peshkov/iStock via Getty Images

I follow a fair number of managements that intend to be disciplined while making acquisitions. Earthstone Energy (NYSE:ESTE) management clearly “leads the pack” with some of the better bargains. Accretive shareholder deals often benefit shareholders far faster than developing prime locations. The additional diversification that comes with these deals offers management some protection from “acreage surprise” that sometimes disappoints management and shareholders.

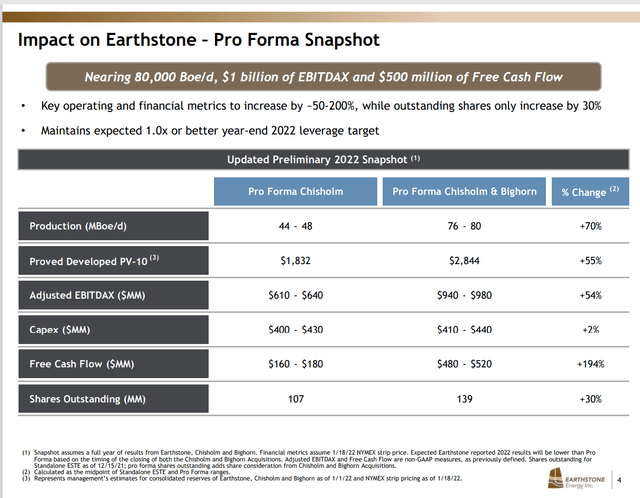

Management announced the acquisition of the Bighorn properties in addition to the recently announced acquisition of the Chisholm properties. The Chisholm acquisition has in fact closed. The Bighorn acquisition closing is still pending. The acquisition of both will create a significantly different company “going forward”.

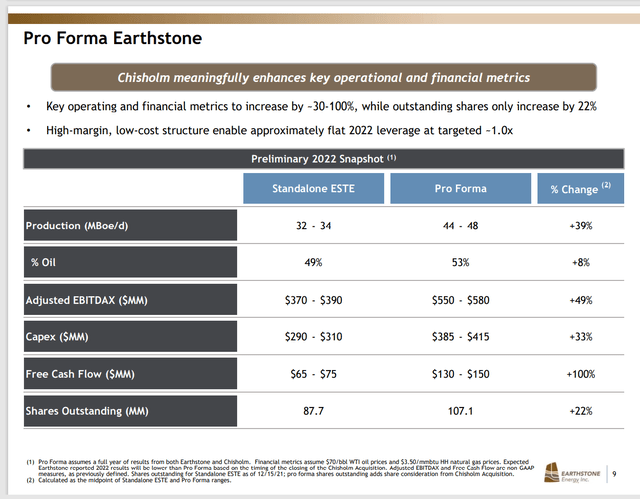

Earthstone Energy Summary Of Financial Benefits Of Chisholm Acquisition (Earthstone Energy Acquisition Presentation January 31, 2022)

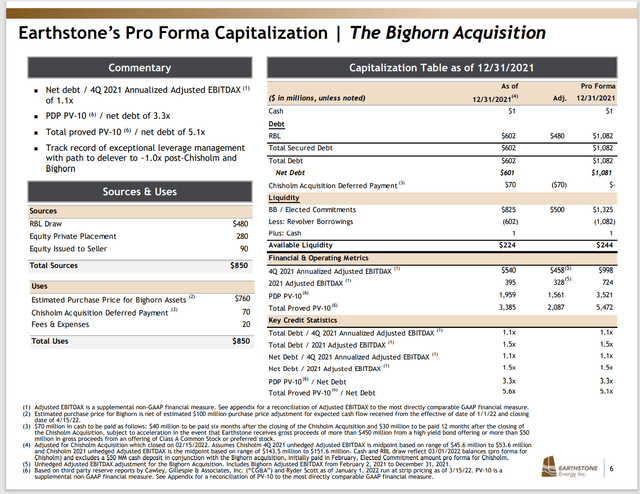

Earthstone is paying about 2.5 times adjusted EBITDAX as shown above for the Bighorn acquisition. That means that the cash flow will be returning the current purchase price quickly. Such an event keeps debt incurred for the purchase low.

Management took out some insurance by using some common shares to purchase the acreage. This allows management to keep the debt ratios low while recovering the cash used in the purchase sooner. Should commodity prices disappoint after the acquisition, management now has common stock used that does not have to be repaid (like debt does) to cushion that disappointment and still repay the debt on a prompt basis.

