Tim Boyle

While still early days, Hanesbrands’s (NYSE:HBI) three pronged restructuring to increase sales, improve profitability, and reduce debt appear to be falling short on all measures. However, the stock has fallen to attractive valuation levels, with a forward P/E of only 7.3x on management’s recently reduced 2022 guidance. Long-term investors may wish to start accumulating shares, particularly as they are being paid a 7.1% dividend yield to wait. The core innerwear business is highly profitable, even during the 2009 recession, and should provide a base level of earnings.

Company Background

Hanesbrands Inc. is a global apparel retailer focusing on innerwear and activewear. The company designs, manufacturers, sources, and sells basic apparel such as T-shirts, bras, underwear, socks, and activewear. It owns many leading brands such as Hanes, Champion, Bonds, Bali, Maidenform, Playtex, Bras N Things and Wonderbra.

Hanesbrands Has Been In Restructuring Mode To Achieve ‘Full Potential’

In the past few quarters, Hanesbrands has been focused on the ‘Full Potential’ restructuring plan announced at its 2021 investor day. As part of the plan, HBI completed the sale of its European innerwear business in March 2022 and has recently placed its U.S. Sheer Hosiery up for sale.

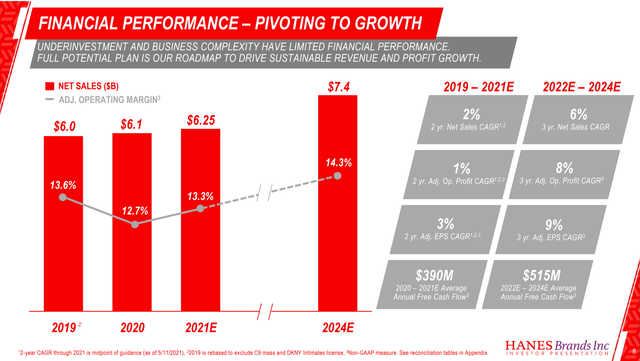

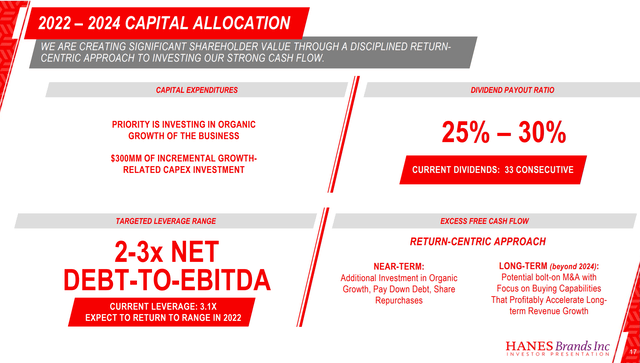

From my understanding, the restructuring plan has three main goals: reignite topline growth to achieve $7.4 billion in revenues by 2024 (6% CAGR from 2021’s $6.25 billion estimate), expand operating margins to over 14% from 13.3% expected in 2021, and reduce leverage to 2-3x Net Debt / EBITDA while maintaining its dividend. The key restructuring metrics are highlighted in Figures 1 and 2.

Figure 1 – Hanesbrands revenue target (Hanesbrands 2021 Investor Day Presentation)

Figure 2 – Hanesbrands capital allocation (Hanesbrands 2021 Investor Day Presentation)

Interim Report Card On Restructuring Is An F

With roughly a year gone by in the 3 year process, it’s time for an interim report card on how Hanesbrands is doing, relative to the goals set out at the investor day.

