Volodimyr Trofimov/iStock Editorial via Getty Images

Considering cyclicality in one’s investment decision-making process is of the utmost importance. Financial literature has proven that most buy-and-hold portfolios underperform successfully rebalanced portfolios unless investors bank on countercyclical assets, which Euroseas (NASDAQ:ESEA) probably isn’t. As such, we analyzed the stock’s prospects from a medium-term cycle vantage point and discovered dominance within a bearish case. Therefore, we downgrade Euroseas to a sell with a 6-month time horizon.

Here are a few variables to consider.

Earnings Review

To start off the analysis, let’s run through a few positives and negatives unveiled in Euroseas’ third-quarter earnings report.

Operational Analysis

As of its third quarter, Euroseas Ltd. achieved 99.4% in year-over-year revenue growth, which definitely can’t be overlooked. During its latest financial quarter and the nine months, the company has benefitted from higher-than-average shipping rates. Port congestion and artificial economic demand spurred on by stimulus checks and expansionary monetary policy. In addition, Euroseas operates in an industry with high barriers to entry, which allowed it to reap full benefits from systemic tailwinds.

Euroseas; Seeking Alpha

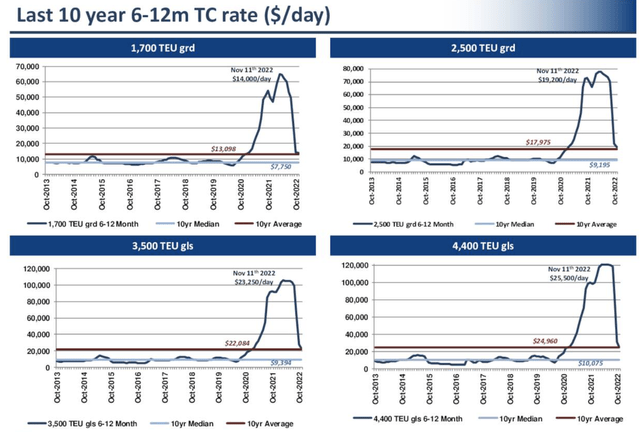

Although Euroseas’ fleet expanded by 3.4% during the past year, the bulk of its top-line support was due to the mentioned macroeconomic tailwinds, which no longer exist. However, let’s elaborate on the company’s recent operational details.

Since the turn of the year, Euroseas has expanded its overall utilization rate to 99.5% from 98.5%. In addition, the firm has increased its average quarterly vessels from 14 to 16.8, conveying better overall output capacity.

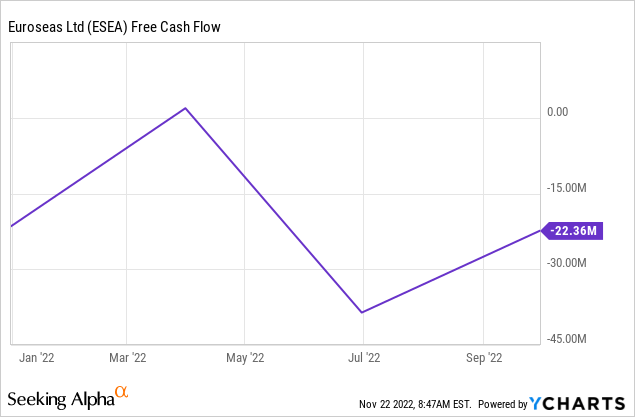

Despite improving on its top line, the company’s costs rose significantly during since January, pushing its breakeven up by approximately 35% in the past nine months. Moreover, Euroseas’ free cash flow is on a downward trajectory largely due to lower cash from operations, primarily driven by softened CapEx.

Cyclicality Risk

A common mistake we all make/have made as market participants is that we tend to look at the financial markets in arrears, in turn, ignoring cyclicality. The economy is a cyclical vehicle with peaks, bottoms, and troughs linked to economic policies and natural consumption. Thus, it’s necessary to consider that Euroseas’ 99.4% year-over-year revenue growth might drop off soon.

Euroseas’ dry bulk activities span across the commodity space, which can be juxtaposed. There’s a clear softening in demand for industrial metals; however, coal demand has risen sharply in the past months amid energy shortages in many parts of the world.

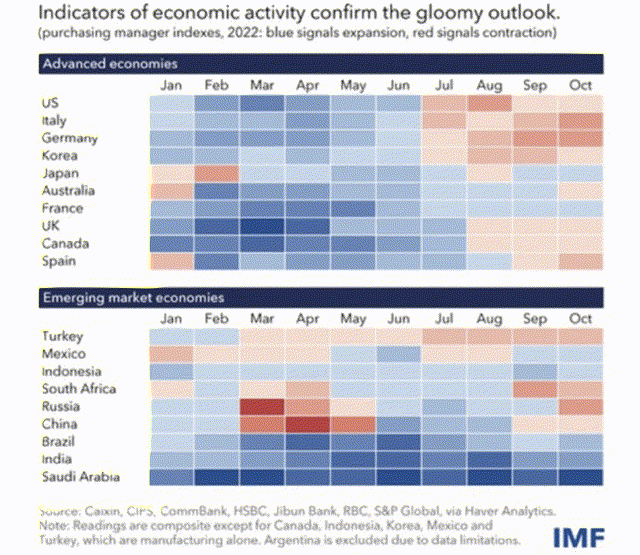

Given the IMF’s survey of global economic health, it’s likely that we’ll be heading into a period of softening industrial production, subsequently affecting shipping activity.