Debt is something that frequently has to be repaid and serviced in good times and not so good times. Oftentimes in this industry, debt comes due at a bad time. Management is keeping ratios conservative so that the down part of the cycle does not threaten the viability of the company.

Interestingly, this is a debt averse management. The fact that management is using debt at all speaks to the optimism about the future of commodity prices “for the time being”. At the same time, management is not risking the company by “piling on the debt” and then attempting to deleverage quickly. This industry probably has too low visibility for that strategy.

The other thing this management emphasizes is the free cash flow. That free cash flow can be used for future deals or repayment of long-term debt. This management knows full well that the best deals are often available during industry downturns when few can buy much of anything. Therefore, the careful increase in financial flexibility as shown by the growth of free cash flow is an important aspect that many skip.

Compare To ConocoPhillips

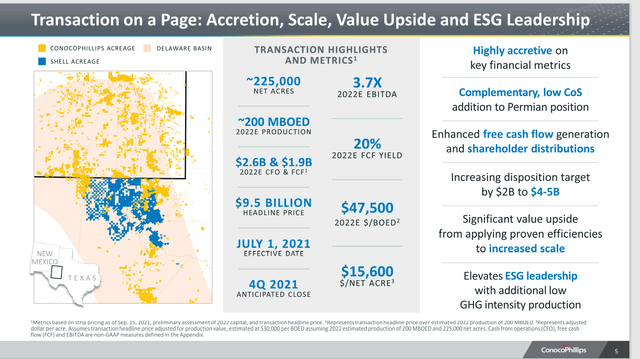

ConocoPhillips (COP) would appear to exhibit far less discipline than was shown by Earthstone management in the current deal.

ConocoPhillips Purchase Of Shell Permian Acreage (ConocoPhillips Purchase Of Shell Permian Acreage September 2021.)

Despite the fact that this transaction took place during a time of weaker pricing, this transaction features an EBITDA ratio that is far higher. Large properties tend to have less competition as fewer bidders are in a position to acquire the acreage. That makes the price paid for this acreage all the more remarkable even if it is “prime Permian acreage”.

Generally, shareholders pay management to find bargain acreage that outperforms the purchase price. When a higher EBITDA or EBITDAX ratio is paid “up front”, that significant outperformance is unlikely. The rise in commodity prices should ensure good results from both this purchase and the proposed transaction shown above for Earthstone.

But higher acreage costs often result in a far more expensive location cost that the more productive well must overcome. Since most companies give breakeven results without any acreage cost in that breakeven calculation, it is logical for investors to consider that the acreage cost of the well will be repaid after the well breaks even on the well costs. But that would mean far lower production is left to account for the purchased acreage. That is probably why many companies do not account for acreage costs in their breakeven presentations to shareholders.

Earthstone Energy management tends to look for acreage that is not prime for one reason or another. That acreage will have less bidding competition and will often have a lower price for the reason that the acreage is not prime. Shareholders pay management to find bargains that make good money for the price paid. Oftentimes, purchasing prime acreage will make money. But it will not make the money that a bargain often produces with less than prime product mixes and other issues that reduced the selling price.

In some ways, it was kind of like buying an unloved house. I often found a house that was less than ideal because the selling price went down far more than the cost to return the house to a more marketable condition. I moved a lot as a professional and it was necessary for me to find a bargain just in case the company wanted to move me again. One time, they moved me three times in a year. A bargain purchase each time was essential to me being able to move as the company’s needs demanded.

Back To Earthstone

So many managements talk about doing deals. Earthstone management has a long history of doing accretive deals through the various companies they have built and sold. Obviously, this company will be built to attract bidders at some point. In the meantime, management is building a better company until the appropriate time comes.

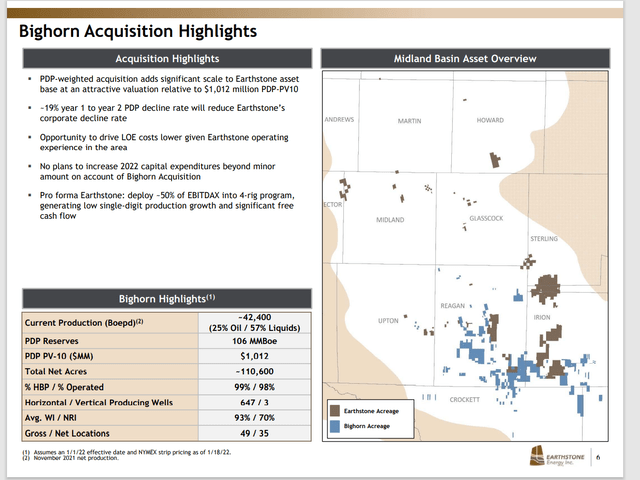

Earthstone Energy Description Of Bighorn Acquisition Advantages (Earthstone Acquisition Presentation January 2022.)