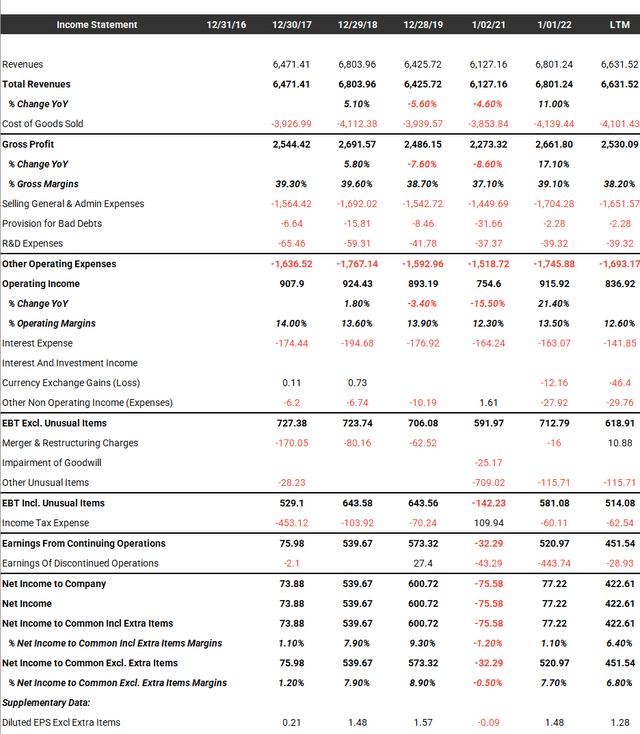

First on revenues, HBI reported $6.8 billion in revenues for calendar year 2021, and LTM revenues of $6.6 billion, which seems to be on track for $7.4 billion by 2024 (Figure 3). However, in the latest quarterly report, the company reduced its full year guidance from $7.0 – $7.15 billion in revenues to $6.45 – $6.55 billion in revenues for 2022.

Figure 3 – HBI condensed financials (tikr.com)

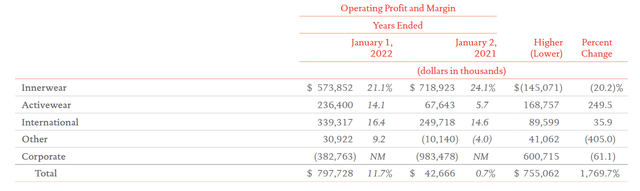

More concerning, operating margin seems to be heading in the wrong direction. In 2021, reported operating margins of 11.7% (Figure 4). However, this figure included $132 million in restructuring costs. Adjusted operating margins would have been 13.7%, excluding the restructuring charges.

Figure 4 – HBI 2021 Operating Margin (HBI 2021 Annual Report)

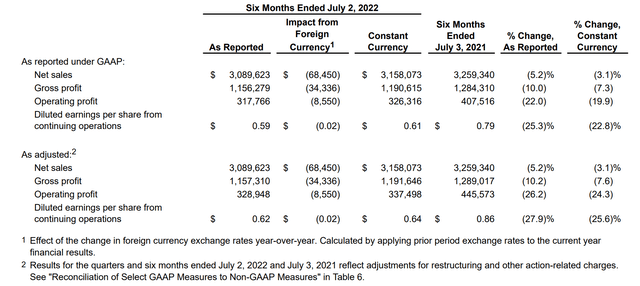

However, in H1/2022, HBI reported adjusted operating margins of 10.7%, a sharp decline from 13.7% YoY (Figure 5). In fact, operation margins in the first half of 2022 are even worse than adjusted operating margins of 12.7% in 2020, which prompted management to launch the restructuring plan in the first place.

Figure 5 – HBI H1/2022 Operating Margin (HBI Q2/2022 Report)

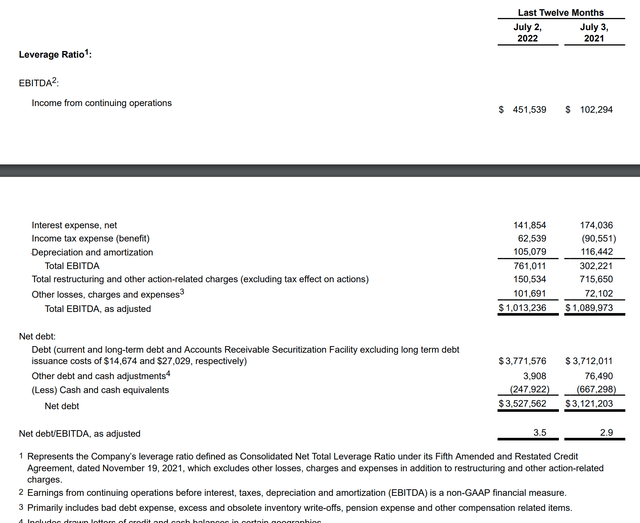

Finally, looking at LTM EBITDA of $1.03 billion versus net debt of $3.5 billion, HBI’s has an adj. Net Debt / EBITDA ratio of 3.5x, a deterioration from the 3.1x when the restructuring plan started (Figure 6).

Figure 6 – HBI Q2/2022 LTM Net Debt / EBITDA (HBI Q2/2022 Report)

Waiting For Champion To Lead Restructuring

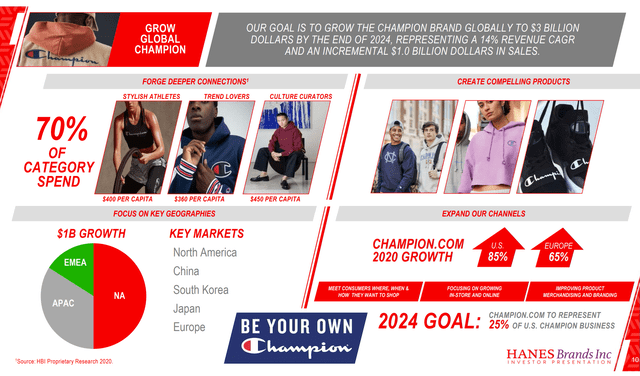

Chief among Hanesbrands restructuring efforts was plans to add an incremental $1.0 billion in sales to the Champion brand, fulfilling much of the corporate revenue growth target (Figure 7).

Figure 7 – HBI Plans For Champion (Hanesbrands 2021 Investor Day Presentation)

Champion is an activewear brand that is best known for authentic American style and performance. It has experienced a renaissance in recent years, with many celebrities like Chance the Rapper and Justin Bieber sporting the brand’s merchandise. Its approachable price point also meant everyone could afford to purchase its products, regardless of income level.

Although Hanesbrands had high hopes for Champion, recent results like the Q2/2022 earnings report were short of expectations:

Global Champion brand sales decreased 20% over prior year in constant currency, or 23% on a reported basis with similar declines in both the U.S. and internationally.

Management blamed a variety of factors for the Champion weakness, including a tough comparable quarter (management highlighted 2yr stacked growth of 96%), a mid-quarter consumer slowdown, and COVID restrictions in China.

Looking forward, HBI recently purchased the North American footwear rights for the Champion brand, which hopefully will convert into revenues in the coming quarters.

Ransomware Incident Does Not Help Restructuring Efforts

In May, Hanesbrands also disclosed it was the victim of a ransomware attack. As disclosed in the Q2 results, the cyber incident impacted order fulfillment by 3 weeks and had a negative impact on sales of $100 million and adj. operating earnings of $35 million.

Valuation Is Cheap

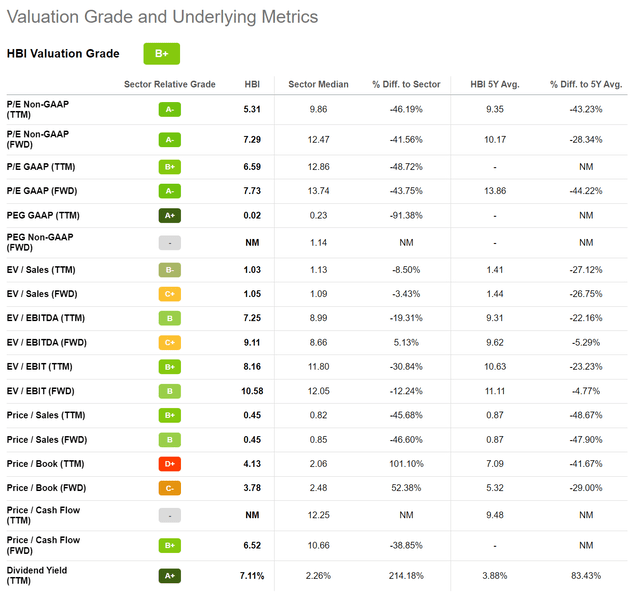

Valuation-wise, Hanesbrands is starting to screen cheap, as it is trading at just a 7.3x Forward P/E, based off of management’s latest lowered guidance of $1.11 – $1.23 in adjusted EPS for 2022. This is a discount to the discretionary sector median 12.5x Forward P/E (Figure 8)

On an EV/EBITDA basis, HBI has a Forward EV/EBITDA valuation of 9.1x, slightly above sector median 8.7x. The discrepancy between P/E and EV/EBITDA is likely due to HBI’s relatively high leverage of 3.5x LTM Net Debt / EBITDA.

Figure 8 – HBI Valuation (Seeking Alpha)

HBI is also paying a $0.15 / quarterly dividend (7.1% yield), which appears to be well covered for now by the adjusted EPS guidance.

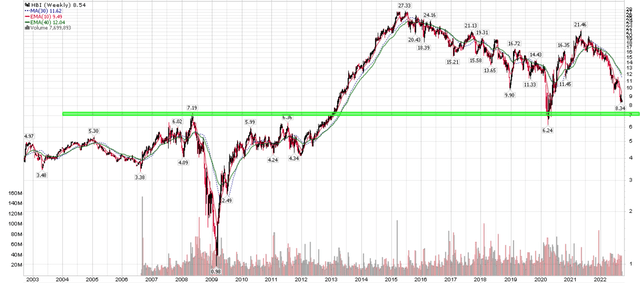

Technicals Nearing Long-Term Support Levels

Technically, HBI’s stock price is nearing COVID-pandemic lows and the breakout levels from more than a decade ago. $7 – 8 / share should be long-term support for the stock (Figure 9).

Figure 9 – HBI Near Long Term Support (Author created with price chart from stockcharts.com)

Risks

The biggest risk to Hanesbrands is a further slowdown in its businesses, especially as the Q2 slowdown seem to have caught management by surprise, given the magnitude of the guidance reduction (8% topline reduction for FY2022).

Hanes, along with channel partners like Walmart (WMT) and Target (TGT) have been reporting elevated levels of inventory that the company expect will take several quarters to normalize. This could cause near-term headwinds on profitability and margins.

Finally, Hanesbrands has relatively high levels of debt, with LTM Net Debt / EBITDA of 3.5x. High levels of debt may restrict management’s ability to respond to changing market conditions. In terms of maturity, HBI has $1.4 billion in 4.625% and 3.5% senior notes coming due in 2024 that is the most pressing. While HBI should have no problem refinancing the debt, they will most likely come at higher interest rates, which would further pressure profitability.

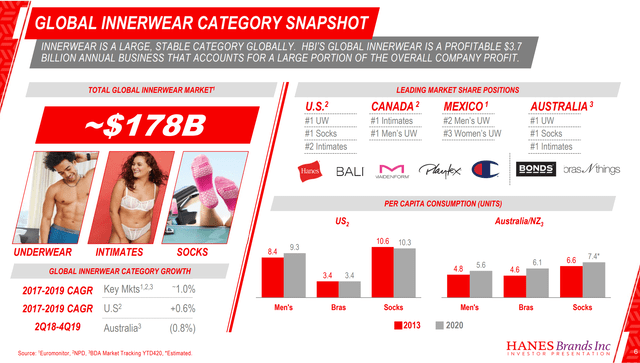

On the positive side, Hanesbrands does have a stable and profitable innerwear business, with $2.7 billion in 2021 sales and operating margins of 21%. Per capita consumption of innerwear (underwear, socks, bras) is stable / growing, and can be thought of as a consumer staple good, rather than a discretionary purchase.

Figure 10 – Innerwear is a consumer staple (Hanesbrands 2021 Investor Day Presentation)

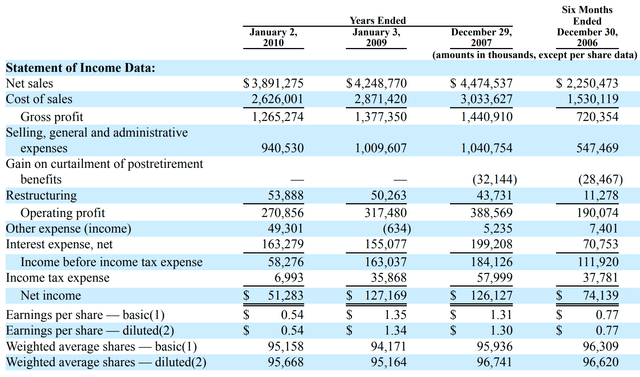

Investors should note that Hanesbrands was profitable even during the Great Financial Crisis (“GFC”), as consumers have to replace socks and underwear on a yearly basis (Figure 11).

Figure 11 – HBI was profitable even during GFC (HBI 2010 10K)

In fact, one of Hanesbrands’ main innerwear competitors, Fruit Of The Loom, is owned by Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B), arguably demonstrating the attractiveness of the innerwear market in my opinion.

Conclusion

While still early days, Hanesbrands’s three pronged restructuring to increase sales, improve profitability, and reduce debt appear to be failing on all measures. Management has bet big on Champion to drive revenue growth and margins, and so far, the bet is yet to pay off.

However, the stock has fallen to attractive valuation levels, with a Forward P/E of only 7.3x on management’s recently reduced 2022 guidance. Long-term investors may wish to start accumulating shares near support of ~$7 to $8 / share, particularly as they are being paid a 7.1% dividend yield to wait. The core innerwear business is highly profitable and should provide a base level of earnings.

Be the first to comment