photoman/iStock via Getty Images

This article was coproduced with Chuck Walston.

(Chuck Walston has been writing on Seeking Alpha since 2013 and we welcome him to both iREIT on Alpha and Dividend Kings).

As 2022 dawned, shares of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) reached a 52-week high of $145. Starting in mid-January, the stock tumbled for nearly six months before hitting a year-to-date low of roughly $74.

Record revenue in Q1, followed by a strong second quarter, resulted in a lackluster boost in the share price.

Lost among concerns that TSM operates in a cyclical industry, the ever-present threat mainland China presents, and customer’s increasing inventories, is the preeminent position TSM holds in the semiconductor industry.

TSM is a veritable poster child for a wide moat business. As such, it commands hefty margins and has a long growth runway.

TSMC’s Quarterly Results Speak Volumes

Back in April, TSM reported record revenue for the month of March of $5.94 billion, up 35% year-over-year. Revenue for the entire quarter stood at $16.97 billion, a 35.5% increase from the comparable quarter.

Q2 results, reported in the middle of last month, beat on the top and bottom line. Revenue was up year-over-year by 36.6% to $18.16 billion. Net income and diluted EPS both increased by 76.4%, year-over-year. Revenue increased 8.8% and net income grew 16.9% relative to Q1 ’22.

Operating margin of 49.1% beat the upper end of management’s guidance by more than 2%. Gross margin for the quarter was 59.1%, and net profit margin was 44.4%.

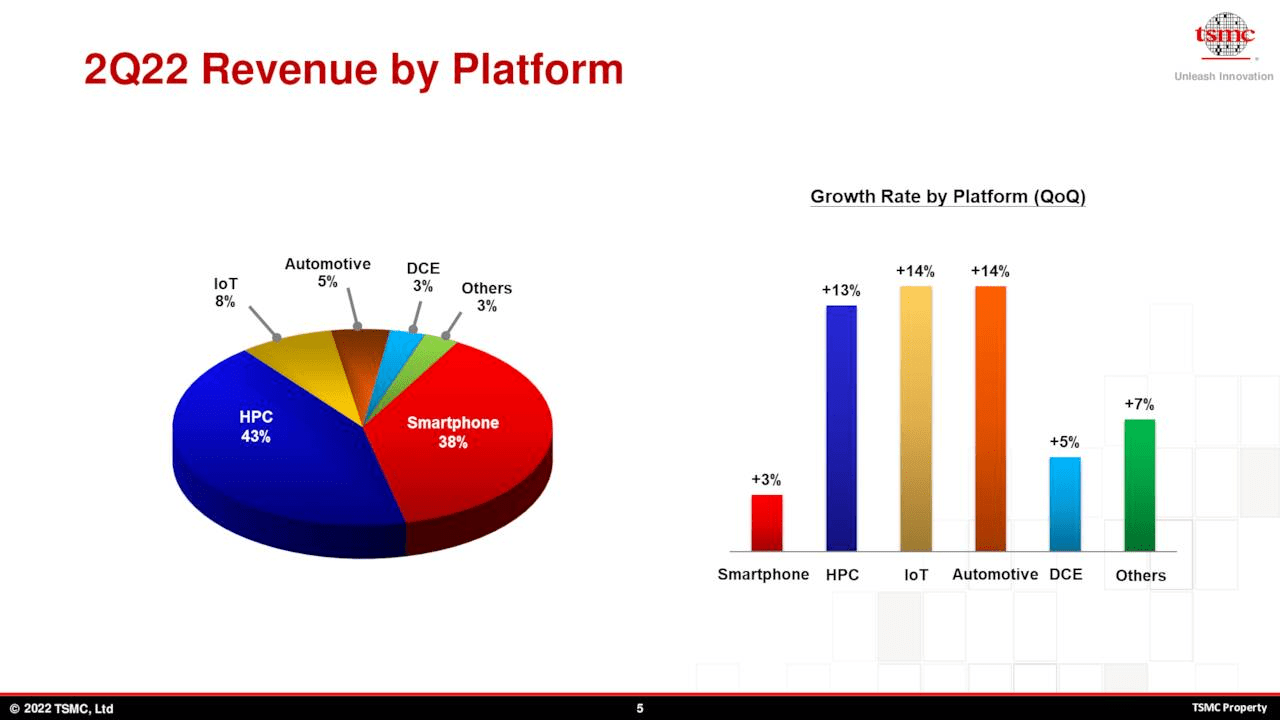

TSM recorded increased demand in every product category, with HPC, IoT and Automotive all witnessing double digit growth.

TSM Investor Presentation

Had management provided weak guidance or expressed concerns regarding demand going forward, I’d be better able to wrap my head around the marked drop in the share price.

The fact is that TSM forecasts margins in the latter half of the year to largely be in line with the latest results. At the same time, revenue is forecast in a range of $19.8 billion to $20.6 billion in Q3, a significant jump from previous quarters.

Management also guides for sustainable annual sales growth of 15%-20%, which is about double its earlier target range.

So I must ask the question: what do the bears see that I might be missing?

A Bear’s Perspective

An understandable concern is the cyclical nature of the semiconductor market. Add to that the swollen inventories of some customers now that COVID related surges in demand are waning.

In particular, PC demand is down and smartphone shipments are shrinking, in part due to supply chain disruptions. Smartphones generate 38% of TSM’s total revenue, so a significant drop in demand would undoubtedly weigh on the stock.

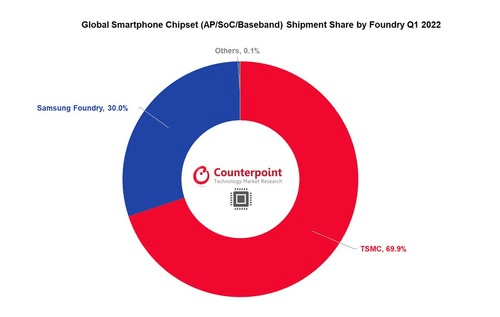

CISION

TSM reported a 3% increase in smartphone revenues in Q2. During the earnings call, an analyst posed a question regarding inventory levels related to smartphones:

Yes, yes. So how about the high-end smartphone inventory correction? Do you expect that top brand inventory — smartphone inventory to see correction as well on the semiconductor demand? Thank you.

To be frank with you, we did not see too much of inventory on the high-end smartphone buildup. So no.

C. C. Wei, CEO

Apple (AAPL) is TSM’s largest customer by a wide margin. Therefore, investors need to monitor that firm’s smartphone sales closely.

During Apple’s last earnings call, management stated that the company set a June quarter record for both revenue and consumers switching to iPhones. Despite foreign exchange headwinds, iPhone revenue grew 3% year-over-year to a June quarter record of $40.7 billion.

Apple also set June quarter records in both developed and emerging markets. Management also noted there was no obvious evidence of macroeconomic impact during the June quarter.

Another major concern is bloated inventory levels. Many of TSM’s customers over-ordered in an effort to adjust for a lack of global semiconductor supply. Once again, I will turn to an exchange between an analyst and management during the last earnings call:

When I look at your customers, their inventories are at a 25-year high. And I think everyone is going to take a look at the seasonality in the second half. And I’m just curious, what are the key variables? What are the key metrics? Or what are the key strategies that you have in place that could mitigate the gross margin balance by this if your customers become more aggressive in inventory correction into next year?

Well, let me answer the question. As I stated in the remark, our customers are doing the inventory correction. But I said that customer demand still exceeds TSMC’s capability to support for this year. So even they do the inventory adjustment, what I say that they decrease their demand versus their original number, TSMC’s capacity is still very tight and will remain very healthy in the utilization. So that’s why we can keep our gross margin intact. Did I answer your question?

C. C. Wei, CEO

Management provided additional color regarding inventory levels.

On the demand side, while we observe softness in consumer end market segment, the end market segments such as data center and automotive-related remains steady. And we are able to reallocate our capacity to support these areas. Despite the ongoing inventory correction, our customers’ demand continues to exceed our ability to supply. We expect our capacity to remain tight throughout 2022 and our full year growth to be mid-30% in U.S. dollar terms.

C. C. Wei, CEO

The threat of a military conflict between Taiwan and mainland China leaves some investors on the sidelines. My response to that scenario is as follows:

In my lifetime, there is either a zero percent chance or a 100% chance of China invading Taiwan.

Moreover, an argument can be made that the loss of TSM would cripple a number of fabless semiconductor companies. At the end of 2021, Apple accounted for a quarter of TSM’s revenue. Add Qualcomm (QCOM), Advanced Micro Devices (AMD), and Nvidia (NVDA) to a long list of companies that rely on TSM to produce their semiconductors.

Should I eschew an investment in those four stocks (and others) due to their exposure to TSM/China risk?

Where We Will See Growth

We reiterate our long-term revenue to be between 15% and 20% CAGR over the next several years in U.S. dollar terms. (Q2 Earnings Call)

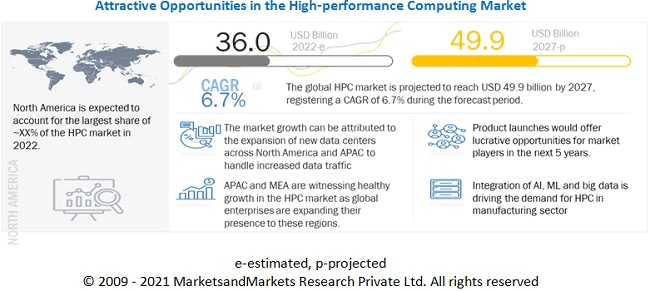

Demand for high-performance computing (HPC) increased by 13% in Q2 and represented 43% of revenue.

MarketsandMarkets forecasts a 6.7% CAGR for the HPC market through 2027.

Marketsandmarkets

Mordor Intelligence has a more robust forecast for the HPC market, projecting a CAGR of 9.44% from 2021 – 2026.

Mordor Intelligence also forecasts a CAGR of 14.98% through 2026 for the global IoT Chip Market. In Q2, IoT comprised 8% of TSM’s revenue.

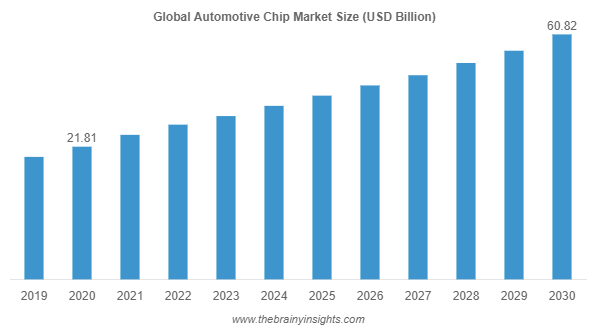

Automotive provided 5% of revenue last quarter. Transparency Market Research forecasts a CAGR of 7.63% through 2031 for the global automotive chip market.

thebrainyinsights.com

However, there are more sanguine projections for the global automotive chip industry with forecasts of a CAGR of 10.8% from 2021 to 2030.

These forecasts are bolstered by the recent claim by General Motors (GM) CEO Mary Barra that the automotive chip shortage will continue into 2023.

Furthermore, the current drag in demand for smartphones is likely short lived. The smartphone market is projected to experience a CAGR of 6.85% through 2027.

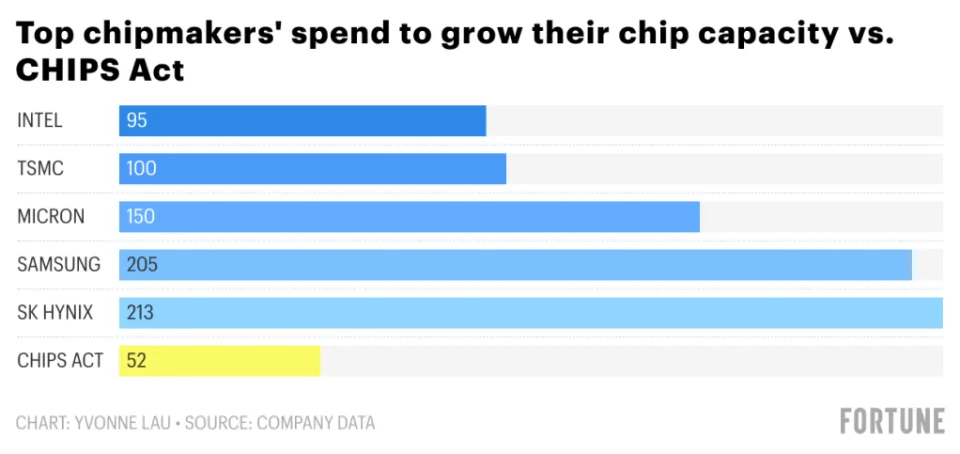

TSM is building a $12 billion plant in Arizona and a $8.6 billion facility in Japan to meet the expected surge in demand. This is part of the company’s projected three year, $100 billion in capex devoted to increasing chip capacity.

FORTUNE

According to Mordor Intelligence, the semiconductor foundry market has a projected CAGR of 7.54% through 2027.

The 800 Pound Gorilla Of Foundries

TSM is the largest and most advanced contract chipmaker. TSM technology is behind approximately 85% of worldwide semiconductor start-up prototypes.

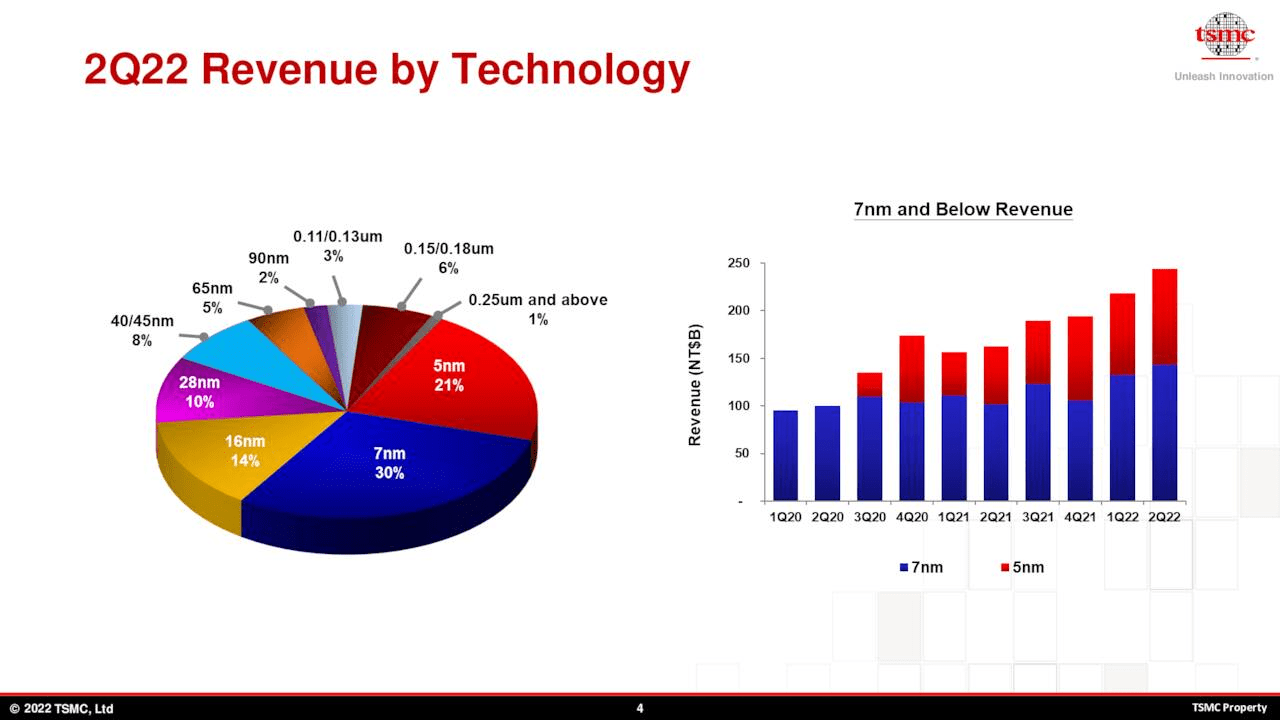

The firm’s lead in technology has made it the dominant producer of 7nm and 5nm nodes. Last quarter, TSM’s advanced technologies, defined as 7-nanometer and below, accounted for 51% of wafer revenue. Revenue from 5 nm products increased over 50% from the prior year.