IMF

The second error we make as investors is to assume that underlying businesses’ stocks will reach fair value. Although a company’s underlying activities and stock price are correlated, they are sometimes somewhat adrift.

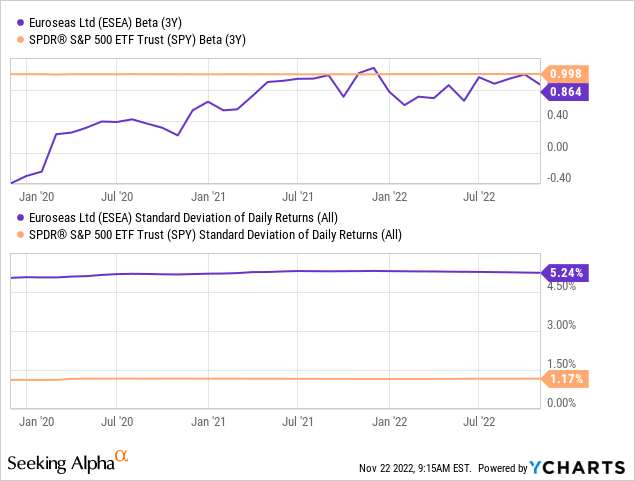

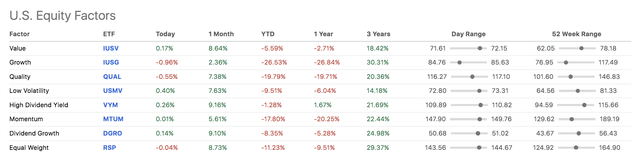

Investor psychology plays a large part in determining a stock’s price. For example, during uncertain economic times, investors generally opt for countercyclical assets, which Euroseas likely isn’t due to its excess exposure to cyclical industries in the manufacturing and basic materials space.

Despite my doubts about cyclicality and Euroseas’ excess standard deviation (to the market), the stock hosts a low Beta. Therefore, a valid beta analysis could derail my argument entirely, which is something for investors to consider.

Valuation & Dividend Profile

From a relative valuation point, you might think there’s no reason not to invest in Euroseas stock. Although I concur that the stock’s valuation multiples could spur investment, I question their sustainability. Firstly, a stock’s price multiples aren’t static and can fluctuate along with cyclicality. In addition, there’s no guarantee that the market will price a stock at its fair equity value.

| Price-to-Earnings | 1.41x |

| Price-to-Book | 0.91x |

| Price-to-Cash Flow | 1.15x |

Source: Seeking Alpha

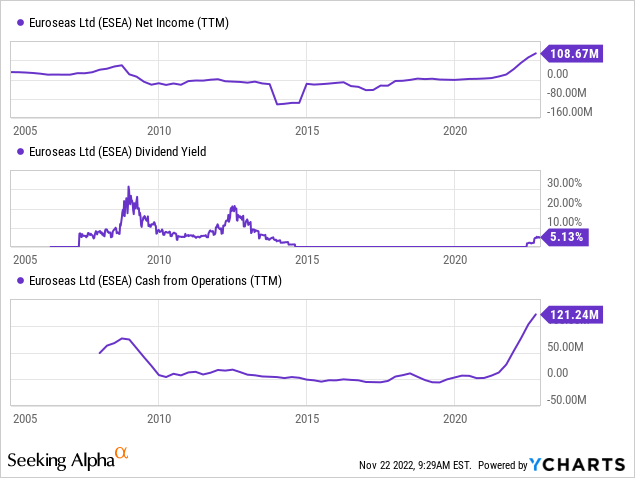

Furthermore, Euroseas pays an enticing dividend, yielding at 5.13%. Moreover, the dividend has a solid dividend coverage ratio of 8.21x, and the company hosts a cash per share ratio of 3.82x, indicating that Euroseas’ dividend is both lucrative and safe. In addition, the current market climate seems conducive to high-dividend yield stocks, providing a pivotal tailwind.

Seeking Alpha

Nevertheless, I revert back to my argument of cyclicality by pointing out the oscillation of Euroseas’ net income, dividend yield, and cash from operations. I want investors to make up their own minds, but I’m betting on a cyclical downturn, which could be priced by the financial markets in due course.

Concluding Thoughts

Euroseas is a brilliant company, but the financial markets could deem this stock a cyclical risk until global economic variables re-align. Evidence suggests that buy-and-hold portfolios underperform managed portfolios and that price entry points are of the utmost importance. Despite Euroseas’ strong third quarter, lucrative dividend yield, and attractive valuation metrics, we believe cyclicality will prevail. Thus, we assign a sell rating to the stock with a six-month horizon.

Be the first to comment