viper-zero/iStock Editorial via Getty Images

Dear readers,

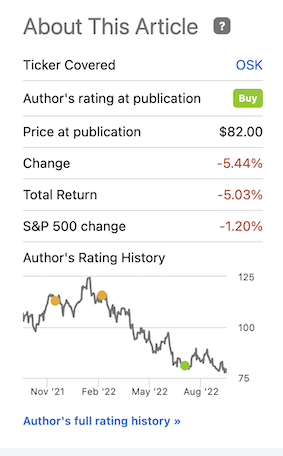

It’s time to update my thesis on Oshkosh (NYSE:OSK). In my previous piece, I finally shifted my stance on Oshkosh to a “BUY” from a “HOLD”. This was due to a 30% drop in the valuation/share price, which was double the market. The decline has continued at a somewhat accelerated pace to the overall market.

OSK IR (OSK IR)

These changes have of course impacted the overall appeal of the company as an investment. In my first article, the share price was around 35% higher than it is today.

It’s time to see what appeal Oshkosh can offer you today, and what has changed since my previous articles.

Oshkosh – a company update

The negative news is that Oshkosh has continued to decline despite the already 30% decline we saw in the last few articles. The company’s overall underperformance is in trend with the broader market but is in fact enhanced by its complex exposures to various manufacturing and infrastructure segments. Its similarities to Caterpillar (CAT) cannot be overstated, but the company has a more consumer-oriented and far lower-level appeal than Caterpillar. Where the former focuses on huge machines involved in mining and similar areas, OSK in fact focuses on things like access equipment, fire engines, and emergency vehicles, and commercial garbage, refuse, and similar-area trucks and machinery.

These areas are slightly less susceptible to overall volatility than are Caterpillar, given that they are less “optional”. You can wait with buying new mining equipment or shut down operations in a mine, but you can’t really shut down garbage pickup, fire stations, or the areas that require access equipment.

It also adds the appeal of an attractive defense segment, which exposes it to governmental budgets and order flows. In order to understand Oshkosh, you should understand at least the basics about things like replacement volumes for aging fleets, municipal procuring processes, the housing and infrastructure market, and so forth. This is what decides much of Oshkosh’s momentary appeal.

Note that I say momentary. Not long-term. Long term, this company usually is an appealing buy if cheap enough – but short term, even cheaply, this company may not see appreciation for the longer term.

Things that continued to decline in my previous article in terms of order flows and trends have more or less continued exactly along this line.

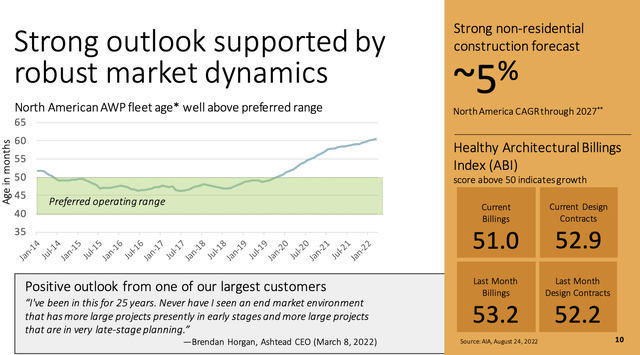

The company’s fundamentals remain extremely strong. Remember what I said about the average fleet age for the company’s customers – take a look at where this currently is.

Despite all the ongoing negativity, this company’s outlook, and my own, remains fundamentally positive going into the H2 2022 and H1 2023 period. You can postpone replacements of older assets for some time – but the thing to remember here is that this average fleet age is only going to be increasing until they pull the trigger, at which point it becomes an addition to OSK’s order book.

As the company shows us in recent updates in September of 2022, the numbers remain very good, with healthy, 50+ ratios in billings.

While the contract remains a political quagmire, OSK remains the contract holder for 165,000 vehicles for the USPS, which comes with a large aftermarket opportunity. Overall, OSK is on par to deliver in the shift from ICE to BEV, and the company is large and significant enough to remain a relevant player in turnkey project solutions, even in cases such as this.

The main arguments for Oshkosh continue to be the absolutely historically unprecedented level of fleet age. Over 50% of the current fire engine age is over 15 years, which could potentially start to threaten safety. The company is responding to this by expanding its production capacity for fire engines.

I also know people don’t like taxes – but the fact is that increased amounts of municipal taxes – it’s up from a 0% average in local property taxes in early 2011 to over 2-3% on average now, as high as 6% back in mid-2021 (Source: Us Census Bureau Quarterly Summary of State & Local Tax Revenue (June 9, 2022)). Some of this goes to replacing such capacities, and Oshkosh is one of the primary beneficiaries of such things.