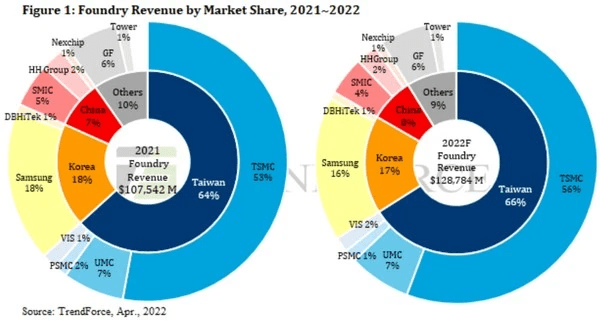

The company’s technological lead gives TSM pricing power. In turn, this provides robust margins. The following chart illustrates the sway TSM holds over the industry.

TrendForce

Even though TSM captures over 50% of the globe’s foundry revenue, the company is still gaining market share, and TSM’s revenues are three-and-a-half times that of the number two competitor.

TSM Investor Presentation

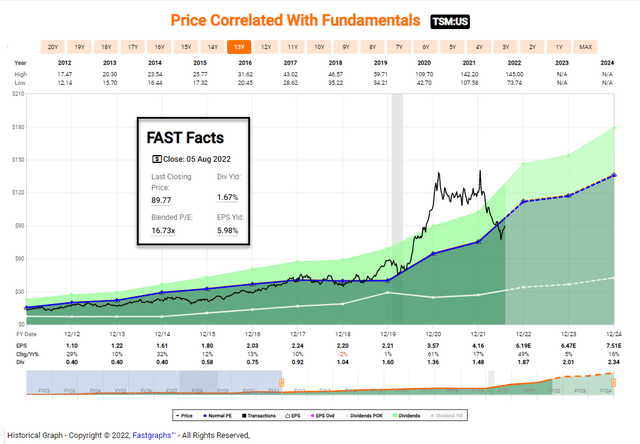

Bears focus on the cyclical nature of the semiconductor industry and the potential for a drop in TSM’s revenues. However, TSM has not experienced a decline of EPS greater than 20% in the last decade. Moreover, from 2009 through 2019, TSM grew EPS at a CAGR of 14.8%.

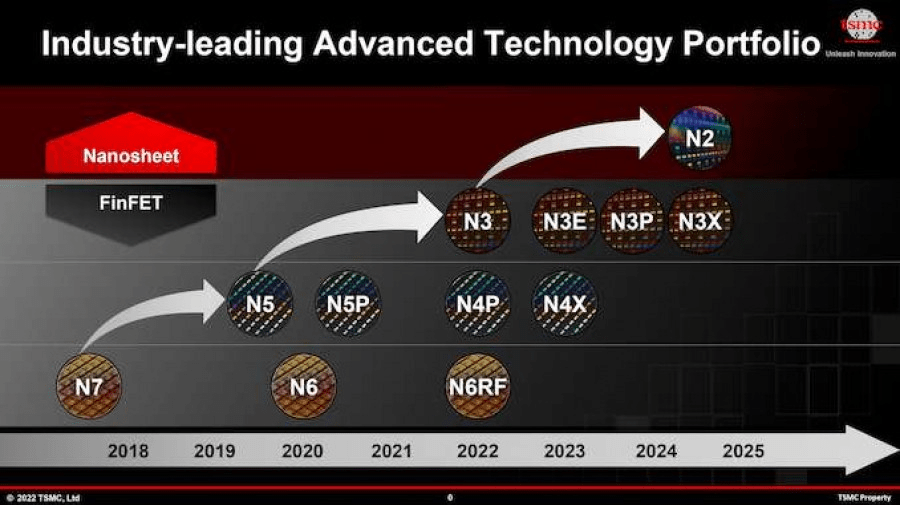

TSM will strengthen its competitive advantage when it begins production of 3nm chips in the latter half of 2022 and 2nm semiconductors in 2025.

The 3nm node will come in five tiers, each more powerful, more transistor-dense, and more efficient than the previous iteration.

The 2nm node is expected to increase performance by 10% to 15% with the same power requirements and an increased chip density.

tom’sHARWARE

Taiwan Semiconductor’s Dividend, Debt And Valuation

The current yield is 2.14%. TSM has a payout ratio a bit below 43%, and a 5 year dividend growth rate of 10.83%. Since its first distribution in 2004, TSM has never reduced the dividend.

Management emphasizes a policy to maintain the dividend even during down cycles with a goal to increase the dividend annually when practicable. The company prioritizes dividends over share repurchases.