One of the reasons that this acreage is cheaper is due to the relatively high percentage of natural gas and natural gas liquids. However, that production mix can be overcome with higher production volumes and cheaper well costs that lead to overall greater profitability.

Just taking the gross cost divided by the acreage leads to a cost of less than $8,000 per acre. Undoubtedly the acreage contains some supporting infrastructure as well that adds value to the purchase.

That price per acre is a price that is low even for dry natural gas producers before considering any value-added characteristics. An investor seeing a purchase like this one should consider that corporate profitability will take a significant jump from that low acreage purchase price combined with the currently strong commodity pricing.

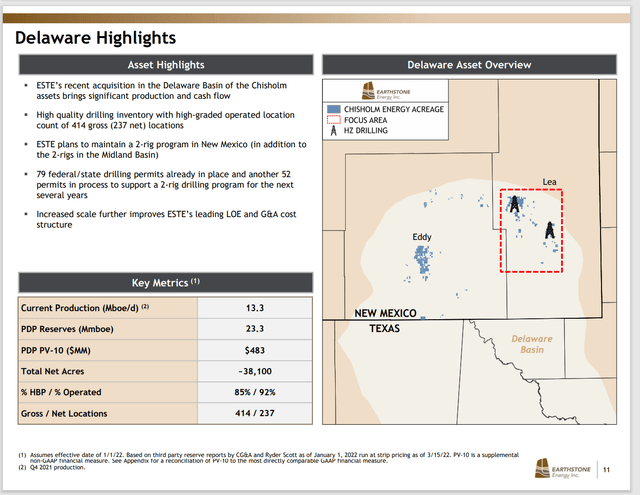

Earthstone Energy Description Of Bighorn Acquisition Advantages (Earthstone Energy Chisholm Acquisition Presentation December 16, 2021.)

The Chisholm acquisition was an even lower ratio to adjusted EBITDAX because a fair amount of acreage requires federal permits. The gross purchase price of $604 million adequately surmounts any concerns about the ability to get more federal permits by returning the purchase money quickly. The sellers retain some appreciation potential through their acceptance of company stock.

The interesting thing is that commodity prices have climbed skyward since this acquisition was announced. So here is the management update.

Earthstone Energy Update On Acquired Chisholm And Other Acreage (Earthstone Energy March 2022, Corporate Presentation)

The company had an adequate supply of permits on hand to support continued drilling well into the future. Management is taking advantage of the current situation to get as many permits approved as is reasonably possible. The chances of this purchase showing an adequate profit are enhanced by some careful considerations noted in the purchase presentation. Management got lucky in that commodity prices climbed to “nosebleed levels”. But luck favors managements that position the company correctly.

This is precisely what investors pay management to do. Management should find bargains that others do not want at a price that should assure a reasonable profit even if things go wrong. In this case, the upside is that federal permits are still being processed. If anything, the federal government wants to process more permits (and the sooner the better). That situation could allow for considerable upside as long as it persists.

There is a risk of purchasing so many large purchases at one time. The purchases may not optimize as management envisioned, leaving shareholders stuck with subpar performance. Future oil and natural gas prices could fail to meet the projections made at the time of the acquisition. Most of the risks will be minimized by a management that has built and sold companies successfully in the past. The depth of experience is unusual for a company of this size.

Earthstone Energy Pro Forma Capitalization For The Bighorn Acquisition (Earthstone Energy March 2022, Corporate Presentation)

Management appears to have a great handle on key operating ratios. In the past, this company sold stock to reduce debt at an accelerated rate. So that may happen at some point in the future. But even if that does not happen, debt levels appear to be conservative enough that the company can easily surmount any unexpected challenges.

Natural gas prices have provided an unexpected boost to the company profitability. In the meantime, there is an excellent chance that the market really does not reflect the improved natural gas pricing outlook in the future. So, there could be more of these “gassy” bargains out there that are reasonably priced (or better).

The outlook for Earthstone Energy appears to be very bright. This management appears to be building a company that is likely to reward long-term shareholders similar to past deals. There is no guarantee of success of course. But the low financial leverage keeps financial risks low while the accretive deals add immediate value to the common stock. This is definitely a company for investors to consider.

Be the first to comment