Warchi

There is nothing noble in being superior to your fellow man; true nobility is being superior to your former self.” ― Ernest Hemingway

Today, we take an in-depth look at a midcap technology infrastructure concern that just made a significant acquisition, is demonstrating consistent growth and whose stock has seen some insider buying. It also picked up a nice contract award this week. An analysis follows below.

Company Presentation

Parsons Corporation (NYSE:PSN) is a Centreville, Virginia based provider of technology based national security and critical infrastructure solutions for governments and large corporations primarily in North America (83% of total revenue) and the Mideast (17%). Growing through the acquisition of nine businesses since 2011, the company delivers systems integration, program management, design engineering, and product development solutions through its ~16,400 employees, of whom ~4,100 hold security clearances. Parsons was founded in 1944 and went public in 2019, raising net proceeds of $536.9 million at $27 per share. Its stock trades just under $42.00 a share and sports a market cap of approximately $4.3 billion.

Operating Segments

The company operates in two reportable segments: Federal Solutions and Critical Infrastructure.

Federal Solutions delivers cybersecurity, missile defense, logistics support, hazardous material remediation and engineering services to the U.S. government and is further divided into two units: Defense & Intelligence (D&I) and Engineered Systems [ES].

D&I provides multi-domain command and control, intelligence, surveillance, electromagnetic spectrum dominance, and directed energy solutions to various agencies under the Department of Defense, as well as the Defense Intelligence Agency. It is Parsons’ largest subsegment, contributing 1H22 revenue of $685.8 million.

ES offers technology services for complex infrastructure, including energy and chemical systems, bio-surveillance, and environmental remediation to agencies such as the Department of Homeland Security, the Department of Energy, and NASA. It generated 1H22 revenue of $343.4 million.

Overall, Federal Solutions generated 1H22 Adj. EBITDA of $90.3 million on revenue of $1.03 billion, up 40% from $64.5 million and 12% from $894.7 million in 1H21, respectively.

Parsons’ Critical Infrastructure segment provides solutions to complex physical and digital infrastructure and like its Federal Solutions counterpart is divided into two subunits: Mobility Solutions [MS] and Connected Communities [CC].

MS delivers planning, engineering, and management services for bridges, tunnels, roads, water and wastewater, dams, and reservoirs. With customers including state governments, Canadian provinces, and Mideast government agencies, MS accounted for 1H22 revenue of $595.1 million.

CC provides state and local governments, as well as private sector infrastructure owners, with ‘smart city’ solutions, such as intelligent transportation systems. It was responsible for 1H22 revenue of $333.4 million.

Collectively, Critical Infrastructure generated 1H22 Adj. EBITDA of $61.2 million on revenue of $928.6 million, down 12% from $69.8 million and up 8% from $859.3 million in 1H21, respectively.

Competition

Parsons competes for fixed-price, time-and-materials, and cost-plus contracts with a small group of significant and typically publicly traded solutions and service providers. Its Federal Solutions rivals include Booz Allen Hamilton (BAH), CACI International (CACI), Leidos (LDOS), ManTech International, Science Applications International Corporation (SAIC), Lockheed Martin (LMT), Northrop Grumman (NOC), and Raytheon (RTX). Critical Infrastructure vies for contracts against AECOM (ACM), Jacobs Engineering, Stantec (STN), Kapsch (OTC:KPSHF), and WSP (OTCPK:WSPOF).

Xator Acquisition

To remain competitive, Parsons looks to expand its portfolio of capabilities as well as its customer base through acquisition, targeting firms with revenue growth and Adj. EBITDA margins of 10% or more. Its most recent deal (and largest since its IPO) occurred on May 30, 2022, when it closed Xator Corporation, a concern with expertise in critical infrastructure protection, counter-unmanned aircraft systems, intelligence and cyber solutions, biometrics, and global threat assessment. In addition to enlarging Parsons’ technical capabilities, the deal is also an entrée into the State Department, a client that provides over one-third of Xator’s top line. For this package, the company paid cash of $388.3 million, which amounts to an EV/FY23E EBITDA multiple of ~11 when tax benefits are given effect.