S&P rates TSM’s debt as AA-/ stable. Moody’s provides a rating of Aa3/stable. Both ratings are solidly investment grade and are the highest debt ratings of any company in the industry.

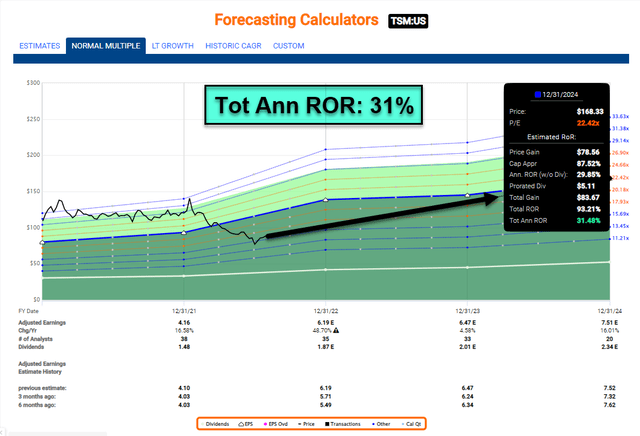

TSM currently trades for $89.77 per share. The average one-year price target of the 8 analysts rating the company is $120.14.

TSM’s forward P/E ratio is 14.18x, well below the stock’s average P/E ratio over the last 5 years of 21.97x. The 5-year PEG ratio of 0.59x is about a third of the sector median PEG of 1.49x.

Is TSM Stock a Buy, Sell, Or Hold?

TSM has been the technological leader in the industry since the early 2000’s. In 2015, when 16/14nm semis were the leading technology, there were six companies competing with TSM. Today, with 5nm chips as the leading semi, the only rival is Samsung, with a revenue share that is less than a third of TSM’s.

It is true that the inventories of many of TSM’s customers are bloated. Nonetheless, management states that it is strained to keep up with current demand.

While I acknowledge the cyclical nature of the industry and a decrease in demand for PCs and other devices, I note that the move to 5G smartphones, the increasing use of semiconductors in car manufacturing, and HPC and IoT related applications support the long-term structural semiconductor demand.

The CEO summed up the environment during the last earnings call:

5G smartphone carries substantially higher silicon content as compared to 4G smartphone. The amount of silicon content in today’s car continue to rise. While the device unit growth of many electronics device may be flattish to low single-digit percentage range, in the next several years, the silicon content growth will be higher, in the mid- to high single-digit percentage range and support the long-term structural semiconductor demand and increase our addressable wafer demand.

…We reiterate our long-term revenue to be between 15 and 20 CAGR over the next several years in U.S. dollar terms.

TSM is currently trading well below its 52-week high of $145. The forward P/E and 5-year PEG indicate the stock is trading well below the average valuation over the last five years.

TSM has a safe, rapidly growing dividend, the strongest debt rating in the industry, and robust profit margins and free cash flow.

While I acknowledge the negatives bears embrace, I believe those concerns are baked into the current share price.

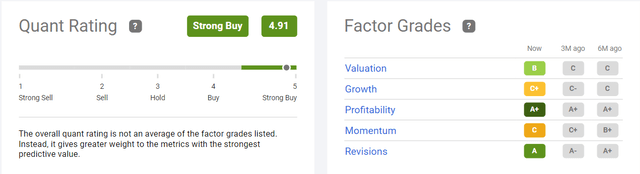

Consequently, I rate TSM as a STRONG BUY.

An investment in Taiwan Semiconductor appeals to those with a buy and hold philosophy. TSM’s gross and operating margins have been double that of rivals for years, and the company has delivered a CAGR of 17.5% in revenue and a 17.1% earnings CAGR since listing in 1994.

I caution that market sentiment can take time to turn. I would not be surprised to see TSM stock trade in a tight range over the short to mid-term.

In July Morningstar reiterated TSM’s shares are very undervalued at around 14x 2023 P/E, as expects diluted EPS to attain 16.7% 2021-26 CAGR even after factoring in a 10% EPS drop in 2023. TSM’s P/E is now the lowest in the past five years, including a period of weak demand in late 2018.

Seeking Alpha’s Quant Ratings agree with ours:

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment