Gary Gladstone/Stockbyte via Getty Images

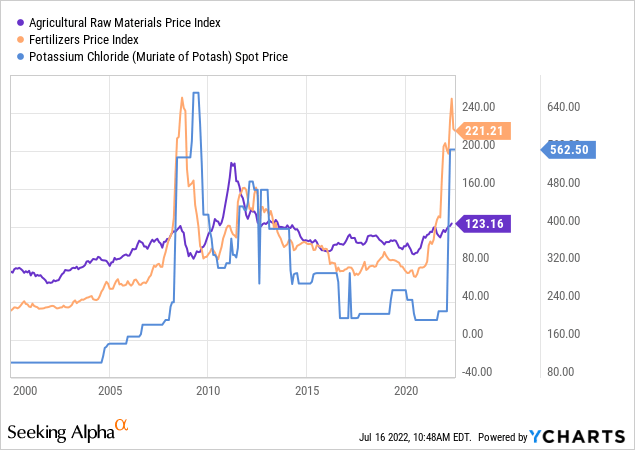

2022 has been a tumultuous year for global agricultural markets. Most agricultural commodities have risen dramatically as global supplies have become more limited. Chief factors include the decline in eastern European exports and production and weather issues across much of the North American crop belt. That said, as with crude oil, agricultural raw materials prices remain well below their peak 2000s prices, particularly when adjusted for inflation. However, fertilizers and critical ingredients such as potash are much closer to all-time highs. See below:

Generally, agricultural commodities such as wheat and corn are led by input commodities such as fertilizers. As fertilizer becomes more expensive, farmers reduce use, leading to a decline in yields and, therefore, higher food prices.

While the sharp rise in prices this year is notable, investors should keep in mind commodity prices were extremely low before 2020 and, on an inflation-adjusted basis, were far higher ten to twenty years ago. The 2010s saw a significant global glut of commodities, leading to substantial financial issues for nearly all commodity producers. This period led many commodity producers to dramatically reduce development spending, leading to a general decline or stagnation in output today. This pattern creates what is known as the “commodity super-cycle” – a consistent phenomenon of relatively consistent multidecade cyclical swings in commodity prices.

Undoubtedly, COVID, the response to COVID, the war in Ukraine, and the reaction to the war are all factors that have accelerated this cycle. However, in my view, we are only seeing the beginning of that cycle, and over the next year or two, it seems likely we will see virtually all commodities reach new all-time-high prices, surpassing their 2000s peaks. Further, though many commodity producer stocks are high, even higher commodity prices should extend gains for years to come.

More recently, we’re seeing notable economic demand destruction that is likely temporarily reducing some commodity prices and stocks. However, as discussed recently regarding United States Steel (X) and Alpha Metallurgical Resources (AMR), I believe the recent sell-off is a great buying opportunity for long-term investors willing to ride a tumultuous few months. Unlike companies in most of the stock market, which I believe have far more downside risk, commodity producers have extremely low valuations (often at “P/E” ratios below 5X) and growing earnings. Besides the two I’ve already discussed, the potash producer Intrepid Potash (NYSE:IPI) appears to be another solid fire-sale commodity producer.

A Crash Without A Firm Cause

Most commodities have undergone a significant correction lower over the past two months due to the growing potential for demand destruction. In my view, it is virtually guaranteed that overall economic demand will decline due in part to rising inflation (and falling real wages). However, the demand for many commodities such as oil and gas as well as fertilizers and potash can only fall so much. There is limited “slack” in these markets since, for better or worse, our current standard of living requires a relatively high degree of continuing commodity consumption.

For example, U.S. natural soil mineral quality is generally poor, and there are few alternatives to inputs such as potash. Hence, a reduction in potash demand necessarily leads to decreased farm yields. A decline in farm yields will increase agricultural prices, leading to replenished cash flows for farmers, allowing them to use more fertilizers over the following season and ideally restoring crops. Fundamentally, unless people reduce food consumption (or food waste), demand for inputs like potash will likely remain nearly constant in the long run.

Problematically, Russia and Belarus produce about 40% of the world’s potash export. Russian fertilizer sales are exempt from sanctions, but exports are still under pressure due to banking and logistical sanctions. However, since January, before the Russian invasion, Belarus was placed under direct potash export sanctions by the U.S due to “disregard for international norms.” Belarus controls a fifth of the global potash market, so these sanctions (not directly related to Russia) are likely the most significant cause of the current U.S potash shortage. Despite the harsh impact this factor has had on U.S farmers and consumers, it seems unlikely Biden will lift sanctions on Belarus soon due to the country’s deepening ties with the Russian campaign.

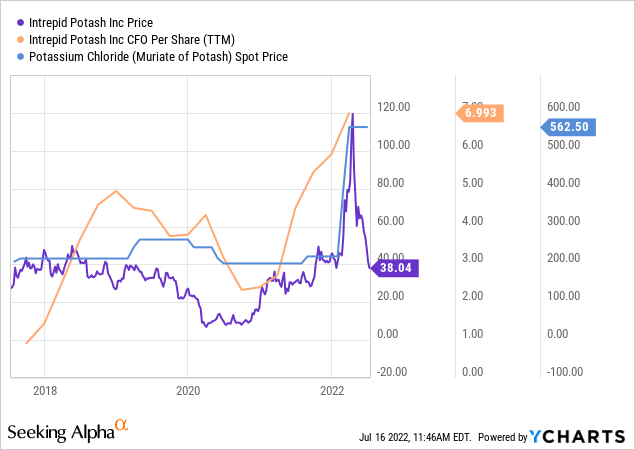

There is little reason to believe potash prices will return to normal. Unlike nitrogen, the potash market is not tied to the cost of natural gas. The sharp decline in natural gas prices is a primary cause for the recent decline in overall fertilizer prices. The top U.S potash producer, Intrepid Potash, has lost two-thirds of its peak value along with fertilizer producers. However, potash prices have remained high, so it remains like Intrepid’s income will rise dramatically and maintain high levels. See its price and cash flow compared to potash below:

Potash prices have sustained the highest levels over the Q2 and Q3 period compared to the first quarter. Even the increased cash flows from Q1 2021 to Q1 2022 do not reflect the likely current cash flows given potash prices. Like others in its industry, the stock was overvalued two months ago due to a surge in “headline and trend-following” buying activity. However, given today’s potash prices, the company will likely generate a quarterly operating cash flow of around $2.5-$3.5. Assuming production levels and costs remain flat, this equates to an annual CFO outlook of $10 to $14, giving it an extremely low forward price-to-cash flow valuation of ~3.4-3.8X.

The current consensus EPS outlook for the company suggests an EPS of $8.7 this year, declining to $2.9 by 2024. In my view, this outlook seems slightly low given the fundamentals in the potash market. Firstly, if Belarusian sanctions remain, the potash shortage may grow dramatically in the short-run and lead to even higher prices. Again, while potash is expensive today, it is still not as expensive as it was in the 2000s, and unlike then, a considerable portion of exports are artificially constrained.

Many companies may not be able to increase potash production quickly. Intrepid fell on the news that its larger Canadian competitor Nutrien (NTR), planned to ramp up potash production to offset declines in eastern Europe. While this news made for a viral headline, the company is not expected to boost production until 2025 and will need to increase mining and logistical capacities dramatically. In the current environment of prolonged supply chain troubles, it is notoriously tricky for physically demanding companies (such as mining) to increase output dramatically.

Increasing commodity output is not as simple as dialing a lever and involves years of planning, development, and considerable resources. On the one hand, Nutrien’s plans to increase production may be “too little too late” compared to the sharp decline in North American supplies. On the other, we should remember that mining companies are notorious for publishing bold plans, attracting investors, and then finishing projects well after their completion dates. Intrepid, on the other hand, has been struggling to maintain production levels due to mine shutdowns and evaporation issues. Put simply, there is limited reason to believe potash prices will decline due to an organic increase in production. Further, it seems more likely that potash prices could climb higher if agricultural commodities rise (due to low yields this season) as farmers’ cash flow improves.

The Bottom Line

Overall, I believe Intrepid Potash is a solid long opportunity today and appears to be trading at a considerable discount following its recent crash. The company is trading at a forward “P/E” around 4-5X, and I expect its income to remain strong for a prolonged period as it seems unlikely the potash shortage will end soon. The company also has no long-term debt and over $125M in working capital, which is high compared to its half-billion market valuation. In my view, Intrepid is a cash-flow machine today and far healthier than most stocks despite its significant volatility.

Intrepid’s chief risk is an end to U.S sanctions against Belarusian potash exports. This factor appears to be the primary reason potash has become so expensive in North America. Thus, U.S and E.U leadership may eventually look to put their citizens’ needs above geopolitical goals. I do not believe this is likely at this point, particularly considering Belarus’s recent unification talks with Russia. However, if (or perhaps when) food prices spike higher due in part to the potash shortage, leaders may begin to reexamine their strategy. This risk factor is significant though challenging to assess; however, Intrepid would not necessarily be overvalued even if Potash prices returned toward pre-2022 levels. Indeed, IPI is currently trading back at its 2021 levels despite the significant increase in its earnings outlook.

It is difficult to give the stock a price target due to the many uncertainties surrounding the global potash market. In my view, $60-$80 seems about right, given I expect its CFO per share to be around $10 to $14 this year and potentially decline slightly over the following years. Of course, there is some reason to believe potash prices could rise higher, which would undoubtedly increase that target. In the short run, the stock may decline further as it can be difficult to catch “falling knives” as short sellers pile up. That said, its extremely low valuation is undeniable to me, and as a long-term investor, that matters more than short-term fluctuations.

Be the first to comment