Yevhenii Orlov

Article Thesis

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) reported third-quarter results that blew away estimates and that showcased excellent progress versus the previous year’s quarter. TSM is growing its advanced technologies business at a hefty pace, which bodes well for the future.

At the same time, TSM trades at a very inexpensive valuation, especially when we consider its outstanding growth. Geopolitical risks persist but seem to be more than priced in at current prices, potentially making Taiwan Semiconductor Manufacturing Company a good investment at current prices.

What Happened

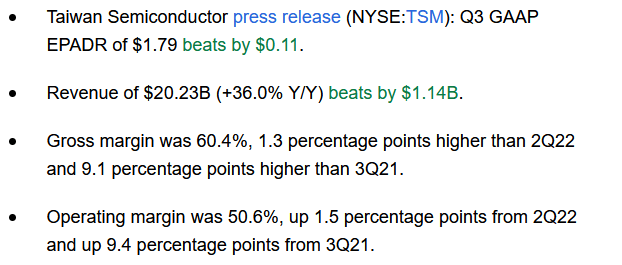

Taiwan Semiconductor Manufacturing Company, the world’s largest and most important foundry, reported its third-quarter 2022 earnings results on Thursday. These were the headline numbers:

Seeking Alpha

Everything in this report showed excellent progress versus the previous year’s quarter, and TSM also easily outperformed expectations. Revenue estimates were beaten by more than 5%, while EPS estimates were beaten by 7%.

The company also managed to grow its margins a lot, as both its gross margin as well as its operating margin were up by more than 900 base points when compared to last year’s third quarter. Importantly, margins also were up on a quarter-to-quarter basis, which indicates that the semiconductor slowdown has not hit the company yet — it is becoming ever more profitable, both on a year-over-year basis as well as on a quarter-to-quarter basis. The same holds true for TSM’s revenues, which were also up on a sequential basis on top of rising by more than one-third on a year-over-year basis.

TSM Continues To Perform Well

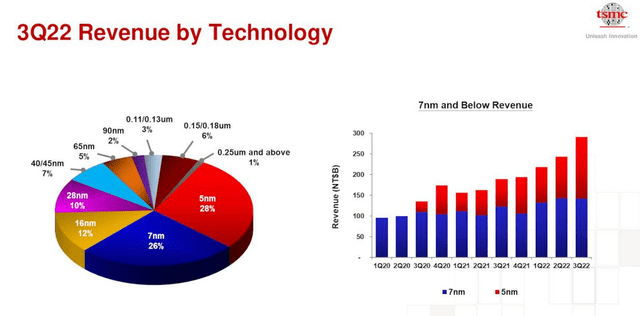

Taking a deeper look into Taiwan Semiconductor Manufacturing’s results, there are a couple of important things to note. First, the product mix for TSM continues to improve, as it has over the last couple of quarters:

While Taiwan Semiconductor Manufacturing had generated less than NT$150 billion in revenue from 5nm and 7nm products two years ago, that amount has roughly doubled to around NT$300 billion during the most recent quarter. That’s easily more than 50% of the entire revenue the company generates, while older/larger processes continue to dwindle in importance. This trend shows that TSM remains the partner of choice for companies with high-end products that require these processes, which is beneficial for TSM from a revenue per chip perspective, and since these advanced products allow TSM to generate/demand higher margins from its partners it manufactures chips for, such as NVIDIA (NVDA).

Taiwan Semiconductor Manufacturing’s broad gains in these advanced technologies make it more specialized and unique over time, as its exposure to more commoditized products shrinks. In theory, that should give the company more bargaining power when it comes to demanding higher prices for producing chips, as the higher-tech products it now increasingly manufactures can’t be produced by a wide range of competing foundries. In other words, high-end fabless chip companies are more or less forced to work with TSM, giving TSM the ability to continue to demand premium prices that are beneficial for its margins which have been developing very well in recent quarters.

Looking at the end markets TSM produces for, smartphones and high-performance chips remain the two largest groups by far, with a revenue share of around 40% each. Taiwan Semiconductor Manufacturing has made gains in smaller, higher-growth markets, however, such as the Internet of Things and the automotive space. These do not yet provide for massive market potential yet, but their higher relative growth rate, compared for example to the smartphone market, should have a positive impact on TSM’s overall revenue growth potential in the long run. Automotive chips, for example, will see a lot of growth over the next decade due to two trends: Electrification, as EVs require more chips than ICE vehicles, e.g. for battery management, and autonomous driving technology which requires a lot of sensors and processors in order to allow these vehicles to make decisions themselves. The automotive chip market is thus poised to grow for many years, and TSM’s growing exposure to this market bodes well for its potential to grow its revenue further going forward.

