Therefore, the market appears to be skeptical that VFC could keep up with its dividend payouts, given the near-term impact on its profitability.

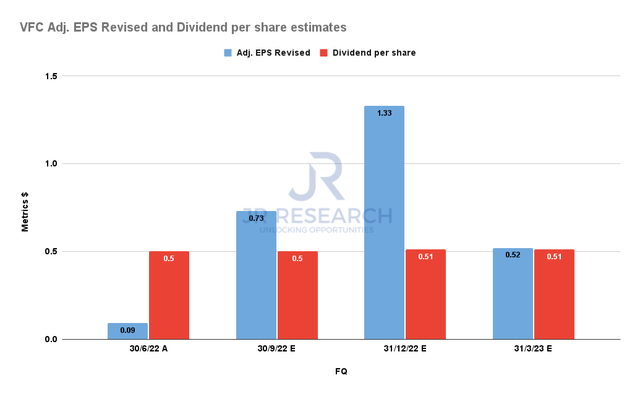

VFC Adjusted revised EPS and Dividend per share estimates (S&P Cap IQ, author’s estimates)

However, we urge investors not to panic, as we assessed that its dividend payouts seem well-covered despite the recent EPS revision for FY23.

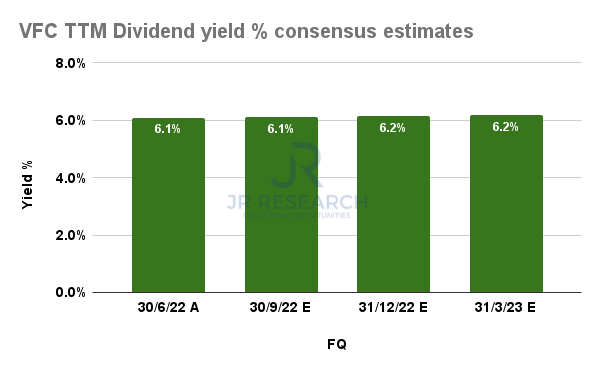

VFC TTM Dividend yields % consensus estimates (S&P Cap IQ)

As a result, we are confident that VFC’s forward dividend yields of more than 6% should continue to offer investors robust valuation support, despite the potential for near-term downside volatility.

Is VFC Stock A Buy, Sell, Or Hold?

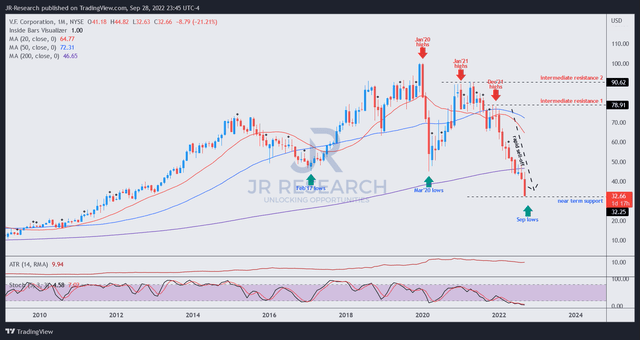

VFC price chart (monthly) (TradingView)

Our analysis indicates that the market has continued its rapid capitulation move on VFC, driving out weak holders and forcing them into submission.

Notwithstanding, we have yet to glean a potential bullish reversal that could form. Therefore, investors should be prepared for near-term volatility, but we believe the extent of the downward move is unsustainable. Hence, we are leaning increasingly bullish and encourage investors to layer in.

Accordingly, we reiterate our Buy rating on VFC.

Be the first to comment