2Q22 Earnings and Revised Outlook

On August 3, 2022, Parsons reported 2Q22 financials that included earnings of $0.41 a share (non-GAAP) and Adj. EBITDA of $77.4 million on revenue of $1.01 billion versus $0.32 a share (non-GAAP) and Adj. EBITDA of $65.7 on revenue of $879.4 million in 2Q21, representing 28%, 18%, and 15% increases, respectively. Organic top-line growth was 9%, with contributions from both Federal Solutions (11%) and Critical Infrastructure (8%). The bottom line was in line with Street consensus while the top line was $79.0 million better than expectations.

August Company Presentation

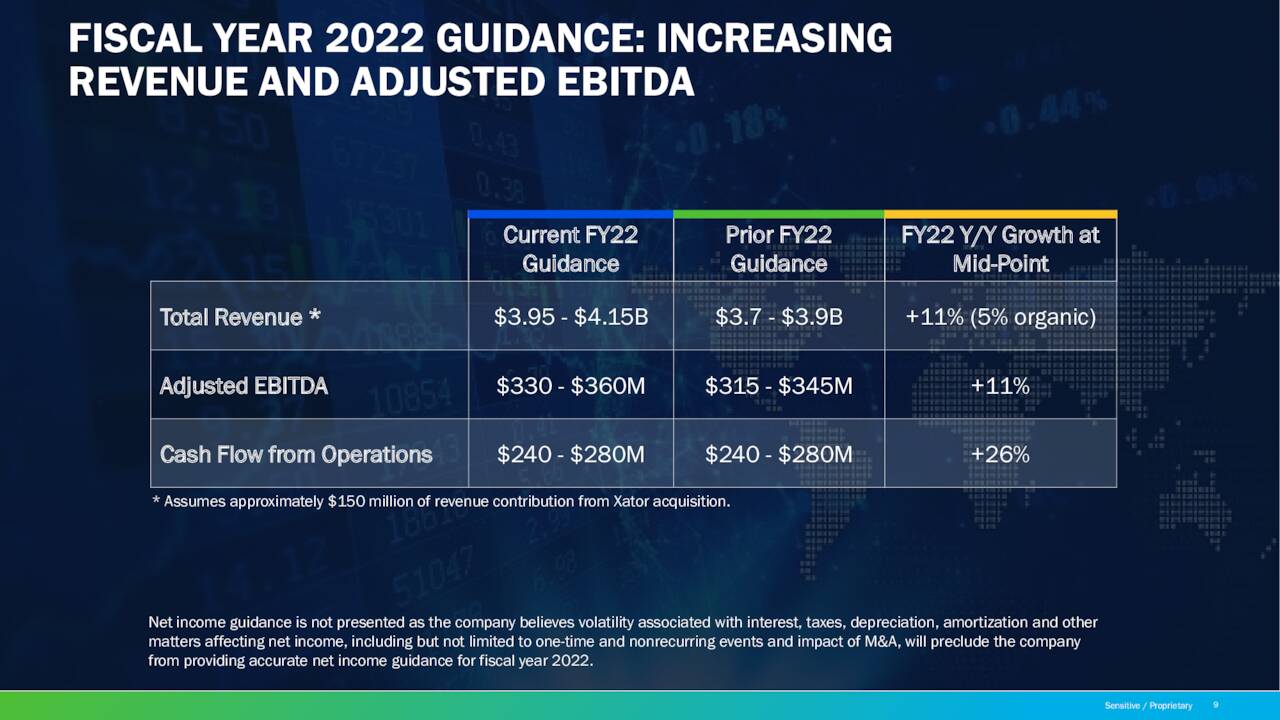

To reflect both the addition of Xator and the strength of its core operations, Parsons raised its FY22 Adj. EBITDA guidance from $330 million to $345 million (all from Xator) and its revenue estimate from $3.8 billion to $4.05 billion, of which $150 million came from Xator – all based on range midpoints.

August Company Presentation

That said, the market essentially ignored the news, trading Parsons’ stock down 2% to $41.72 on lackluster volume.

