Jacobs Stock Photography Ltd

Tattooed Chef, Inc. (TTCF), a plant-based food company, produces and sells a portfolio of frozen foods. It supplies plant-based products to retailers in the United States.

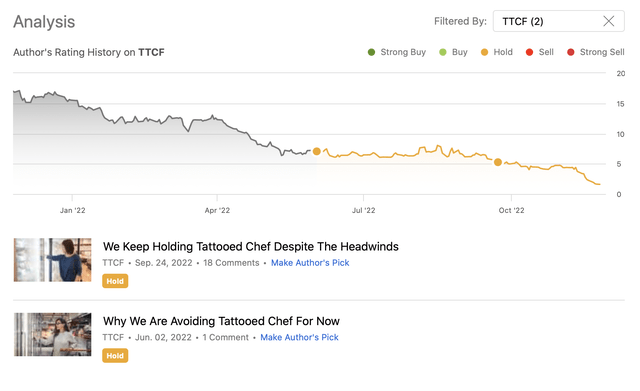

This year, we have published two articles on the firm, rating their stock as a “hold” both times. These articles were namely:

We Are Avoiding Tattooed Chef For Now (NASDAQ:TTCF)

Tattooed Chef Stock: Holding Despite Headwinds (NASDAQ:TTCF)

Analysis history (Author)

The reasons for our “hold” ratings were:

- Double-digit revenue growth in the first quarter, but significantly widening loss from operations, due to increased operating expenses.

- We expected the firm’s deal with Walmart to increase the brand’s presence in the stores and fuel future growth, which could have potentially led to capturing a larger market share.

- Although margins have been contracting since the IPO, we expected that the investment in cold storage facilities and automation improvements could turn this trend around.

- Macroeconomic headwinds were expected to have a negative influence in the near term.

While the initiatives are currently being executed, we have not seen their positive impacts so far, leading to disappointing Q3 results.

Q3 results

Revenue

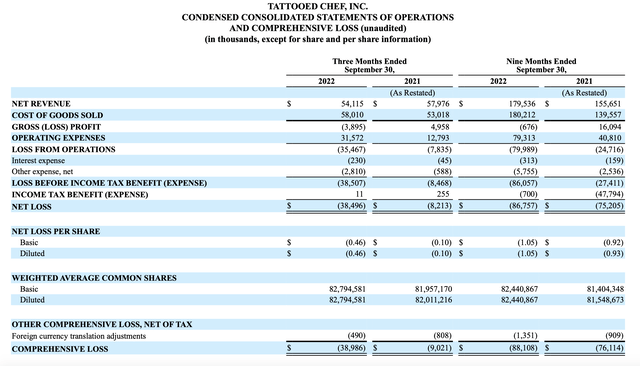

In the third quarter, TTCF’s revenue has declined by 6.7% to $54.1 million compared to the year ago quarter. Along with the declining revenue, cost of goods sold and operating expenses have increased substantially.

Income statement (TTCF)

“Net revenue decreased by 6.7% to $54.1 million in Q3 2022 from $58.0 million for the three months ended September 30, 2021 (“Q3 2021”), the result of a $10.3 million year-over-year decrease in Tattooed Chef branded products. Private label and other revenues increased 27.4% or $6.4 million year over year driven by revenue contributions from our acquisitions of BCI Acquisition and various New Mexico entities and assets. The decline in branded product sales was driven by a $15.0 million decline in a tier-1 club and retail account and a $6.2 million increase in trade or contra revenue related expenses. Trade revenue included a $1.2 million increase in slotting fees as we focused on expanding Tattooed Chef branded products into additional retail stores across the country. Partially offsetting the impacts of this tier-1 account and step-up in slotting fees, branded product sales to accounts other than the tier-1 account referred to above in Q3 2022 increased 17.1% or $5.9 million over Q3 2021.”

In times of low consumer confidence, when customers are uncertain about their financial situation and the economy as a whole, they tend to start saving money by switching to lower cost alternatives. The demand for products, which are non-essential start to decline. We believe that the current decline in the demand for TTCF’s products reflects that the firm does not have a loyal customer base and does not have a moat against its competitors.

Not only the demand appears to be troubling, but also the increasing costs.

Cost of goods sold

“Cost of goods sold increased by 9.4% in Q3 2022 to $58.0 million from $53.0 million in Q3 2021. This increase was driven primarily by continued inflationary pressures pushing labor and freight to 34.1% of net revenue from 24.9% of net revenue in Q3 2021. These cost impacts were compounded by the addition of a new manufacturing facility in August 2022, which while expected to be accretive in the near term, increased the Company’s rent, depreciation and other fixed costs in Q3 2022.”

Because of the lack of moat mentioned before, we believe that the firm may not be able to easily pass on these cost increases to the customers. As a result, margins may continue to be depressed in the coming quarters.

Operating expenses

The increase in operating expenses, primarily driven by the $7.0 million increase in stock-based compensation, is also bad news for current shareholders.

“Operating expenses increased to $31.6 million from $12.8 million in Q3 2021. The increase is primarily due to a $7.0 million increase in stock-based compensation, driven by shares issued under the Company’s equity incentive plan, a $4.6 million increase marketing and advertising expenses, a $2.5 million increase in outside services expense, a $2.0 million increase in payroll related expenses, and a $0.7 million increase in facility expenses.”

The stock-based compensation does not only increase the operating expenses, but it also dilutes the existing shareholders. While it is not uncommon for relatively young companies to issue shares or use extensive stock-based compensation, we believe this action makes the stock unattractive in the current market environment.

EPS

As a result of the declining revenue and increasing costs, the firm’s net loss came in at $38.5 million, or $0.46 per share, in contracts to a net loss of $8.2 million, or $0.10 per share, in the year ago quarter.

Outlook

If the quarterly results have not been disappointing enough, then the outlook definitely does the job.

Revenue forecasts have been reduced to $235 – $245 million, from the prior guidance of $280-$285 million, while gross margin expectations have been lowered to 0 – 3%, from prior guidance of 8-10%.

Further, the firm has announced that it intends to raise additional debt or equity capital in the near future. Again, we understand that capital is needed to growth and expansion, but in the current interest rate environment, we are concerned about both the cost of debt and equity. Increasing cost of capital can have a material impact on the investors required rate of return and therefore on the stock price. While the stock price has declined dramatically year-to-date, we are not sure, whether all the negative news are priced in yet.

For now, we would not like to remain shareholders. To upgrade the stock again, we would like to see increasing demand, improving operational efficiencies and expanding margins.

Be the first to comment