imaginima

Infrastructure is something that has had the attention of many investors since the United States Congress passed an infrastructure package last November. However, there have been some challenges in figuring out exactly what companies would benefit from it. This challenge has been especially pronounced for those investors that need income because, although infrastructure companies tend to be quite popular for income seekers, it can be quite difficult to put together a portfolio of the best-of-breed companies and still have sufficient diversification. It can also be difficult to include some companies in a tax-deferred account due to various regulations.

One possible solution for all of these problems is to purchase shares of a closed-end fund that specializes in the sector. That is because these funds provide easy access to a professionally-managed diversified portfolio that can in most cases deliver higher yields than anything else in the market. In most cases too, these funds are structured in a way that they can easily be included in a retirement account or other tax-advantaged vehicle.

In this article, we will discuss the Kayne Anderson Energy Infrastructure Fund, Inc. (NYSE:KYN), which is one fund that can be used for this purpose. This closed-end fund (“CEF”) yields an impressive 8.93% at the current price, which is certain to turn anyone’s head, as it is well above most other yields in the market. I have discussed this fund before, but admittedly more than a year has passed since that time, so a great many things have changed. This article will, therefore, focus specifically on those changes as well as provide an updated analysis of the fund’s finances.

About The Fund

According to the fund’s webpage, the Kayne Anderson Energy Infrastructure Fund has the stated objective of providing investors with a high level of after-tax total return. This is hardly surprising for an equity fund. After all, investors typically buy equities for their total return characteristics, as these securities provide both capital appreciation and direct payments in the form of dividends or distributions.

The fund additionally specifies that it aims to deliver the majority of its total return in the form of distributions made to investors. This is likewise not particularly surprising, especially for an infrastructure fund. One of the characteristics of infrastructure companies is that they usually have fairly low growth rates. This is partly due to the high cost of constructing infrastructure, but it is also due to the fact that infrastructure capacity does not need to be increased by 10% or more per year most of the time. Thus, these companies tend to pay out a sizable proportion of their cash flows to investors in the form of distributions. The fund will then pass this money through to its own investors.

Interestingly, though, the fund does not state whether it only invests in the common equity issued by infrastructure companies or if the portfolio might also include preferred securities or debt. If it can include fixed-income securities, it may help to reduce the fund’s volatility somewhat since these securities tend to be more stable over time in terms of their prices. However, the common equity of some infrastructure firms (such as midstream energy companies) boasts higher yields than preferred securities or debt issued by the same company. In addition, fixed-income assets do not have the same potential for capital appreciation so the fund could be sacrificing some return if it does include these securities.

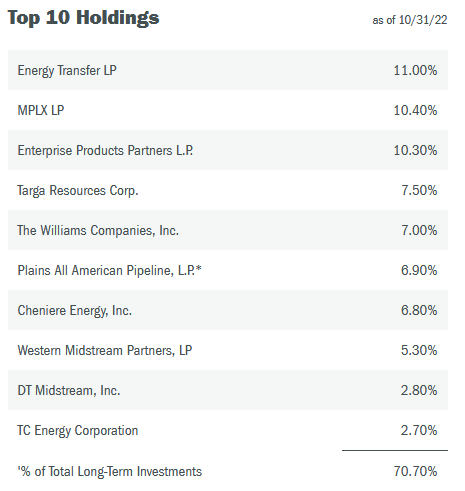

The fund’s definition of an infrastructure company is mostly what an average person would think of. These include things like utilities and midstream energy companies that provide services that are critical for daily life but yet most people do not even think about the necessity of these services. As my regular readers are no doubt well aware, I have devoted a considerable amount of time and effort over the years to discussing these companies here at Seeking Alpha. As such, the largest positions in the fund will probably be familiar to most readers. Here they are:

Kayne Anderson

With the notable exception of Western Midstream Partners (WES), I have discussed every one of these companies multiple times in the past. Interestingly, despite the fund stating that it invests in both midstream and utility companies, the only firm on this list that is not a midstream company is Cheniere Energy (LNG). With that said, this is a fairly solid midstream portfolio, though, as most of these are among the best companies in the industry and many of them have solid growth potential due to the growing global demand for natural gas. As I have pointed out many times in the past, the International Energy Agency (“IEA”) projects that the global demand for natural gas will increase by 29% over the next twenty years due to the need to supplement unreliable renewable energy sources.

Perhaps nobody is better positioned to capitalize on this demand growth than Cheniere Energy, as that company is the largest producer of liquefied natural gas in the United States. As the demand growth for natural gas is global, natural gas will need to be shipped from resource-rich countries like the United States and Canada to nations in Europe and Asia. This will require transporting natural gas over the ocean and the only way to do that effectively is by converting natural gas into a liquid state. This should result in growing business for Cheniere Energy as the demand grows. Many of the other companies that we see on this list transport significant amounts of natural gas, so they will also see growing business as the natural gas needs to be moved from inland basins to the coast for shipment.

There have been very few changes to the fund’s largest holdings since the last time that we reviewed it. The only two of note are that Magellan Midstream Partners (MMP) and ONEOK (OKE) were replaced with Cheniere Energy and DT Midstream (DTM). These are certainly not bad changes, since they do increase the fund’s exposure to the growing demand for natural gas. This comes from the fact that Magellan Midstream Partners transports crude oil and refined products but DT Midstream transports natural gas. ONEOK is likely to benefit from the growing demand for natural gas, but Cheniere Energy is much more exposed to this dynamic. Overall, it is very difficult to complain about these changes.

The fact that the fund has made relatively few changes to its portfolio might lead us to think that it has a very low turnover rate. However, this is not the case, as the Kayne Anderson Energy Infrastructure Fund has a 50.80% annual turnover, which is roughly average for a closed-end equity fund. The reason that we need to care about the fund’s turnover is that it costs money to trade stocks or other assets, which are billed to the fund’s investors. This creates a drag on the fund’s performance and makes the job of the fund managers more difficult. This is because the fund will need to recoup all its trading expenses as well as deliver a return that is reasonably attractive to the fund’s investors.

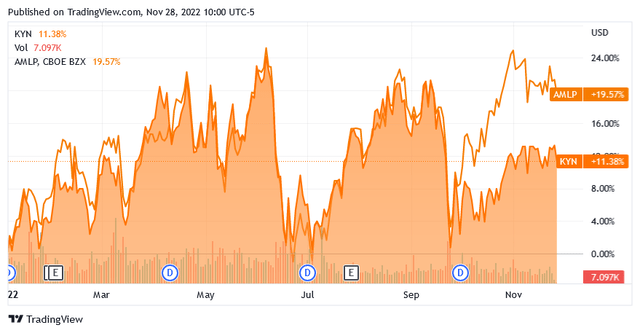

This is a difficult task to accomplish and it is one reason why many closed-end funds fail to beat their corresponding indices. The Kayne Anderson Energy Infrastructure Fund is no exception here. As we can see, the fund has returned 11.38% year-to-date, while the Alerian MLP Index (AMLP) has returned 19.57% over the same period:

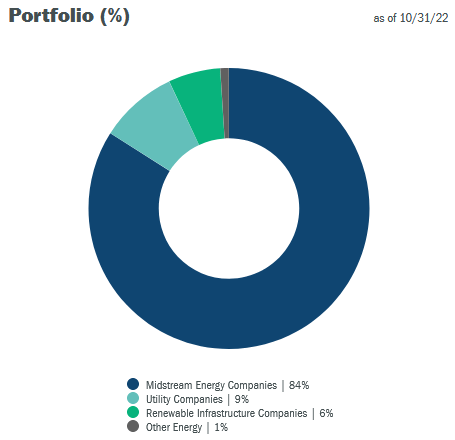

With that said, the Kayne Anderson fund does have a somewhat higher yield, but that is not enough to close the performance gap. However, this is not a perfect comparison between the index and the fund. As mentioned earlier, the Kayne Anderson Energy Infrastructure Fund invests in both midstream companies and utilities, despite the fact that we do not see any utilities in the fund’s largest positions list. In fact, though, only 84% of the fund is invested in midstream companies:

Kayne Anderson

This is something that is important to keep in mind, since utilities and renewable companies are not particularly correlated with midstream companies in terms of performance. We saw this in 2020 and 2021 following the outbreak of the pandemic and the lockdowns that resulted. As you may recall, the demand and prices of crude oil and natural gas plummeted, which dragged down the equity prices of midstream companies. However, renewable companies did extremely well, as many investors entered the market using their stimulus checks and began to purchase the equities issued by these companies. Once the mania wore off, though, midstream companies significantly outperformed their green energy counterparts.

The fact that this fund has exposure to both types of companies should help reduce volatility somewhat. With that said, the fund is nowhere near as balanced as some of its peers, so, we should still expect it to trade at least somewhat in line with the midstream indices.

Leverage

As mentioned earlier in the article, closed-end funds are able to use certain strategies to boost their yields above that of the underlying assets. The Kayne Anderson Energy Infrastructure Fund is no exception to this, as it does yield quite a bit more than the 7.17% of the MLP index.

One technique that the fund uses to accomplish this is the use of leverage. Basically, the fund borrows money and uses that borrowed money to invest in the equities issued by energy infrastructure companies. As long as the yield of the purchased assets is higher than the interest rate that the fund has to pay for the borrowed money, this strategy works pretty well to boost the overall yield of the portfolio. However, the use of debt is a double-edged sword since leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. For this reason, I do not generally like to see a fund’s leverage ratio above a third as a percentage of its assets. The Kayne Anderson Energy Infrastructure Fund certainly fits this requirement as it currently has a leverage ratio of 25.16% of its assets. Thus, the fund appears to be striking a reasonable balance between risk and reward.

Distribution Analysis

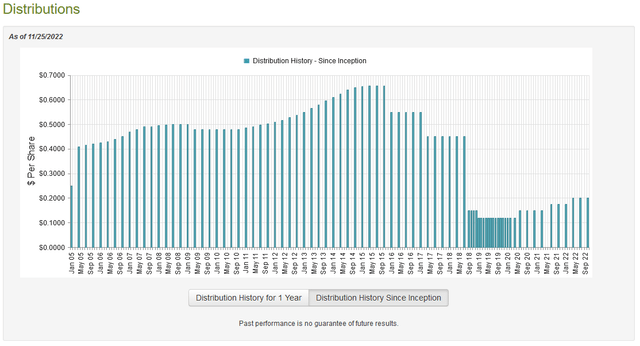

As mentioned a few times throughout this article, investors will frequently buy infrastructure companies because they tend to have higher yields than many other things in the market. In addition, the Kayne Anderson Energy Infrastructure Fund states that it intends to deliver its total return primarily through distributions paid to the investors. As such, we might assume that the fund would have a relatively high distribution yield. This is indeed the case, as it currently pays a quarterly distribution of $0.20 per share ($0.80 per share annually), which gives it an 8.93% yield at the current price. Unfortunately, the fund has not been particularly consistent about this distribution over the years:

As we can see, the fund’s distribution started to decline back in 2015, although it has since begun to rise again. At first glance, it may appear as though the fund began to raise its distribution in 2020, but that is not correct. This is because the fund switched from a $0.12 per share monthly distribution to a $0.15 per share quarterly distribution, which is actually a significant distribution cut on an annualized basis. It was not unusual to see a fund like this cut its distribution in 2020, as that was a time of great uncertainty for the traditional energy industry. Thus, we can somewhat excuse that, although the fund’s track record over the 2015 to 2020 period, in general, is quite disappointing.

It is nice to see that the fund has begun correcting this problem and raising its distribution again now that the industry has recovered, although it still remains quite low relative to its historical level. However, anyone purchasing the fund’s shares today will receive the current distribution at the current yield so the most important thing is how well the fund can sustain the distribution that it is currently paying out.

Fortunately, we have a very recent report that we can consult for that purpose. Unlike most closed-end funds, the Kayne Anderson Energy Infrastructure Fund reports its results quarterly instead of semi-annually. As a result, the fund’s most recent financial report corresponds to the nine-month period ending August 31, 2022. This is rather nice because it should show us how well the fund performed during the summer, which was a time of generally falling crude oil and natural gas prices as well as during the very strong market in the first half of the year. During the nine-month period, the fund brought in a total of $81.926 million in dividends and distributions net of foreign withholding taxes. It also received a total of $216,000 in interest income during the time period. This gives the fund an income of $42.052 million, which is lower than we would expect because of the fact that the $36.993 million that the fund received from master limited partnerships is considered to be a return of capital and not actual income.

The fund paid all its expenses out of these amounts, leaving it with $7.139 million available for investors. This is nowhere close to enough to cover the $76.581 million that the fund actually paid out in distributions during the period. In fact, it is not enough even if we add back in the money that the fund received from master limited partnerships. At first glance, this is certainly very concerning.

However, there are other ways that the fund can obtain the money that it needs to cover its distributions, such as capital gains. As might be expected by the strength that we saw in the energy market during much of 2022, the fund was very successful at this. During the nine-month period, the Kayne Anderson Energy Infrastructure Fund reported net realized gains of $72.868 million and achieved another $214.577 million net unrealized gains. This was more than sufficient to cover the distributions that were paid out. We can clearly see this in the fact that the fund’s assets increased by $320.010 million after accounting for all inflows and outflows. Overall, the fund’s distribution appears to be quite sustainable.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Kayne Anderson Energy Infrastructure Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. That is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. This is indeed the case with this fund. As of November 25, 2022 (the most recent date for which data is currently available), the Kayne Anderson Energy Infrastructure Fund had a net asset value of $10.55 per share. However, shares currently trade for $8.91 per share. This gives the shares a discount of 15.55% to the net asset value today. This is certainly a very reasonable discount that is more attractive than the 14.04% discount that the shares have traded at on average over the past month. Overall, the price certainly looks fairly appealing today.

Conclusion

In conclusion, the Kayne Anderson Energy Infrastructure Fund appears to offer a way to play the midstream sector but it does underperform the index. Although the closed-end fund offers a higher yield, the performance difference between the two is enough that many investors will prefer the index fund. However, the Kayne Anderson fund does offer better exposure to both natural gas and renewables, which are going to be the two areas leading the energy transition that will likely be taking place over the next few decades.

The Kayne Anderson Energy Infrastructure Fund’s 8.93% current yield appears both attractive and sustainable. When we couple this with a very reasonable valuation, we can still certainly see some reasons to invest in the fund.

Be the first to comment