Furthermore, as of September 2022, housing starts are up 3.8% YTD, and Oshkosh is now forecasting elevated levels all the way until 2027, with a 5% CAGR.

Why? The infrastructure investment and Jobs act is one major growth factor – but also an increased focus on lifecycle parts and services, which despite inflation and cost increases we’re seeing, will result in expected market expansion. The company is also pushing further into R&D and growth.

The company delivered new targets for 2025E – including over $10B in sales, a double-digit EBIT margin, up to $13 EPS, and a 22%+ ROIC. Very impressive targets, with assumptions regarding CapEx and sales.

Results for Q2 unfortunately aren’t as good as we might expect based off this – and it’s part of what is causing the drop we’re currently seeing. While the backlog of the company has remained strong – over $13 billion at current levels – the main news for 2Q22 is that current expectations are based off inflation tapering off somewhat. This has not yet happened. Things are still increasing, and the FED is continuing to raise rates. Not only that, but supply chain constraints are showing no signs of abating at this time either – another factor Oshkosh was counting on.

This majorly impacts and dictates what we can expect for the 2022 Fiscal, even if this is still highly dependent on what happens to inflation, rates, and macro in the next few months.

Let’s look at the updated valuation.

Oshkosh Valuation Update

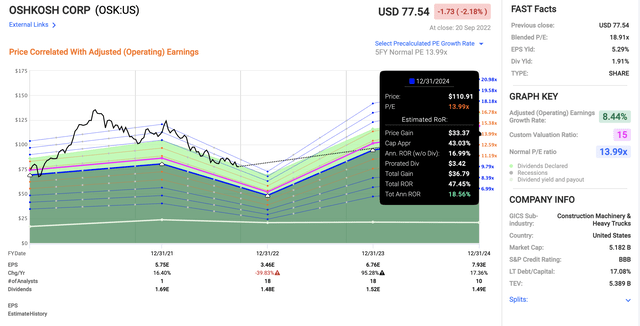

The main question is if the company’s recent declines make justified the upside and if we can see conservative double digits here. What I previously characterized as moderate EPS development is now a certain (seeming) decline.

We’re now expecting a 40% EPS decline going into 2022, that’s well lower than the last article. However, the bounce-up is expected to be absolutely massive when it actually does happen. Almost triple digits (80-90%), with another 15-25% in the following year, if the company’s margins and trends hold.

The problem with Oshkosh has always been forecasting these trends accurately. That’s why analyst expectations have a 42% miss ratio on a 2-year basis with a 20% margin of error.

To my question, there is an overall upside to Oshkosh.

That upside also is double digits – nearly 19% on a current 2024E forecast.

Is this realistic? I would argue that for the long term, it most definitely is. Inflation and the current set of problems can only be around for so long. Whether that is 1 year of 3 years, we don’t currently know. I don’t think it’s “only” 2 months more, or 4.

Based on current EPS growth assumptions, this company could potentially deliver some absolutely stellar levels of outperformance. Before, investing in Oshkosh could have delivered maybe 5-11% annually – at optimistic expectations or so. Today, that upside is far higher. Following a 30+% drop, conservative assumptions call for upsides of 18-19% annually to a 2024E <14X P/E.

That is an impressive upside, even with some of the volatility inherent to the stock.

Updated S&P Global analyst numbers for September of 2022 call for the following new targets. Analysts are down from triple-digit price targets that we saw early on in the year. As a reminder, a year ago we had analysts targeting close to a $150/share PT for Oshkosh. That target is now down to $94/share with a high of $114 and a low of $80/share.

9 out of 18 analysts have either a “BUY” or equivalent target on the company, calling for Oshkosh to increase toward that 21.2% current upside. I did not previously give any particular stable price target for the company – and that is something I intend to change here.

There is a high degree of uncertainty to current movements, but looking at the way the company seems to be going, I would argue anything below a 13x 2024E P/E on a normalized basis. This comes to around $110/share.

This is also where I set my current OSK price target.

Thesis

The current Oshkosh thesis is as follows:

- This is a very high-quality business with great fundamentals and excellent management in an appealing, if cyclical, set of segments. The current foundation paves the road for a very convincing upside.

- In my first article, I said that this company’s cyclical characteristics will bring this company back down to fair value. That has now more than happened and in my view, fair value has turned to “undervalued”, and even more since my last piece.

- Due to this, I call this company a “BUY” at this valuation.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, and safely, and harvest well-covered dividends while doing so, and your time frame is 5-30 years, then I might be for you.

These are my overall criteria, and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment