Justin Sullivan

Wells Fargo (NYSE:WFC) is a conservative bank with no exciting plans ahead of itself. Its forward guidance estimates show relatively low strength but do not mean this company will lose money. As the world moves into a potentially long-term recession, this may be worthwhile to hold to earn a minor, predictable profit over the coming years.

Fundamentals have been flat

Ratios

The profit margin has been very flat for Wells Fargo stock.

|

Metric |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Days of sales outstanding |

271.615 |

253.706 |

234.088 |

296.803 |

182.774 |

|

Net profit margin |

0.257 |

0.259 |

0.230 |

0.046 |

0.275 |

Source: Financial Modelling Prep

Data

All significant simple moving average periods show a profit, but it is pretty substandard versus other companies. So as we know about the opportunity cost to invest in Wells Fargo, it would be better to look elsewhere for higher profitable companies with faster-moving stock prices.

|

Metric |

Values |

|

SMA20 |

0.26% |

|

SMA50 |

5.09% |

|

SMA200 |

1.23% |

Source: FinViz

Enterprise

Consider that Wells Fargo’s stock price historically peaked in 2017 and steadily dropped to 2020 levels during the pandemic. However, Wells Fargo’s stock price bounced back quite nicely, nearly doubling in 2021.

Market capitalization has steadily declined from 2017 to the pandemic of 2020. But, just like the stock price, Wells Fargo’s market cap nearly doubled last year.

|

Metric |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Symbol |

WFC |

WFC |

WFC |

WFC |

WFC |

|

Stock price |

65.280 |

50.090 |

47.910 |

29.880 |

54.190 |

|

Number of shares |

4.965 B |

4.800 B |

4.393 B |

4.118 B |

4.062 B |

|

Market capitalization |

324.089 B |

240.417 B |

210.473 B |

123.046 B |

220.114 B |

Source: Financial Modelling Prep

Estimate

For guidance, it’s very conservative at Wells Fargo as they only offer two years out. Most companies with future solid momentum will offer up to six years. When there are only two, it shows that the company might be very uncertain about its future in my opinion. Also, it is generally common knowledge that Wells Fargo is a very conservative bank.

As one can see, the revenue has about a 10% growth rate over two years. Therefore, the dividend yield may appreciate by 50%, but it’s still relatively low compared to higher offerings of dividends elsewhere. However, earnings per share grew, so one hopefully expects the stock price to do well based on this expectation.

|

YEARLY ESTIMATES |

2022 |

2023 |

2024 |

|

Revenue |

74,209 |

81,615 |

83,098 |

|

Dividend |

1.10 |

1.33 |

1.59 |

|

Dividend Yield (in %) |

2.36 % |

2.84 % |

3.40 % |

|

EPS |

3.77 |

5.13 |

5.76 |

|

P/E Ratio |

12.39 |

9.11 |

8.11 |

|

EBIT |

20,800 |

28,826 |

29,555 |

|

EBITDA |

– |

– |

– |

|

Net Profit |

14,691 |

19,080 |

20,714 |

Source: BusinessInsider

Technical Analysis Shows Decent Recovery

Fibonacci

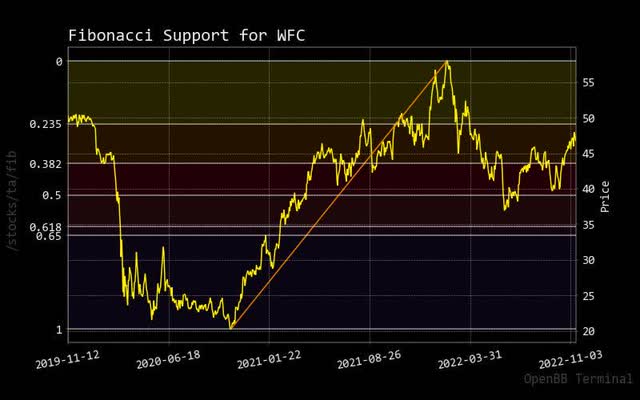

it might take a few weeks to months for the stock price of Wells Fargo to hit its prior high in the last year. The recent week’s simple moving average moves may take longer than one would imagine. There appears to be minimal momentum in the stock price for Wells Fargo.

fibonacci well fargo (custom platform)

Bollinger Bonds

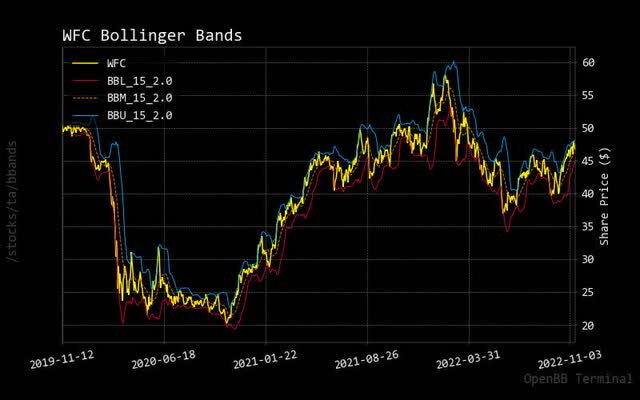

Based on the most current price action of Wells Fargo stock price, the price may increase faster than one would think.

bollinger wfc (custom platform)

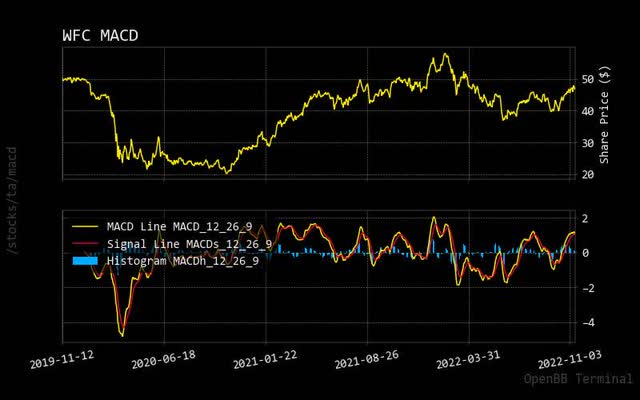

MACD

When an investor looks at the most recent MACD price action, it shows minimal declines; shows near full price recovery. So the current stock price of Wells Fargo has demonstrated the potential of maxing out as it may start to pull back to the zero line.

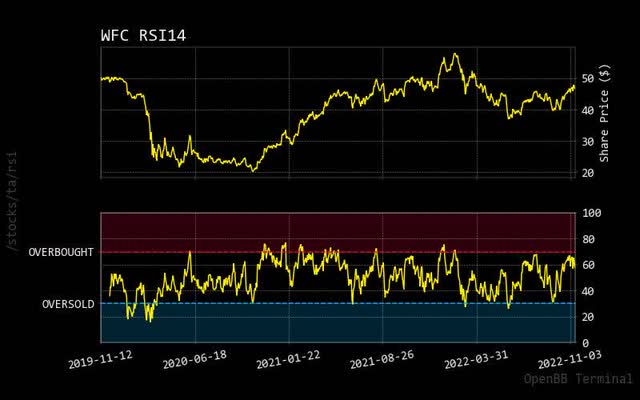

RSI

As predicted, the most recent stock price action of Wells Fargo has reached its maximum potential on this last upswing. It will then decline or go flat as the RSI drops back to a more reasonable rating of potentially 50. As the fundamentals confirmed, there needs to be more sustainable momentum to continuously drive up the stock price of Wells Fargo.

Prediction via AI

Monte Carlo

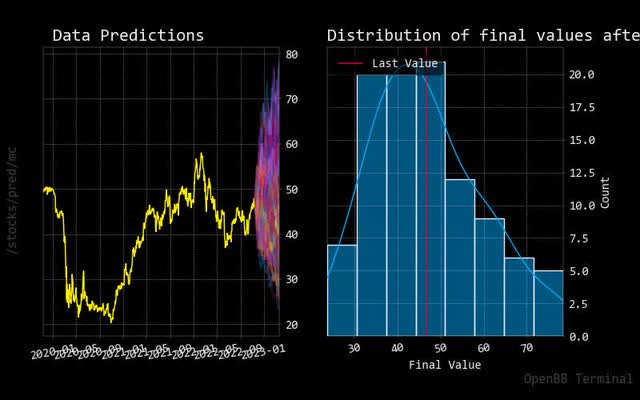

This Monte Carlo simulation shows an approximate 3:1 or 3:2 ratio of higher stock price activity. As a result, there is a higher probability for the Wells Fargo stock price in the predictive paths.

The accompanying normalized distribution does show a higher probability for stock price expectations to grow. The amount shown could be more convincing, but the trend is clear to see an anticipation of higher prices in Wells Fargo.

montecarlo wfc (custom platform)

Regression

As for the 30-day forecast, it has a red regression line; there appears to be no stock price upswing or downswing. Weak stock growth is confirmed by last week’s simple moving average of 20 working days.

regression wfc (custom platform)

Risk Show Safe Bet Moving Forward

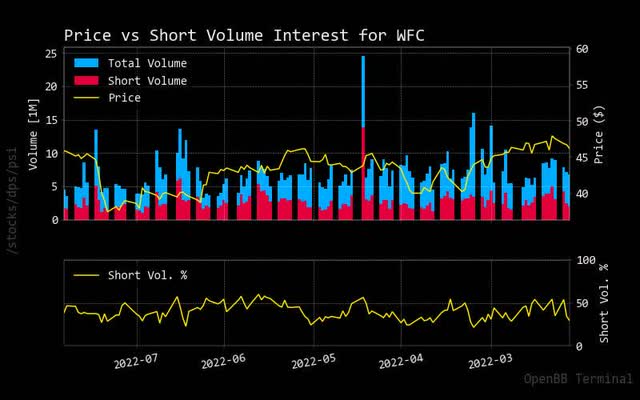

As there was a short-lived stock price upswing for Wells Fargo, the needed interest to potentially short against the stock price was not favored; therefore, it dipped well below the 50 percent line.

shorting wfc (custom platform )

Source: StockGrid

Recommendation

In the past week or month, one can see how market analysts have been very conservative but still mostly have a buy rating. However, it was only on the last day that these analysts signaled a sell rating.

|

Interval |

RECOMMENDATION |

BUY |

SELL |

NEUTRAL |

|

One month |

BUY |

13 |

4 |

9 |

|

One week |

BUY |

10 |

7 |

9 |

|

One day |

SELL |

4 |

13 |

9 |

Source: Trading View

Sustainability

One bright spot for Wells Fargo is its sustainability rating with an outperformance. Again, this bank appears to set standards that any bank should be able to achieve despite how many loans they offer.

|

Metric |

Value |

|

Social score |

15.4 |

|

Peer count |

172 |

|

Governance score |

15.51 |

|

Total esg |

32.84 |

|

Highest controversy |

5 |

|

ESG performance |

OUT_PERF |

|

Percentile |

72.65 |

|

Environment score |

1.94 |

Source: Yahoo Finance

Due Diligence

Price Target

Sometimes market analysts will set arguably unrealistic stock price targets for any company to meet. In the case of Wells Fargo, I think one can see this, which sometimes means that either the stock price is underperforming or market analysts are unrealistic with their predictions.

Source: BusinessInsider

Conclusion

As Wells Fargo is a reasonably conservative bank that showed weak but profitable strength over the last 200 working days, it is safe to say that there will be slight growth in the stock price. As my fundamental analysis shows, there is a forecasted drop in the stock price. The further analysis says the opposite. Despite there being no certainty on market direction for Wells Fargo and its conservative stance in future growth, it is best to place this stock on hold. Unless strong momentum comes into the stock price, which shows it will outperform its competition, it might be best for investors to look elsewhere for a better long-term opportunity.

Be the first to comment