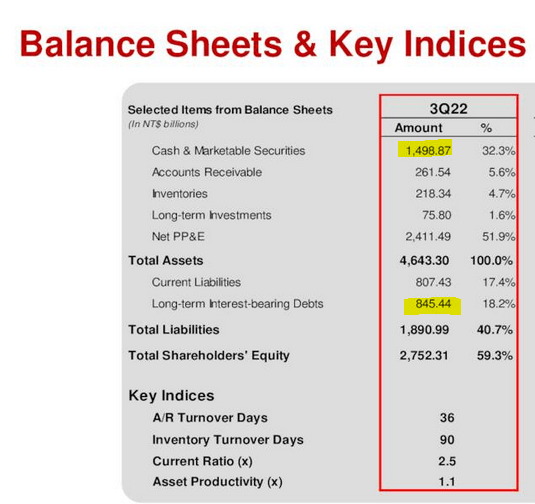

Excellent Balance Sheet And Shareholder Return Potential

Taiwan Semiconductor Manufacturing Company is a company that needs to invest heavily in new fabs, machines, and so on. Unlike fabless chip companies, it has large capital expenditures. But still, the company is operating with a very clean balance sheet, as we can see in the following slide from its earnings release:

TSM presentation

Its total cash position, including marketing securities, totaled NT$1.5 trillion at the end of the third quarter. That’s close to twice as high as its long-term debt of NT$850 billion. Even when we include all other liabilities, such as accounts payable, which are not bearing interest, total liabilities are only slightly higher than TSM’s cash position. When we include current assets such as inventories and accounts receivable, cash and current assets are around equal to TSM’s total liabilities (not all of that being debt). In other words, TSM is operating with a very clean balance sheet, which means two things. First, the company is safe from interest rate risk. Since it is not operating with meaningful net debt, rising interest rates aren’t hurting its profitability meaningfully. On top of that, the strong balance sheet also means that TSM is well-positioned to maintain or even increase shareholder returns if it wants to.

Taiwan Semiconductor’s cash flows from operation totaled NT$413 billion during the most recent quarter. At the same time, the company invested NT$266 billion into new equipment. That pencils out to a free cash flow of NT$147 billion — or US$4.6 billion at current exchange rates. On an annualized basis, TSM is thus generating free cash flows of more than $18 billion right now, despite investing at a more than US$30 billion a year pace. With growth investments this high, ongoing business growth is very likely, and yet the company still generates massive free cash flows at the same time. Those were partially used for dividend payments during the third quarter, while the company also used some of its free cash flows to reduce debt levels.

Further debt paydown isn’t really required due to the balance sheet already being pretty strong, thus TSM might shift towards a more shareholder-return-centered approach. I do believe that share repurchases could be highly valuable at current valuation levels — TSM is trading at just 10x forward earnings while still growing at a massive rate. Buying back shares at this valuation and reducing the share count could be highly value-creating in the long run, as shareholders will profit forever from the fact that future profits and dividends would be distributed over a smaller number of shares.

TSM’s most recent dividend of NT$2.75 per share pencils out to US$0.085 per share, which translates into a $0.43 per ADR dividend (the conversion ratio is 1 ADR being equal to 5 shares). Annualizing that amount gets us to $1.72, which translates into a dividend yield of 2.7%. That’s not an ultra-high dividend yield, but way higher than the dividend yield of the broad market. It’s also very rare to see a company offering a dividend yield of close to 3% that is growing at a 30%+ annual pace, making TSM look compelling for dividend growth investors.

Low Valuation Due To Potentially Overblown Macro Risks

Today, TSM is trading for just 10x this year’s expected net profit. Since TSM has easily outperformed expectations for the third quarter, EPS estimates for the remainder of the year could rise, which would make TSM even cheaper. A company that is growing at a 30%+ rate that is trading at an earnings yield of 10% is pretty rare. The reason for this low valuation is mainly that the market fears a conflict between China and Taiwan. While that is a risk for sure, I do believe that investors are potentially pricing it into TSM’s stock to a too-high degree. Other companies that would be extremely exposed to such a conflict, such as Apple (AAPL) or Tesla (TSLA), are not nearly trading at valuation levels that are historically low. Thus it seems like a disconnect when the market prices TSM like war is very likely, while other highly exposed stocks are trading like war is very unlikely. The ongoing war in Ukraine also could show the Chinese leadership that war isn’t a good idea, hopefully reducing the risk of escalation between China and Taiwan.

So while this geopolitical hotspot remains a key risk for TSM, I do believe that it is more than fully priced into TSM’s stock right now. Keeping exposure limited makes sense, but I believe that the risk-reward ratio is making TSM look like an interesting investment at current ultra-low valuations.

Be the first to comment