August Company Presentation

The culprit was backlog, which fell from $8.4 billion on June 30, 2021 to $8.2 billion on June 30, 2022 as the number of total awards fell from $1.7 billion to $1.0 billion in 2Q22. The Federal Solutions segment saw awards drop from $1.2 billion to $0.4 billion as activity has been gummed up by longer client evaluations. As a result, its overall book-to-bill ratio (i.e., contracts awarded divided by revenue) was 1.0, flat sequentially versus 1Q22 and down from 1.9 in 2Q21.

That said, bookings are usually lumpy, and the funded portion of the backlog increased from $4.0 billion to $4.4 billion in the past year. It should be noted that Critical Infrastructure (at 1.3) realized its seventh consecutive quarter of book-to-bills above 1.0, somewhat a function of the company’s leverage to the Gulf region, the countries in which are accelerating programs – led by the Saudi Vision 2030 initiative – due to higher oil prices.

Balance Sheet & Analyst Commentary

That said, Parsons’ balance sheet – even with the recent acquisition of Xator – is in strong stead, reflecting cash of $126 million against debt of $793 million, putting net leverage at 2.0. Cash flow from operations during 1H22 was $25.3 million, which was down from $38.5 million in 1H21. However, this was a function of cash outflows of $45.1 million from working capital accounts, whereas cash net income improved $16.9 million. Owing to the seasonality of the company’s business, cash flow cadence should increase significantly in 2H22, with management still anticipating FY22 cash flow from operations of $260 million. Parsons does not pay a dividend but returns capital to shareholders via share repurchases. During 1H22, the company bought 427,088 shares at an average price of $36.40, leaving $62.8 million remaining on its authorization.

The Street is decidedly dour on Parsons’ prospects, featuring five hold recommendations against only one buy and one outperform. Their twelve-month price target is $41. On average, they expect the company to earn $1.89 a share (non-GAAP) on revenue of $4.05 billion in FY22, followed by $2.18 a share (non-GAAP) on revenue of $4.34 billion in FY23, representing increases of 15% and 7%, respectively. The 15% bottom line growth expectation is preceded by a 14% growth expectation (FY22E vs FY21A (1.65)) and followed by another 15% growth expectation (FY24E ($2.50) vs FY23E).

This consistency at the Parsons’ bottom line is matched by insiders’ bullishness. They have never sold a share in the 14 transactions since the company’s IPO. The latest buyer was board member and former CFO George Ball, who purchased 70,000 shares at $41.50 on August 5, 2022.

Verdict

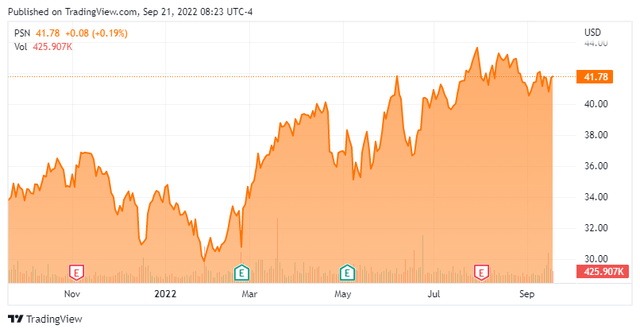

With the exception of the pandemic-induced selloff in March-April 2020, shares of PSN have remained rangebound between $30 and $45 per share since shortly after its IPO. It is currently at the top end of that range due to increased geopolitical tensions and the perception that it will be a beneficiary of the $115 billion to be deployed on cybersecurity and resiliency as part of the $1.2 trillion Infrastructure Investment and Jobs Act.

However, its stock is not ‘cheap’, sporting a P/E ratio of 19 on FY23E EPS. Even factoring the consistent (at least anticipated) 15% growth, the PEG ratio is 1.3, which is slightly rich. As such, shares of PSN are likely to have a hard time busting through the mid-40s, unless there is a significant upside surprise in Parsons’ 3Q22 report (consensus of $0.50 per share on revenue of $1.05 billion). That said, with all the activity in the Mideast, there is solid earnings visibility and a return to the low-30s is not likely. If PSN fell back below $40, it would make a decent covered call candidate. At $35 I would consider a larger stake provided business fundamentals were holding up.

On the highest throne in the world, we still sit only on our own bottom.”― Michel de Montaigne

Be the first to comment